Analyzing The Reasons Behind BigBear.ai (BBAI)'s 2025 Stock Plunge

Table of Contents

Macroeconomic Factors Influencing the BBAI Stock Plunge

The BigBear.ai (BBAI) stock crash didn't happen in isolation. Several significant macroeconomic factors created a perfect storm that negatively impacted not only BBAI but the broader tech sector.

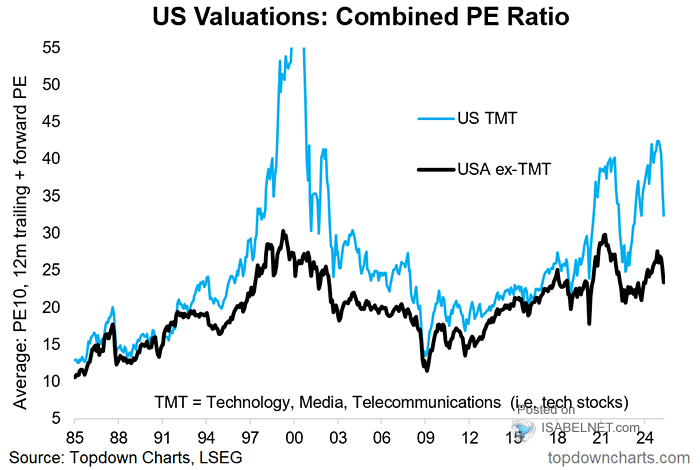

The Broad Tech Sector Downturn of 2025

2025 witnessed a significant correction in the tech market, impacting AI companies like BigBear.ai disproportionately. Several factors fueled this downturn:

- Rising Interest Rates: Increased interest rates made borrowing more expensive, impacting investment in growth-oriented tech companies.

- Inflation: High inflation eroded consumer spending and reduced corporate profits, leading to decreased investor confidence.

- Recessionary Fears: Growing concerns about a potential recession further dampened investor sentiment, driving a sell-off in riskier assets, including BBAI stock.

- Investor Risk Aversion: In the face of economic uncertainty, investors shifted towards safer investments, reducing capital available for growth stocks like BigBear.ai.

This overall market contraction significantly reduced the valuation of many tech companies, including BBAI, making it more susceptible to further negative news and price declines.

Geopolitical Instability and its Ripple Effect on BBAI

Geopolitical instability also played a role in the BBAI stock plunge. Several global events created uncertainty and negatively impacted investor confidence:

- International Conflicts: Ongoing international conflicts disrupted supply chains and created uncertainty about future economic growth.

- Trade Wars: Increased trade tensions between major economies further contributed to supply chain disruptions and reduced global trade.

- Supply Chain Disruptions: The combination of conflicts and trade wars resulted in significant supply chain issues, impacting the production and delivery of technology products and negatively impacting BBAI's operations.

These geopolitical factors added to the overall economic uncertainty, impacting investor sentiment towards BBAI and accelerating the stock price decline.

Company-Specific Factors Contributing to the BBAI Stock Decline

While macroeconomic forces played a significant role, several company-specific issues exacerbated the BigBear.ai (BBAI) stock plunge.

Disappointing Financial Performance and Missed Earnings Expectations

BBAI's financial performance leading up to the crash was far from stellar. Several key factors contributed to this:

- Revenue Shortfalls: The company consistently missed revenue projections, raising concerns about its growth trajectory.

- Increased Operating Costs: Rising operating costs squeezed profit margins, further eroding investor confidence.

- Lower-than-Expected Profits: The combination of revenue shortfalls and increasing costs resulted in significantly lower-than-expected profits, triggering a sell-off.

These disappointing financial results fueled negative sentiment and contributed significantly to the BBAI stock price decline.

Competition and Market Saturation in the AI Industry

The AI industry is becoming increasingly competitive. BBAI faced challenges in this landscape:

- Emergence of New Competitors: The emergence of numerous new competitors intensified competition for market share and contracts.

- Increased Market Competition: The highly competitive AI market made it difficult for BBAI to maintain its market share and achieve sustainable growth.

- Loss of Market Share: BBAI's inability to effectively compete led to a loss of market share, impacting its revenue and overall financial performance.

The inability to maintain a strong competitive position contributed substantially to the stock's decline.

