Analyzing Warren Buffett's Apple Investment Strategy

Table of Contents

Warren Buffett, the Oracle of Omaha, and his investment firm, Berkshire Hathaway, have made headlines for their significant investment in Apple. This monumental bet has generated substantial returns and offers invaluable lessons for investors of all experience levels. This article delves into the intricacies of Buffett's Apple investment strategy, examining the rationale behind his decision, the performance of the investment, and the key takeaways for building a successful portfolio. We will analyze the factors influencing his choice, the investment's performance, and its implications for both novice and seasoned investors.

The Rationale Behind Buffett's Apple Investment

Keywords: Apple's business model, consumer loyalty, brand strength, competitive advantage, durable competitive moat, intrinsic value, value investing principles

Buffett's investment in Apple wasn't a random decision; it was a calculated move based on his core value investing principles. Several factors likely influenced his decision:

-

Unmatched Brand Strength and Consumer Loyalty: Apple boasts unparalleled brand recognition and fiercely loyal customers willing to pay a premium for its products. This translates into consistent demand and predictable revenue streams, a cornerstone of Buffett's investment philosophy.

-

Recurring Revenue from Services: Beyond hardware sales, Apple generates significant recurring revenue from its services ecosystem, including the App Store, iCloud, Apple Music, and AppleCare. This predictable income stream significantly reduces the volatility inherent in many technology stocks.

-

Innovative Capacity and Technological Leadership: Apple consistently pushes the boundaries of technological innovation, maintaining its position at the forefront of the industry. This ongoing innovation ensures Apple stays relevant and competitive, a crucial factor for long-term investment success.

-

Pricing Power and High Profit Margins: Apple enjoys significant pricing power due to its brand strength and loyal customer base. This allows them to maintain high profit margins, a key metric for value investors like Buffett.

-

Alignment with Value Investing Principles: All these factors align perfectly with Buffett's focus on identifying companies with strong fundamentals, durable competitive advantages, and a clear path to long-term growth. He invests in businesses he understands and believes have an enduring competitive "moat," protecting them from competition. Apple clearly fit this criteria.

Analyzing Apple's financial statements reveals consistently strong revenue growth, high profit margins, and a robust balance sheet. Comparing these metrics to competitors like Samsung or Google highlights Apple's superior performance and justifies the long-term investment.

The Performance of Buffett's Apple Investment

Keywords: Return on investment (ROI), Berkshire Hathaway portfolio, stock price performance, dividend payouts, capital appreciation, total return

