Understanding Elevated Stock Market Valuations: Insights From BofA

Table of Contents

BofA's Perspective on Current Market Valuations

Bank of America's analysts have, in various reports throughout [Insert recent year or timeframe], expressed concerns about elevated stock market valuations. While they haven't consistently labeled the market as definitively "overvalued," their assessments frequently point to a market pricing in significant future growth, creating a potential vulnerability. Their perspective often incorporates a cautious outlook, highlighting the risks associated with the current valuations.

-

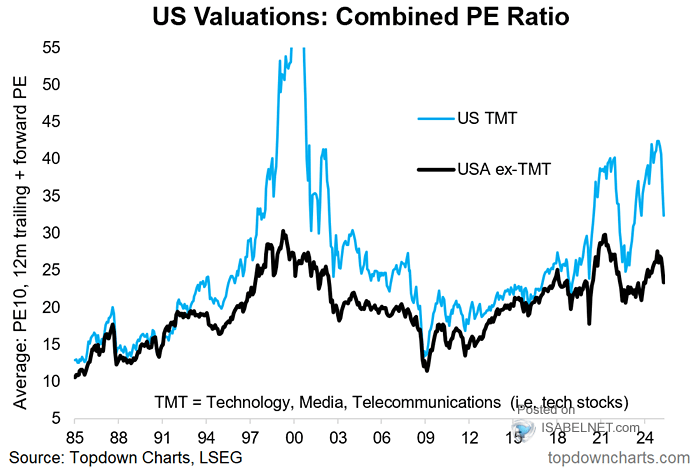

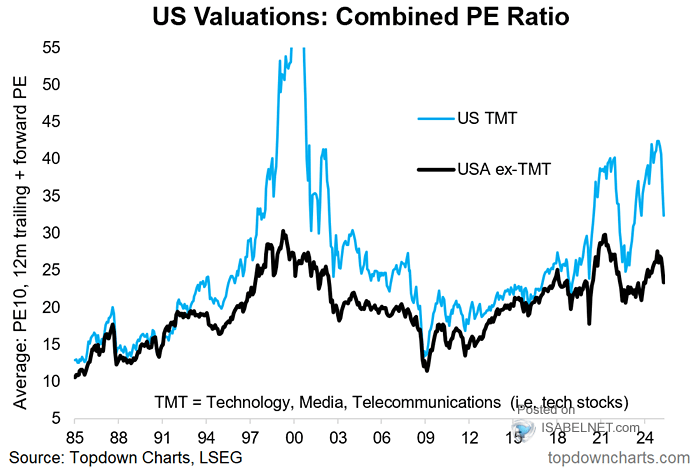

Summary of BofA's Reasoning: BofA's analysis typically considers a range of factors, including historical P/E ratios, projected earnings growth, and prevailing interest rate environments. They often compare current valuations to historical averages and long-term trends to determine potential overvaluation.

-

Sectors Highlighted: Specific sectors highlighted by BofA as potentially overvalued in certain reports have included [Insert specific sectors mentioned by BofA, e.g., technology, consumer discretionary]. Conversely, [Insert specific sectors mentioned by BofA, e.g., financials, energy] have sometimes been identified as potentially more fairly valued or even undervalued, depending on the specific report and timeframe.

-

Relevant Statistics: BofA's research often cites statistics such as elevated price-to-earnings (P/E) ratios compared to historical averages and rapid growth in market capitalization in certain sectors. For example, they might note that the S&P 500's P/E ratio is significantly above its historical average, indicating potential overvaluation. (Note: Replace this with specific statistics and citations from actual BofA reports).

Key Valuation Metrics Used by BofA

BofA, like most financial institutions, employs a variety of valuation metrics to assess market conditions and individual stock valuations. These metrics offer different perspectives on a company's or market's worth.

-

Price-to-Earnings Ratio (P/E): This ratio compares a company's stock price to its earnings per share. A high P/E ratio suggests investors are paying a premium for each dollar of earnings, potentially indicating overvaluation. BofA likely uses this extensively to analyze market-wide and sector-specific valuations.

-

Price-to-Sales Ratio (P/S): This ratio compares a company's stock price to its revenue. It's particularly useful for evaluating companies with negative earnings or those in high-growth sectors. BofA might use this to assess valuations in rapidly expanding technology companies.

-

Price-to-Book Ratio (P/B): This ratio compares a company's stock price to its book value (assets minus liabilities). A high P/B ratio can suggest overvaluation, while a low one could indicate undervaluation. BofA would likely use this for evaluating companies with substantial tangible assets.

-

Dividend Yield: This metric represents the annual dividend payment per share relative to the share price. A higher dividend yield can be attractive to investors seeking income, and BofA's analysis might consider this factor in assessing the overall attractiveness of different sectors.

Factors Contributing to Elevated Stock Market Valuations (According to BofA)

BofA's analysis likely attributes elevated stock market valuations to a combination of factors:

-

Low Interest Rates: Historically low interest rates make borrowing cheaper for companies and encourage investors to seek higher returns in the stock market, driving up prices.