Negative News and Investor Sentiment

Negative news and controversies surrounding BBAI further damaged investor confidence:

- Negative Press Coverage: Several critical news articles highlighted issues with the company’s technology, management, and financial performance.

- Lawsuits: The company faced several lawsuits, increasing legal expenses and damaging its reputation.

- Regulatory Issues: Regulatory scrutiny and potential fines added to the company's challenges.

- Leadership Changes: Frequent leadership changes created uncertainty and instability, further eroding investor trust.

This accumulation of negative news created a negative feedback loop, accelerating the downward trend of the BBAI stock price.

Technical Analysis of the BBAI Stock Crash

Technical analysis reveals additional insights into the BigBear.ai (BBAI) stock plunge.

Chart Patterns and Trading Volume

The BBAI stock chart showed classic signs of a major decline:

- High Trading Volume During the Crash: Extremely high trading volume during the crash indicated significant selling pressure.

- Significant Price Drops: The stock experienced sharp and sustained price drops, breaking through key support levels.

- Breakdown of Key Support Levels: The stock’s price consistently fell below crucial support levels, indicating a loss of investor confidence and a potential for further decline.

These technical indicators confirm the severity and speed of the stock's downfall.

Investor Behavior and Sentiment Indicators

Investor sentiment data further explains the rapid decline:

- High Short Interest: High short interest indicated a significant number of investors betting against BBAI, further pressuring the stock price.

- Negative Social Media Sentiment: Negative sentiment on social media platforms amplified the sell-off, influencing the actions of other investors.

- Large Sell-offs by Institutional Investors: Large institutional investors selling off their BBAI holdings accelerated the decline.

Conclusion: Lessons Learned from the BigBear.ai (BBAI) Stock Plunge of 2025

The BigBear.ai (BBAI) stock plunge of 2025 resulted from a complex interplay of macroeconomic headwinds, company-specific challenges, and negative investor sentiment. The rapid decline underscores the importance of understanding the broader economic context, conducting thorough due diligence on individual companies, and monitoring investor sentiment indicators.

Key Takeaways:

- Macroeconomic factors can significantly impact even strong companies in the tech sector.

- Company-specific issues, including financial performance, competition, and negative news, can severely damage investor confidence.

- Technical analysis can provide valuable insights into market trends and investor behavior.

Call to Action: Understanding the reasons behind the BigBear.ai (BBAI) stock plunge is crucial for investors navigating the volatile AI sector. Thorough due diligence, a careful assessment of macroeconomic conditions, and monitoring of company-specific risks are essential before investing in any BigBear.ai (BBAI) related assets or similar AI companies. Stay informed about market trends and conduct comprehensive research to mitigate investment risks.

Featured Posts

-

Nyt Mini Crossword Puzzle Solutions March 18 2025

May 20, 2025

Nyt Mini Crossword Puzzle Solutions March 18 2025

May 20, 2025 -

Find Sandylands U On Tv Your Guide To Airtimes

May 20, 2025

Find Sandylands U On Tv Your Guide To Airtimes

May 20, 2025 -

Understanding Elevated Stock Market Valuations Insights From Bof A

May 20, 2025

Understanding Elevated Stock Market Valuations Insights From Bof A

May 20, 2025 -

Hrvatski Dramski Pisac Predstavlja Novu Dramu Prica O Nevinima

May 20, 2025

Hrvatski Dramski Pisac Predstavlja Novu Dramu Prica O Nevinima

May 20, 2025 -

Complete Guide To Nyt Mini Crossword March 20 2025

May 20, 2025

Complete Guide To Nyt Mini Crossword March 20 2025

May 20, 2025

Latest Posts

-

Gangsta Granny A Comparative Analysis Of Walliams Works

May 20, 2025

Gangsta Granny A Comparative Analysis Of Walliams Works

May 20, 2025 -

Gangsta Granny Activities And Resources For Kids

May 20, 2025

Gangsta Granny Activities And Resources For Kids

May 20, 2025 -

Understanding The Humor In Gangsta Granny

May 20, 2025

Understanding The Humor In Gangsta Granny

May 20, 2025 -

Complete Tv Schedule For Sandylands U

May 20, 2025

Complete Tv Schedule For Sandylands U

May 20, 2025 -

Gangsta Granny Themes Characters And Literary Devices Explored

May 20, 2025

Gangsta Granny Themes Characters And Literary Devices Explored

May 20, 2025