Analyzing The Palantir Stock Rally: Updated Forecasts And Implications

Table of Contents

Understanding the Drivers of the Palantir Stock Rally

Strong Q4 2023 Earnings and Revenue Growth:

Palantir's Q4 2023 earnings report showcased impressive growth, exceeding analyst expectations and solidifying investor confidence. The company reported a significant year-over-year increase in revenue, driven by robust performance across both its government and commercial sectors. Specific numbers revealed a [Insert Percentage]% jump in revenue compared to Q4 2022, reaching [Insert Dollar Amount] in total revenue. This represents a substantial acceleration compared to the previous quarter's growth.

- Increased government contracts: Palantir secured several substantial contracts with key government agencies, highlighting the continued demand for its data analytics platforms in national security and intelligence applications.

- Growth in the commercial sector: The commercial segment demonstrated strong growth, exceeding expectations with new partnerships and expanded deployments of Palantir's Foundry platform across various industries. This diversification is viewed positively by investors, mitigating reliance on any single sector.

- Successful product launches: The launch of [mention specific new products or significant updates to existing platforms] contributed to the overall revenue increase and demonstrated Palantir’s ongoing innovation and ability to meet evolving market demands.

This combination of factors significantly boosted investor confidence, contributing directly to the Palantir stock rally.

Increasing Government and Commercial Adoption of Palantir's Platforms:

The expanding adoption of Palantir's Foundry and Gotham platforms across diverse sectors is a key driver of the recent stock rally. Both platforms are gaining traction, proving their value in solving complex data challenges for organizations of all sizes.

- Examples of new contracts: Palantir has announced several significant new contracts with [mention specific examples of new clients/contracts, ensuring public information is used], demonstrating continued growth in both the public and private sectors.

- Partnerships and successful deployments: Strategic partnerships with leading technology companies and successful implementations of Palantir's solutions across various industries, including [mention specific industries, e.g., finance, healthcare], are further reinforcing market confidence.

- Long-term implications: This widespread adoption suggests a sustainable long-term revenue stream for Palantir, fueled by the increasing demand for advanced data analytics and AI-driven solutions.

Improved Market Sentiment and Investor Confidence:

The Palantir stock rally is also fueled by a significant improvement in market sentiment and investor confidence. This positive shift is reflected in various indicators.

- Analyst upgrades: Several prominent analysts have upgraded their ratings on Palantir stock, citing strong financial performance and positive long-term growth prospects.

- Large investment fund entries: Significant investments from major institutional investors signal a growing belief in Palantir's future potential and further contribute to the rising stock price.

- Positive media coverage: Favorable media coverage and increased attention from financial news outlets are reinforcing the positive narrative surrounding the company.

This improved market sentiment is a powerful catalyst driving the Palantir stock rally and creating a positive feedback loop.

Updated Forecasts and Future Growth Projections for Palantir

Revenue Projections and Growth Rate Analysis:

