Ryanair: Tariff War Biggest Threat, Stock Buyback Planned

Table of Contents

The Looming Threat of a Tariff War on Ryanair Stock

The brewing tariff war poses a multi-pronged threat to Ryanair's financial health and consequently, its stock price. Increased tariffs will likely impact several key areas of the business.

Impact on Fuel Costs

Increased tariffs on imported fuel will directly increase Ryanair's operating costs. Fuel is a significant expense for any airline, and for a budget carrier like Ryanair, even a small percentage increase can significantly impact profit margins.

- Analysis: Fuel costs typically represent a substantial percentage (often exceeding 20%) of Ryanair's total expenses. Any tariff-induced increase will directly translate to higher operating costs.

- Price Increases: To maintain profitability, Ryanair may be forced to pass on these increased costs to passengers, leading to higher ticket prices. This could negatively impact passenger numbers, especially in a price-sensitive market.

- Competitor Comparison: How will Ryanair's fuel costs compare to those of its competitors? Will the impact be disproportionately felt by Ryanair, potentially impacting its market share? A comparative analysis is crucial here.

- Regional Impact: The specific regions and countries affected by the tariffs will directly determine the impact on Ryanair's flight routes. Routes heavily reliant on fuel imports from tariff-affected regions will be disproportionately impacted.

Impact on Aircraft Manufacturing and Maintenance

Tariffs on imported aircraft parts will inevitably disrupt Ryanair's maintenance schedules and increase repair costs. This is a significant concern given the sheer size of Ryanair's fleet and its reliance on a just-in-time maintenance approach.

- Part Breakdown: Identifying which specific aircraft parts are subject to tariffs is critical in assessing the overall impact. Engine components, crucial electronics, and other specialized parts will be particularly concerning.

- Maintenance Delays: Delays in receiving crucial parts can lead to grounded aircraft and operational disruptions, further impacting profitability.

- Cost Implications: The increased cost of imported parts will translate directly into higher maintenance expenses for Ryanair, squeezing profit margins even further.

- Alternative Sourcing: Can Ryanair successfully source alternative parts from non-tariff affected regions? This will require significant logistical adjustments and might not always be feasible.

Impact on Passenger Numbers

Higher ticket prices, a direct consequence of increased operating costs, are likely to deter price-sensitive passengers. This could lead to a decline in passenger numbers and ultimately, a decrease in revenue.

- Price Elasticity: Understanding the price elasticity of demand for Ryanair flights is crucial. How sensitive are Ryanair's customers to price changes? Will they switch to competitors, or will demand remain relatively inelastic?

- Competitor Analysis: Competitors might not face the same level of tariff impact, giving them a competitive advantage. Ryanair will need to strategize to maintain its market share.

- Market Share Impact: The overall impact on Ryanair's market share is a key concern. A significant decrease in passenger numbers could result in a loss of market share to competitors.

- Mitigation Strategies: Can Ryanair offset increased costs through route optimization, improved operational efficiency, or other cost-cutting measures? These strategies will need careful consideration.

Ryanair's Strategic Response: The Stock Buyback

Ryanair's announcement of a stock buyback is a significant strategic move, conveying a message of confidence despite the challenges posed by the tariff war.

Signaling Confidence in Future Growth

By repurchasing its own stock, Ryanair is signaling its belief in its ability to overcome the challenges posed by the tariff war and maintain its profitability and long-term growth trajectory.

- Buyback Details: The specifics of the buyback—the amount of stock to be repurchased, the timeline, and the method of execution—will be key factors in evaluating its impact.

- Shareholder Value: A successful buyback can increase the value of the remaining shares, benefiting existing shareholders.

- Management Rationale: Understanding the management's rationale behind the buyback—as expressed in official statements and financial projections—is crucial for investor confidence.

Impact on Ryanair Stock Price

The stock buyback is likely to positively influence investor sentiment and potentially boost the Ryanair stock price.

- Market Analysis: Analyzing similar buybacks in the past can provide insights into the potential impact on stock prices.

- Price Targets: While predicting future stock prices is inherently uncertain, analyzing market conditions and expert opinions can help estimate potential price targets.

- Risk Assessment: However, the impact of the buyback is not guaranteed. Several factors, including the severity of the tariff war, could still negatively impact the stock price.

- Liquidity and Volume: The buyback could also impact the stock's liquidity and trading volume.

Alternative Uses of Capital

Ryanair's decision to engage in a stock buyback implies a strategic choice over other potential uses of capital.

