Analyzing The Potential Market Reaction To QBTS Earnings

Table of Contents

Pre-Earnings Expectations and Analyst Predictions

The consensus among analysts regarding QBTS's expected earnings per share (EPS) and revenue is currently mixed. While some predict a strong performance based on recent positive industry trends, others express caution citing potential headwinds. A range of predictions currently exists, with EPS estimates fluctuating between $X and $Y, reflecting the uncertainty surrounding the upcoming release. Recent strategic partnerships and a successful new product launch have boosted pre-earnings optimism, but concerns about supply chain disruptions and increasing competition temper some expectations.

- Analyst Ratings: Major investment firms have issued varying ratings, with a roughly even split between "buy" and "hold" recommendations. Sell recommendations are currently in the minority. Justifications for these ratings vary widely, reflecting differing perspectives on QBTS's long-term growth potential and short-term challenges.

- EPS Revisions: There have been several upward revisions to EPS estimates in recent weeks, primarily driven by positive pre-release data and improved investor sentiment. However, some analysts have slightly lowered their predictions, citing concerns regarding macroeconomic factors.

- Potential Catalysts: The successful integration of a recent acquisition and the potential for a significant new contract award could act as significant positive catalysts, potentially exceeding even the most optimistic earnings predictions.

Key Metrics to Watch Beyond EPS

While EPS is undoubtedly a crucial indicator, analyzing the potential market reaction to QBTS earnings requires a holistic view. Several other key metrics deserve close scrutiny:

- Revenue Growth: Monitoring QBTS's revenue growth compared to industry benchmarks is vital. Strong revenue growth indicates robust demand and a healthy market position. Analyzing the sources of this growth, including organic growth versus acquisitions, will provide further insights.

- Gross Margin: Changes in gross margin reflect QBTS's pricing power and efficiency in managing costs. A shrinking gross margin could signal intensifying competition or rising input costs, potentially leading to reduced profitability.

- Operating Income & Cash Flow: Positive operating income demonstrates profitability beyond revenue, while strong cash flow underscores QBTS's financial health and ability to reinvest in future growth or return value to shareholders. Analyzing the trend of these metrics provides valuable insights into the long-term sustainability of the business.

Potential Market Reactions Based on Earnings Outcomes

The market's response to QBTS's earnings will depend heavily on whether the results beat, meet, or miss expectations.

- Beating Expectations: If QBTS significantly exceeds expectations, a strong positive market reaction is likely, leading to a substantial increase in the stock price (potentially 5-10% or more). Increased investor confidence and positive media coverage would likely amplify this effect.

- Meeting Expectations: Meeting expectations would probably result in a relatively muted market response, with minimal price movement. The stock price may experience slight fluctuations, but no significant gains or losses are expected.

- Missing Expectations: Missing expectations could trigger a significant negative market reaction, resulting in a considerable drop in the stock price (potentially 5-10% or more), especially if the shortfall is substantial. This negative reaction could be amplified by pre-existing negative sentiment or broader market weakness.

Identifying Potential Risks and Opportunities

Analyzing the potential market reaction to QBTS earnings requires assessing both potential risks and opportunities.

- Risks: Key risks include intense competition from established players, potential regulatory hurdles, and the impact of any macroeconomic slowdown. Supply chain disruptions and fluctuating input costs also represent significant potential threats.

- Opportunities: New market expansion into emerging regions and advancements in core technologies offer significant growth opportunities. Strategic partnerships and successful product launches also promise future upside.

Conclusion: Assessing the Overall Impact of QBTS Earnings and Next Steps

Analyzing the potential market reaction to QBTS earnings necessitates a thorough examination of pre-earnings expectations, key financial metrics beyond EPS, and the interplay of various market factors. The market's response will be a complex interplay of these factors. Remember to consider both the potential risks and opportunities facing QBTS. Stay tuned for the QBTS earnings release and conduct your own thorough analysis before making any investment decisions. Continue your research on the impact of QBTS earnings to inform your investment strategy and assessing the potential market reaction to QBTS’s upcoming earnings report.

