Ethereum CrossX Signals Institutional Accumulation: Analyst Predicts $4,000

Table of Contents

Understanding Ethereum CrossX and its Importance

Ethereum CrossX refers to off-chain trading mechanisms and platforms facilitating large-scale Ethereum (ETH) transactions outside the main Ethereum blockchain. These platforms are designed to handle the unique needs of institutional investors, providing solutions to challenges they face when trading significant amounts of ETH on-chain. Its purpose is primarily to enable efficient, private, and cost-effective execution of large ETH trades.

Why are institutions drawn to Ethereum CrossX? The answer lies in several key advantages:

- Reduced Transaction Fees: Ethereum CrossX significantly reduces the gas fees associated with large on-chain transactions, saving institutions substantial costs.

- Increased Privacy and Anonymity: Large trades on the public Ethereum blockchain can be easily tracked and analyzed, potentially revealing sensitive information. Ethereum CrossX offers enhanced privacy, shielding institutional trading activity from public scrutiny.

- Improved Efficiency for Managing Substantial ETH Holdings: Managing vast quantities of ETH on-chain can be complex and time-consuming. Ethereum CrossX streamlines this process, allowing institutions to manage their holdings more efficiently.

- Reduced Market Impact from Large Orders: Executing massive ETH trades directly on the main blockchain can cause significant price fluctuations. Ethereum CrossX minimizes this market impact, allowing for smoother and more predictable trades.

Evidence of Institutional Accumulation via Ethereum CrossX

The evidence supporting institutional accumulation via Ethereum CrossX is compelling. On-chain data reveals a notable surge in activity, pointing to increased institutional involvement. While specific data might be proprietary to certain analytics firms, general trends are observable:

- Significant Increase in Daily/Weekly/Monthly Volume on Ethereum CrossX: Reports suggest a marked increase in trading volume on platforms facilitating these off-chain transactions.

- Growth in the Average Transaction Size, Suggesting Larger Institutional Trades: The average size of trades executed through Ethereum CrossX has been growing steadily, strongly indicating participation by institutional players.

- Increased Frequency of Large Transactions: The number of large-value transactions processed via Ethereum CrossX has also shown a significant uptick, further confirming institutional involvement.

- Correlation Between Ethereum CrossX Activity and ETH Price Increases: A positive correlation between increased activity on Ethereum CrossX and subsequent rises in the ETH price has been noted by several market analysts, suggesting a causal link between institutional buying and price appreciation. (Note: This section would ideally include relevant charts and graphs to visually support these claims.)

Analyst's Rationale for the $4,000 Ethereum Price Target

The analyst's prediction of a $4,000 Ethereum price target is directly linked to the observed institutional accumulation evidenced through Ethereum CrossX activity. The rationale is based on several factors:

- Analyst's Track Record and Credibility: The analyst's previous predictions and market analysis should be cited here to establish credibility. (Mentioning the analyst's name and firm would add weight to this section.)

- Specific Market Analysis Used to Reach the $4,000 Target: A detailed explanation of the analytical models and methodologies employed to arrive at this price target is crucial.

- Potential Catalysts That Could Accelerate Price Appreciation: Factors such as further network adoption, DeFi growth, or positive regulatory developments could act as catalysts, potentially pushing the price towards $4,000.

- Risks and Potential Downsides to the Prediction: It's essential to acknowledge potential headwinds, such as broader macroeconomic conditions or unexpected regulatory changes.

Alternative Perspectives and Potential Challenges

While the evidence for institutional accumulation through Ethereum CrossX is encouraging, it's crucial to acknowledge alternative perspectives and potential challenges:

- Regulatory Uncertainty and its Impact on the Crypto Market: Changes in regulatory frameworks could significantly impact the cryptocurrency market, potentially affecting Ethereum's price.

- Competition from Other Layer-1 Blockchains: Competition from rival layer-1 blockchain networks could influence Ethereum's market share and price.

- Macroeconomic Factors Influencing Cryptocurrency Prices: Global economic conditions and other macroeconomic factors can greatly affect cryptocurrency prices.

- Potential for Market Corrections: The cryptocurrency market is known for its volatility; a market correction could temporarily hinder the price increase.

Conclusion: Ethereum CrossX and the Path to $4,000

The evidence presented strongly suggests that institutional investors are accumulating Ethereum through platforms like Ethereum CrossX. This activity, coupled with other positive market indicators, supports the analyst's prediction of a $4,000 Ethereum price target. Monitoring Ethereum CrossX activity provides valuable insights into institutional sentiment and future price movements.

To capitalize on this potential, stay updated on Ethereum CrossX signals, analyze the latest Ethereum CrossX data, and track Ethereum CrossX activity for potential investment opportunities. The confluence of institutional interest and technological advancements positions Ethereum for substantial growth. Conduct your own thorough research and carefully consider the implications of this potential price increase for your investment strategy. The future of Ethereum, fueled by institutional adoption as evidenced by Ethereum CrossX data, looks promising.

Featured Posts

-

Understanding The Recent Surge In Bitcoin Mining Operations

May 08, 2025

Understanding The Recent Surge In Bitcoin Mining Operations

May 08, 2025 -

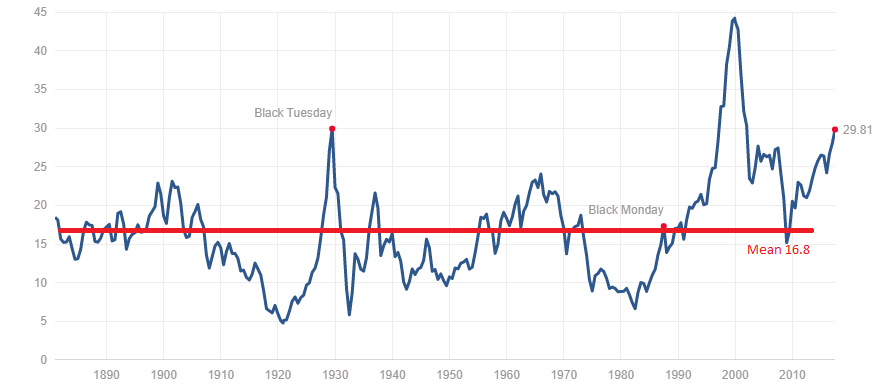

Bof As Take On High Stock Market Valuations A Reason For Investor Optimism

May 08, 2025

Bof As Take On High Stock Market Valuations A Reason For Investor Optimism

May 08, 2025 -

Watch Los Angeles Angels Games In 2025 Cord Cutting Options

May 08, 2025

Watch Los Angeles Angels Games In 2025 Cord Cutting Options

May 08, 2025 -

Dwps Increased Home Visits Concerns For Benefit Claimants Rise

May 08, 2025

Dwps Increased Home Visits Concerns For Benefit Claimants Rise

May 08, 2025 -

January 6th Hearings Witness Cassidy Hutchinson To Publish Memoir

May 08, 2025

January 6th Hearings Witness Cassidy Hutchinson To Publish Memoir

May 08, 2025