Analyzing The D-Wave Quantum (QBTS) Stock Decrease On Thursday

Table of Contents

Market-Wide Factors Influencing QBTS Performance

The D-Wave Quantum (QBTS) stock decrease didn't occur in isolation. Thursday saw broader market volatility impacting various sectors. Understanding these macroeconomic factors is crucial to analyzing the QBTS price fluctuations.

- Overall Market Downturn: Major market indices like the NASDAQ and S&P 500 also experienced declines on Thursday. This general negative sentiment could have contributed to selling pressure across the board, including QBTS.

- Tech Stock Sell-Off: The technology sector, which QBTS belongs to, often experiences heightened sensitivity to market shifts. A broader sell-off in technology stocks could have disproportionately impacted QBTS.

- Macroeconomic News: Any negative macroeconomic news, such as disappointing economic indicators or geopolitical instability, could have created a risk-averse environment, leading to investors liquidating positions in riskier assets like QBTS. The correlation between QBTS and other tech stocks should be examined to see if this is the case. Analyzing this correlation can offer valuable insight into the extent to which broader market trends influenced the QBTS price movement.

Company-Specific News and Announcements

Analyzing company-specific news surrounding the D-Wave Quantum (QBTS) stock decrease is equally important. Any negative announcements or press releases could have directly triggered selling pressure.

- Financial Reports and Earnings: If D-Wave Quantum released financial reports or earnings announcements around Thursday, these could have disappointed investors if actual results fell short of expectations. Any negative outlook for future earnings could further exacerbate selling pressure.

- Technological Setbacks: Negative news concerning the company's technology, potential delays in product development, or challenges in scaling operations could significantly impact investor confidence and drive down the stock price.

- Partnership Issues: Problems with key partnerships or collaborations could negatively impact the perceived value and future prospects of D-Wave Quantum, contributing to the QBTS stock decrease. Analyzing the overall sentiment surrounding news related to D-Wave Quantum is essential for assessing the impact of company-specific factors on the stock price.

Technical Analysis of QBTS Stock Chart

A technical analysis of the QBTS stock chart provides further insights into the reasons behind the price drop. Examining specific indicators and chart patterns can shed light on the dynamics of the market.

- Resistance and Support Levels: Did the price drop break through key support levels, indicating a potential shift in market sentiment and a continuation of the downward trend? Were resistance levels preventing a recovery?

- Trading Volume: High trading volume accompanying the decrease suggests significant selling pressure, while low volume could point to other factors at play.

- Technical Indicators: Studying indicators like RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) can reveal whether the QBTS stock was oversold or experiencing a trend reversal. Identifying these patterns helps to understand the short-term implications of the D-Wave Quantum (QBTS) stock decrease.

Investor Sentiment and Trading Activity

Gauging investor sentiment is vital for understanding the D-Wave Quantum (QBTS) stock decrease. Negative sentiment can drive down prices, regardless of other factors.

- Social Media Sentiment: Analyzing social media discussions and sentiment surrounding QBTS can provide clues about the prevailing investor outlook. Negative sentiment often precedes price drops.

- Institutional Investor Activity: Large institutional investors' decisions can heavily influence the stock price. Significant selling by institutional investors could have contributed to the decrease.

- Trading Volume and its Implications: High trading volume during the price drop suggests significant participation by investors, possibly indicating a concerted selling effort or panic-selling. This provides insights into the strength and potential duration of the downward trend. Understanding the interplay between these factors is crucial for assessing the overall market dynamics.

Conclusion: Assessing the Future of D-Wave Quantum (QBTS) Stock

The D-Wave Quantum (QBTS) stock decrease on Thursday resulted from a complex interplay of market-wide factors, company-specific news, technical indicators, and prevailing investor sentiment. While the short-term outlook might appear bearish, it’s crucial to consider that the quantum computing sector holds significant long-term potential. Future developments regarding D-Wave Quantum's technology and market adoption will play a crucial role in shaping the stock's performance.

