Analyzing The Net Asset Value (NAV) For The Amundi Dow Jones Industrial Average UCITS ETF

Table of Contents

Factors Influencing the Amundi Dow Jones Industrial Average UCITS ETF NAV

The Amundi Dow Jones Industrial Average UCITS ETF NAV is directly tied to the performance of its underlying asset: the Dow Jones Industrial Average (DJIA) index. This means the daily fluctuations of the DJIA have a significant impact on the ETF's NAV. Understanding this direct relationship is fundamental to interpreting the ETF's value.

-

The Dow Jones Industrial Average's Performance: The most significant factor influencing the Amundi DJIA UCITS ETF NAV is the daily performance of the DJIA itself. An increase in the index's value generally leads to a rise in the ETF's NAV, and vice versa. This is because the ETF aims to mirror the index's performance.

-

Currency Fluctuations: As a UCITS ETF, the Amundi Dow Jones Industrial Average UCITS ETF is subject to currency fluctuations if the underlying assets are denominated in a currency different from the ETF's base currency. For instance, if the ETF is held in Euros but the DJIA components are primarily US dollar-denominated, changes in the EUR/USD exchange rate will influence the NAV.

-

Management Fees and Expenses: The Amundi Dow Jones Industrial Average UCITS ETF, like all ETFs, incurs management fees and expenses. These costs are deducted from the ETF's assets, which directly impacts the NAV. While the fees are typically small, they cumulatively reduce the NAV over time.

-

Dividend Distributions: When companies within the DJIA pay dividends, these distributions are usually passed on to the ETF's shareholders. This will cause a temporary decrease in the ETF's NAV on the ex-dividend date, reflecting the distribution of assets.

How to Access and Interpret the Amundi Dow Jones Industrial Average UCITS ETF NAV

Accessing real-time and historical Amundi Dow Jones Industrial Average UCITS ETF NAV data is straightforward. Several reliable sources provide this information:

-

Amundi's Website: The official website of Amundi, the ETF provider, is the most reliable source for the current NAV. Look for dedicated ETF pages and fact sheets.

-

Financial News Sources: Reputable financial news websites and data providers (e.g., Bloomberg, Yahoo Finance, Google Finance) usually list the current and historical NAV data for actively traded ETFs like the Amundi DJIA UCITS ETF.

-

Brokerage Platforms: If you hold the Amundi Dow Jones Industrial Average UCITS ETF through a brokerage account, your platform will likely display the current NAV alongside the market price.

Understanding the data requires recognizing the difference between the NAV and the market price. The NAV represents the net asset value per share, while the market price is the price at which the ETF is currently trading. A difference between these two reflects the bid-ask spread, which is influenced by supply and demand. Visualizing NAV trends using charts and graphs can provide valuable insights into the ETF's performance over time.

Using NAV to Make Informed Investment Decisions with the Amundi Dow Jones Industrial Average UCITS ETF

Monitoring the Amundi Dow Jones Industrial Average UCITS ETF NAV is essential for assessing its performance. By tracking changes in the NAV over time, you can gain a clear picture of the ETF's growth or decline.

-

Performance Assessment: Tracking NAV changes allows investors to gauge both short-term and long-term performance, helping them to make informed decisions about buying, selling, or holding their investment.

-

Identifying Potential Arbitrage Opportunities: By comparing the ETF's NAV to its market price, investors might identify potential arbitrage opportunities if a significant discrepancy exists. However, this requires careful consideration and understanding of market dynamics.

-

Comprehensive Investment Strategy: While the NAV is a crucial factor, it shouldn't be the sole determinant of investment decisions. Consider it alongside other factors such as overall market trends, risk tolerance, and diversification strategy.

Common Misconceptions about Amundi Dow Jones Industrial Average UCITS ETF NAV

Several misunderstandings surrounding ETF NAVs need clarification:

-

NAV vs. Market Price: The most frequent misconception is confusing the NAV with the market price. Remember, the NAV is the theoretical value of the ETF's underlying assets, while the market price reflects the actual trading price.

