Analyzing The Ripple Effect: Trump's Endorsement And Institutional XRP Investment

Table of Contents

Trump's Endorsement and its Impact on Market Sentiment

The Psychology of Celebrity Endorsements in Crypto

Celebrity endorsements wield significant power in the cryptocurrency world. High-profile figures like Donald Trump can dramatically sway public perception and drive increased trading volume. This is fueled by several psychological factors:

- Increased media coverage and social media buzz: Trump's comments, regardless of their clarity, generate significant media attention, leading to increased exposure for XRP and heightened investor interest.

- Potential for "fear of missing out" (FOMO) among retail investors: The perception of a "Trump effect" can trigger FOMO, prompting retail investors to jump into the market, potentially pushing prices upward in the short term.

- Influence on short-term price volatility: This increased interest and trading activity directly impacts XRP's price, leading to considerable short-term volatility.

Analyzing the Ambiguity of Trump's Statements

It's crucial to analyze Trump's statements cautiously. His comments regarding cryptocurrencies have often been vague and open to interpretation.

- Examples of Trump's comments related to cryptocurrencies: We need to examine specific instances of Trump mentioning crypto, avoiding generalizations and focusing on verifiable statements.

- Distinction between implied support and explicit endorsements: Carefully differentiating between implied support (e.g., positive comments about the technology) and explicit endorsements (direct calls to invest) is vital for accurate assessment.

- The role of media interpretation in shaping market sentiment: The media's interpretation and amplification of Trump's remarks heavily influence market sentiment, sometimes creating a narrative that differs from the original intent.

Institutional XRP Investment: Trends and Motivations

The Appeal of XRP for Institutional Investors

Institutional investors aren't driven solely by hype; they seek tangible value. Several factors make XRP attractive:

- XRP's technology and its potential for faster, cheaper transactions: XRP's underlying technology aims for faster and more cost-effective cross-border payments compared to traditional systems.

- Ripple's partnerships with financial institutions: Ripple's extensive network of partnerships within the financial sector adds credibility and potential for large-scale adoption.

- Comparison of XRP with other cryptocurrencies favored by institutional investors: XRP's position relative to other institutional favorites, such as Bitcoin or Ethereum, needs to be considered in terms of risk and reward profiles.

Risk Assessment in Institutional XRP Investments

Despite its appeal, XRP investment carries considerable risk:

- Analysis of the SEC lawsuit and its potential impact on XRP's future: The ongoing legal battle between Ripple and the SEC casts a significant shadow, impacting investor confidence and potential future regulatory outcomes.

- Regulatory risks in different jurisdictions: Regulatory landscapes for cryptocurrencies vary widely across countries, presenting significant challenges for international investment in XRP.

- Diversification strategies for institutional investors in the crypto market: Institutional investors need robust diversification strategies to mitigate the risks associated with XRP and other crypto assets.

The Ripple Effect: Long-Term Implications for XRP Price and Adoption

Short-Term Volatility vs. Long-Term Growth Potential

Trump's endorsement might cause short-term volatility, but long-term growth depends on other factors:

- Predicting the impact of regulatory clarity on XRP's price: A clear regulatory framework, regardless of its specifics, could significantly stabilize XRP's price and boost investor confidence.

- The role of technological advancements in driving adoption: Continuous innovation and improvements in XRP's technology are crucial for attracting wider adoption and increasing its value proposition.

- Factors influencing the long-term market capitalization of XRP: Market adoption, network effects, and overall cryptocurrency market trends will be key drivers of XRP's long-term value.

The Future of Institutional XRP Adoption

Increased institutional adoption depends on several scenarios:

- Potential future partnerships and collaborations for Ripple: Strategic alliances with other financial institutions could significantly broaden XRP's reach and utility.

- The impact of increased competition from other cryptocurrencies: Competition from other payment-focused cryptocurrencies could significantly impact XRP's market share and growth trajectory.

- The role of blockchain technology in the future of finance: The overall acceptance and integration of blockchain technology within the financial sector will directly impact the future of XRP and similar assets.

Conclusion: Trump's apparent endorsement of XRP, while potentially influencing short-term market sentiment, shouldn't overshadow a thorough analysis of institutional XRP investment. The long-term success of XRP hinges on factors beyond political influence, including regulatory clarity, technological innovation, and its ability to solve real-world problems in the financial sector. Understanding the risks and potential rewards associated with XRP investment is crucial for both institutional and retail investors. Before making any investment decisions, it is recommended to conduct your own thorough research and consider seeking advice from a qualified financial advisor regarding XRP investment strategies. Remember to carefully weigh the potential benefits and risks before considering any XRP investment.

