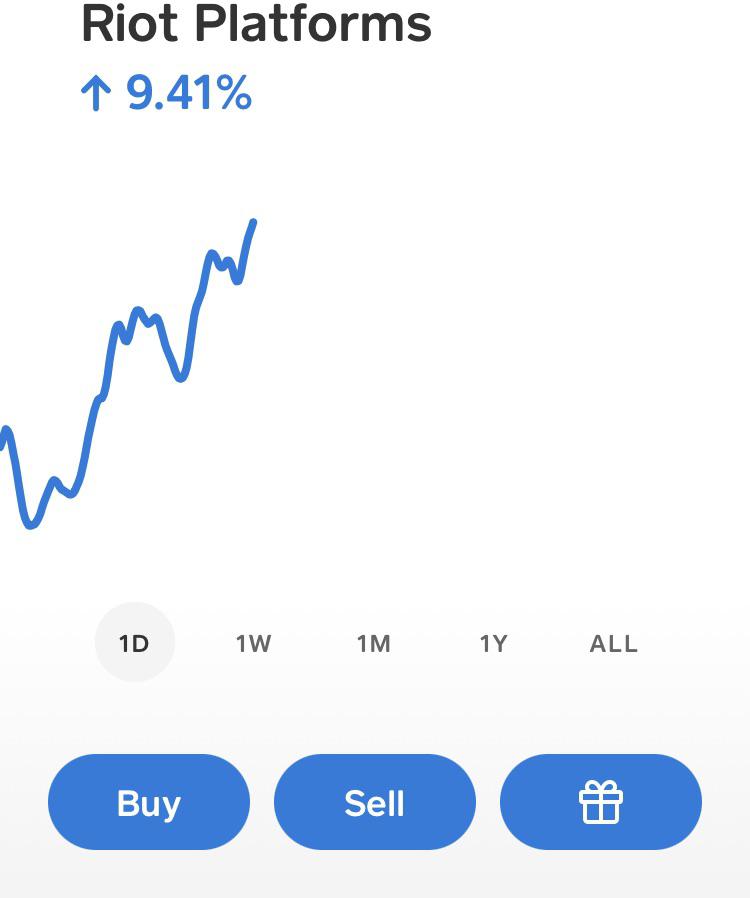

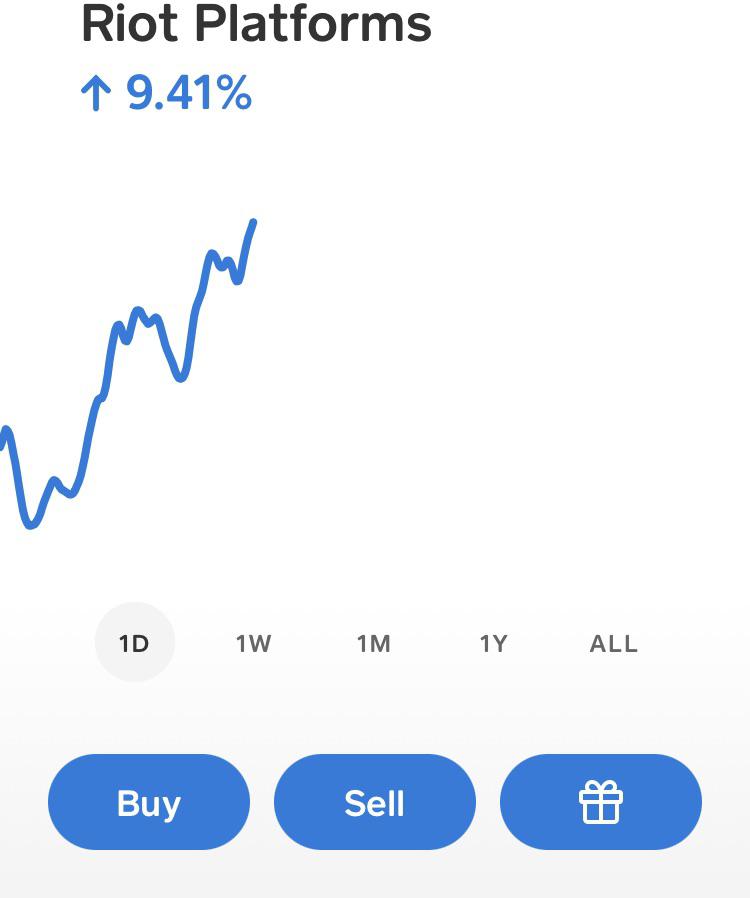

Analyzing Riot Platforms (RIOT) Stock Performance Against Market Trends

Table of Contents

RIOT Stock Price Correlation with Bitcoin Price

The strong positive correlation between Riot Platforms (RIOT) stock price and the price of Bitcoin (BTC) is undeniable. A rising Bitcoin price generally translates to increased profitability for Bitcoin miners like RIOT, boosting investor confidence and, consequently, the stock price. This correlation is a key factor in understanding RIOT's performance.

-

Analyzing historical data to demonstrate the correlation: Examining historical price charts of both RIOT and BTC reveals a clear pattern. Periods of significant Bitcoin price appreciation are usually mirrored by increases in RIOT's stock price, and vice-versa. This positive correlation isn't always perfectly linear, as other factors influence the stock price, but the trend is consistently observable.

-

Impact of Bitcoin price volatility on RIOT's short-term and long-term stock performance: Bitcoin's inherent volatility directly affects RIOT's stock. Sharp price swings in Bitcoin can lead to significant short-term fluctuations in RIOT's stock price. However, long-term investors may view these short-term dips as buying opportunities if they believe in Bitcoin's long-term growth potential and, subsequently, RIOT's.