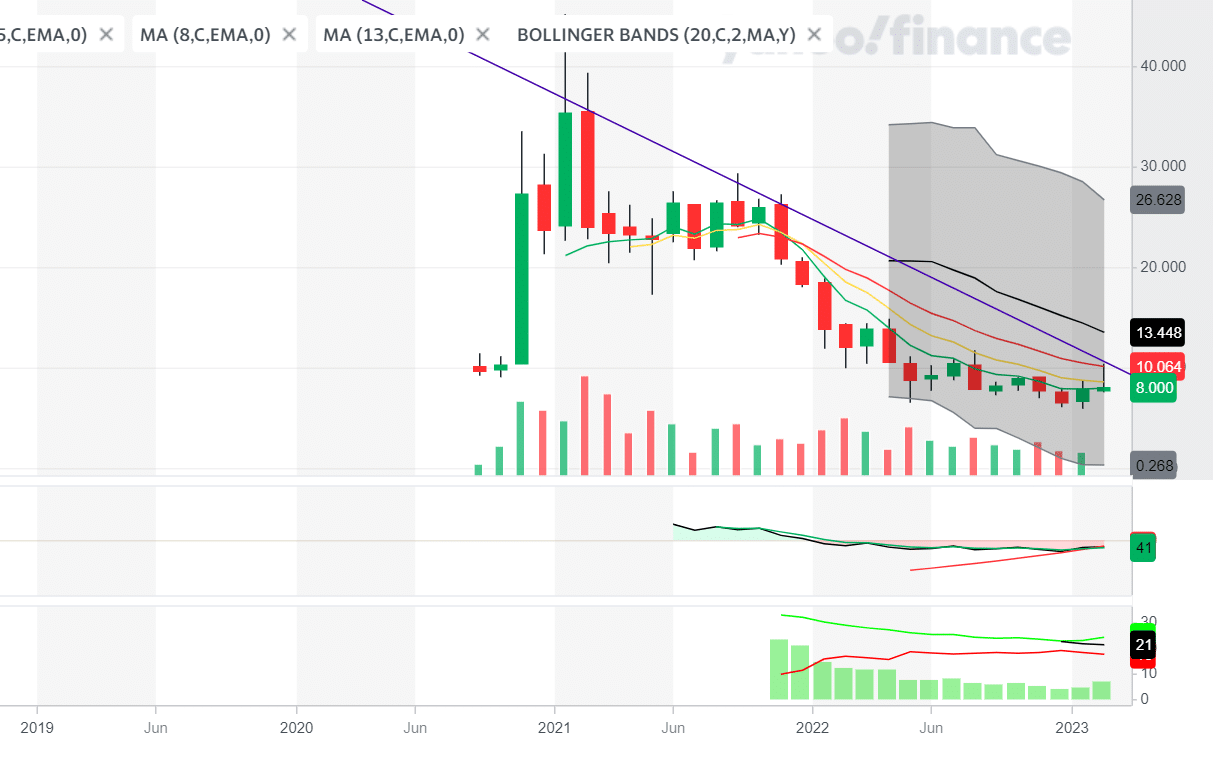

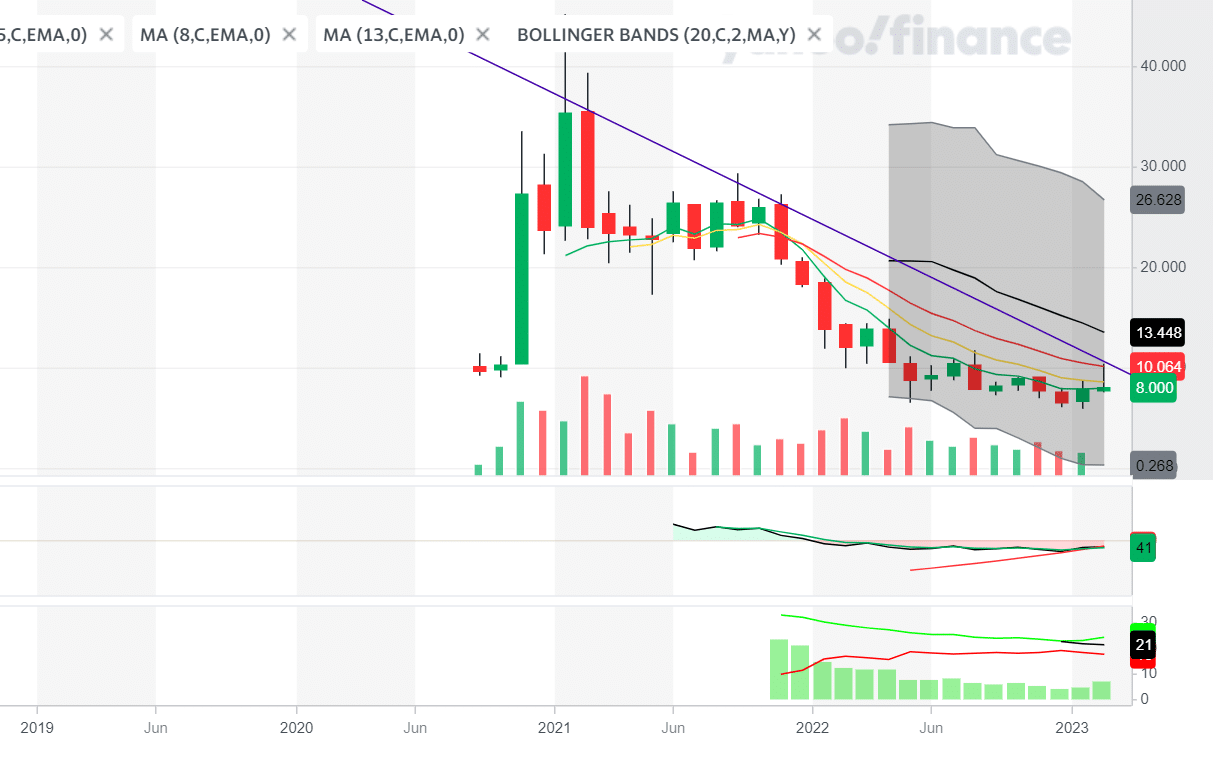

Based on Palantir's Q4 2023 performance and current market trends, we project [Insert Percentage]% revenue growth for the next fiscal year, reaching approximately [Insert Dollar Amount] in total revenue. This growth rate is expected to [Increase/Decrease/Remain Stable] in subsequent years, depending on various factors, including global macroeconomic conditions and competition. [Insert chart/graph if available illustrating revenue projections].

