Are Minnesota's Film Tax Credits Working? An In-Depth Analysis

Table of Contents

The Structure and Scope of Minnesota's Film Tax Credits

Minnesota offers several film tax credits designed to incentivize film production within the state. Understanding the structure and scope of these credits is crucial to evaluating their effectiveness.

Types of Tax Credits Offered

Minnesota's film tax credit program offers incentives for various aspects of filmmaking:

- Production Tax Credit: A percentage credit against the Minnesota corporate franchise or individual income tax for qualified production expenses incurred within the state. The exact percentage may vary depending on the project and specific regulations.

- Post-Production Tax Credit: Similar to the production credit, this incentivizes post-production work, such as editing and sound mixing, performed within Minnesota.

- Digital Animation Tax Credit: This credit specifically targets the growing digital animation sector, offering further incentives for qualified expenses related to animation projects.

Eligibility criteria for each credit may vary, often involving minimum spending thresholds within the state and adherence to specific guidelines on hiring local crew and using Minnesota-based vendors.

Eligibility Requirements

To qualify for Minnesota's film tax credits, production companies must meet several criteria, including:

- The production must be filmed primarily within Minnesota.

- A significant portion of the production budget must be spent within the state, supporting local businesses and employment.

- The project must meet specific criteria demonstrating economic benefit to the state.

- The applicant must complete a thorough application process, providing detailed documentation of expenditures.

These requirements aim to ensure that the tax credits directly benefit the Minnesota economy.

Application Process

Applying for Minnesota's film tax credits involves a multi-step process:

- Submitting a detailed application outlining the production plan and projected expenditures.

- Providing documentation to substantiate all claimed expenses.

- Undergoing a review process by the state agency responsible for administering the program.

- Receiving approval and subsequent reimbursement or tax credit allocation.

The process involves significant paperwork and requires careful adherence to the program's guidelines.

- Budget Allocation: The annual budget allocated to the film tax credit program plays a significant role in its overall reach and impact.

- Administrative Oversight: Effective oversight and administration are critical to prevent fraud and ensure transparency.

Economic Impact Assessment of the Film Tax Credits

Assessing the economic impact of Minnesota's film tax credits requires a comprehensive analysis of job creation, revenue generation, and the effects on local businesses.

Job Creation

Studies are needed to definitively quantify the number of jobs directly and indirectly attributable to the film tax credits. While anecdotal evidence suggests increased employment in the film sector, a thorough analysis using econometric modeling would be necessary to isolate the impact of the tax credits from other factors contributing to employment growth.

Revenue Generation

Determining the net fiscal impact requires comparing the amount of tax revenue generated by the film industry (through sales tax, income tax, and other sources) with the amount of tax credits issued. This analysis should also consider indirect revenue streams, such as increased tourism and spending in local businesses. Again, robust data and econometric modeling would be required for a definitive assessment.

Local Business Impact

Film productions often stimulate local economies by utilizing services from hotels, restaurants, equipment rental companies, and other businesses. Quantifying this "multiplier effect" is essential for a complete understanding of the program's overall impact. Gathering data on spending by film productions in these sectors is vital to this assessment.

- Employment Numbers: Tracking employment within the film industry, both directly involved in productions and indirectly supported by related businesses.

- Revenue Figures: Analyzing data on state and local tax revenues associated with the film industry, both direct and indirect.

Comparison with Other States' Film Incentive Programs

To assess the effectiveness of Minnesota's program, comparing it to other states with successful film industries provides valuable insight.

Benchmarking Against Successful Programs

States like Georgia and California have significantly larger and more established film industries, partly attributed to their generous film incentive programs. Analyzing their approaches – including the type of incentives offered, their administration, and their overall impact – can highlight best practices and areas where Minnesota's program could be improved.

Analysis of Different Incentive Models

Various states utilize different incentive models, such as direct rebates versus tax credits. Examining the relative effectiveness of these models can help determine the optimal approach for Minnesota. A cost-benefit analysis comparing different incentive models would be beneficial.

- Georgia's Film Tax Credit: A prominent example of a successful program, known for its significant impact on job creation and economic development.

- California's Film Tax Credit: While facing its own challenges, California's program remains a significant driver of the state's film industry.

Challenges and Limitations of Minnesota's Film Tax Credits

Despite the potential benefits, Minnesota's film tax credit program faces challenges and limitations.

Issues with Program Administration

Potential issues include application processing delays, lack of transparency, and difficulties navigating the application process. Streamlining the application process and improving transparency would enhance the program's effectiveness.

Potential for Abuse

Any tax incentive program is vulnerable to abuse or fraud. Mechanisms for preventing and detecting fraudulent claims are crucial. Robust auditing procedures and strong oversight are essential to prevent misuse.

