Analyzing Jim Cramer's Positive Outlook On Foot Locker (FL)

Table of Contents

Cramer's Rationale for a Positive Foot Locker (FL) Outlook

Analyzing Cramer's Statements

To understand Cramer's optimism, we need to examine his specific comments. While pinpointing exact quotes requires referencing specific broadcast dates, his positive statements generally revolve around several key factors. He often highlights Foot Locker's ability to adapt to changing consumer preferences and its strategic partnerships with major sneaker brands. Cramer frequently emphasizes the importance of strong brand loyalty and Foot Locker's position as a key retailer in the athletic footwear market.

- Specific quotes (example – replace with actual quotes and sources): "Foot Locker is showing remarkable resilience... they're adapting their strategy to the changing market." (Source: CNBC Mad Money, [Date])

- Key Performance Indicators (KPIs): Cramer likely focuses on metrics like same-store sales growth, online sales performance, and gross margin improvement. He might also mention the company's inventory management and supply chain efficiency.

- Links to source material: [Insert links to relevant CNBC Mad Money episodes or transcripts].

Foot Locker's (FL) Recent Performance and Financial Health

Examining the Financials

Foot Locker's recent financial performance is crucial in evaluating Cramer's assessment. We need to analyze key financial statements to determine the validity of his positive outlook.

- Recent quarterly earnings reports: [Insert data on revenue, earnings per share (EPS), and other relevant financial figures from recent quarterly reports. Include links to official Foot Locker financial releases].

- Analysis of debt-to-equity ratio: A lower debt-to-equity ratio suggests better financial health and lower risk. [Insert analysis and relevant data].

- Stock price performance: Compare FL's stock performance against competitors like Nike and Adidas, as well as relevant market indices (e.g., S&P 500). [Include charts and graphs illustrating performance].

Potential Risks and Challenges Facing Foot Locker (FL)

Counterarguments and Concerns

While Cramer's outlook is positive, it's crucial to acknowledge potential downsides. Investing in Foot Locker involves inherent risks.

- Competition: The athletic footwear market is fiercely competitive, with online retailers like Amazon and direct-to-consumer brands posing significant challenges.

- Economic downturns: Consumer spending on discretionary items like athletic footwear can be significantly impacted by economic recessions.

- Supply chain disruptions: Global supply chain issues can affect inventory levels and profitability.

- Brand dependence: Foot Locker's reliance on specific brands (e.g., Nike) exposes it to risks associated with those brands' performance.

Expert Opinions and Market Sentiment on Foot Locker (FL)

Wider Perspective

To gain a balanced perspective, it's vital to consider opinions from other financial analysts.

- Analyst ratings and price targets: Summarize the consensus view from reputable financial analysts. [Include data on buy, hold, and sell ratings, along with average price targets].

- News articles and financial publications: Refer to relevant news articles and financial publications discussing Foot Locker's prospects. [Include links to reputable sources].

- Market sentiment: Describe the overall market sentiment towards FL, highlighting whether it is generally bullish, bearish, or neutral.

Conclusion

Analyzing Jim Cramer's positive outlook on Foot Locker requires a comprehensive evaluation of the company's financial health, market position, and the overall economic climate. While Cramer's insights are valuable, they should not be the sole basis for investment decisions. The data presented suggests [Summarize whether the evidence supports Cramer's bullish stance or not – be objective]. While Foot Locker shows signs of strength, potential risks, including competition and economic factors, must be considered.

Further research into Jim Cramer's analysis and Foot Locker's (FL) financial health is crucial before making any investment decisions. Remember to always conduct thorough due diligence before investing in Jim Cramer Foot Locker or any other stock. Diversification and understanding your own risk tolerance are paramount to successful investing.