Featured Posts

-

Postpartum Glow Jennifer Lawrence Dazzles In Backless Gown

May 20, 2025

Postpartum Glow Jennifer Lawrence Dazzles In Backless Gown

May 20, 2025 -

Ryanair Tariff War Biggest Threat Stock Buyback Planned

May 20, 2025

Ryanair Tariff War Biggest Threat Stock Buyback Planned

May 20, 2025 -

O Thanatos Toy Baggeli Giakoymaki I Friki Toy Bullying

May 20, 2025

O Thanatos Toy Baggeli Giakoymaki I Friki Toy Bullying

May 20, 2025 -

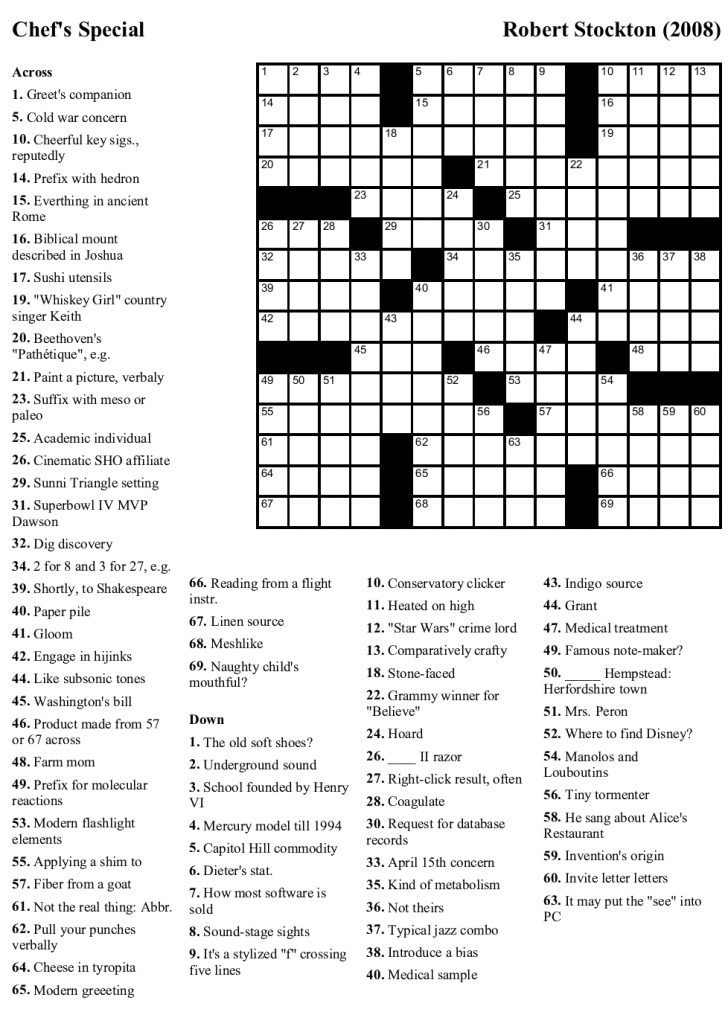

Complete Nyt Mini Crossword Answers March 13 Solutions And Hints

May 20, 2025

Complete Nyt Mini Crossword Answers March 13 Solutions And Hints

May 20, 2025 -

Typhon Missile System Chinas Plea For Philippine Withdrawal To Ease Tensions

May 20, 2025

Typhon Missile System Chinas Plea For Philippine Withdrawal To Ease Tensions

May 20, 2025

Latest Posts

-

T Hriskeytiki Esperida Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025

T Hriskeytiki Esperida Megali Tessarakosti Stin Patriarxiki Akadimia Kritis

May 20, 2025 -

Ap It

May 20, 2025

Ap It

May 20, 2025 -

Pracovne Prostredie A Jeho Vplyv Na Produktivitu Home Office Vs Kancelaria

May 20, 2025

Pracovne Prostredie A Jeho Vplyv Na Produktivitu Home Office Vs Kancelaria

May 20, 2025 -

Patriarxiki Akadimia Kritis Esperida Gia Ti Megali Tessarakosti

May 20, 2025

Patriarxiki Akadimia Kritis Esperida Gia Ti Megali Tessarakosti

May 20, 2025 -

Ap

May 20, 2025

Ap

May 20, 2025