Unintended Consequences

Potential negative consequences could include attracting productions that would have occurred in Minnesota regardless of the incentives, or disproportionately benefiting large productions at the expense of smaller, independent filmmakers.

- Application Backlog: Delays in processing applications can deter filmmakers and reduce the program's effectiveness.

- Lack of Transparency: A lack of clear guidelines and publicly available data can lead to uncertainty and distrust.

Conclusion: Are Minnesota's Film Tax Credits Worth It?

The effectiveness of Minnesota's film tax credits remains a complex question. While the program aims to stimulate job creation, generate revenue, and bolster the state's film industry, a comprehensive analysis including robust data and econometric modeling is needed to definitively assess its success. The program's structure, administration, and potential for abuse must be continually evaluated and improved. A comparison with other states' successful programs can provide insights into best practices and areas for improvement. Further research is crucial to determine whether the benefits outweigh the costs and whether adjustments are needed to optimize the program’s impact.

Continue the conversation: Share your thoughts on whether Minnesota's film tax credits are achieving their goals, and how they could be improved to further support the growth of the state's film industry. Let’s work together to determine how best to foster a thriving Minnesota film industry through effective policy.

Featured Posts

-

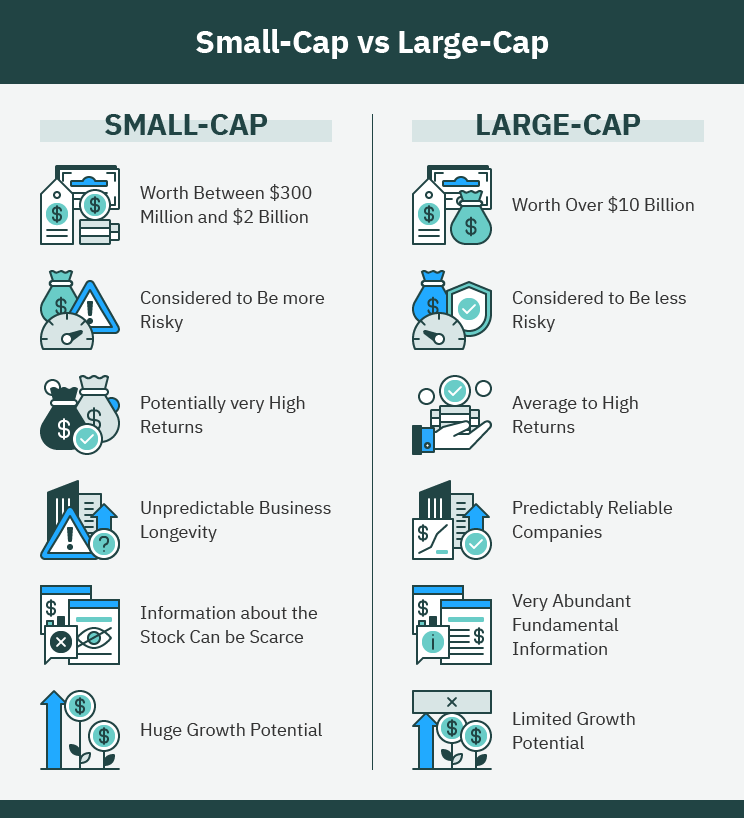

Strong Reliance Earnings Positive Impact On Indias Large Cap Stocks Predicted

