Analyzing Trump's Hints At Privatizing Student Loans: Potential Impacts

Table of Contents

The Current State of Student Loan Debt in the US

The sheer magnitude of the student loan debt crisis in the US is alarming and warrants a comprehensive understanding before considering drastic policy changes like privatizing student loans.

Magnitude of the Problem

- Total Student Loan Debt: Over $1.7 trillion (Source: Federal Reserve Bank of New York, 2023)

- Average Debt per Borrower: Over $37,000 (Source: Education Data Initiative, 2023)

- Delinquency Rates: Significantly high, particularly among borrowers struggling with repayment (Source: Department of Education, 2023)

This unsustainable level of debt significantly impacts individuals, hindering their ability to purchase homes, start families, and build financial security. It also ripples through the economy, impacting consumer spending and overall economic growth.

Existing Government Programs

The federal government currently offers various student loan programs, including:

- Subsidized Federal Stafford Loans: Loans where the government pays the interest while the borrower is in school.

- Unsubsidized Federal Stafford Loans: Loans where interest accrues during the borrower's schooling.

- Federal PLUS Loans: Loans available to graduate students and parents of undergraduate students.

- Income-Driven Repayment Plans: Plans that adjust monthly payments based on the borrower's income.

While these programs provide crucial access to higher education, they suffer from several limitations, including complex repayment options, high interest rates for some borrowers, and a lack of adequate consumer protections. These shortcomings make the debate surrounding privatizing student loans particularly complex.

Trump's Stance on Privatizing Student Loans: A Deep Dive

Understanding Trump's position on privatizing student loans is crucial to assessing the potential impacts of such a policy.

Past Statements and Policy Proposals

While Trump's specific proposals regarding student loan privatization were not always fully articulated, his rhetoric often implied a preference for reducing government involvement in student lending. For example, [insert direct quote or reference to a speech or policy paper]. This suggests a potential openness to exploring private sector solutions for student loan financing. [Insert another quote or reference, if available, to support the analysis].

Potential Models for Privatization

Several models for privatizing student loans could be considered:

- Complete Sale of Existing Loans: The government could sell its existing portfolio of student loans to private entities.

- Private Lending Partnerships: The government could partner with private lenders to offer loans, sharing risk and responsibilities.

- Complete Privatization of New Loans: The government could cease its direct involvement in student lending, leaving the entire market to private entities.

Each model presents unique advantages and disadvantages, affecting borrowers, lenders, and the government differently. A complete shift to private lending might lead to increased competition, but it also raises concerns about accessibility and potential predatory lending practices.

Potential Positive Impacts of Privatizing Student Loans

Advocates for privatizing student loans often point to potential benefits:

Increased Competition and Innovation

Private lenders might offer:

- More competitive interest rates.

- More flexible repayment options.

- Innovative loan products tailored to individual borrower needs.

This increased competition could, theoretically, benefit borrowers. However, the potential for predatory lending and lack of borrower protections must be carefully considered.

Reduced Government Burden

Privatization could potentially:

- Reduce government spending on student loan programs.

- Free up government resources for other priorities.

However, this potential cost savings needs to be weighed against the potential negative impacts on access to education and increased costs for borrowers.

Potential Negative Impacts of Privatizing Student Loans

Conversely, several significant risks are associated with privatizing student loans:

Increased Costs for Borrowers

Private lenders may charge:

- Higher interest rates than the government.

- Steeper fees and charges.

This could lead to significantly higher total repayment costs for borrowers, impacting their long-term financial health.

Reduced Access to Education

Privatization could disproportionately affect:

- Low-income students.

- Minority students.

- Students from rural areas.

Private lenders may be less willing to lend to these groups, thus reducing access to higher education for already vulnerable populations.

Risk of Predatory Lending Practices

A shift towards private lending increases the risk of:

- Unfair loan terms.

- High-pressure sales tactics.

- Deceptive marketing practices.

Robust consumer protections are vital to mitigating these risks and ensuring fair treatment for all borrowers.

Analyzing Trump's Hints at Privatizing Student Loans: A Final Verdict

The potential impacts of privatizing student loans, as suggested by Trump's statements, are multifaceted and complex. While proponents point to increased competition and reduced government burden, the risks of higher costs for borrowers, reduced access to education, and predatory lending practices cannot be ignored. Before implementing such a sweeping policy change, a careful cost-benefit analysis, considering its effects on all segments of the population, is paramount. The potential for exacerbating existing inequalities must be a central concern.

Therefore, it's crucial that the public engages in thorough research and informed discussions on privatizing student loans and its potential ramifications. This critical issue demands careful consideration and a broad-based, thoughtful debate before any significant changes are implemented. We urge you to continue researching the topic of student loan privatization and contribute to the conversation. The future of higher education and the financial well-being of millions depends on it.

