US Bond ETF Sell-Off: Taiwanese Investors Leading The Retreat

Table of Contents

Why are Taiwanese Investors Selling US Bond ETFs?

The recent surge in selling of US Bond ETFs by Taiwanese investors is a complex phenomenon driven by a confluence of factors. Understanding these factors is crucial to grasping the full impact on both the Taiwanese and US markets.

Rising Interest Rates in Taiwan

The increased interest rates in Taiwan have significantly altered the investment landscape, making domestic bonds more attractive.

- Yield Comparison: Taiwanese bond yields have recently surpassed those offered by many US bond ETFs, offering a higher return for comparable risk. For instance, a hypothetical 10-year Taiwanese government bond might yield 3%, while a similar US Treasury bond might yield only 2.5%. This 0.5% difference, while seemingly small, can be substantial for large investment portfolios.

- Percentage Change: The Central Bank of Taiwan's recent interest rate hikes, perhaps a percentage increase of 0.25% to 0.5% at each meeting, have directly contributed to this shift in yield differentials. This makes domestic investments more appealing to risk-averse investors.

Concerns about US Economic Outlook

Growing concerns regarding the US economic outlook are another major factor pushing Taiwanese investors away from US Bond ETFs.

- Inflation and Unemployment: High inflation rates and rising unemployment figures in the US have fueled anxieties about a potential recession. These economic indicators negatively affect investor sentiment, prompting a shift towards safer havens.

- Expert Opinions: Several leading economists have voiced concerns about the sustainability of the current US economic growth, further exacerbating investor apprehension and contributing to the US Bond ETF sell-off. These concerns are reflected in decreased confidence in the US market.

Diversification Strategies

The sell-off might also reflect a broader portfolio diversification strategy employed by Taiwanese investors.

- Shifting Asset Allocation: Some Taiwanese investors may be reallocating assets away from US bonds and towards other asset classes perceived as less risky or offering higher potential returns in the current climate. This might include increased investment in Taiwanese stocks or real estate.

- Portfolio Rebalancing: The sell-off could simply be a part of a routine portfolio rebalancing exercise by institutional investors aiming to adjust their risk exposure to changing market conditions. This would be a proactive measure to protect against potential market downturns.

