Apple Stock And The Trump Tariffs: A Comprehensive Analysis

Table of Contents

The Direct Impact of Tariffs on Apple's Products

The Trump tariffs directly impacted Apple in several ways, primarily by increasing production costs and potentially reducing consumer demand.

Increased Production Costs

Many of Apple's products rely on components sourced globally. Tariffs on these imports directly increased Apple's manufacturing costs.

- Displays: Many iPhone and iPad displays are sourced from manufacturers in China and South Korea, making them subject to tariffs.

- Memory Chips: A significant portion of Apple's memory chip supply comes from countries impacted by tariffs, increasing the cost of production for all Apple devices.

- Other Components: Numerous other components, including processors, batteries, and various other electronic parts, were affected, adding up to substantial cost increases.

These increased costs squeezed Apple's profit margins, forcing the company to explore strategies to mitigate the impact. Apple implemented various measures, such as shifting some production to other countries with more favorable trade agreements, though this proved a complex and lengthy process.

Reduced Consumer Demand (Indirect Effect)

The tariffs, by increasing the price of Apple products, potentially led to reduced consumer demand. While Apple products are often considered premium goods, they are still subject to market forces and price sensitivity.

- Elasticity of Demand: While Apple enjoys considerable brand loyalty, the elasticity of demand for its products is not infinite. Price increases, even for premium brands, can lead to decreased sales.

- Sales Figures: Analyzing sales figures from before, during, and after the tariff implementation would provide valuable data on the impact on demand. While isolating the effect of tariffs from other market factors is challenging, such an analysis could reveal trends.

- Geographical Variations: The impact of the tariffs likely varied geographically, depending on local market conditions and consumer purchasing power.

Tariffs and Supply Chain Disruptions

Apple's highly complex global supply chain proved vulnerable to the disruptions caused by the trade war. The tariffs not only increased costs but also created uncertainty and delays.

- Supply Chain Complexity: Apple's reliance on a vast network of suppliers across multiple countries made it particularly exposed to trade disruptions.

- Supply Chain Diversification: In response, Apple likely accelerated efforts to diversify its supply chain, reducing its dependence on specific countries and manufacturers. This is a long-term strategy that may take years to fully implement.

- Data & Evidence: Reports from industry analysts and news sources regarding Apple's supply chain resilience during the tariff period provide evidence of these disruptions and mitigating strategies.

The Market Reaction to the Trump Tariffs and Apple Stock

The announcement and implementation of Trump tariffs led to significant volatility in Apple's stock price.