Featured Posts

-

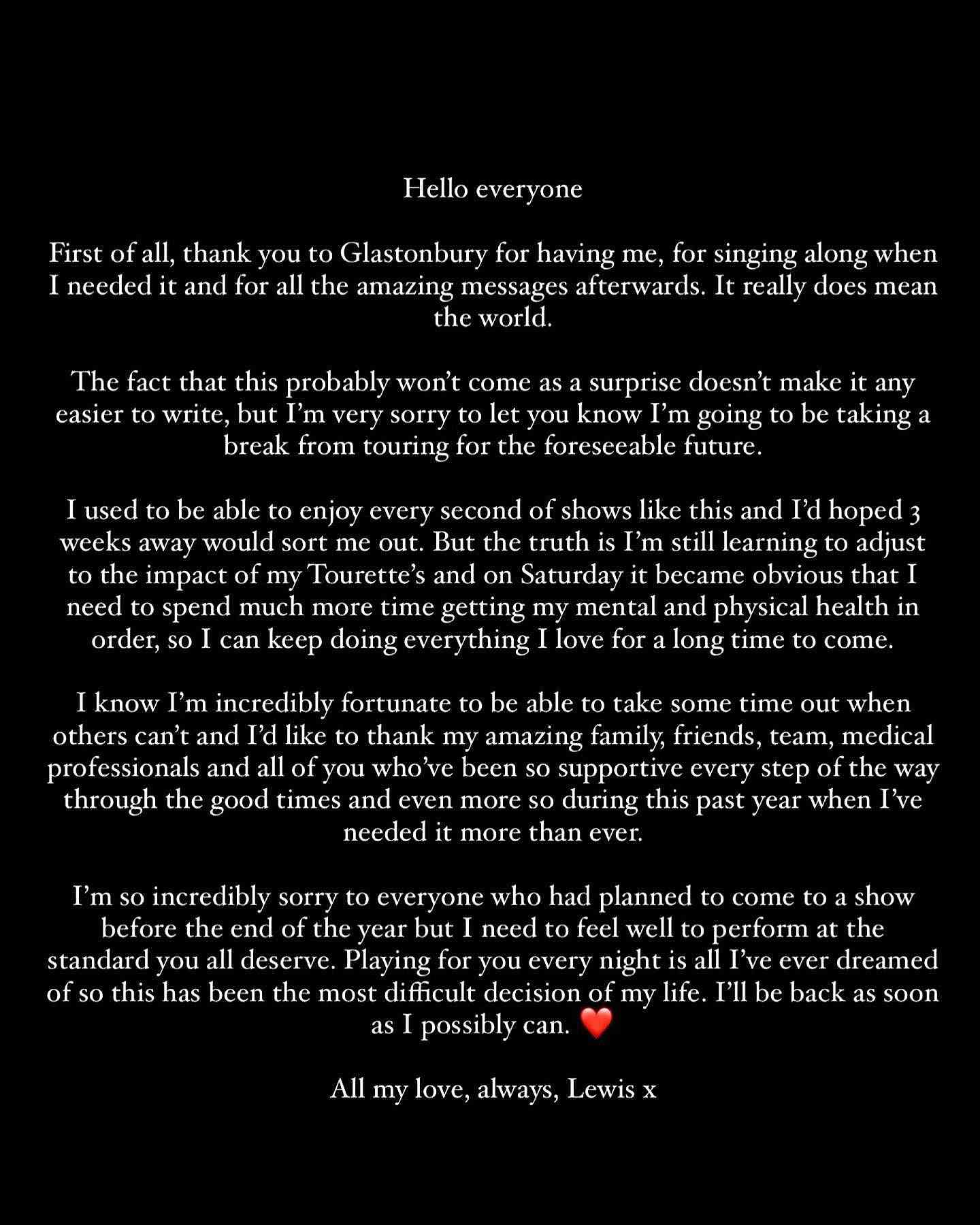

Mental Health Focus Lewis Capaldis Long Awaited Return To The Stage

May 07, 2025

Mental Health Focus Lewis Capaldis Long Awaited Return To The Stage

May 07, 2025 -

Lion Electrics Future Uncertain Court Appointed Monitor Suggests Liquidation

May 07, 2025

Lion Electrics Future Uncertain Court Appointed Monitor Suggests Liquidation

May 07, 2025 -

Simone Biles Police Involvement After Disturbing Texts About Nassar And Owens

May 07, 2025

Simone Biles Police Involvement After Disturbing Texts About Nassar And Owens

May 07, 2025 -

The Enduring Success Of Lewis Capaldis Latest Album

May 07, 2025

The Enduring Success Of Lewis Capaldis Latest Album

May 07, 2025 -

Decryptage Du Profil De Lane Hutson Defenseur Numero 1 Potentiel

May 07, 2025

Decryptage Du Profil De Lane Hutson Defenseur Numero 1 Potentiel

May 07, 2025

Latest Posts

-

The Night Counting Crows Changed A Saturday Night Live Story

May 08, 2025

The Night Counting Crows Changed A Saturday Night Live Story

May 08, 2025 -

The Night Counting Crows Changed Their Snl Performance And Its Legacy

May 08, 2025

The Night Counting Crows Changed Their Snl Performance And Its Legacy

May 08, 2025 -

Saturday Night Live And Counting Crows A Defining Moment In Music History

May 08, 2025

Saturday Night Live And Counting Crows A Defining Moment In Music History

May 08, 2025 -

Saturday Night Live And Counting Crows A Career Defining Performance

May 08, 2025

Saturday Night Live And Counting Crows A Career Defining Performance

May 08, 2025 -

The Night That Changed Everything Counting Crows And Saturday Night Live

May 08, 2025

The Night That Changed Everything Counting Crows And Saturday Night Live

May 08, 2025