-

Calculating Returns: The NAV is crucial for calculating your investment returns accurately. Changes in the NAV directly reflect the growth or loss of your investment.

-

Frequency of NAV Updates: The NAV is typically updated daily, reflecting the closing values of the underlying assets. However, real-time prices will vary depending on market activity.

Conclusion: Mastering the Amundi Dow Jones Industrial Average UCITS ETF NAV

Understanding the Amundi Dow Jones Industrial Average UCITS ETF NAV is vital for making informed investment decisions. By comprehending the factors influencing the NAV, accessing reliable data sources, and interpreting the information correctly, you can effectively monitor your investment's performance and identify potential opportunities. Start analyzing the Amundi Dow Jones Industrial Average UCITS ETF NAV today and make informed investment decisions! For more information, visit the Amundi website [insert link here].

Featured Posts

-

Hamilton Faces Backlash After Unfair Comments

May 24, 2025

Hamilton Faces Backlash After Unfair Comments

May 24, 2025 -

Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025

Ultimate Porsche Macan Buyers Guide Models Specs And Pricing

May 24, 2025 -

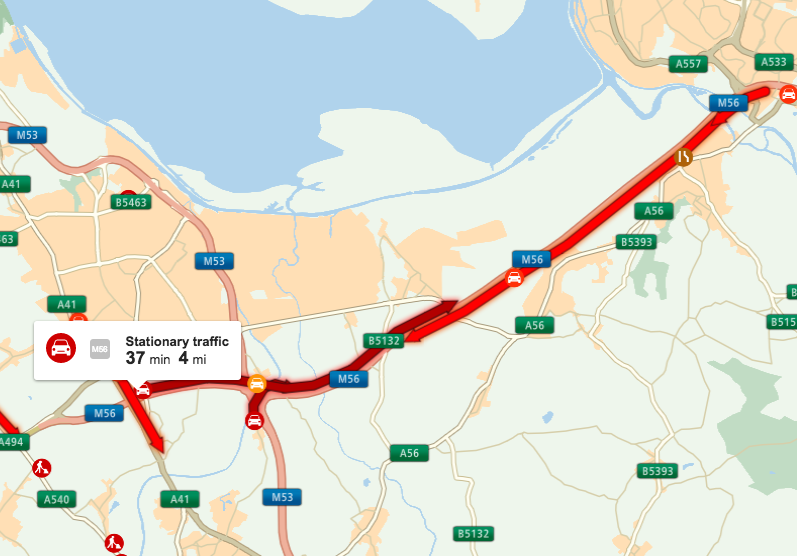

M56 Collision Cheshire Deeside Border Delays

May 24, 2025

M56 Collision Cheshire Deeside Border Delays

May 24, 2025 -

Voorspelling Toekomst Van Europese Aandelen Ten Opzichte Van Wall Street

May 24, 2025

Voorspelling Toekomst Van Europese Aandelen Ten Opzichte Van Wall Street

May 24, 2025 -

Tim Cooks Tariff Warning Triggers Apple Stock Sell Off

May 24, 2025

Tim Cooks Tariff Warning Triggers Apple Stock Sell Off

May 24, 2025

Latest Posts

-

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025

Mia Farrows Comeback Is Ronan Farrow The Key

May 24, 2025 -

Past Florida Film Festival Guests Mia Farrow Christina Ricci And Other Notable Stars

May 24, 2025

Past Florida Film Festival Guests Mia Farrow Christina Ricci And Other Notable Stars

May 24, 2025 -

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025

Ronan Farrows Role In Mia Farrows Potential Comeback

May 24, 2025 -

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025

Florida Film Festival Celebrity Sightings Mia Farrow Christina Ricci And More

May 24, 2025 -

Sadie Sink And Mia Farrow A Broadway Encounter Image 5162787

May 24, 2025

Sadie Sink And Mia Farrow A Broadway Encounter Image 5162787

May 24, 2025