- Investment Opportunities: Why did Ryanair opt for a buyback instead of investing in fleet expansion, new routes, or technological upgrades?

- Return on Investment: Comparing the expected return on investment (ROI) for the buyback against alternative investments is vital for evaluating the strategic decision.

- Financial Health: The company's debt levels and overall financial health will significantly influence the choice of capital allocation.

Conclusion

The threat of a tariff war presents a considerable challenge to Ryanair, potentially impacting fuel costs, aircraft maintenance, and passenger numbers, all of which could affect Ryanair stock. However, the planned stock buyback demonstrates a degree of confidence in the company's long-term resilience. Investors should carefully analyze the unfolding situation, monitoring the tariff war's impact on Ryanair's operations and assessing the effectiveness of its strategic responses. Keeping abreast of developments surrounding Ryanair stock and its strategies for navigating this economic uncertainty is crucial for making informed investment decisions. Stay informed about the latest news regarding Ryanair stock and its future performance.

Featured Posts

-

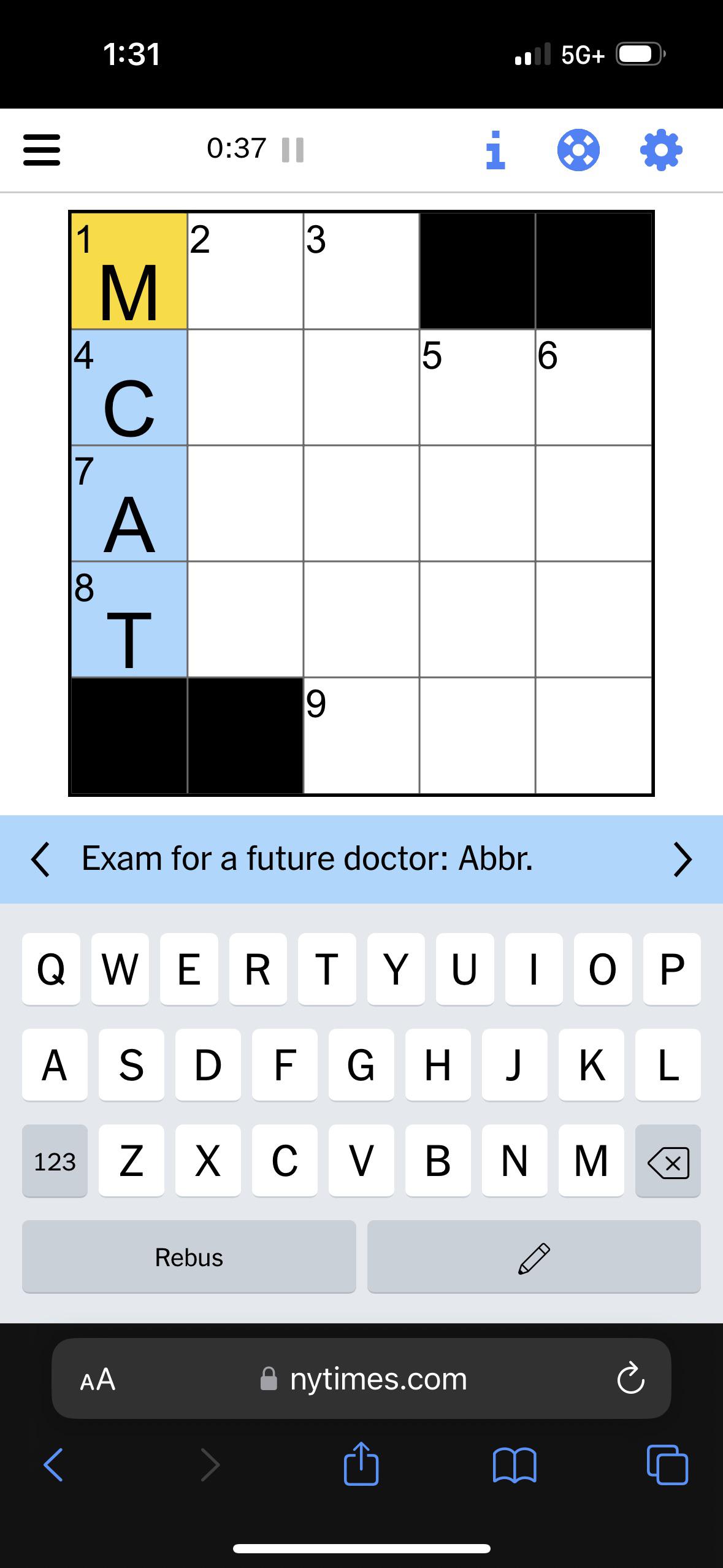

Complete Nyt Mini Crossword Answers March 13 Solutions And Hints

May 20, 2025

Complete Nyt Mini Crossword Answers March 13 Solutions And Hints

May 20, 2025 -

New Us Missile System Tested In Australia Implications For China

May 20, 2025

New Us Missile System Tested In Australia Implications For China

May 20, 2025 -

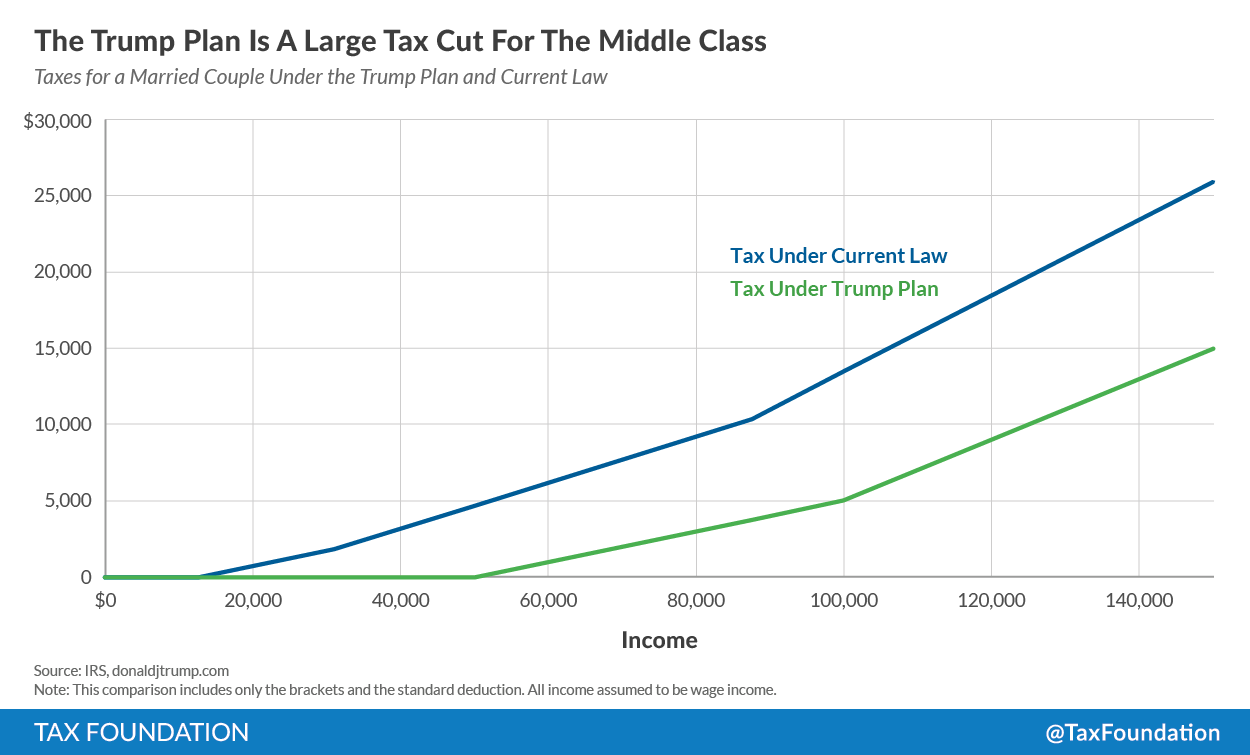

Gop Tax Plan Does It Really Cut The Deficit A Mathematical Look

May 20, 2025

Gop Tax Plan Does It Really Cut The Deficit A Mathematical Look

May 20, 2025 -

Todays Nyt Mini Crossword Answers For March 31

May 20, 2025

Todays Nyt Mini Crossword Answers For March 31

May 20, 2025 -

