Analyst's Bitcoin Prediction: Rally Starting Soon (May 6 Chart)

Table of Contents

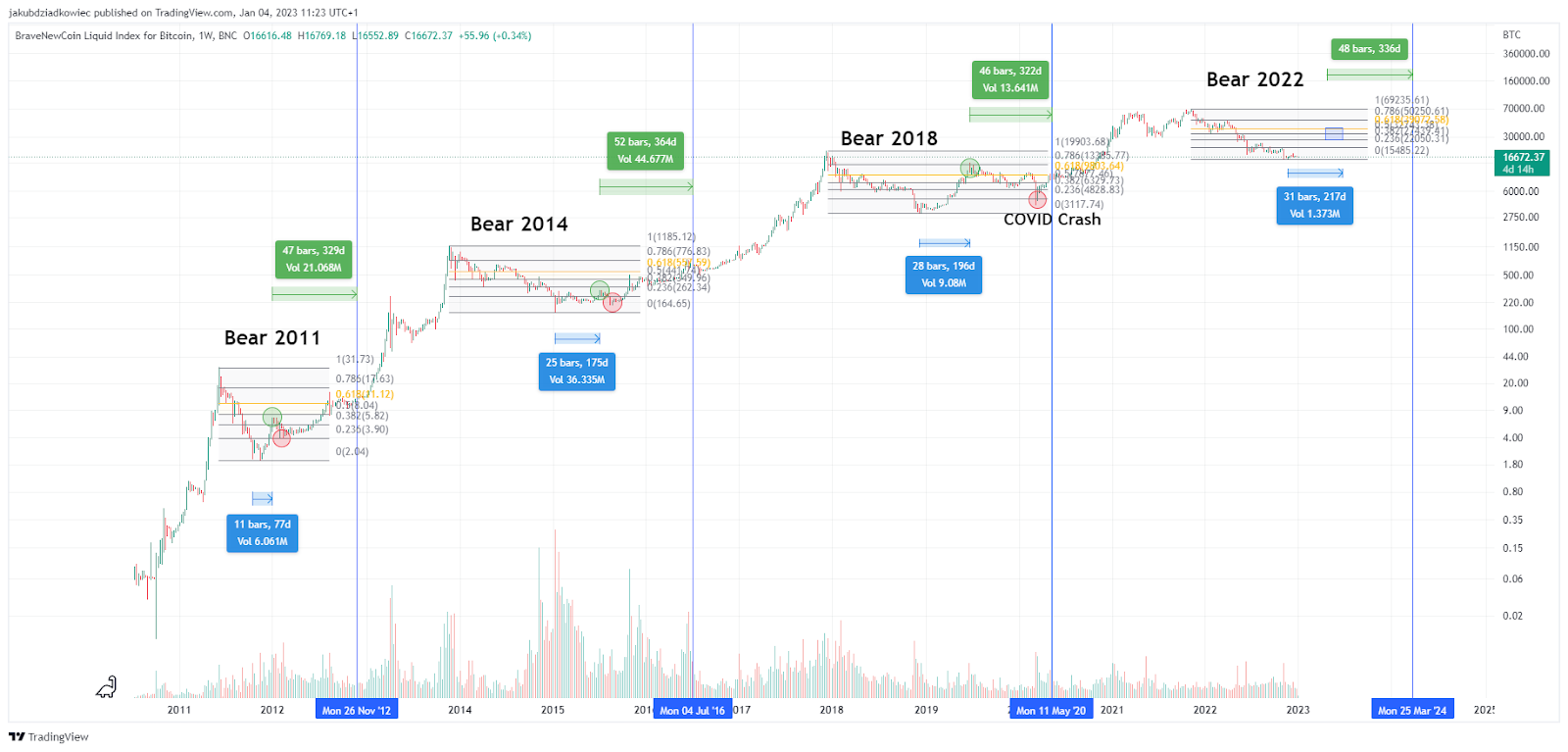

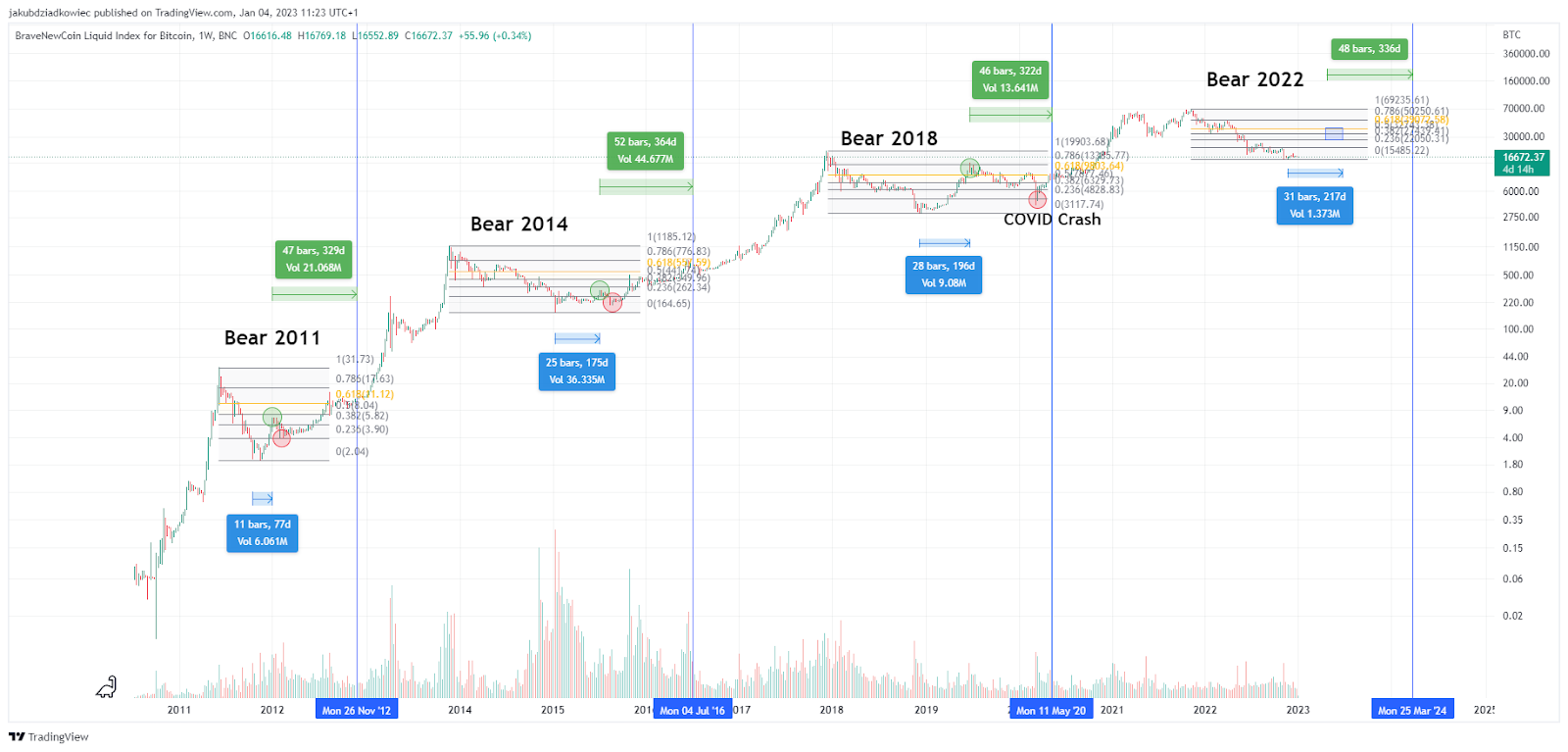

Analyzing the May 6th Bitcoin Chart

The analyst's prediction hinges heavily on their interpretation of the Bitcoin chart from May 6th. Several key technical indicators and a consideration of market sentiment contributed to their bullish outlook.

Key Technical Indicators

The analysis utilizes several crucial technical indicators to gauge the potential for a Bitcoin rally.

- Moving Averages: The 50-day and 200-day moving averages showed a potential "golden cross" on the May 6th chart, a bullish signal suggesting an upcoming price increase. This pattern, where the shorter-term moving average crosses above the longer-term one, historically indicates a shift in momentum.

- Relative Strength Index (RSI): The RSI, a momentum oscillator, indicated the Bitcoin price was oversold around May 6th, implying a potential bounce back. A reading below 30 is generally considered oversold, and the May 6th chart showed an RSI nearing this level.

- Moving Average Convergence Divergence (MACD): The MACD, which measures the relationship between two moving averages, showed a bullish crossover around the same timeframe, further supporting the potential for a rally. This crossover suggests a shift from bearish to bullish momentum.

[Insert chart/graph illustrating the moving averages, RSI, and MACD around May 6th]

These indicators, taken together, strongly suggest a potential upswing in the Bitcoin price. Keywords: Technical analysis, Bitcoin indicators, RSI, moving averages, MACD, chart patterns.