Apr 29, 2025

Strong Reliance Earnings Positive Impact On Indias Large Cap Stocks Predicted

Apr 29, 2025 -

Us Attorney General Targets Minnesota Over Transgender Athlete Ban Compliance

Apr 29, 2025

Us Attorney General Targets Minnesota Over Transgender Athlete Ban Compliance

Apr 29, 2025 -

Transgender Sports Ban Minnesota Under Pressure From Us Attorney General

Apr 29, 2025

Transgender Sports Ban Minnesota Under Pressure From Us Attorney General

Apr 29, 2025 -

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 29, 2025

Post Roe America How Otc Birth Control Reshapes Reproductive Healthcare

Apr 29, 2025 -

Funding Cuts Spur International Pursuit Of Us Scientific Talent

Apr 29, 2025

Funding Cuts Spur International Pursuit Of Us Scientific Talent

Apr 29, 2025

Latest Posts

-

Chat Gpt Developer Open Ai Investigated By The Ftc

Apr 29, 2025

Chat Gpt Developer Open Ai Investigated By The Ftc

Apr 29, 2025 -

Open Ai Faces Ftc Probe Examining The Future Of Ai Accountability

Apr 29, 2025

Open Ai Faces Ftc Probe Examining The Future Of Ai Accountability

Apr 29, 2025 -

Secret Service Ends Probe Of Cocaine Found At White House

Apr 29, 2025

Secret Service Ends Probe Of Cocaine Found At White House

Apr 29, 2025 -

Ftc Probes Open Ai Implications For Ai Development And Regulation

Apr 29, 2025

Ftc Probes Open Ai Implications For Ai Development And Regulation

Apr 29, 2025 -

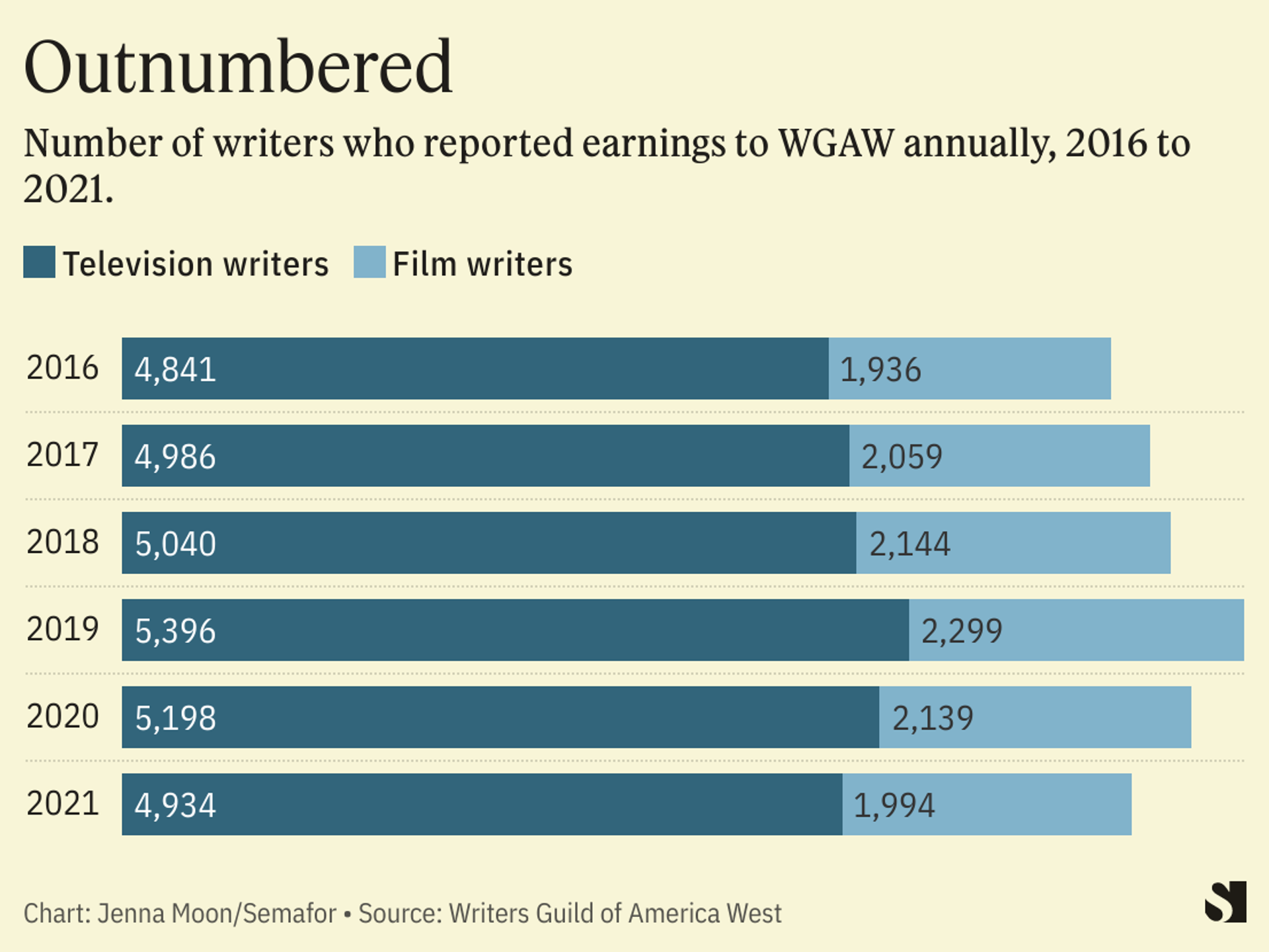

Double Strike Cripples Hollywood Actors And Writers Demand Fair Treatment

Apr 29, 2025

Double Strike Cripples Hollywood Actors And Writers Demand Fair Treatment

Apr 29, 2025