D Wave Quantum Qbts Stock Price Fall In 2025 Factors And Future Outlook

May 20, 2025

D Wave Quantum Qbts Stock Price Fall In 2025 Factors And Future Outlook

May 20, 2025

Latest Posts

-

Big Bear Ai Stock Buy Sell Or Hold

May 20, 2025

Big Bear Ai Stock Buy Sell Or Hold

May 20, 2025 -

The 12 Best Ai Stocks To Buy According To Reddit

May 20, 2025

The 12 Best Ai Stocks To Buy According To Reddit

May 20, 2025 -

Big Bear Ai Stock A Detailed Investment Analysis

May 20, 2025

Big Bear Ai Stock A Detailed Investment Analysis

May 20, 2025 -

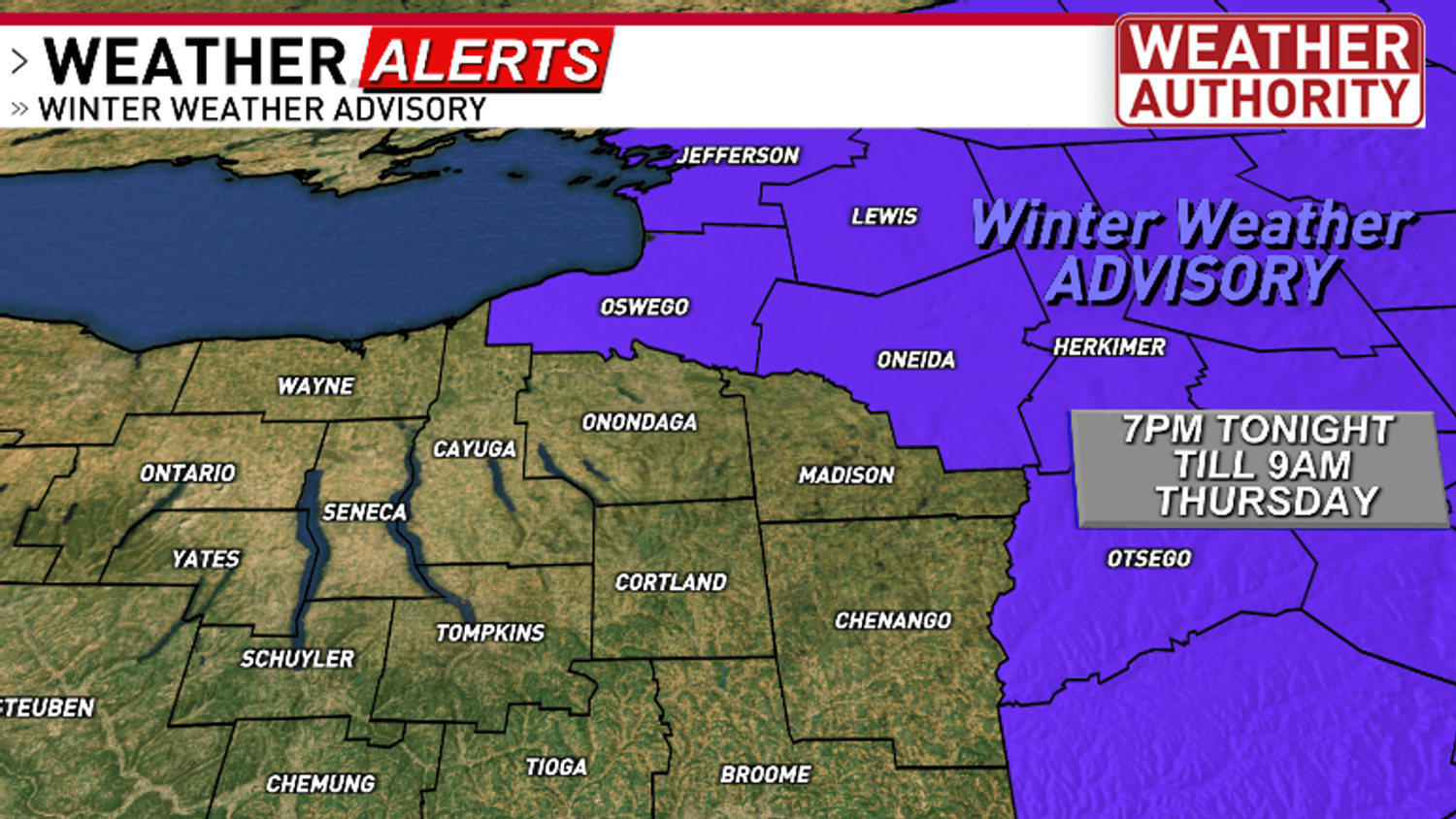

Understanding Winter Weather Advisories And Their Impact On School Schedules

May 20, 2025

Understanding Winter Weather Advisories And Their Impact On School Schedules

May 20, 2025 -

Navigating Winter Weather Advisories School Decisions And Safety Tips

May 20, 2025

Navigating Winter Weather Advisories School Decisions And Safety Tips

May 20, 2025