Analyzing Ethereum's Market Dynamics: A Price Prediction

Table of Contents

Ethereum's Technological Advancements and Network Growth

Ethereum's price is intrinsically linked to its technological advancements and the growth of its network. Two key areas significantly impacting its future price are Ethereum 2.0 and the explosive growth of its DeFi and NFT ecosystems.

Ethereum 2.0 and its Impact

The transition to Ethereum 2.0, with its shift to a Proof-of-Stake (PoS) consensus mechanism, is a game-changer. This upgrade addresses several critical limitations of the previous Proof-of-Work (PoW) system.

- Reduced transaction costs: The move to PoS drastically reduces energy consumption and transaction fees (gas fees), making Ethereum more accessible to a wider range of users and applications. Lower gas fees translate to lower barriers to entry for developers and users alike, potentially driving significant price appreciation.

- Improved scalability: Sharding, a core component of Ethereum 2.0, significantly improves scalability by dividing the network into smaller, more manageable parts. This allows for a substantial increase in transactions per second (TPS), addressing a major bottleneck that has hampered Ethereum's growth in the past. Increased TPS translates to better performance and a more user-friendly experience, boosting adoption and price.

- Enhanced security: The PoS consensus mechanism enhances the security and decentralization of the Ethereum network. This reduces the risk of 51% attacks and strengthens the overall robustness of the platform, fostering investor confidence and positively influencing the Ethereum price prediction.

DeFi and NFT Ecosystem Growth

The thriving decentralized finance (DeFi) and non-fungible token (NFT) ecosystems built on Ethereum are major drivers of its price. These burgeoning sectors create significant demand for ETH, the native token of the Ethereum network.

- Growing number of DeFi applications: The number of DeFi applications, offering services like lending, borrowing, and decentralized exchanges (DEXs), is continuously expanding. This increased usage drives demand for ETH, as it's the primary currency used within these applications. The growth of DeFi directly impacts Ethereum price prediction models.

- Increasing NFT trading volume: The NFT market, built largely on Ethereum, has experienced phenomenal growth, with trading volumes reaching billions of dollars. This increased activity directly contributes to higher demand for ETH, further influencing the Ethereum price prediction.

- Network congestion and its influence on gas fees: While the growth of DeFi and NFTs is positive, it also leads to network congestion, resulting in higher gas fees. This can sometimes negatively impact short-term price fluctuations, but long-term, the increased demand usually outweighs the temporary negative effects.

Macroeconomic Factors and Regulatory Landscape

External factors significantly influence Ethereum's price. Global economic conditions and the regulatory landscape play crucial roles.

Global Economic Conditions

Macroeconomic factors, such as inflation, interest rates, and overall economic sentiment, have a profound impact on cryptocurrency markets, including Ethereum.

- Correlation between traditional market downturns and cryptocurrency price drops: Historically, there's a correlation between downturns in traditional markets and dips in cryptocurrency prices. During economic uncertainty, investors may sell off riskier assets like cryptocurrencies.

- Impact of inflation on the value of cryptocurrencies as a hedge: Some view cryptocurrencies, including Ethereum, as a hedge against inflation. If inflation rises, the demand for cryptocurrencies as a store of value could increase, potentially driving price appreciation.

Regulatory Scrutiny and Government Policies

Governmental regulations and policies significantly influence cryptocurrency adoption and investment.

- Impact of regulatory uncertainty on investor confidence: Regulatory uncertainty can deter investors, impacting the price. Clear, consistent regulations could potentially boost investor confidence and attract more capital.

- Potential for increased regulation to either stifle or boost adoption: Regulations could stifle innovation or foster a more secure and regulated environment, ultimately influencing the adoption and price of Ethereum. The outcome is highly dependent on the specific nature and implementation of the regulations.