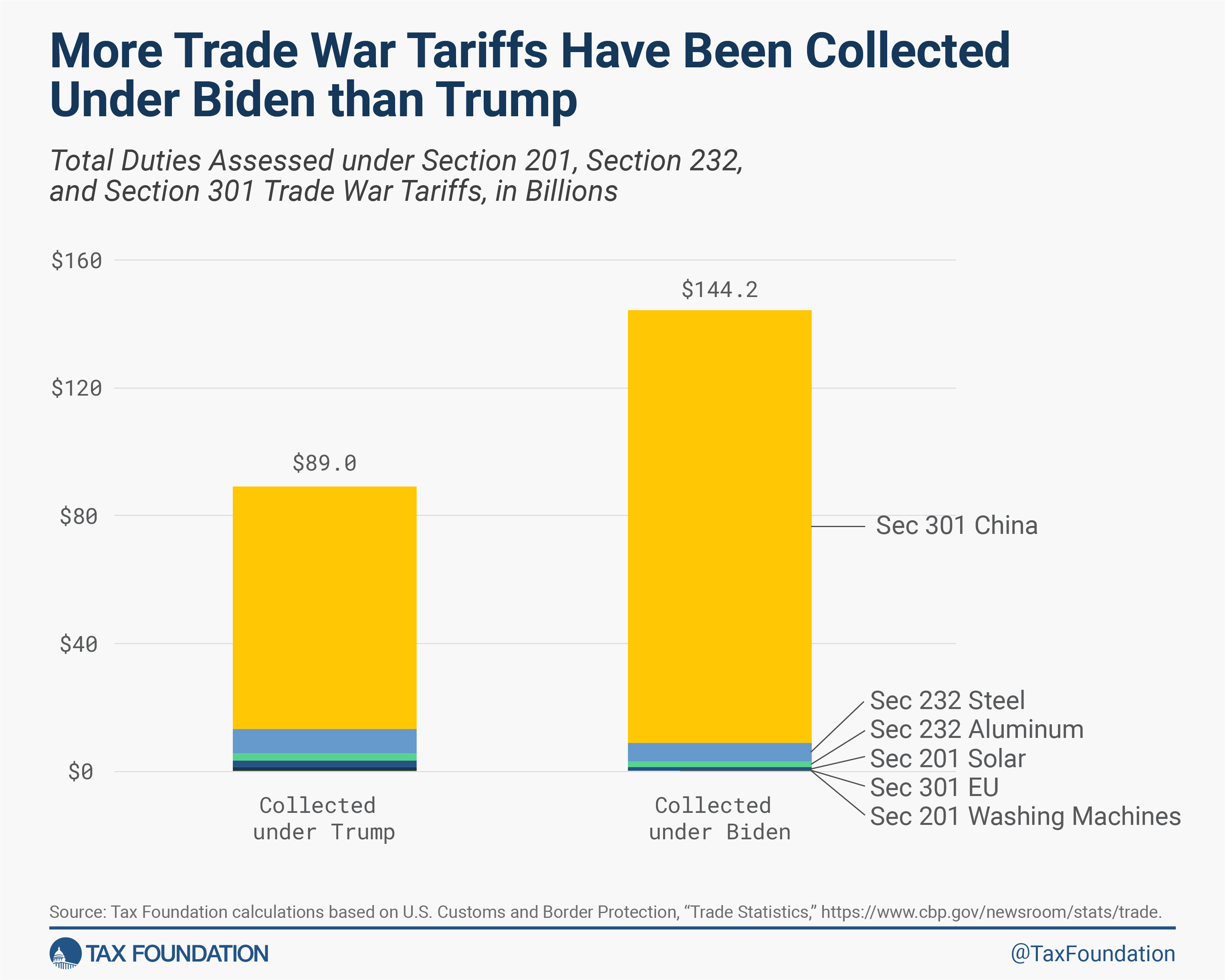

Stock Market Volatility

Apple's stock price fluctuated considerably in response to tariff announcements and escalations.

- Charts and Graphs: Visual representations of Apple's stock price movements during this period, alongside relevant market indices (like the S&P 500 and Nasdaq), offer a clearer picture.

- Investor Sentiment: Investor sentiment plays a crucial role in stock price fluctuations. Negative news regarding tariffs and trade wars undoubtedly affected investor confidence in Apple.

- Market Correlation: The correlation between Apple's stock performance and the overall market reaction to tariff news is an important factor to consider.

Investor Confidence and Long-Term Outlook

The tariffs undeniably impacted investor confidence in Apple.

- Analyst Ratings and Forecasts: Changes in analyst ratings and forecasts for Apple's stock following tariff announcements reflect the shifting investor sentiment.

- Long-Term Implications: The long-term implications of the tariffs on Apple's business model, including potential shifts in production and supply chain strategies, needed careful consideration by investors.

- Geopolitical Uncertainty: The overall geopolitical uncertainty surrounding the trade war added another layer of complexity, influencing investor behavior and risk appetite.

Apple's Strategic Responses to the Tariffs

Apple actively responded to the tariffs through various strategies:

Lobbying Efforts

Apple, like other large corporations, likely engaged in lobbying efforts to influence trade policy and mitigate the negative effects of tariffs. Details on these activities are often less transparent.

Production Diversification

Diversifying its manufacturing base was a crucial long-term strategy for Apple. This involved shifting production to countries with more favorable trade relationships.

Pricing Strategies

Apple likely adjusted its pricing strategies to account for increased costs due to tariffs, but this had to be carefully balanced against maintaining market share and consumer demand.

Conclusion: Understanding the Long-Term Implications of Trump Tariffs on Apple Stock

This analysis highlights the multifaceted impact of Trump tariffs on Apple stock, covering both the direct increase in production costs and indirect effects on consumer demand and supply chain disruptions. The resulting stock market volatility underscores the importance of understanding the intricate relationship between trade policy and stock market performance. While Apple demonstrated resilience through strategic responses, the long-term implications of trade disputes on Apple's stock and its business model require ongoing monitoring. To gain a deeper understanding of investment strategies in a volatile global market, continue researching "Apple stock and trade policy," and consider subscribing for further updates on the effects of "trade tariffs on Apple stock."

Featured Posts

-

Le Pens Rally Underwhelms National Rallys Sunday Demonstration Analyzed

May 25, 2025

Le Pens Rally Underwhelms National Rallys Sunday Demonstration Analyzed

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Their Significance

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Their Significance

May 25, 2025 -

Mia Farrow Supports Fellow Tony Nominee Sadie Sink On Broadway

May 25, 2025

Mia Farrow Supports Fellow Tony Nominee Sadie Sink On Broadway

May 25, 2025 -

Significant Fall In Amsterdam Stock Exchange Aex Index At One Year Low

May 25, 2025

Significant Fall In Amsterdam Stock Exchange Aex Index At One Year Low

May 25, 2025 -

Kering Stock Takes A Hit Q1 Results Fuel 6 Share Decline

May 25, 2025

Kering Stock Takes A Hit Q1 Results Fuel 6 Share Decline

May 25, 2025

Latest Posts

-

Millions Stolen Inside Job Exposes Office365 Executive Account Vulnerabilities

May 25, 2025

Millions Stolen Inside Job Exposes Office365 Executive Account Vulnerabilities

May 25, 2025 -

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 25, 2025

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 25, 2025 -

Build Voice Assistants Easily Open Ais New Tools At The 2024 Developer Conference

May 25, 2025

Build Voice Assistants Easily Open Ais New Tools At The 2024 Developer Conference

May 25, 2025 -

T Mobile Penalized 16 Million For Three Years Of Data Breaches

May 25, 2025

T Mobile Penalized 16 Million For Three Years Of Data Breaches

May 25, 2025 -

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025