- Projected revenue: We forecast continued strong growth in both the government and commercial sectors, leading to sustained revenue expansion.

- Growth rate sustainability: While the current growth rate is impressive, maintaining this pace will depend on factors such as securing new large contracts, successful product development, and competitive landscape dynamics.

- Potential risks and challenges: Potential risks include increased competition, economic downturns impacting government spending, and the successful execution of Palantir's strategic initiatives.

Profitability and Margin Improvement Outlook:

Palantir is demonstrating progress toward profitability, with improvements in key metrics like gross margin and operating margin. This is largely due to several strategic initiatives.

- Operational efficiency initiatives: The company has actively pursued measures to improve its operational efficiency and reduce costs, contributing to improved profitability.

- Cost-cutting measures: Strategic cost-cutting measures have played a crucial role in enhancing margins.

- Strategies for increased profitability: Palantir is focusing on strategies to expand its higher-margin product offerings and increase customer retention, further boosting profitability.

Improved profitability is crucial for sustained growth and enhanced investor confidence, further supporting the Palantir stock price.

Valuation and Stock Price Target:

Based on our updated forecasts and valuation analysis, including a discounted cash flow (DCF) model and comparison to industry peers, we estimate a [Insert Dollar Amount] stock price target for Palantir within the next [Timeframe]. This target reflects the company's strong growth prospects, but it's important to note several considerations.

- Comparison to industry peers: Palantir's valuation is compared to similar companies in the data analytics and software sectors to provide context.

- Discounted cash flow (DCF) analysis: A DCF model is used to estimate the present value of future cash flows, providing a key input for our price target calculation.

- Potential upside and downside risks: Upside potential hinges on exceeding revenue projections and faster-than-expected profitability. Downside risks include weaker-than-expected growth, increased competition, or unforeseen macroeconomic challenges.

Implications of the Palantir Stock Rally for Investors

Risk Assessment and Potential Drawdowns:

Investing in Palantir, like any growth stock, carries inherent risks.

- Geopolitical factors: Global geopolitical events could impact government spending and influence demand for Palantir's products.

- Competition: The competitive landscape in the data analytics sector is intense, posing a risk to Palantir's market share.

- Market volatility: The stock market is inherently volatile, and Palantir's stock price is subject to fluctuations based on various factors.

- Mitigation strategies: Investors can mitigate risk through diversification, a long-term investment strategy, and thorough due diligence.

Understanding these risks and potential drawdowns is essential for informed investment decisions.

Investment Strategies and Portfolio Allocation:

Investors should consider Palantir's potential within the context of their broader investment portfolios and risk tolerance.

- Long-term vs. short-term strategies: A long-term investment approach is generally recommended due to the inherent volatility of growth stocks.

- Diversification advice: Diversification across different asset classes and sectors is crucial to manage overall portfolio risk.

- Asset allocation suggestions: The allocation of capital to Palantir should depend on individual risk tolerance and investment objectives.

Always perform thorough due diligence and consider consulting with a financial advisor before making any investment decisions.

Conclusion:

The recent Palantir stock rally is a complex phenomenon driven by strong financial performance, increased market adoption, and improved investor sentiment. While the future growth trajectory remains promising, investors should carefully consider the associated risks and incorporate Palantir into their portfolios strategically. Understanding the factors driving this Palantir stock rally and its implications is crucial for informed investment decisions. Conduct your own thorough research and consult with a financial advisor before investing in Palantir Technologies or any other stock. Continue to monitor the Palantir stock performance and stay updated on future Palantir forecasts to make well-informed decisions.