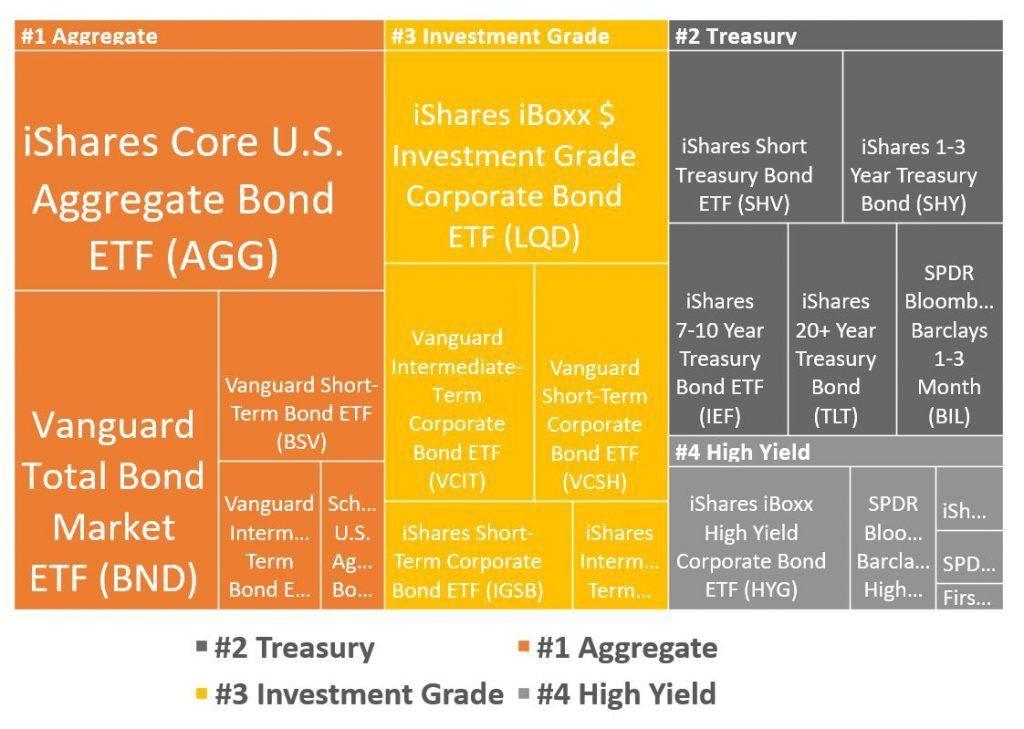

The Impact of the Sell-Off on the US Bond Market

The Taiwanese sell-off has had a noticeable impact on the US bond market, contributing to increased volatility and uncertainty.

Market Volatility and Price Fluctuations

The substantial volume of US Bond ETF sales by Taiwanese investors has contributed to increased volatility in the market.

- Price Movements: The prices of several US Bond ETFs have experienced noticeable declines in response to this selling pressure. This indicates a decrease in demand for US bonds.

- Trading Volumes: Trading volumes in relevant US Bond ETFs have also seen a surge, reflecting the heightened activity driven by the sell-off.

Implications for US Interest Rates

The sell-off has implications for US interest rate expectations.

- Bond Prices and Interest Rates: The inverse relationship between bond prices and interest rates means that the decreased demand for US bonds (lower prices) could put upward pressure on US interest rates.

- Federal Reserve Policy: The Federal Reserve might adjust its monetary policy in response to these market dynamics, potentially influencing future interest rate decisions.

Long-Term Implications and Future Outlook

The long-term implications of this US Bond ETF sell-off remain uncertain, but several factors will likely shape its trajectory.

Potential for Continued Sell-Off

The possibility of continued selling pressure from Taiwanese and other international investors remains a key concern.

- Geopolitical Events: Unforeseen geopolitical events could further impact investor confidence and trigger additional selling.

- Economic Data Releases: Upcoming economic data releases from both Taiwan and the US will significantly influence future investment decisions.

Investment Strategies for Navigating Market Uncertainty

Navigating the current market uncertainty requires a cautious and adaptable approach.

- Diversification: Maintaining a well-diversified portfolio across different asset classes is crucial to mitigate risk.

- Risk Management: Employing effective risk management techniques, including setting stop-loss orders and limiting exposure to volatile assets, is essential.

Conclusion: Understanding the US Bond ETF Sell-Off and its Impact

The recent US Bond ETF sell-off, significantly driven by Taiwanese investors, highlights the interconnectedness of global financial markets and the impact of domestic economic policies on international investment flows. Rising interest rates in Taiwan, concerns over the US economic outlook, and diversification strategies have all played a crucial role in this development. The resulting market volatility and potential implications for US interest rates necessitate careful monitoring and strategic adaptation by investors. To make informed investment decisions, stay updated on the latest developments related to the US Bond ETF sell-off and conduct thorough research before making any significant investment changes. Consult with a financial advisor for personalized guidance.

Featured Posts

-

Xrp Price Increase Analyzing The Possible Impact Of Trumps Announcements

May 08, 2025

Xrp Price Increase Analyzing The Possible Impact Of Trumps Announcements

May 08, 2025 -

Psg Derrota Al Lyon En Su Propio Estadio

May 08, 2025

Psg Derrota Al Lyon En Su Propio Estadio

May 08, 2025 -

The Great Decoupling Rethinking Globalization And Trade

May 08, 2025

The Great Decoupling Rethinking Globalization And Trade

May 08, 2025 -

400 Up And Still Climbing Exploring Xrps Price Trajectory

May 08, 2025

400 Up And Still Climbing Exploring Xrps Price Trajectory

May 08, 2025 -

Xrp Future Price Analyzing The Post Sec Lawsuit Market

May 08, 2025

Xrp Future Price Analyzing The Post Sec Lawsuit Market

May 08, 2025