Featured Posts

-

Voennaya Agressiya Rf Masshtabnaya Raketno Dronovaya Ataka Na Ukrainu

May 15, 2025

Voennaya Agressiya Rf Masshtabnaya Raketno Dronovaya Ataka Na Ukrainu

May 15, 2025 -

Menendez Case New Sentencing Possible After Judges Decision

May 15, 2025

Menendez Case New Sentencing Possible After Judges Decision

May 15, 2025 -

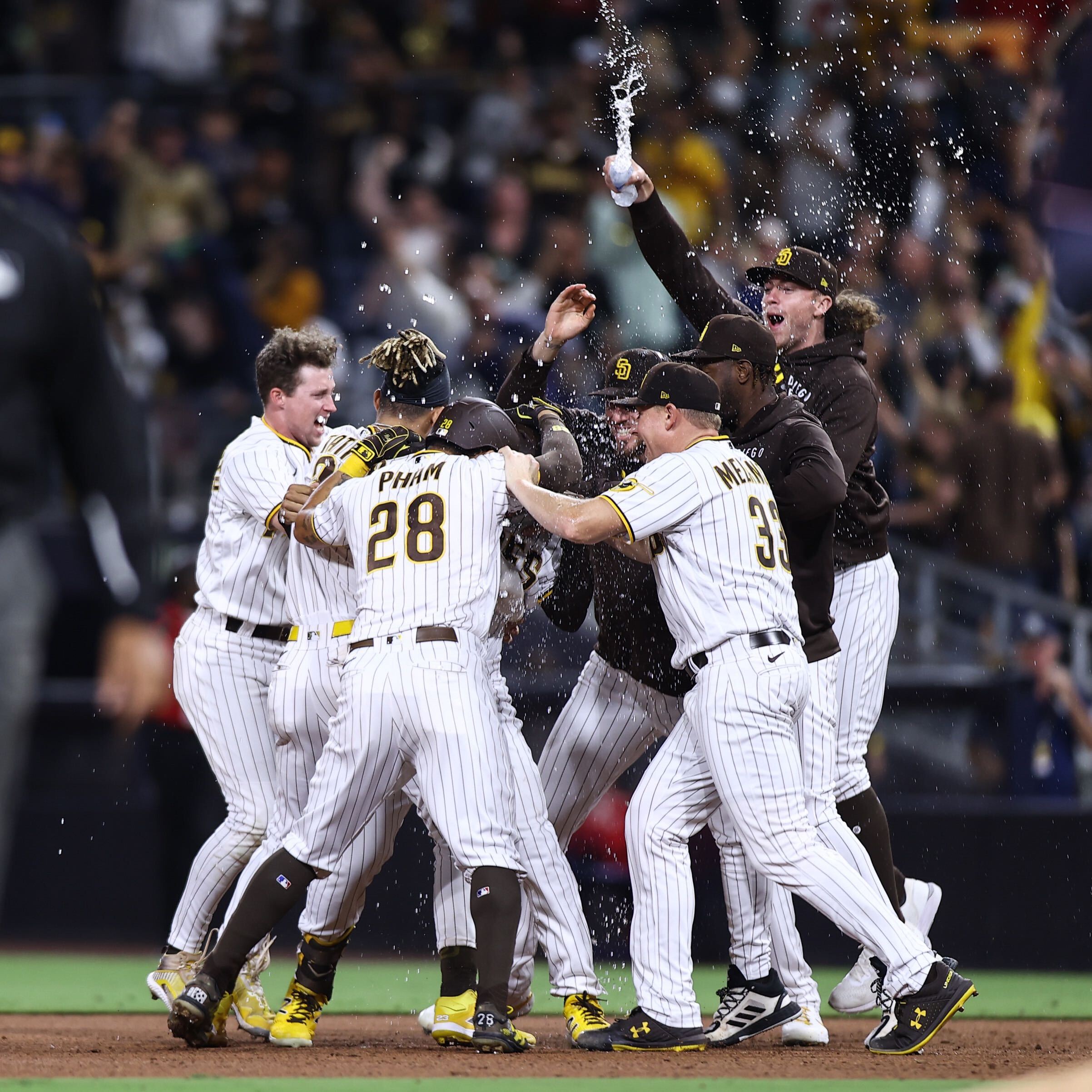

Padres Comeback Win Fight Back Against Cubs

May 15, 2025

Padres Comeback Win Fight Back Against Cubs

May 15, 2025 -

Navigate The Private Credit Boom 5 Dos And Don Ts To Land Your Dream Job

May 15, 2025

Navigate The Private Credit Boom 5 Dos And Don Ts To Land Your Dream Job

May 15, 2025 -

Rekordsmen N Kh L Po Silovym Priemam Zavershil Kareru

May 15, 2025

Rekordsmen N Kh L Po Silovym Priemam Zavershil Kareru

May 15, 2025

Latest Posts

-

Is Tom Cruise Ever Going To Pay Tom Hanks That Dollar

May 16, 2025

Is Tom Cruise Ever Going To Pay Tom Hanks That Dollar

May 16, 2025 -

12

May 16, 2025

12

May 16, 2025 -

Tom Hanks And Tom Cruises Funny 1 Debt A Hollywood Anecdote

May 16, 2025

Tom Hanks And Tom Cruises Funny 1 Debt A Hollywood Anecdote

May 16, 2025 -

7 12

May 16, 2025

7 12

May 16, 2025 -

The Tom Cruise Tom Hanks 1 Debt Will It Ever Be Repaid

May 16, 2025

The Tom Cruise Tom Hanks 1 Debt Will It Ever Be Repaid

May 16, 2025