Featured Posts

-

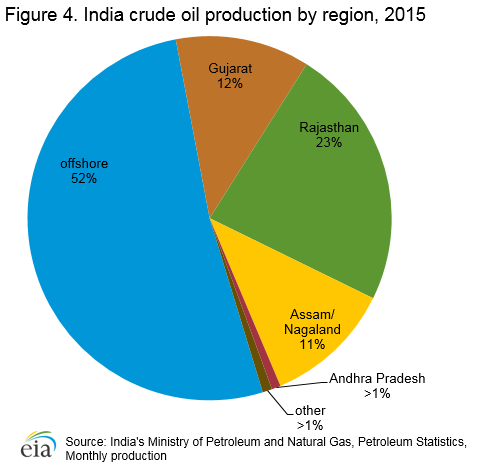

Oil Market Overview And Forecast May 16 2024

May 17, 2025

Oil Market Overview And Forecast May 16 2024

May 17, 2025 -

Paramount Sets China Release For Mission Impossible Film

May 17, 2025

Paramount Sets China Release For Mission Impossible Film

May 17, 2025 -

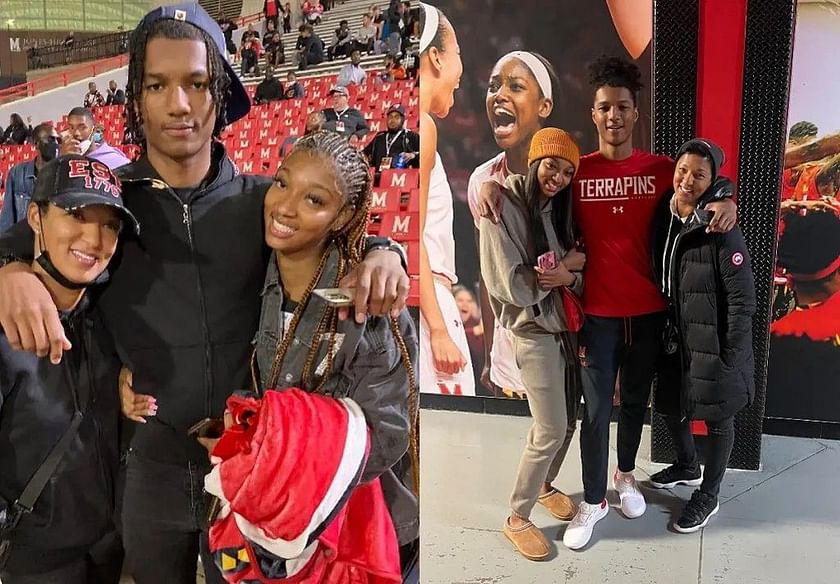

Angel Reese Shares Heartwarming Photos With Mom Angel Webb Reese

May 17, 2025

Angel Reese Shares Heartwarming Photos With Mom Angel Webb Reese

May 17, 2025 -

Black Communitys Reaction To Trumps Student Loan Order

May 17, 2025

Black Communitys Reaction To Trumps Student Loan Order

May 17, 2025 -

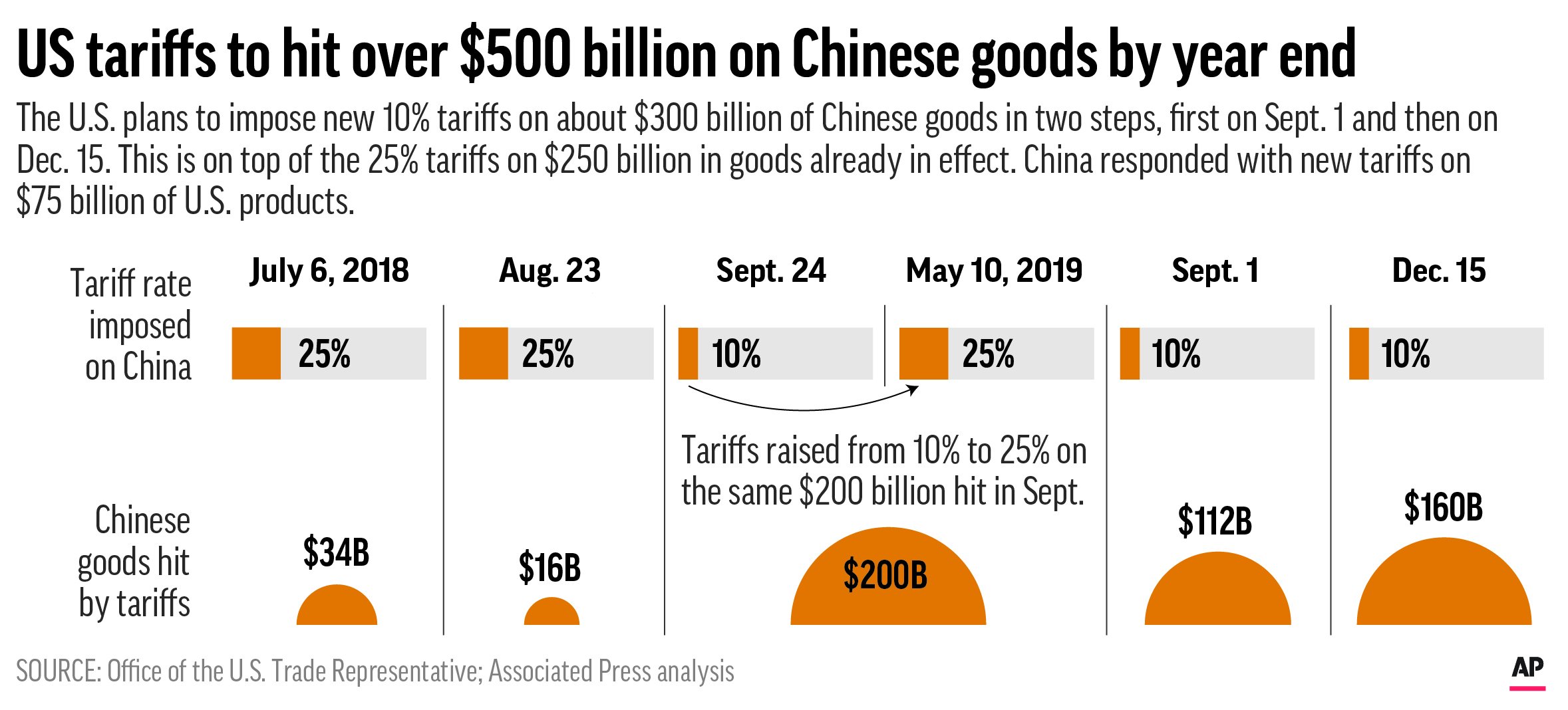

Trumps China Tariffs Projected Impact And Timeline Through 2025

May 17, 2025

Trumps China Tariffs Projected Impact And Timeline Through 2025

