Analyzing The Surge: Temu's Price Increases And The Legacy Of Trump Tariffs

Table of Contents

H2: The Rise and Fall (and Rise?) of Temu's Ultra-Low Prices

H3: Temu's Business Model and Initial Success: Temu's meteoric rise is largely attributed to its strategy of offering incredibly low prices on a vast array of products. Originating in China, this e-commerce platform leveraged aggressive marketing tactics and a strong social media presence to rapidly expand into the US market. Its initial success stemmed from a business model that seemed almost too good to be true.

- Subsidies: Temu initially subsidized its products, absorbing losses to gain market share and build brand awareness. This aggressive approach allowed them to undercut competitors dramatically, establishing a reputation for incredibly cheap Temu products.

- Competitive Pricing: By leveraging its massive supply chain in China and utilizing efficient logistics, Temu was able to offer prices significantly lower than established players in the US market.

- Aggressive Marketing: Temu's savvy marketing campaigns, particularly on social media platforms like TikTok, played a crucial role in driving rapid user acquisition and brand recognition. This contributed significantly to the perception of "cheap Temu products."

H3: Factors Contributing to Price Increases: While the era of unbelievably low prices appears to be ending, several factors explain the recent Temu price surge.

- Inflation: Global inflation has impacted the cost of raw materials, manufacturing, and shipping, squeezing profit margins for businesses across all sectors, including Temu.

- Increased Shipping Costs: Rising fuel prices and global supply chain disruptions have significantly increased shipping costs, adding to the overall expense of getting products from China to consumers in the US. This directly impacts the "Temu discount."

- Supplier Agreements: Changes in supplier agreements or the need to secure more reliable sourcing could also be contributing to increased costs.

- Manufacturing Costs: Increased manufacturing costs in China, due to various factors including rising labor costs and energy prices, are another potential driver of Temu price increases.

- Potential Impact of Tariffs: While not explicitly stated, the lingering effect of tariffs could indirectly contribute to cost increases.

