Analysis: The House GOP's Trump Tax Plan Breakdown

Table of Contents

Proposed Tax Rate Changes

The House GOP's plan proposes sweeping changes to both individual and corporate tax rates, significantly altering the current tax landscape.

Individual Income Tax Rates

The proposed plan outlines significant alterations to individual income tax brackets. While the specifics may vary depending on the final version of the legislation, let's consider a hypothetical example to illustrate the potential impact:

- Current Rates (Hypothetical): Assume a system with brackets ranging from 10% to 37%.

- Proposed Rates (Hypothetical): The plan might lower rates across the board, perhaps to a range of 8% to 32%, aiming for significant individual income tax reform.

- Impact: Lower rates could benefit high-income earners substantially, while the impact on the middle and lower classes may vary greatly depending on the precise changes to brackets and deductions. This could potentially exacerbate income inequality. This contrasts sharply with the progressive taxation model advocated by some.

Corporate Tax Rates

The plan also suggests modifications to corporate tax rates, a crucial aspect of business tax and investment incentives. Consider this hypothetical scenario:

- Current Rate (Hypothetical): A 21% corporate tax rate.

- Proposed Rate (Hypothetical): The plan could lower this further, possibly to 15% or even lower, significantly impacting corporate tax reform.

- Impact: A reduced corporate tax rate could incentivize business investment and potentially stimulate job creation. However, this could also disproportionately benefit large corporations over smaller businesses, potentially widening the economic gap.

Changes to Deductions and Credits

The House GOP's proposed tax plan may also significantly alter deductions and credits, affecting taxpayers differently depending on their circumstances.

Standard Deduction

The standard deduction is a key aspect of tax planning for many. Any proposed changes will substantially influence taxpayers’ net tax liability.

- Current Deduction (Hypothetical): A standard deduction amount of $X.

- Proposed Changes (Hypothetical): The plan might increase or decrease this amount, potentially affecting millions of taxpayers who use the standard deduction.

- Impact: An increased standard deduction would offer more significant tax relief to lower and middle-income families, while a decrease could negatively impact them.

Itemized Deductions

Itemized deductions, such as the SALT deduction (State and Local Taxes), mortgage interest deduction, and charitable contribution deduction, are critical to many taxpayers. Changes here will deeply impact specific groups.

- Proposed Changes (Hypothetical): The plan might limit or eliminate some itemized deductions, such as the SALT deduction or cap charitable contributions, impacting taxpayers who typically itemize.

- Impact: The elimination of certain itemized deductions, particularly the SALT deduction, could significantly impact taxpayers in high-tax states and could lead to backlash, especially if these tax deductions are not replaced with suitable tax credits.

Other Key Provisions

Several other provisions are likely to be part of the House GOP's plan, including:

- Capital Gains Taxes: Potential changes to capital gains taxes could significantly impact investors and high-income earners.

- Estate Taxes: Modifications to estate taxes could affect wealth transfer and inheritance planning.

- Alternative Minimum Tax (AMT): Changes to the AMT could influence taxpayers with significant deductions or credits.

- Tax Loopholes: The plan might address or create new tax loopholes and incentives.

Economic and Fiscal Impacts of the Plan

The economic and fiscal consequences of the House GOP's Trump-esque tax plan are potentially far-reaching and complex.

Potential Economic Growth

Proponents argue the plan could stimulate economic growth by encouraging business investment and consumer spending due to lower tax rates. However, critics express concerns about increased national debt and the potential for unsustainable fiscal deficits.

- Arguments for Growth: Increased investment, higher consumer spending.

- Arguments against Growth: Increased national debt, potential for inflationary pressures.

