Analyzing The Ethereum Weekly Chart: A Buy Signal Emerges

Table of Contents

Identifying Key Support and Resistance Levels on the Ethereum Weekly Chart

This section analyzes significant price levels that have historically acted as support (price floor) and resistance (price ceiling) for ETH. Breaking these levels often signals a shift in momentum. Identifying these key levels is fundamental to effective Ethereum chart analysis.

-

Identifying the most recent significant support level: Our analysis shows a recent significant support level around $1,600. This level held during previous dips, indicating its strength. A break below this level could signal further bearish pressure.

-

Analyzing the strength of the support level based on past price action: The $1,600 support held for several weeks, suggesting a strong base of buying interest. This is confirmed by observing the volume during those periods (we'll examine this further below).

-

Determining potential resistance levels to watch for: Looking ahead, potential resistance levels are visible around $1,800 and $2,000. Breaking above these levels would signal stronger bullish momentum.

-

Illustrating support and resistance levels using a clear chart example: [Insert clear, well-labeled chart here showing support and resistance levels on the Ethereum weekly chart]. The chart visually confirms the support and resistance zones we've identified. This Ethereum chart analysis is crucial for context.

Analyzing the Moving Averages for Ethereum (MA)

Moving averages (MA) provide insights into the overall trend of ETH's price. We'll examine various moving averages, such as the 50-week MA and 200-week MA, to gauge momentum. Understanding these averages is key to Ethereum price prediction.

-

Explanation of how different moving average periods work (e.g., short-term vs. long-term): Shorter-term MAs (like the 50-week MA) react more quickly to price changes, while longer-term MAs (like the 200-week MA) provide a smoother indication of the overall trend.

-

Analysis of whether the shorter MAs are crossing above the longer MAs, indicating a bullish crossover: Our analysis reveals the 50-week MA recently crossed above the 200-week MA, a classic "golden cross" often interpreted as a strong bullish signal. This Ethereum MA crossover suggests positive momentum.

-

Visual representation of moving averages on the weekly chart: [Insert clear, well-labeled chart here showing the 50-week and 200-week MAs on the Ethereum weekly chart, highlighting the crossover]. The chart visually confirms the golden cross. This is a critical aspect of this Ethereum chart analysis.

-

Discussion on the significance of a "golden cross" (50-week MA crossing above the 200-week MA): The golden cross is a highly significant technical indicator, suggesting a potential long-term bullish trend reversal.

Assessing the Relative Strength Index (RSI) for Ethereum

The RSI is a momentum indicator that measures the magnitude of recent price changes to evaluate overbought or oversold conditions. This helps gauge the strength of the current trend.

-

Explanation of how the RSI works (0-100 scale): Readings above 70 generally indicate overbought conditions, while readings below 30 suggest oversold conditions.

-

Analysis of the current RSI value for Ethereum: The current RSI value for Ethereum is [Insert Current RSI Value], suggesting [Overbought/Oversold/Neutral] conditions.

-

Determining whether the RSI suggests overbought or oversold conditions: [Explain the implications of the current RSI value based on its position relative to overbought/oversold levels. Is it confirming the bullish trend or suggesting caution?]

-

Discussing the implications of the RSI for potential price movements: The RSI, in conjunction with other indicators, helps us assess the sustainability of the current price movement.

Volume Analysis: Confirming the Buy Signal

Analyzing trading volume alongside price action helps validate the buy signal. Increased volume during price increases confirms strength. Volume confirmation is crucial for this Ethereum buy signal.

-

Examination of volume during recent price increases: We observe increased volume during the recent price uptrend, supporting the bullish momentum.

-

Discussion on whether volume supports the bullish trend identified by other indicators: The increased volume adds weight to the bullish signals from the moving averages and RSI, suggesting a stronger and more sustainable upward trend.

-

Visual representation of volume on the chart: [Insert clear, well-labeled chart showing volume alongside price action on the Ethereum weekly chart]. The chart visually reinforces the volume confirmation of the bullish trend.

