Analyzing The Nifty's Surge: A Deep Dive Into India's Market Dynamics

Table of Contents

Macroeconomic Factors Fueling the Nifty's Rise

Several macroeconomic factors have contributed significantly to the Nifty's recent surge. These factors create a favorable environment for both domestic and foreign investment in the Indian stock market.

-

Strong GDP Growth: India's robust economic growth is a primary driver of the Nifty's rise. Recent GDP figures have shown consistent expansion, exceeding expectations and attracting significant foreign investment. For example, [Insert recent GDP growth data and source]. This positive growth outlook fuels investor confidence and encourages further investment in the Indian stock market.

-

Controlled Inflation: Relatively stable inflation rates contribute to a positive investment climate. While inflation has fluctuated, it remains within manageable levels, allowing the Reserve Bank of India (RBI) to maintain a relatively accommodative monetary policy. [Insert recent inflation data and source]. This stability encourages investment and prevents erosion of purchasing power.

-

Foreign Institutional Investor (FII) Inflows: Significant FII inflows have injected substantial liquidity into the Indian stock market, further boosting the Nifty 50. Recent data shows a considerable increase in FII investment, indicating strong international confidence in India's economic prospects. [Insert recent FII inflow data and source]. This influx of capital fuels demand and drives up stock prices.

-

Stable Rupee: A relatively stable Indian Rupee against major currencies like the US dollar enhances investor confidence. A stable currency minimizes exchange rate risks, making Indian assets more attractive to international investors. [Insert recent Rupee exchange rate data and source]. This stability reduces uncertainty and encourages further investment.

-

Government Policies: Government initiatives focused on infrastructure development, tax reforms, and ease of doing business have positively impacted market sentiment. These policies aim to stimulate economic growth and attract further investment. [Cite specific examples of government policies and their impact]. These structural reforms boost investor confidence and contribute to the overall market strength.

Sector-Specific Performances Driving the Nifty's Surge

The Nifty's surge is not solely due to macroeconomic factors; strong sector-specific performances have also played a crucial role. Several key sectors have experienced exceptional growth, contributing significantly to the overall index's rise.

-

Information Technology (IT) Boom: The IT sector has been a star performer, contributing substantially to the Nifty's rise. Strong global demand for IT services and the dominance of several Indian IT giants have driven exceptional growth. [Mention specific IT companies and their performance data]. This sector's strength is a major driver of the overall market's upward trajectory.

-

Financial Services Growth: The banking and financial services sector has also shown significant growth, reflecting improved economic activity and increased lending. [Mention specific bank performances and relevant data]. The expansion of this sector indicates a positive outlook for the broader economy.

-

Pharmaceutical Sector Resilience: The pharmaceutical sector has shown resilience amidst global uncertainties. India's large and growing pharmaceutical industry has demonstrated adaptability and continues to perform well. [Mention specific pharmaceutical companies and their contributions]. This sector's stability adds strength to the overall market.

-

Consumer Goods Recovery: The consumer goods sector has experienced a recovery, indicating improving consumer spending and economic confidence. [Mention specific consumer goods companies and relevant data]. This recovery highlights the increasing purchasing power and optimism within the Indian economy.

-

Infrastructure Development: Government initiatives focused on infrastructure development have spurred growth in related sectors like construction and materials. This sector’s growth will likely continue to support the Nifty’s performance in the coming years.

Analyzing Individual Nifty 50 Stocks

Analyzing individual Nifty 50 stocks provides a deeper understanding of the market dynamics. Looking at both large-cap and mid-cap stocks offers a comprehensive perspective.

-

Top Performers: Identifying the best-performing Nifty 50 stocks and understanding the reasons behind their success offers valuable insights into market trends. [Mention examples and reasons for their success]. This analysis provides clues to identifying future winners.

-

Valuation Metrics: Examining valuation ratios like Price-to-Earnings (P/E) and Price-to-Book (P/B) ratios for key stocks helps in assessing market sentiment and identifying potential overvaluation or undervaluation. [Explain how to use these ratios and offer examples]. This provides a critical framework for evaluating investment opportunities.

-

Risk Assessment: Analyzing potential risks associated with the current market rally, such as geopolitical instability or inflation spikes, is vital for informed decision-making. [Discuss potential risks and mitigation strategies]. This approach is crucial for responsible and profitable investment.

Future Outlook and Investment Implications

The future outlook for the Nifty 50 remains largely positive, but investors should adopt a cautious approach.

-

Sustained Growth Potential: While continued growth is anticipated, factors like global economic uncertainty and potential interest rate hikes by the RBI need to be considered. [Discuss potential growth drivers and headwinds]. Understanding these factors is vital for accurate predictions.

-

Investment Strategies: Investment strategies should be tailored to individual risk tolerance and investment horizons. Long-term investors may benefit from a buy-and-hold approach, while short-term investors may adopt a more tactical approach. [Suggest suitable investment strategies]. Adapting your strategy to the current market context is crucial.

-

Risk Management: Diversification is key to mitigating risk. Investors should spread their investments across different sectors and asset classes to reduce exposure to any single risk. [Explain the importance of diversification and risk management]. This protects your portfolio from unexpected market fluctuations.

