Analyzing Elon Musk's Financial Strategy: A Case Study In Success

Table of Contents

High-Risk, High-Reward Investments

Elon Musk’s financial strategy is inherently characterized by its high-risk, high-reward nature. This approach is evident in his reliance on two key funding mechanisms: early-stage funding and strategic debt financing.

Early-Stage Funding and Venture Capital

Musk's early successes were fueled by securing venture capital for projects that many deemed too ambitious or too risky. His ability to articulate a compelling vision, despite the inherent uncertainties, proved crucial.

- Examples: Early funding rounds for PayPal, SpaceX, and Tesla all involved significant risk for investors. Securing this funding required not just a strong business plan, but a persuasive presentation of Musk's visionary leadership.

- Detail: Musk’s approach to pitching his vision involved demonstrating not just the potential for profit, but also the transformative impact of his ventures. This resonated deeply with early investors who were willing to gamble on his exceptional vision and execution. His deep understanding of technology, his relentless work ethic, and his unwavering belief in his projects played a crucial role in garnering investor confidence despite high risk.

- Keyword Integration: This high-risk investment strategy, reliant on securing venture capital funding for early-stage investments, showcases Musk's ability to attract investors to ventures with significant potential, but also inherent uncertainty.

Strategic Debt Financing

To fuel the rapid growth of his companies, Musk has also embraced strategic debt financing. While this approach offers advantages in terms of leveraging assets and accelerating expansion, it carries significant risk, particularly in volatile markets.

- Examples: Tesla’s aggressive expansion, including the construction of Gigafactories and the development of new vehicle models, has been heavily reliant on debt financing. SpaceX, too, has leveraged debt to fund its ambitious space exploration programs.

- Detail: The impact of fluctuating interest rates and the potential downsides of high debt levels are ever-present challenges for Musk's companies. The successful management of debt is therefore a crucial aspect of his overall financial strategy. Mismanaging debt could severely impact profitability and even lead to financial distress.

- Keyword Integration: This debt financing strategy, while vital for leveraged growth, underscores the crucial role of financial risk management in Musk's overall approach.

Long-Term Vision and Patience

A hallmark of Elon Musk's financial strategy is his unwavering commitment to long-term goals, even at the expense of short-term profitability. This strategic patience is a critical differentiator.

Prioritizing Long-Term Goals Over Short-Term Profits

Musk consistently prioritizes the long-term vision of his companies over immediate financial gains. This often means enduring periods of significant losses before achieving major milestones.

- Examples: Tesla faced considerable financial struggles in its early years, accumulating substantial debt and experiencing production delays before achieving mass-market success. SpaceX, too, underwent numerous setbacks and near-failures before successfully launching reusable rockets and securing lucrative contracts.

- Detail: The success of this long-term financial planning hinges on the patience and understanding of investors. This long-term outlook requires a different kind of investor – one willing to absorb short-term losses in exchange for potential long-term gains. It's a testament to Musk's ability to attract and retain such investors.

- Keyword Integration: His emphasis on long-term financial planning and strategic patience has been key to his success. This visionary leadership is rarely found in short-sighted, profit-obsessed businesses.

Innovation and Market Disruption

Musk’s focus on disruptive innovation is intrinsically linked to his financial strategy. By creating entirely new markets and technologies, he effectively circumvents traditional financial constraints.

- Examples: Tesla’s electric vehicles disrupted the established automotive industry, forcing traditional car manufacturers to adapt. SpaceX similarly revolutionized the space exploration industry by making reusable rockets a reality.

- Detail: This disruptive innovation creates new markets and attracts investment despite initial skepticism. The first-mover advantage gained by Musk often provides a substantial competitive edge, offsetting some of the risks associated with his ventures.

- Keyword Integration: This market disruption strategy, driven by relentless disruptive innovation, has become a cornerstone of his success.

Diversification and Synergies

Elon Musk's financial strategy also involves a sophisticated approach to diversification and leveraging synergies across his various companies.

Creating Synergies Across Companies

Musk strategically leverages synergies between his companies to improve efficiency and reduce costs. This interconnectedness minimizes risks and maximizes overall profitability.

- Examples: Technological advancements developed by one company (e.g., battery technology from Tesla) can be readily adapted and applied in another (e.g., SpaceX's rockets). This sharing of resources and expertise allows for economies of scale and significant cost reductions.

- Detail: This corporate synergy is a crucial aspect of Musk's financial strategy, allowing for the efficient allocation of resources and a reduction in overall financial risk. The cross-pollination of ideas and technologies strengthens each individual company while enhancing the collective financial performance.

- Keyword Integration: This diversification strategy, complemented by effective portfolio management and the exploitation of corporate synergy, significantly reduces the overall risk associated with such ambitious ventures.

Strategic Acquisitions and Partnerships

Strategic acquisitions and partnerships are further elements of Musk's financial strategy, enabling expansion into new markets and technological domains.

- Examples: While specific examples require further case-by-case study, the overall strategy of acquiring companies or forming strategic partnerships demonstrates a willingness to quickly gain expertise or market access.

- Detail: The strategic rationale behind these moves is typically to gain access to new technologies, talent, or markets, accelerating growth and enhancing competitive positioning. Such actions are carefully calculated components of his overall financial planning, reflecting calculated risk-taking to increase long-term value.

- Keyword Integration: This strategic acquisition and strategic partnership approach reflects a dynamic and adaptive business expansion strategy.