May 17, 2025

Latest Posts

-

Competition Heats Up Waymo And Uber Roll Out Robotaxis In Austin

May 17, 2025

Competition Heats Up Waymo And Uber Roll Out Robotaxis In Austin

May 17, 2025 -

Austin Becomes Latest City For Waymo And Uber Robotaxi Services

May 17, 2025

Austin Becomes Latest City For Waymo And Uber Robotaxi Services

May 17, 2025 -

Uber Investment Risks And Rewards

May 17, 2025

Uber Investment Risks And Rewards

May 17, 2025 -

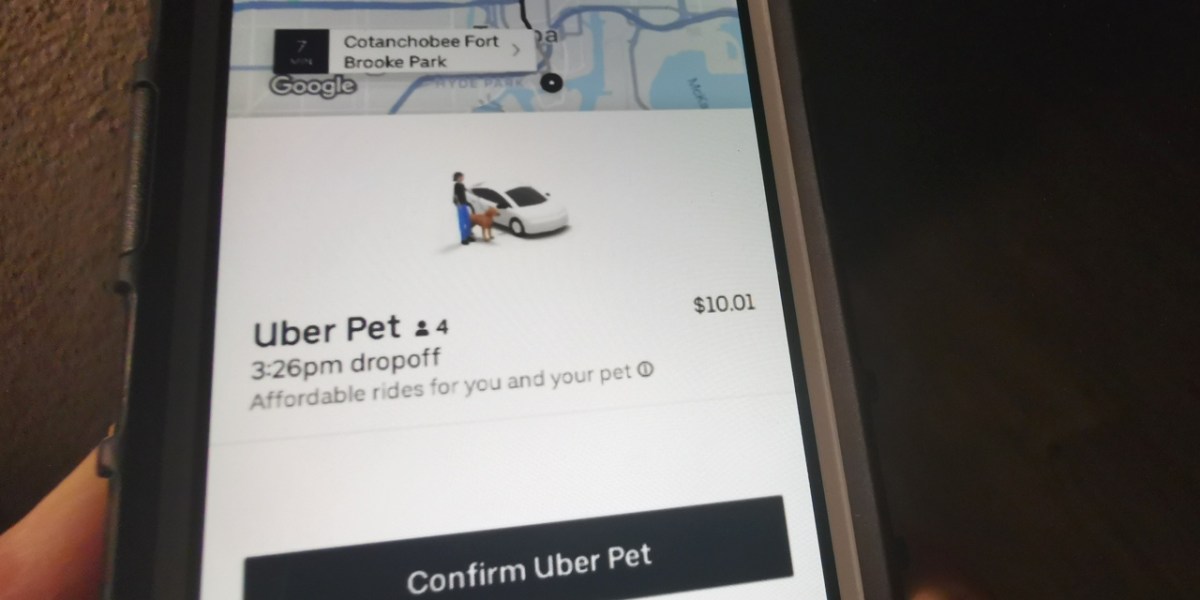

Convenient Pet Transport Uber Pet Launches In Delhi And Mumbai

May 17, 2025

Convenient Pet Transport Uber Pet Launches In Delhi And Mumbai

May 17, 2025 -

Waymo And Uber Expand Autonomous Vehicle Services In Austin

May 17, 2025

Waymo And Uber Expand Autonomous Vehicle Services In Austin

May 17, 2025