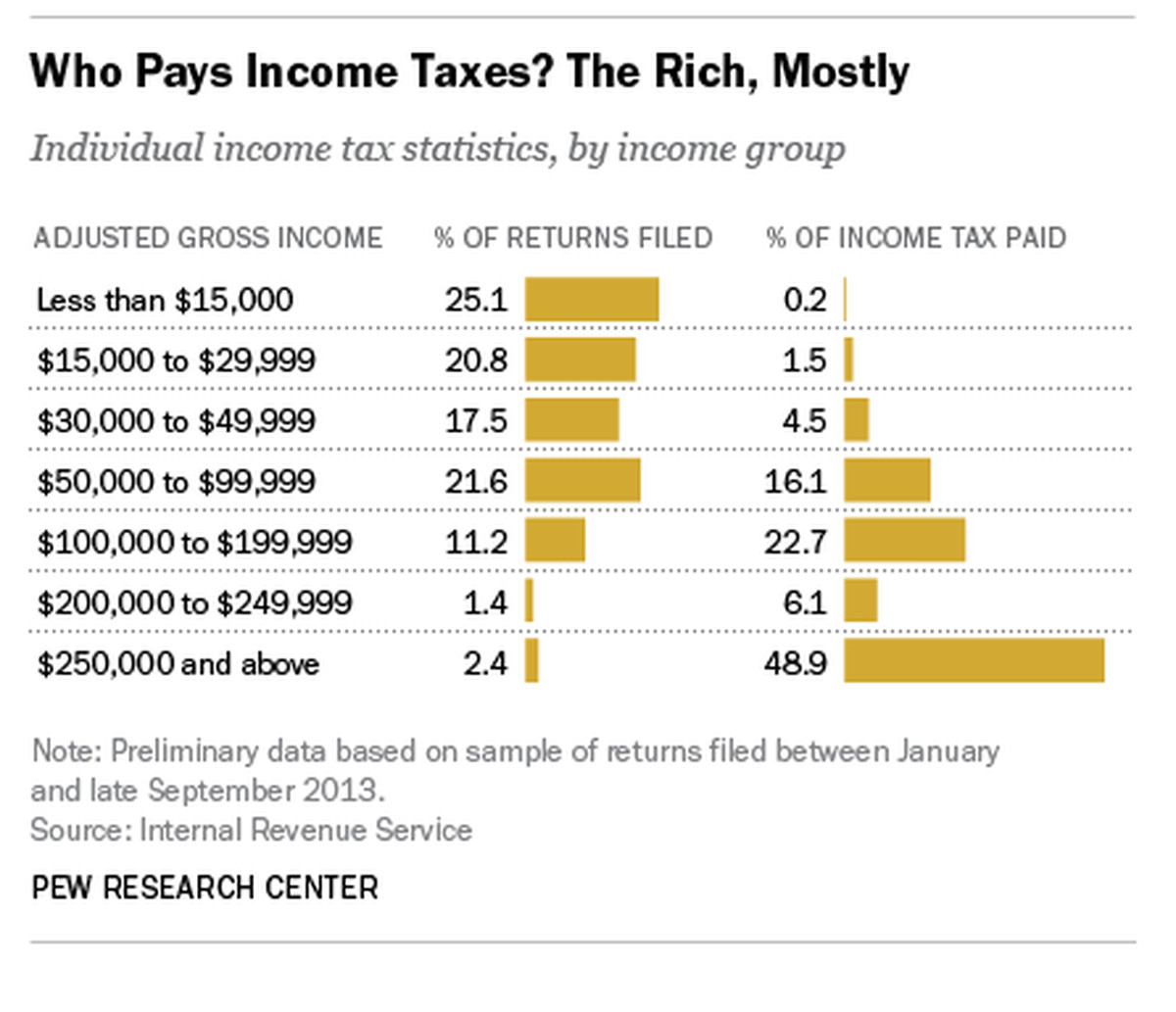

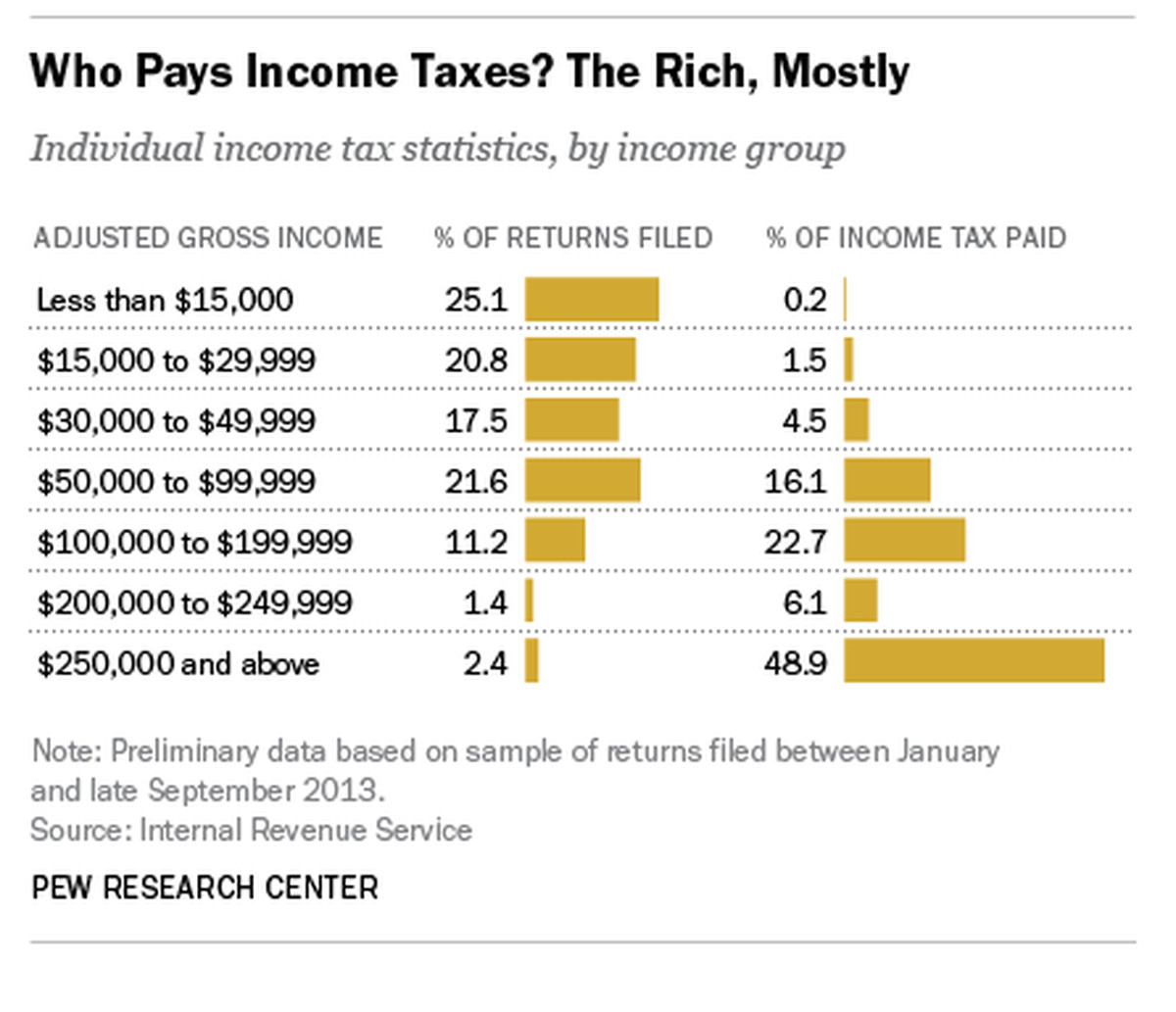

Distributional Effects

The plan's impact on different income groups is a major point of contention. The potential for increased income inequality is a significant concern.

- Impact on the Wealthy: Lower rates and reduced deductions could disproportionately benefit high-income earners.

- Impact on the Middle Class: The impact on the middle class is highly uncertain and depends greatly on the specific details of the final plan.

- Impact on Low-Income Individuals: Low-income individuals may see minimal to no benefits.

Conclusion: Evaluating the House GOP's Trump Tax Plan – A Final Analysis

The House GOP's Trump-inspired tax plan is a complex proposal with potentially significant ramifications for the American economy and its citizens. Its potential benefits, including increased economic growth and business investment, must be carefully weighed against potential drawbacks such as increased income inequality and a ballooning national debt. The proposed changes to individual and corporate tax rates, deductions, and credits will differently impact various income brackets. Understanding the nuances of this plan and its potential impact is crucial for informed civic engagement. Further research into the House GOP's tax proposals is critical for navigating this complex landscape and advocating for policies that benefit all Americans. Understanding the implications of this Trump-esque tax plan is critical for informed civic engagement, and active participation in the ongoing debate surrounding tax policy is essential.