-

Quantitative Easing (QE): Central bank policies like QE inject liquidity into the market, increasing the money supply and potentially fueling asset price inflation, including stocks.

-

Strong Corporate Earnings (in some sectors): Robust earnings growth in certain sectors can justify higher valuations, though the sustainability of this growth is often a key concern.

-

Technological Innovation: Rapid advancements in technology have driven significant growth in certain sectors, attracting substantial investment and pushing valuations higher.

-

Investor Sentiment: Positive investor sentiment, fueled by optimism about future growth, can drive up demand for stocks, leading to higher valuations.

The Role of Interest Rates in Stock Valuations

Interest rates have a significant inverse relationship with stock valuations. When interest rates rise, bonds become more attractive, drawing investment away from stocks and potentially reducing stock prices. Conversely, low interest rates make stocks comparatively more attractive. BofA's predictions regarding future interest rate changes are crucial in forecasting market movements. Their analysis often incorporates various scenarios based on different interest rate trajectories, highlighting potential impacts on stock valuations. Investors can adjust their strategies by considering BofA's interest rate forecasts and diversifying their portfolios to mitigate risk across different asset classes.

Investment Strategies in a Market with Elevated Valuations

Based on BofA's analysis, navigating a market with potentially high valuations requires a thoughtful investment strategy.

-

Diversification: Diversifying across different sectors, asset classes (stocks, bonds, real estate), and geographies can help mitigate risk. BofA might suggest reducing exposure to potentially overvalued sectors.

-

Sector-Specific Opportunities: While some sectors might be overvalued, BofA’s research may highlight specific undervalued sectors or companies with strong growth potential.

-

Defensive Investment Strategies: In a market with elevated valuations, defensive strategies such as investing in dividend-paying stocks or focusing on companies with strong balance sheets might be considered.

-

Long-Term Investing: Maintaining a long-term perspective is crucial. Short-term market fluctuations should not dictate long-term investment decisions.

Conclusion

BofA's analysis of elevated stock market valuations points to a complex interplay of factors, including low interest rates, strong corporate earnings in certain sectors, technological innovation, and overall investor sentiment. Understanding key valuation metrics like P/E ratios, P/S ratios, and P/B ratios is crucial for assessing market conditions. Employing a diversified investment strategy, considering defensive approaches, and maintaining a long-term perspective are vital strategies for navigating this environment. Stay informed about market trends and regularly review your investment strategy based on the latest insights on understanding elevated stock market valuations, like those provided by BofA and other reputable financial institutions. Continuously monitor your portfolio and make adjustments as needed to navigate the complexities of the market.

Featured Posts

-

Dubai Reit Ipo Size Boosted To 584 Million By Dubai Holding

May 20, 2025

Dubai Reit Ipo Size Boosted To 584 Million By Dubai Holding

May 20, 2025 -

Le Marche Des Restaurants A Biarritz Nouveaux Chefs Et Adresses A Tester

May 20, 2025

Le Marche Des Restaurants A Biarritz Nouveaux Chefs Et Adresses A Tester

May 20, 2025 -

Imanol Harinordoquy Et Jean Michel Suhubiette Au Restaurant Rooftop Des Galeries Lafayette Biarritz

May 20, 2025

Imanol Harinordoquy Et Jean Michel Suhubiette Au Restaurant Rooftop Des Galeries Lafayette Biarritz

May 20, 2025 -

Economic Downturn In College Towns The Impact Of Declining Enrollment

May 20, 2025

Economic Downturn In College Towns The Impact Of Declining Enrollment

May 20, 2025 -

Gaite Lyrique Situation D Urgence Et Demande D Intervention De La Mairie De Paris

May 20, 2025

Gaite Lyrique Situation D Urgence Et Demande D Intervention De La Mairie De Paris

May 20, 2025

Latest Posts

-

Corruption Case Shakes Us Navy Four Star Admirals Fall From Grace

May 20, 2025

Corruption Case Shakes Us Navy Four Star Admirals Fall From Grace

May 20, 2025 -

Bribery Prosecution Of 4 Star Admiral Uncovering Deep Rooted Navy Cultural Issues

May 20, 2025

Bribery Prosecution Of 4 Star Admiral Uncovering Deep Rooted Navy Cultural Issues

May 20, 2025 -

Us Four Star Admiral Found Guilty Charges And Sentencing

May 20, 2025

Us Four Star Admiral Found Guilty Charges And Sentencing

May 20, 2025 -

Four Star Admirals Corruption Conviction A Deep Dive

May 20, 2025

Four Star Admirals Corruption Conviction A Deep Dive

May 20, 2025 -

Job Exchange Scheme Leads To Bribery Charges Against Navys Burke

May 20, 2025

Job Exchange Scheme Leads To Bribery Charges Against Navys Burke

May 20, 2025