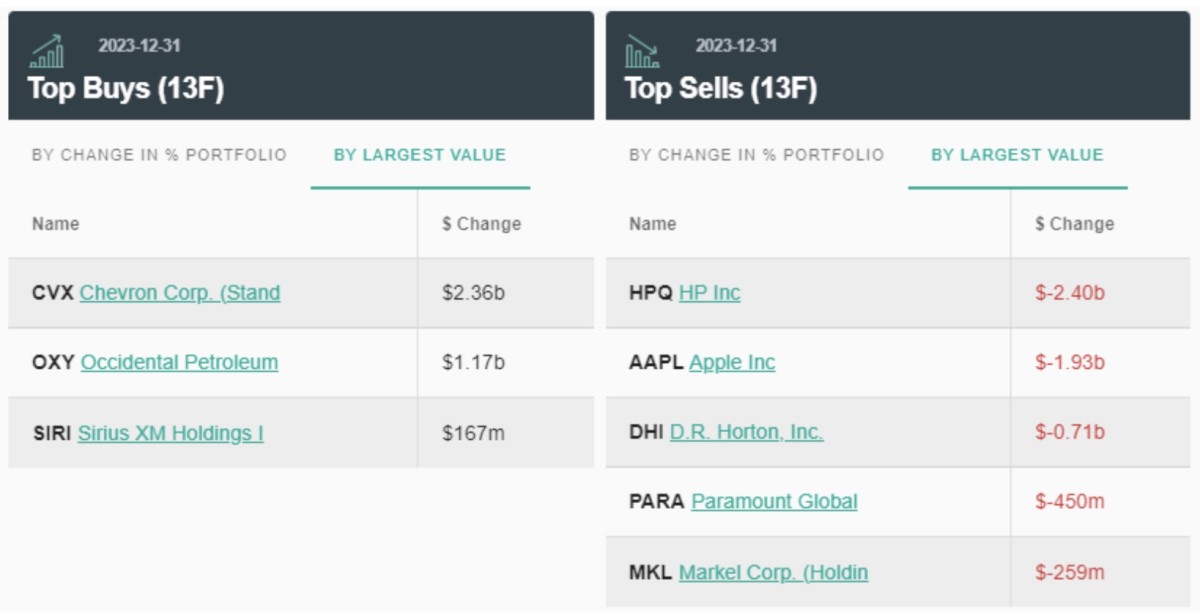

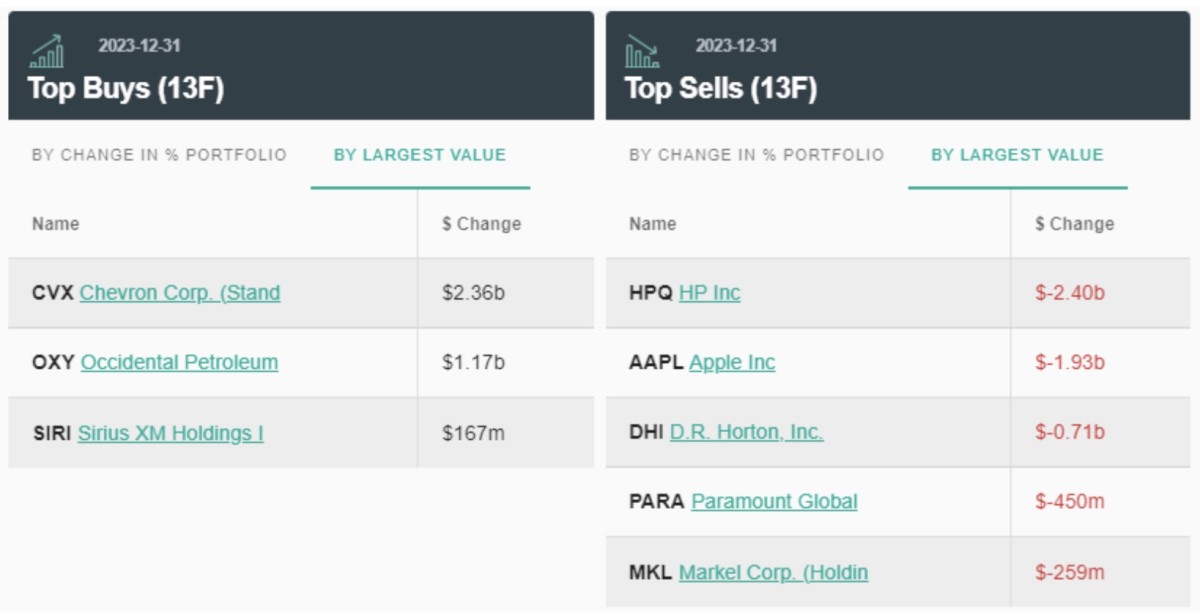

Berkshire Hathaway's investment in Apple has been remarkably successful. Let's examine the performance:

-

Exceptional ROI: Berkshire Hathaway's Apple investment has yielded a substantial return on investment, significantly exceeding the returns from many other investments in their portfolio. This success is primarily due to capital appreciation, driven by Apple's consistent growth and increased stock price.

-

Impact on Berkshire Hathaway's Portfolio: Apple has become a cornerstone holding in Berkshire Hathaway's portfolio, contributing significantly to the overall portfolio performance and reducing overall portfolio volatility.

-

Dividend Payouts: While Apple's dividend payouts are not massive, they contribute to the overall return, providing a steady stream of income for Berkshire Hathaway.

-

Stock Price Fluctuations: Although Apple's stock price has experienced fluctuations like any publicly traded company, the long-term upward trend has outweighed any short-term dips, illustrating the benefits of a long-term investment horizon.