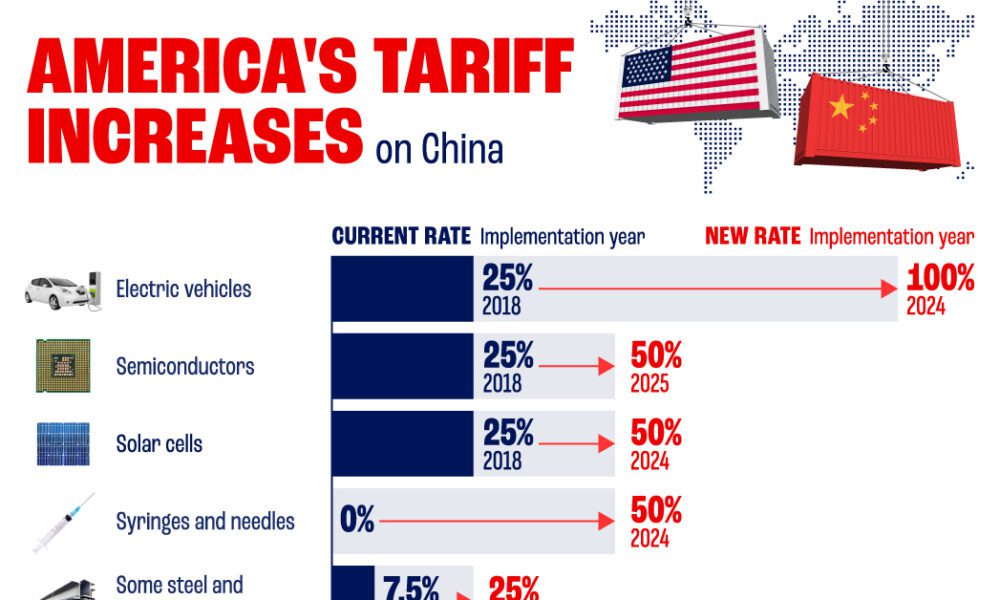

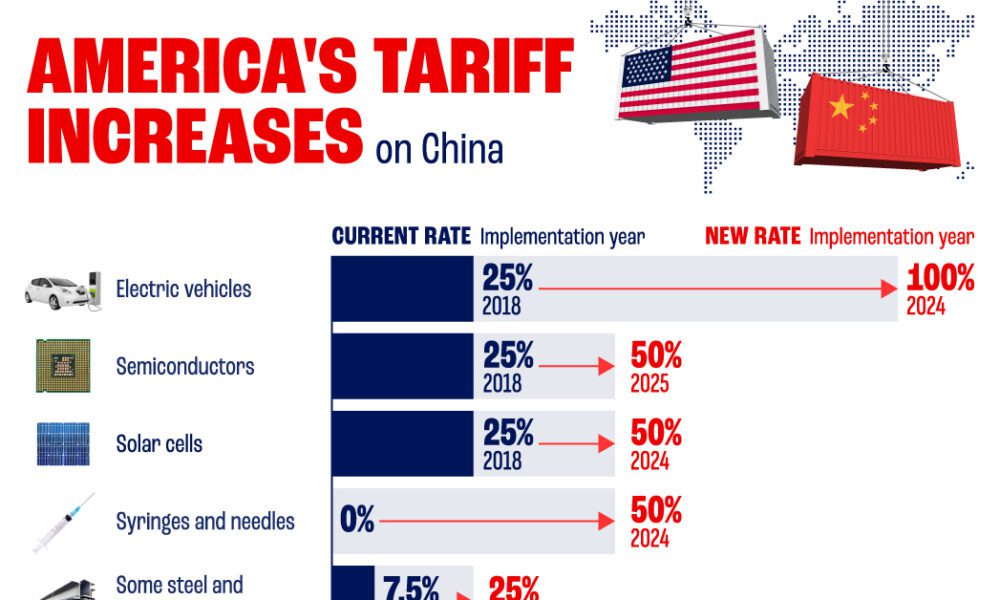

H2: The Lingering Shadow of Trump Tariffs

H3: Impact of Tariffs on Chinese Imports: The Trump administration's tariffs on Chinese goods significantly increased the cost of importing many products into the United States. For retailers like Temu, sourcing products from China, these tariffs directly impacted their bottom line. While Temu may have employed various tariff avoidance strategies, these efforts often add complexity and potentially increase costs.

- Increased Costs for Consumers: The increased import costs resulting from tariffs are often passed on to consumers, meaning higher prices for many products, including those sold by Temu.

- Impact on Temu's Pricing: The tariffs' influence on import costs might have made it increasingly difficult for Temu to maintain its ultra-low prices, thereby contributing to the recent price hikes.

H3: Navigating Trade Tensions: The ongoing trade relationship between the US and China remains complex and volatile. This uncertainty adds another layer of complexity for companies like Temu, which rely heavily on Chinese manufacturing and supply chains.

- Trade Negotiations: Ongoing trade negotiations and potential changes in trade policies between the US and China could significantly influence Temu's future pricing strategy and ability to source products.

- Supply Chain Challenges: Maintaining a reliable and cost-effective supply chain from China presents ongoing challenges and risks for Temu, particularly given the ongoing trade tensions.

H2: The Future of Temu and Consumer Expectations

H3: Consumer Response to Price Increases: The recent Temu price increases have undoubtedly sparked reactions from consumers. Some may shift to alternative platforms, while others might remain loyal, recognizing the potential value for money still offered.

- Shifting Consumer Behavior: Consumers accustomed to incredibly low prices may seek out alternative retailers offering similar products at lower costs. This increases the competition Temu faces.

- Increased Competition: The rise in Temu's prices might create an opening for competitors to gain market share.

- Long-Term Sustainability: The sustainability of Temu's business model in the long term, given the increased costs and changing consumer expectations, remains a key question.

H3: Predictions and Analysis: Predicting Temu's future pricing strategy is challenging, but several scenarios are possible. They might continue to adjust prices upwards gradually, seeking a balance between profitability and maintaining a competitive edge. Alternatively, they might explore different sourcing strategies to mitigate the impact of tariffs and other cost increases.

- Future Price Adjustments: Expect further adjustments to Temu's pricing structure as the company navigates the challenges of inflation, supply chain disruptions, and trade tensions.

- Maintaining Competitiveness: Temu will need to adopt strategies to remain competitive, such as refining its logistics, optimizing its supply chain, or focusing on niche product categories.

- Long-Term Impact of Tariffs: The long-term impact of Trump-era tariffs will continue to shape the pricing landscape for online retailers like Temu.

3. Conclusion:

Temu's initial success was built upon a foundation of unbelievably low prices, a strategy fueled by subsidies, aggressive marketing, and efficient supply chains. However, recent Temu price increases reflect the challenges posed by inflation, increased shipping costs, and the lingering effects of Trump-era tariffs on Chinese imports. The future of Temu's pricing strategy remains uncertain, but the company faces an evolving landscape of consumer expectations and increased competition.

Have you noticed the Temu price increases? Share your thoughts and experiences in the comments below. Let's discuss the impact of Temu's price surge and the lasting effects of Trump tariffs on online retail. [Link to a relevant discussion forum or social media page]