Conclusion

The Nifty's recent surge is a testament to India's robust economic growth and strong sector-specific performances. However, investors should adopt a cautious approach, carefully analyzing individual stock valuations, understanding market dynamics, and employing sound risk management strategies. By staying informed about the factors influencing the Nifty 50 and its constituent stocks, investors can make informed decisions and potentially benefit from the continued growth of India's booming stock market. Continue to analyze the Nifty 50 and its constituent stocks to make informed investment decisions and maximize your returns. Remember to always conduct your own thorough research before making any investment.

Featured Posts

-

Cantor Tether And Soft Bank Explore 3 Billion Crypto Spac Merger

Apr 24, 2025

Cantor Tether And Soft Bank Explore 3 Billion Crypto Spac Merger

Apr 24, 2025 -

Eu To Discuss Spot Market Ban On Russian Natural Gas

Apr 24, 2025

Eu To Discuss Spot Market Ban On Russian Natural Gas

Apr 24, 2025 -

John Travoltas Candid Bedroom Photo A Look Inside His 3 M Home

Apr 24, 2025

John Travoltas Candid Bedroom Photo A Look Inside His 3 M Home

Apr 24, 2025 -

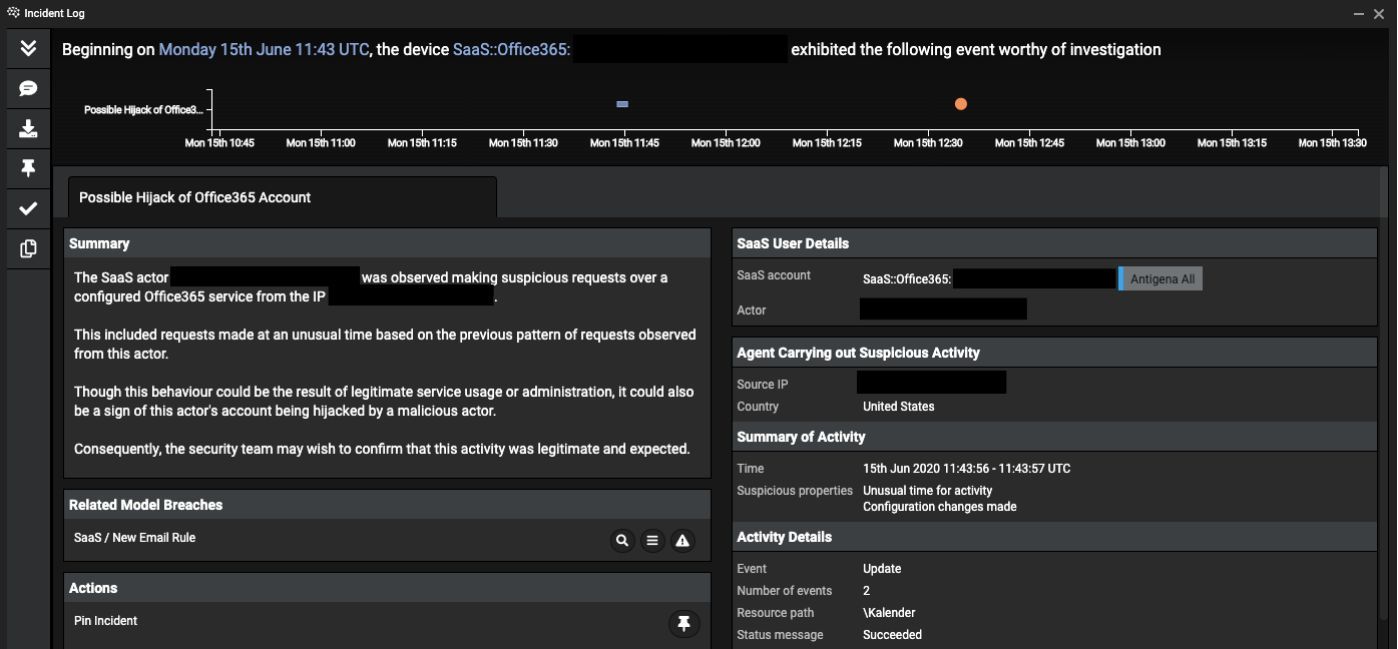

Cybercriminal Accused Of Millions In Office365 Account Compromises

Apr 24, 2025

Cybercriminal Accused Of Millions In Office365 Account Compromises

Apr 24, 2025 -

Las Vegas Airport Faa Examines Potential Collision Hazards

Apr 24, 2025

Las Vegas Airport Faa Examines Potential Collision Hazards

Apr 24, 2025

Latest Posts

-

Pokhudenie Dzhessiki Simpson Podrobnosti Ee Diety I Trenirovok

May 12, 2025

Pokhudenie Dzhessiki Simpson Podrobnosti Ee Diety I Trenirovok

May 12, 2025 -

Neal Mc Clellands Ill House U Ft Andrea Love House Musics Latest Hit

May 12, 2025

Neal Mc Clellands Ill House U Ft Andrea Love House Musics Latest Hit

May 12, 2025 -

Jessica Simpsons Cheetah Print And Blue Fur Coat A Glamorous Airport Look

May 12, 2025

Jessica Simpsons Cheetah Print And Blue Fur Coat A Glamorous Airport Look

May 12, 2025 -

From Mtv Cribs A Look At The Architectural Styles Of Celebrity Homes

May 12, 2025

From Mtv Cribs A Look At The Architectural Styles Of Celebrity Homes

May 12, 2025 -

Exploring The Lavish Estates Showcased On Mtv Cribs

May 12, 2025

Exploring The Lavish Estates Showcased On Mtv Cribs

May 12, 2025