Analyzing Uber (UBER) As A Long-Term Investment

Table of Contents

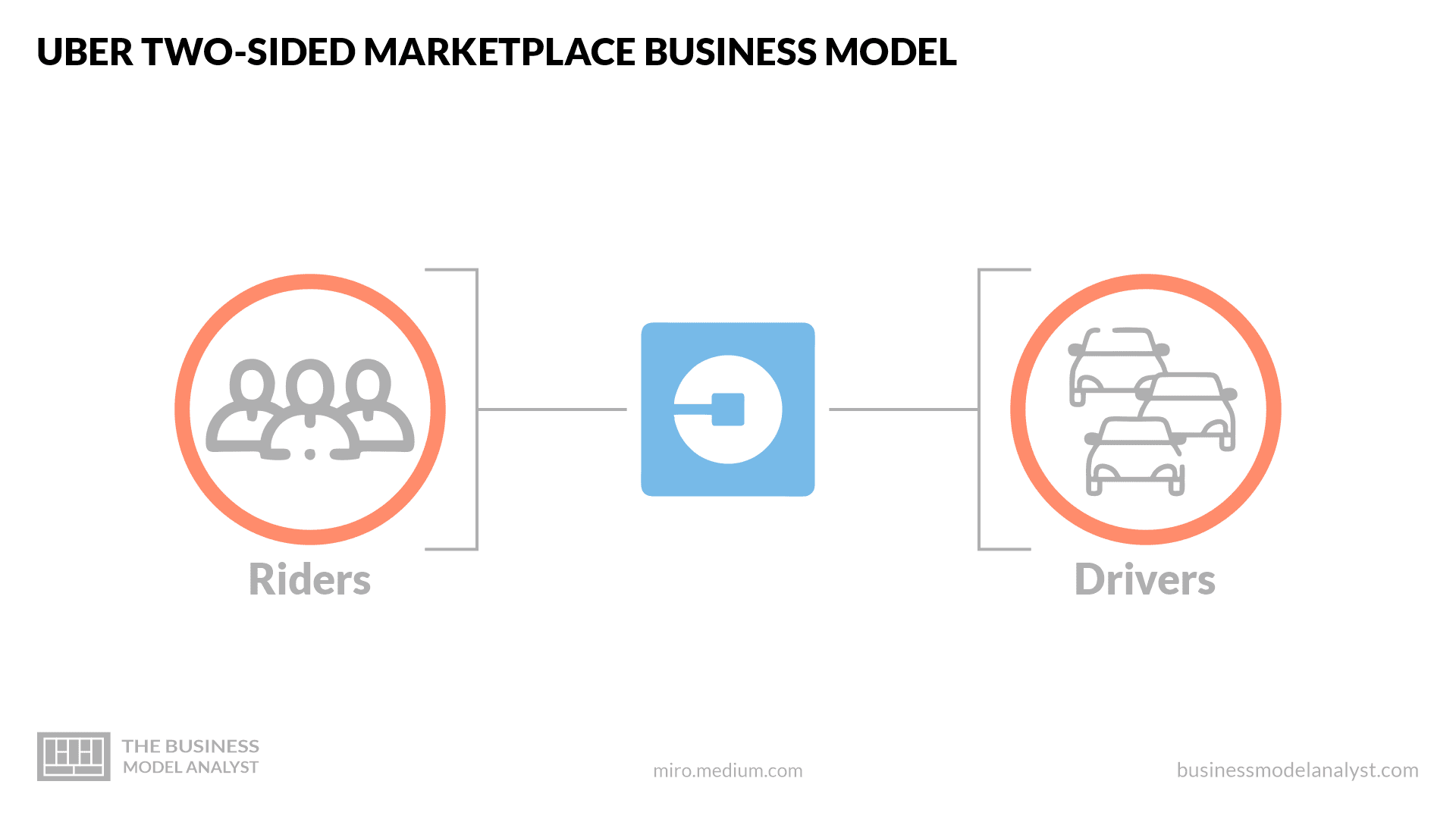

Uber's Business Model and Market Dominance

The Ride-Sharing Market

Uber's core business is its ride-sharing platform, connecting passengers with drivers through a convenient mobile app. Globally, Uber holds a significant market share, particularly in major metropolitan areas. Its competitive advantages include its extensive network of drivers, robust technology platform, and widespread brand recognition. This established market presence offers a strong foundation for continued growth, making it a compelling factor in the "UBER stock" narrative. However, the ride-sharing landscape is not without its challenges. Intense competition from rivals like Lyft, and the emergence of alternative transportation options, requires ongoing innovation and adaptation.

Beyond Ridesharing: Diversification and Future Growth

Uber's ambition extends far beyond ride-sharing. Uber Eats, its food delivery service, has become a significant revenue generator, competing directly with other food delivery giants. Uber Freight, focusing on logistics and trucking, represents another key diversification initiative. These ventures contribute significantly to Uber's overall revenue and long-term growth potential. Analyzing "Uber Eats investment" and "Uber Freight opportunities" separately reveals promising avenues for future growth. This diversification strategy mitigates the risk associated with reliance on a single revenue stream, enhancing the long-term viability of a "ride-sharing investment" in Uber.

- Market share statistics: Uber holds a leading market share in many key regions, although precise figures fluctuate based on geographic location and competitive pressures.

- Growth rate projections: Analyst projections for Uber's various segments vary, but generally indicate strong growth, particularly in the food delivery and freight sectors.