Conclusion

Elon Musk’s financial strategy is a complex interplay of high-risk investments, a long-term vision, strategic diversification, and the astute leveraging of synergies across his various companies. His approach is characterized by an acceptance of significant risk, a commitment to long-term goals, and a relentless pursuit of innovation. While not without its failures, the overall success of his ventures demonstrates the potential of this unconventional strategy. The key takeaways include the importance of a clear vision, the willingness to accept significant risks for substantial rewards, and the ability to adapt and innovate in the face of challenges.

To further explore Elon Musk's financial strategy, consider researching his individual companies' financial reports and analyzing specific funding rounds and acquisitions. Remember, while aspects of his approach might be inspirational, replicating his level of risk-taking requires substantial expertise and a high tolerance for failure. Carefully analyze the inherent risks before attempting to adapt any element of his strategy to your own financial ventures.

Featured Posts

-

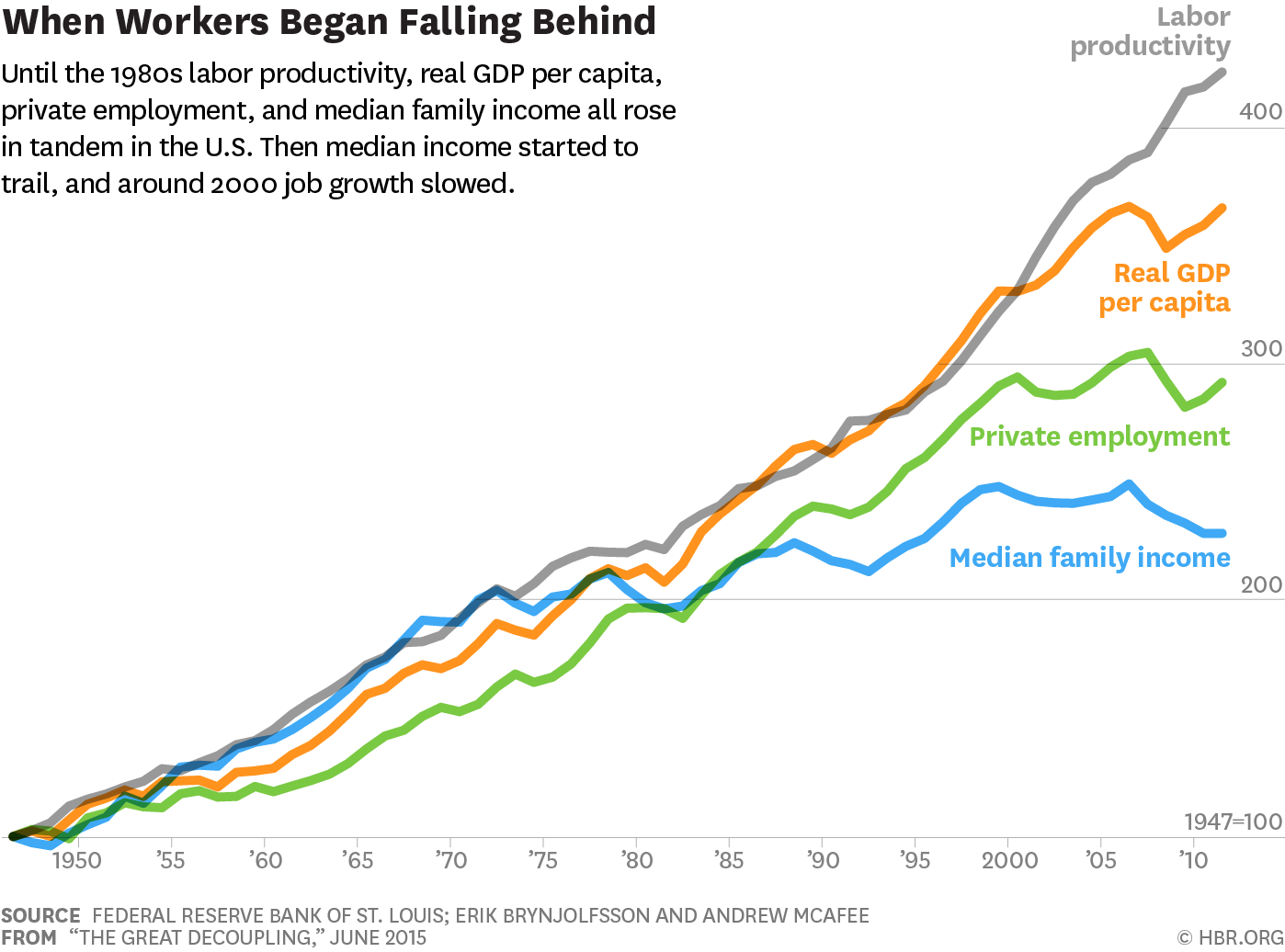

The Great Decoupling Reshaping Global Supply Chains And Trade

May 09, 2025

The Great Decoupling Reshaping Global Supply Chains And Trade

May 09, 2025 -

Former Ag Pam Bondi To Release Documents On Epstein Diddy Jfk And Mlk

May 09, 2025

Former Ag Pam Bondi To Release Documents On Epstein Diddy Jfk And Mlk

May 09, 2025 -

Overtaym Drama Vegas Golden Nayts Pobezhdayut Minnesotu V Pley Off

May 09, 2025

Overtaym Drama Vegas Golden Nayts Pobezhdayut Minnesotu V Pley Off

May 09, 2025 -

Bitcoin Madenciligi Karlilik Duesuesue Ve Gelecegi

May 09, 2025

Bitcoin Madenciligi Karlilik Duesuesue Ve Gelecegi

May 09, 2025 -

Elaxista Xionia Sta Imalaia Epikindyni Meiosi Se 23eti Vasi

May 09, 2025

Elaxista Xionia Sta Imalaia Epikindyni Meiosi Se 23eti Vasi

May 09, 2025