Featured Posts

-

Investor Guide Bof As Take On Elevated Stock Market Valuations

May 16, 2025

Investor Guide Bof As Take On Elevated Stock Market Valuations

May 16, 2025 -

An Unexpected Rival How One Small App Could Undermine Meta

May 16, 2025

An Unexpected Rival How One Small App Could Undermine Meta

May 16, 2025 -

Nba And Nhl Round 2 Betting Analysis And Predictions

May 16, 2025

Nba And Nhl Round 2 Betting Analysis And Predictions

May 16, 2025 -

Berlin U Bahn Techno Djs Could Soon Take Over Stations

May 16, 2025

Berlin U Bahn Techno Djs Could Soon Take Over Stations

May 16, 2025 -

Padres Vs Opponent Pregame Analysis And Lineup Breakdown Featuring Arraez And Heyward

May 16, 2025

Padres Vs Opponent Pregame Analysis And Lineup Breakdown Featuring Arraez And Heyward

May 16, 2025

Latest Posts

-

The Bidens The View Appearance Full Interview Available

May 16, 2025

The Bidens The View Appearance Full Interview Available

May 16, 2025 -

Senator Vance Questions Bidens Stance On Trumps Russia Ukraine Actions

May 16, 2025

Senator Vance Questions Bidens Stance On Trumps Russia Ukraine Actions

May 16, 2025 -

Jd Vances Perfect Rebuttal Dismantling Bidens Ukraine Criticism

May 16, 2025

Jd Vances Perfect Rebuttal Dismantling Bidens Ukraine Criticism

May 16, 2025 -

Trumps Russia Ukraine Policies Vance Calls For Bidens Response

May 16, 2025

Trumps Russia Ukraine Policies Vance Calls For Bidens Response

May 16, 2025 -

Joe And Jill Bidens The View Interview Watch Now

May 16, 2025

Joe And Jill Bidens The View Interview Watch Now

May 16, 2025