- Competitive landscape: The competitive landscape is intense, requiring continuous innovation and strategic adjustments to maintain market leadership.

Financial Performance and Key Metrics

Revenue Growth and Profitability

Analyzing "UBER financial analysis" reveals a complex picture. While Uber has demonstrated significant revenue growth, achieving consistent profitability has proven challenging. Examining key financial ratios such as operating margin and net income is crucial. Understanding the trend in "revenue growth" and profitability is paramount to assess the long-term investment potential.

Debt and Cash Flow

Evaluating Uber's "UBER debt" levels, cash flow generation, and overall "financial stability" is crucial for understanding its long-term financial health. A thorough "cash flow analysis" helps determine Uber's ability to service its debt, invest in future growth, and withstand economic downturns.

- Historical financial data: Examining past financial statements reveals trends in revenue, expenses, and profitability.

- Key financial ratios: Analyzing ratios such as debt-to-equity and free cash flow yield offers valuable insights into the company's financial strength.

- Industry benchmarks: Comparing Uber's financial performance to industry benchmarks provides a comparative perspective.

Growth Potential and Future Outlook

Technological Advancements and Innovation

Uber's investment in "autonomous vehicle technology" and other "technological innovation" presents a significant growth driver. The potential for self-driving vehicles to revolutionize transportation could significantly impact Uber's operational efficiency and profitability. However, the development and deployment of this technology present significant hurdles and uncertainties.

Regulatory Landscape and Geopolitical Factors

The regulatory environment significantly impacts Uber's operations. Navigating "regulatory hurdles" and addressing "geopolitical risks" in different markets is crucial for sustained success. Changes in regulations concerning ride-sharing and data privacy could present significant challenges.

- Growth drivers: Technological innovation, expansion into new markets, and strategic partnerships are key growth drivers.

- Strategic initiatives: Uber's strategic initiatives, such as its focus on electric vehicles and sustainable transportation, will shape its future.

- Market projections: Long-term market projections for the ride-sharing and food delivery industries are generally positive, indicating continued growth potential.

Risks and Challenges Associated with UBER as a Long-Term Investment

Competition and Market Saturation

The ride-sharing and food delivery markets are intensely competitive. "Competitive pressures" from established players and new entrants pose a constant threat. The risk of "market saturation" in certain areas is also a concern.

Regulatory Uncertainty and Legal Battles

Uber faces significant "regulatory uncertainty" and potential "legal challenges" related to labor laws, data privacy, and antitrust regulations. These "legal risks" could negatively impact profitability and operational efficiency.

- Key risks: Competition, regulatory uncertainty, economic downturns, and technological disruptions are key risks.

- Impact assessment: It is crucial to assess the likelihood and potential impact of these risks on Uber's future performance.

Conclusion: Is Uber (UBER) Right for Your Long-Term Investment Portfolio?

Analyzing Uber (UBER) as a long-term investment reveals a complex picture. While its market dominance, diversification strategy, and technological advancements present compelling growth opportunities, intense competition, regulatory uncertainties, and the need for consistent profitability remain significant challenges. Ultimately, whether "UBER stock" is a suitable addition to your "long-term investment strategy" depends on your individual risk tolerance and investment goals. This "UBER stock analysis" highlights the importance of conducting thorough due diligence and considering Uber as part of a diversified portfolio. Remember, responsible investing requires careful consideration of both potential rewards and inherent risks. Consider conducting further research and consult with a financial advisor before making any investment decisions.

Featured Posts

-

Novak Dokovic Jedinstven Podvig Pre 19 Godina Detaljna Analiza

May 18, 2025

Novak Dokovic Jedinstven Podvig Pre 19 Godina Detaljna Analiza

May 18, 2025 -

Dry Spell Could Douse Easter Bonfire Celebrations

May 18, 2025

Dry Spell Could Douse Easter Bonfire Celebrations

May 18, 2025 -

7 Bit Casino Review And Ranking Among Best Online Casinos In Canada

May 18, 2025

7 Bit Casino Review And Ranking Among Best Online Casinos In Canada

May 18, 2025 -

Jbs Jbss 3 Withdraws From Banco Master Asset Acquisition Talks

May 18, 2025

Jbs Jbss 3 Withdraws From Banco Master Asset Acquisition Talks

May 18, 2025 -

Snls Ego Nwodim Stuns Viewers During Weekend Update

May 18, 2025

Snls Ego Nwodim Stuns Viewers During Weekend Update

May 18, 2025

Latest Posts

-

1850 1950 Art Review Of The Global Modern Artworld

May 19, 2025

1850 1950 Art Review Of The Global Modern Artworld

May 19, 2025 -

A Global Artworld 1850 1950 An Art Review For 2025

May 19, 2025

A Global Artworld 1850 1950 An Art Review For 2025

May 19, 2025 -

Modern Life Reflected A Global Artworld 1850 1950 Art Review 2025

May 19, 2025

Modern Life Reflected A Global Artworld 1850 1950 Art Review 2025

May 19, 2025 -

When Dreams Are Stolen A Restaurant Owners Pursuit Of Accountability

May 19, 2025

When Dreams Are Stolen A Restaurant Owners Pursuit Of Accountability

May 19, 2025 -

Justice For Stolen Dreams The Struggle Of A Restaurant Owner

May 19, 2025

Justice For Stolen Dreams The Struggle Of A Restaurant Owner

May 19, 2025