The chart below (insert chart here – showing Apple stock performance and Berkshire Hathaway's investment performance over time) visually represents the exceptional performance. Comparing Apple’s performance against the S&P 500 index further emphasizes its outperformance. While the investment carries inherent risks, the overall risk/reward profile has proved incredibly favorable.

Lessons Learned from Buffett's Apple Investment Strategy

Keywords: Long-term investment horizon, patience in investing, understanding business models, diversification benefits, risk management, investment philosophy

Buffett's Apple investment offers several crucial lessons for investors:

-

The Long-Term Investment Horizon: Patience and a long-term perspective are paramount. Buffett didn't expect overnight riches; his success stems from a long-term vision and unwavering commitment.

-

Understanding the Business Model: Thorough due diligence and a deep understanding of the underlying business model are crucial before investing. Buffett recognized Apple's strong brand, recurring revenue streams, and innovative capacity.

-

Identifying Strong Competitive Advantages: Invest in companies with durable competitive advantages (moats). Apple's strong brand, ecosystem, and loyal customer base are key examples of such advantages.

-

Patience and Discipline: Successful investing requires patience, discipline, and the ability to resist emotional decision-making. Buffett's approach exemplifies this principle.

-

Portfolio Diversification (with a focus): While diversification is important, it doesn't necessitate spreading investments thinly across numerous assets. A concentrated investment in high-quality companies, like Buffett's approach, can yield significant returns.

By contrasting Buffett's long-term approach with short-term trading strategies, we highlight the pitfalls of chasing quick profits. The concept of a "moat" – sustainable competitive advantages – is crucial for long-term investment success.

Conclusion

This analysis of Warren Buffett's Apple investment strategy reveals a masterclass in long-term value investing. By focusing on companies with strong fundamentals, durable competitive advantages, and a clear understanding of their business models, Buffett has achieved exceptional returns. His Apple investment exemplifies his investment philosophy and provides actionable insights for building a successful portfolio.

Understanding Warren Buffett's investment approach, particularly his Apple investment, offers invaluable knowledge for anyone building a successful investment portfolio. Start analyzing your own investment opportunities based on the principles of Warren Buffett’s Apple investment strategy today! Learn more about building your own long-term investment strategy by researching [link to relevant resource].

Featured Posts

-

Millions Made From Office365 Breaches Inside The Executive Email Heist

May 06, 2025

Millions Made From Office365 Breaches Inside The Executive Email Heist

May 06, 2025 -

Celtics Vs Suns Game Information Time Tv Coverage And Streaming Options For April 4th

May 06, 2025

Celtics Vs Suns Game Information Time Tv Coverage And Streaming Options For April 4th

May 06, 2025 -

The Truth Behind Patrick Schwarzenegger And Abby Champions Wedding Postponement

May 06, 2025

The Truth Behind Patrick Schwarzenegger And Abby Champions Wedding Postponement

May 06, 2025 -

Rising Copper Prices Impact Of Potential China Us Trade Deal

May 06, 2025

Rising Copper Prices Impact Of Potential China Us Trade Deal

May 06, 2025 -

Canadas Economic Future Gary Mars Perspective On Western Development And Mark Carneys Role

May 06, 2025

Canadas Economic Future Gary Mars Perspective On Western Development And Mark Carneys Role

May 06, 2025

Latest Posts

-

Analyzing The Popularity Of Rather Be Alone By Leon Thomas And Halle Bailey

May 06, 2025

Analyzing The Popularity Of Rather Be Alone By Leon Thomas And Halle Bailey

May 06, 2025 -

Halle Baileys 25th Birthday A Look At The Celebration

May 06, 2025

Halle Baileys 25th Birthday A Look At The Celebration

May 06, 2025 -

Exploring The Success Of Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025

Exploring The Success Of Leon Thomas And Halle Baileys Rather Be Alone

May 06, 2025 -

Halle Bailey Celebrates 25th Birthday With Sweet Photos

May 06, 2025

Halle Bailey Celebrates 25th Birthday With Sweet Photos

May 06, 2025 -

Halle Baileys 25th Birthday Cake Cuteness And Love

May 06, 2025

Halle Baileys 25th Birthday Cake Cuteness And Love

May 06, 2025