Conclusion

The Ethereum weekly chart analysis reveals a potential buy signal based on the convergence of key indicators like support/resistance breaks, bullish moving average crossovers, and a supportive RSI. While not a guarantee of future price increases, the confluence of these factors suggests a bullish outlook. However, remember that cryptocurrency markets are inherently volatile. Always conduct your own thorough research before making any investment decisions. Continue to monitor the Ethereum weekly chart and other relevant indicators to make informed choices regarding your ETH investments. Start your own Ethereum weekly chart analysis today!

Featured Posts

-

Broadcoms V Mware Acquisition A 1050 Price Hike Claim By At And T

May 08, 2025

Broadcoms V Mware Acquisition A 1050 Price Hike Claim By At And T

May 08, 2025 -

Star Wars Andor Tony Gilroys Production Insights

May 08, 2025

Star Wars Andor Tony Gilroys Production Insights

May 08, 2025 -

Lyon Psg Maci Ne Zaman Ve Hangi Kanalda Canli Izleme Rehberi

May 08, 2025

Lyon Psg Maci Ne Zaman Ve Hangi Kanalda Canli Izleme Rehberi

May 08, 2025 -

Kyle Kuzmas Instagram Comment On Jayson Tatum Sparks Debate

May 08, 2025

Kyle Kuzmas Instagram Comment On Jayson Tatum Sparks Debate

May 08, 2025 -

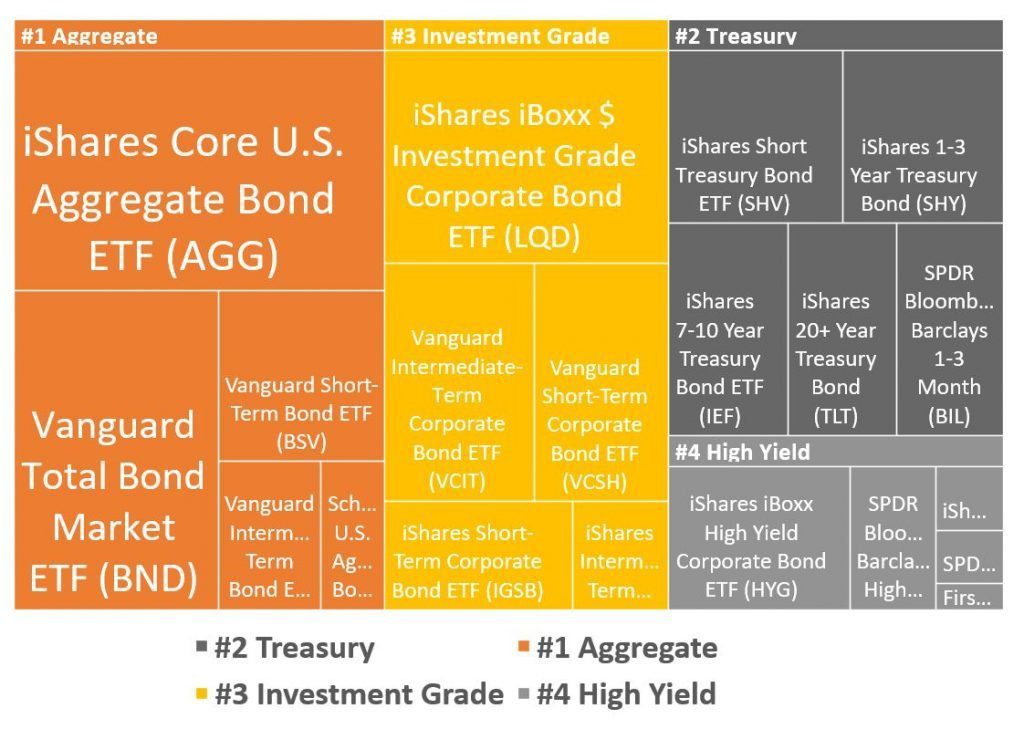

Us Bond Etf Sell Off Taiwanese Investors Leading The Retreat

May 08, 2025

Us Bond Etf Sell Off Taiwanese Investors Leading The Retreat

May 08, 2025