Stay informed about the future of D-Wave Quantum (QBTS) stock and its performance by regularly checking financial news and conducting your own in-depth analysis. [Link to relevant financial resource]. Understanding the nuances of the D-Wave Quantum (QBTS) stock decrease is vital for making informed investment decisions in the dynamic quantum computing market.

Featured Posts

-

Flavio Cobolli First Atp Title In Bucharest

May 20, 2025

Flavio Cobolli First Atp Title In Bucharest

May 20, 2025 -

Recent D Wave Quantum Qbts Stock Market Performance A Detailed Look

May 20, 2025

Recent D Wave Quantum Qbts Stock Market Performance A Detailed Look

May 20, 2025 -

Aldhkae Alastnaey Yuhyy Aghatha Krysty Imkanyat W Thdyat

May 20, 2025

Aldhkae Alastnaey Yuhyy Aghatha Krysty Imkanyat W Thdyat

May 20, 2025 -

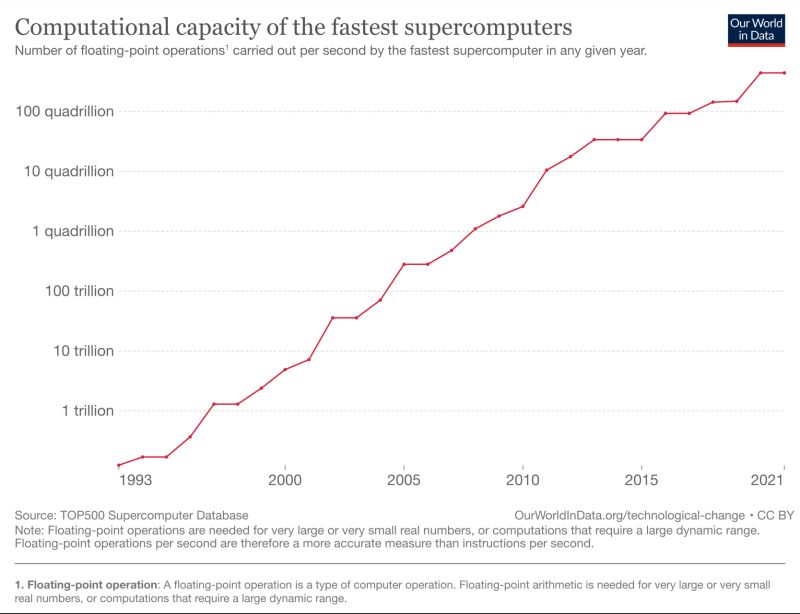

China Assembles Space Based Supercomputer Capabilities And Implications

May 20, 2025

China Assembles Space Based Supercomputer Capabilities And Implications

May 20, 2025 -

Four Star Admirals Corruption Conviction A Detailed Analysis

May 20, 2025

Four Star Admirals Corruption Conviction A Detailed Analysis

May 20, 2025

Latest Posts

-

Pasxa Kai Protomagia Sto Oropedio Evdomos Enas Oneirikos Proorismos

May 20, 2025

Pasxa Kai Protomagia Sto Oropedio Evdomos Enas Oneirikos Proorismos

May 20, 2025 -

Oropedio Evdomos Protomagia Drastiriotites And Protaseis

May 20, 2025

Oropedio Evdomos Protomagia Drastiriotites And Protaseis

May 20, 2025 -

Prokrisi Ston Teliko Champions League I Kroyz Azoyl Toy Giakoymaki

May 20, 2025

Prokrisi Ston Teliko Champions League I Kroyz Azoyl Toy Giakoymaki

May 20, 2025 -

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 20, 2025

Eksereynontas To Oropedio Evdomos Tin Protomagia

May 20, 2025 -

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn Tin Prokrisi Ston Teliko

May 20, 2025

Champions League I Kroyz Azoyl Kai O Giakoymakis Diekdikoyn Tin Prokrisi Ston Teliko

May 20, 2025