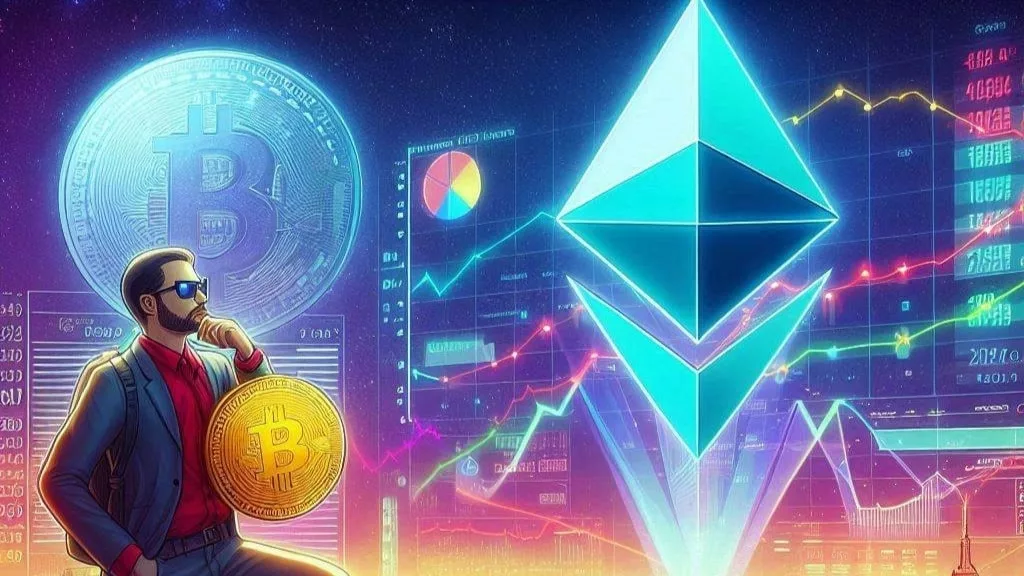

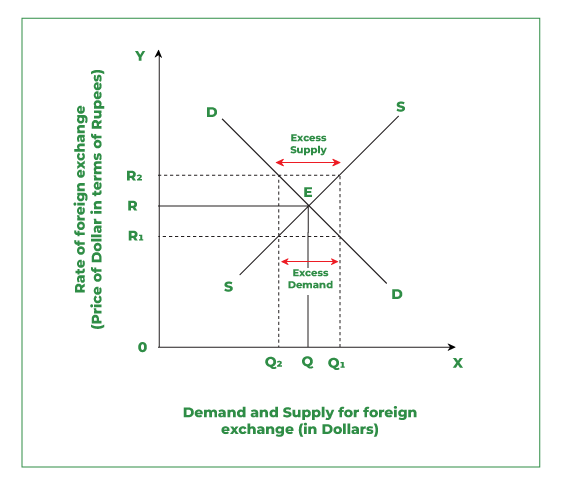

Supply and Demand Dynamics

Understanding the supply and demand dynamics of Ethereum is critical for any Ethereum price prediction.

Ethereum's Circulating Supply and Market Cap

The circulating supply of Ethereum and its market capitalization are crucial factors in determining its price.

- Effect of ETH burning mechanisms on circulating supply: Mechanisms that burn ETH, removing it from circulation, can potentially reduce supply and increase value. This deflationary pressure can contribute to price appreciation.

- Comparison with Bitcoin's market cap and dominance: Comparing Ethereum's market cap to Bitcoin's provides context and helps gauge its potential for future growth.

Investor Sentiment and Market Volatility

Investor sentiment, media coverage, and market speculation significantly influence Ethereum's price.

- Influence of social media and news on price movements: News, social media trends, and influencer opinions can dramatically impact investor sentiment and drive price volatility. FOMO (Fear Of Missing Out) and FUD (Fear, Uncertainty, and Doubt) can heavily influence short-term price swings.

- Analysis of historical price volatility and patterns: Studying past price volatility and identifying patterns can offer insights, though it's crucial to remember that past performance is not indicative of future results.

Conclusion

This analysis of Ethereum's market dynamics, including technological advancements, macroeconomic factors, and supply and demand, provides a nuanced understanding of the forces shaping its price. While predicting the future price of Ethereum with absolute certainty is impossible, considering these factors offers a more informed perspective. Further research and monitoring of these variables are crucial for accurate Ethereum price prediction. We encourage continued monitoring of these dynamics for a better understanding of future Ethereum price predictions and informed investment decisions. Stay updated on the latest developments in the Ethereum ecosystem for better Ethereum price prediction analysis.

Featured Posts

-

Nathan Fillions Brief But Powerful Role In Saving Private Ryan

May 08, 2025

Nathan Fillions Brief But Powerful Role In Saving Private Ryan

May 08, 2025 -

Nc State Recruiting Update Kendrick Raphaels Transfer

May 08, 2025

Nc State Recruiting Update Kendrick Raphaels Transfer

May 08, 2025 -

Jayson Tatums Ankle Examining The Severity And Implications For The Boston Celtics

May 08, 2025

Jayson Tatums Ankle Examining The Severity And Implications For The Boston Celtics

May 08, 2025 -

Hkd Usd Exchange Rate Intervention Triggers Record Interest Rate Drop

May 08, 2025

Hkd Usd Exchange Rate Intervention Triggers Record Interest Rate Drop

May 08, 2025 -

Andor Book Scrapped Ai Fears Halt Star Wars Publication

May 08, 2025

Andor Book Scrapped Ai Fears Halt Star Wars Publication

May 08, 2025