Volume and Market Sentiment

Analyzing trading volume alongside technical indicators provides a more comprehensive picture. Around May 6th, while the price was relatively low, the trading volume remained relatively high, suggesting strong underlying interest and potential for a price surge. High volume during a period of low price can signal accumulation, where investors are buying at a lower price point in anticipation of a future rally.

Market sentiment, as measured by the fear and greed index and social media sentiment analysis, also contributed to the prediction. While fear might have been prevalent leading up to May 6th, there were signs of increasing optimism within the cryptocurrency community, further supporting the analyst's bullish outlook. Keywords: Bitcoin trading volume, market sentiment, fear and greed index, Bitcoin social media.

The Analyst's Reasoning and Methodology

Understanding the analyst's reasoning and methodology is crucial to evaluating the prediction's validity.

Analyst's Expertise and Track Record

The analyst behind this prediction, [Analyst Name], is a renowned figure in the cryptocurrency market with a proven track record of accurate predictions. [Analyst Name]'s expertise in technical analysis and deep understanding of the Bitcoin market contribute significantly to the credibility of their prediction. Details about their background and past successes can be found at [link to analyst's website/profile]. Keywords: Crypto analyst, Bitcoin expert, market prediction, trading strategy.

Supporting Evidence and Factors

The prediction isn't solely based on the May 6th chart. [Analyst Name] considered several other factors:

- Regulatory News: Recent regulatory developments (mention specific examples, if any) could positively impact Bitcoin's price.

- Adoption Rates: Increasing adoption of Bitcoin by institutions and businesses adds to the long-term bullish outlook.

- Macroeconomic Factors: The analyst factored in macroeconomic conditions (mention relevant factors, e.g., inflation, interest rates) that could influence Bitcoin's price.

These factors, combined with the technical analysis of the May 6th chart, bolster the prediction of an upcoming Bitcoin rally. Keywords: Bitcoin adoption, regulatory landscape, macroeconomic factors, Bitcoin news.

Potential Bitcoin Price Targets and Timeline

The analyst's prediction points toward a significant Bitcoin price increase.

Realistic Price Projections

[Analyst Name] projects a Bitcoin price increase to [Target Price] within the next [Timeline, e.g., 3-6 months]. This prediction considers potential resistance levels around [Price Level] and support levels around [Price Level].

[Insert chart/graph illustrating potential price targets and resistance/support levels]

Keywords: Bitcoin price target, price prediction, Bitcoin resistance, Bitcoin support.

Risk Assessment and Disclaimer

It's crucial to acknowledge the inherent risks involved in cryptocurrency investments. Bitcoin's price is notoriously volatile, and significant price drops are possible. Past performance is not indicative of future results. This analysis should not be construed as financial advice. Always conduct your own thorough research and consider your risk tolerance before investing in Bitcoin or any other cryptocurrency. Keywords: Cryptocurrency risk, investment risk, Bitcoin volatility.

Conclusion: Should You Invest Based on This Bitcoin Prediction?

This analysis of the May 6th Bitcoin chart, combined with the analyst's expertise and consideration of other factors, presents a compelling case for a potential Bitcoin rally. The technical indicators, market sentiment, and additional supporting evidence all point toward a bullish outlook. However, remember that the cryptocurrency market is highly volatile, and no prediction can guarantee future performance.

While this analyst's Bitcoin prediction points towards a potential rally, remember to conduct thorough due diligence before investing. Learn more about the potential of a Bitcoin rally and stay informed on the latest Bitcoin price predictions by following reputable sources and conducting your own research. This article provides valuable insight but should not be taken as financial advice. The future of Bitcoin price is subject to numerous factors, and you need to make an informed decision about your investment strategy. Keywords: Bitcoin investment, cryptocurrency trading, Bitcoin analysis, market outlook.

Featured Posts

-

Glen Powells Bulletproof Transformation For The Running Man

May 08, 2025

Glen Powells Bulletproof Transformation For The Running Man

May 08, 2025 -

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025 -

Arsenal Manager Arteta Under Fire From Collymore Latest News

May 08, 2025

Arsenal Manager Arteta Under Fire From Collymore Latest News

May 08, 2025 -

Realistic Wwii Movies Military Historians Pick Their Top Choices

May 08, 2025

Realistic Wwii Movies Military Historians Pick Their Top Choices

May 08, 2025 -

Presidents Article On Trump And Ripple What It Means For Xrp Investors

May 08, 2025

Presidents Article On Trump And Ripple What It Means For Xrp Investors

May 08, 2025