Featured Posts

-

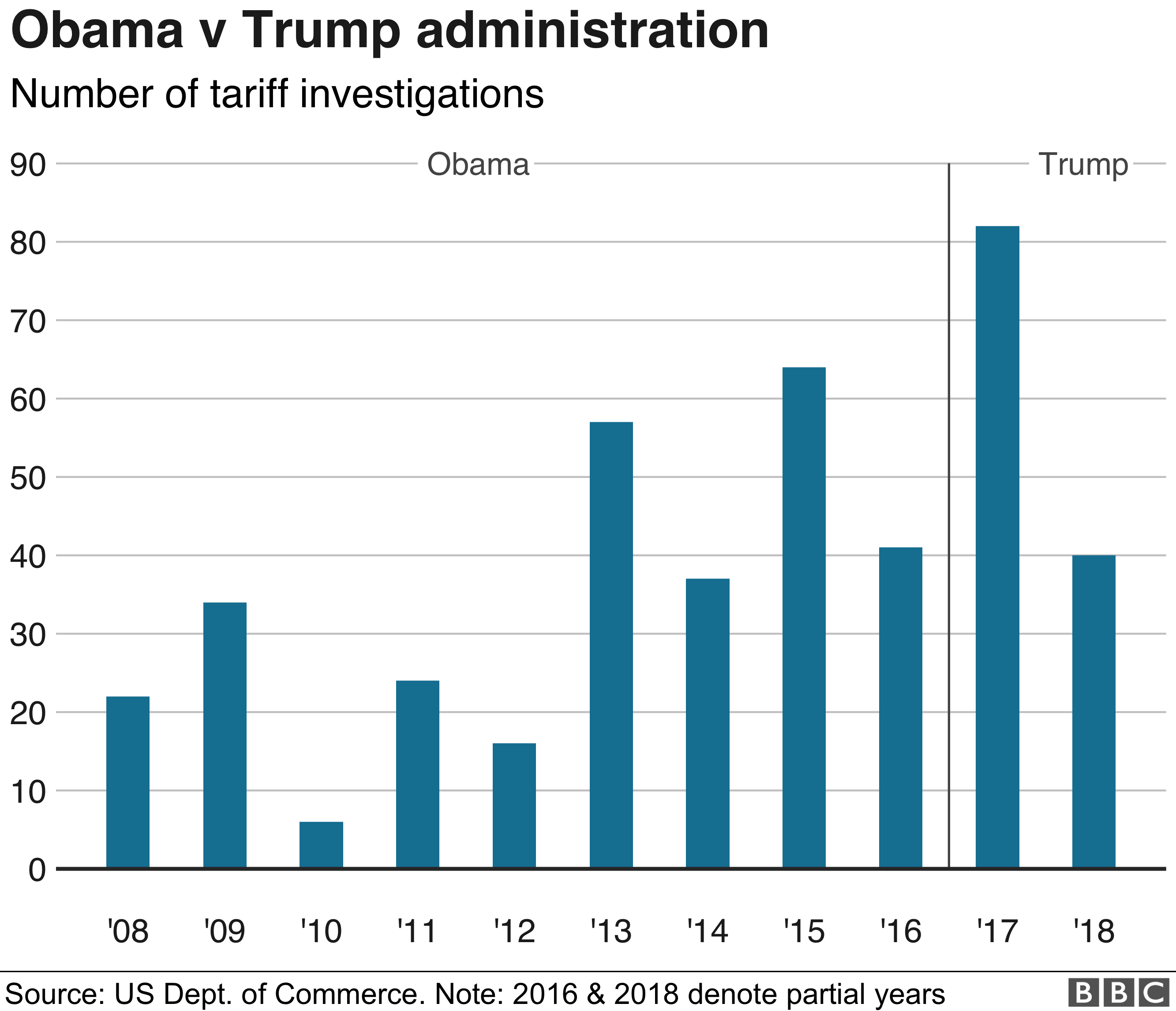

How Trumps Tariffs Cost Top 10 Billionaires 174 Billion

May 09, 2025

How Trumps Tariffs Cost Top 10 Billionaires 174 Billion

May 09, 2025 -

Jeanine Pirro Trumps Pick For Dc Prosecutor Fox News Role Explored

May 09, 2025

Jeanine Pirro Trumps Pick For Dc Prosecutor Fox News Role Explored

May 09, 2025 -

Leon Draisaitl Edmonton Oilers Hart Trophy Contender

May 09, 2025

Leon Draisaitl Edmonton Oilers Hart Trophy Contender

May 09, 2025 -

3 000 Babysitter Cost Turns Into 3 600 Daycare Bill One Mans Frustration

May 09, 2025

3 000 Babysitter Cost Turns Into 3 600 Daycare Bill One Mans Frustration

May 09, 2025 -

Infineons Ifx Lower Than Expected Sales Guidance Impact Of Trump Tariffs

May 09, 2025

Infineons Ifx Lower Than Expected Sales Guidance Impact Of Trump Tariffs

May 09, 2025