Featured Posts

-

Cnn Reports Underground Nightclub Raid 100 Immigrants Detained

Apr 29, 2025

Cnn Reports Underground Nightclub Raid 100 Immigrants Detained

Apr 29, 2025 -

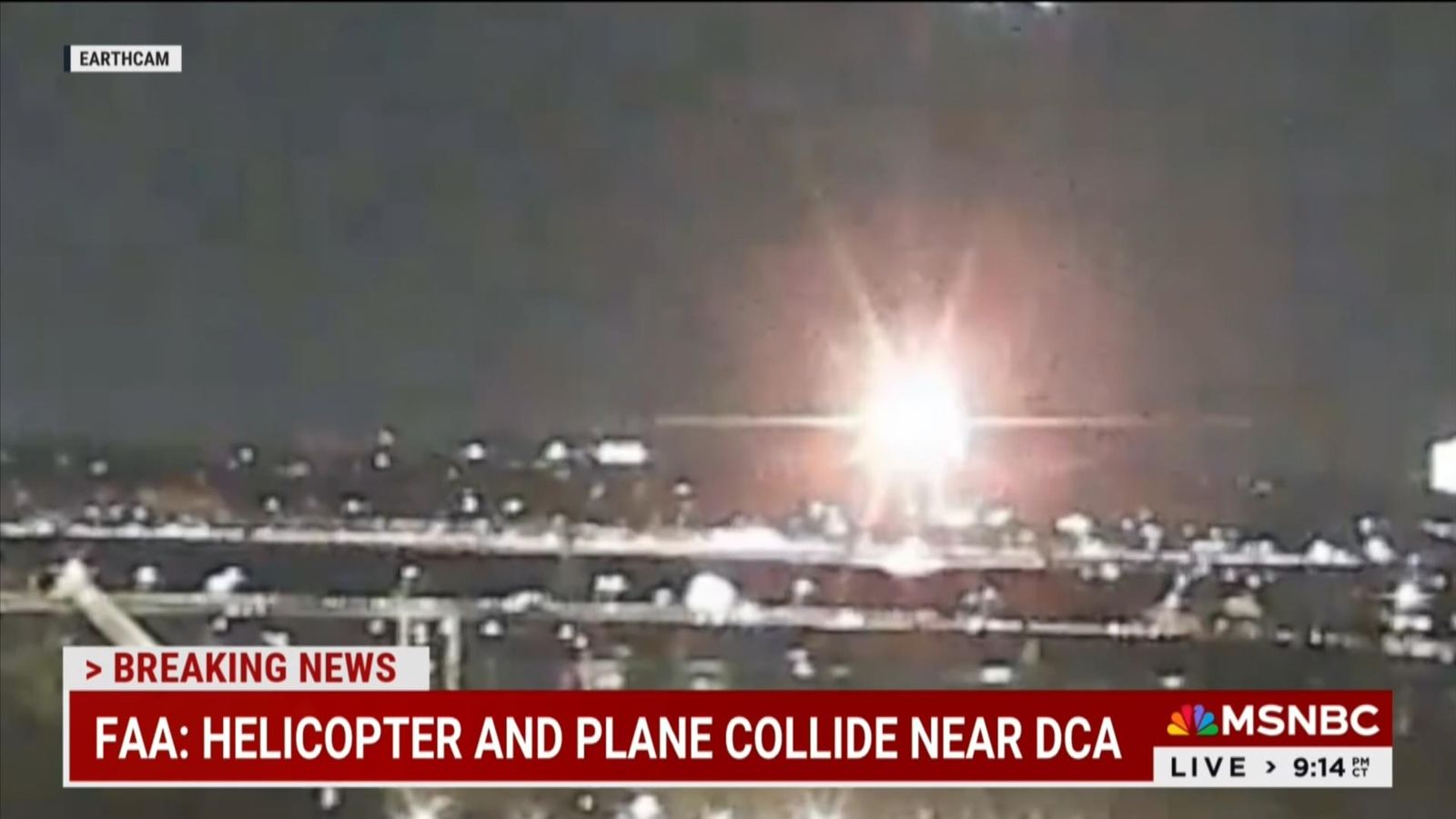

Black Hawk Collision Near Dc Report Details Pilots Failure To Follow Instructions

Apr 29, 2025

Black Hawk Collision Near Dc Report Details Pilots Failure To Follow Instructions

Apr 29, 2025 -

One Plus 13 R Review A Practical Assessment

Apr 29, 2025

One Plus 13 R Review A Practical Assessment

Apr 29, 2025 -

Find Lionel Messis Inter Miami Games Mls Schedule Live Streaming Options And Betting

Apr 29, 2025

Find Lionel Messis Inter Miami Games Mls Schedule Live Streaming Options And Betting

Apr 29, 2025 -

Are Minnesotas Film Tax Credits Working An In Depth Analysis

Apr 29, 2025

Are Minnesotas Film Tax Credits Working An In Depth Analysis

Apr 29, 2025

Latest Posts

-

Pw C Us Partners Ordered To Sever Ties With Brokerage Following Internal Probe

Apr 29, 2025

Pw C Us Partners Ordered To Sever Ties With Brokerage Following Internal Probe

Apr 29, 2025 -

Pw C Inaugurates State Of The Art Office In Bgc Philippines

Apr 29, 2025

Pw C Inaugurates State Of The Art Office In Bgc Philippines

Apr 29, 2025 -

New Pw C Office In Bgc Philippines A Boost For Business

Apr 29, 2025

New Pw C Office In Bgc Philippines A Boost For Business

Apr 29, 2025 -

Pw C Expands Philippine Presence With Bgc Office Launch

Apr 29, 2025

Pw C Expands Philippine Presence With Bgc Office Launch

Apr 29, 2025 -

Accounting Firm Pw C Faces Backlash Multiple Country Exits Spark Debate

Apr 29, 2025

Accounting Firm Pw C Faces Backlash Multiple Country Exits Spark Debate

Apr 29, 2025