-

Impact of Bitcoin halving events on RIOT's stock price: Bitcoin halving events, which reduce the rate of new Bitcoin creation, historically have led to increased scarcity and, often, price appreciation. This, in turn, positively impacts RIOT's profitability and stock price, although the effect is not always immediate and can be influenced by other market forces.

Influence of Macroeconomic Factors on RIOT Stock

Broader macroeconomic conditions significantly impact RIOT's stock performance. Factors such as interest rates, inflation, energy prices, and the regulatory environment play crucial roles in shaping investor sentiment and the company's profitability.

-

Impact of rising interest rates on investor appetite for riskier assets like RIOT stock: Rising interest rates generally decrease investor appetite for riskier assets, including cryptocurrency-related stocks like RIOT. Investors might shift their investments towards safer, higher-yielding bonds, causing RIOT's stock price to potentially decline.

-

Influence of energy price fluctuations on RIOT's operational costs and profitability: Bitcoin mining is energy-intensive. Fluctuations in energy prices directly impact RIOT's operational costs and profitability. High energy prices can squeeze profit margins, negatively affecting the stock price.

-

Effect of regulatory changes concerning cryptocurrency mining on RIOT's stock valuation: Regulatory uncertainty surrounding cryptocurrency mining can significantly impact investor confidence. Favorable regulations can boost the stock price, while stricter regulations or outright bans can lead to significant declines.

Comparing RIOT's Performance to Other Cryptocurrency Mining Stocks

Comparing RIOT's performance against its competitors provides valuable insights into its relative strength and market position within the cryptocurrency mining sector.

-

Identifying RIOT's key competitors and analyzing their respective stock performance: RIOT competes with other publicly traded Bitcoin miners. Analyzing their stock performance – considering factors like market capitalization, revenue generation, and operational efficiency – helps establish RIOT's competitive positioning.

-

Comparing RIOT's market share and growth trajectory with its competitors: Market share analysis helps determine RIOT's dominance in the industry. A robust growth trajectory, reflected in increasing market share and revenue, generally signifies a stronger stock performance.

-

Factors contributing to RIOT's competitive advantages or disadvantages: Analyzing RIOT's operational efficiency, mining technology, geographic location, and energy sourcing strategies helps pinpoint its competitive advantages or disadvantages relative to its peers.

Technical Analysis of RIOT Stock Charts

Technical analysis of RIOT stock charts can provide insights into potential future price movements. This involves identifying support and resistance levels, chart patterns, and using trading indicators.

-

Analyzing historical price charts using various technical indicators: Tools like moving averages, Relative Strength Index (RSI), and MACD can provide insights into price trends, momentum, and potential buy/sell signals.

-

Identifying key support and resistance levels to predict potential price reversals: Identifying these levels helps predict potential price reversals or consolidations. Support levels represent potential price floors, while resistance levels act as potential price ceilings.

-

Discussion of potential chart patterns: Identifying chart patterns such as head and shoulders, double tops/bottoms, or flags can offer potential predictions of future price movements. However, it's important to remember that technical analysis is not foolproof.

Conclusion

This analysis has examined Riot Platforms (RIOT) stock performance in relation to Bitcoin's price, macroeconomic factors, and competitor performance. Understanding these correlations is crucial for investors navigating the volatile cryptocurrency market. Technical analysis provides additional tools for forecasting potential price movements. Remember, however, that all investments carry risk, and this analysis should not be considered financial advice.

Call to Action: Continue your research into Riot Platforms (RIOT) stock and other cryptocurrency mining stocks. Careful analysis of market trends and company performance is key to making informed investment decisions in this dynamic sector. Conduct thorough due diligence before investing in any security, including RIOT stock.

Featured Posts

-

Brookfields Us Manufacturing Investment A Tariffs Conundrum

May 02, 2025

Brookfields Us Manufacturing Investment A Tariffs Conundrum

May 02, 2025 -

Boostez Vos Thes Dansants Grace A L Accompagnement Numerique

May 02, 2025

Boostez Vos Thes Dansants Grace A L Accompagnement Numerique

May 02, 2025 -

Check The Winning Numbers Lotto Lotto Plus 1 Lotto Plus 2

May 02, 2025

Check The Winning Numbers Lotto Lotto Plus 1 Lotto Plus 2

May 02, 2025 -

Fortnite Rare Skins You Might Never See Again

May 02, 2025

Fortnite Rare Skins You Might Never See Again

May 02, 2025 -

Champions League Souness Issues Stark Warning To Arsenal

May 02, 2025

Champions League Souness Issues Stark Warning To Arsenal

May 02, 2025

Latest Posts

-

David Tennants Return To The Max Harry Potter Series Unlikely

May 03, 2025

David Tennants Return To The Max Harry Potter Series Unlikely

May 03, 2025 -

Planuojamas Hario Poterio Parkas Sanchajuje Datos Ir Informacija 2027 Metams

May 03, 2025

Planuojamas Hario Poterio Parkas Sanchajuje Datos Ir Informacija 2027 Metams

May 03, 2025 -

A Harry Potter Remakes Path To Success Six Key Considerations

May 03, 2025

A Harry Potter Remakes Path To Success Six Key Considerations

May 03, 2025 -

Will The Harry Potter Remake Succeed 6 Essential Ingredients

May 03, 2025

Will The Harry Potter Remake Succeed 6 Essential Ingredients

May 03, 2025 -

Naujas Hario Poterio Pramogu Parkas Sanchajuje Atidarymas 2027 Metais

May 03, 2025

Naujas Hario Poterio Pramogu Parkas Sanchajuje Atidarymas 2027 Metais

May 03, 2025