Apple Stock: Navigating The Q2 Earnings Report

Table of Contents

Key Figures and Financial Highlights

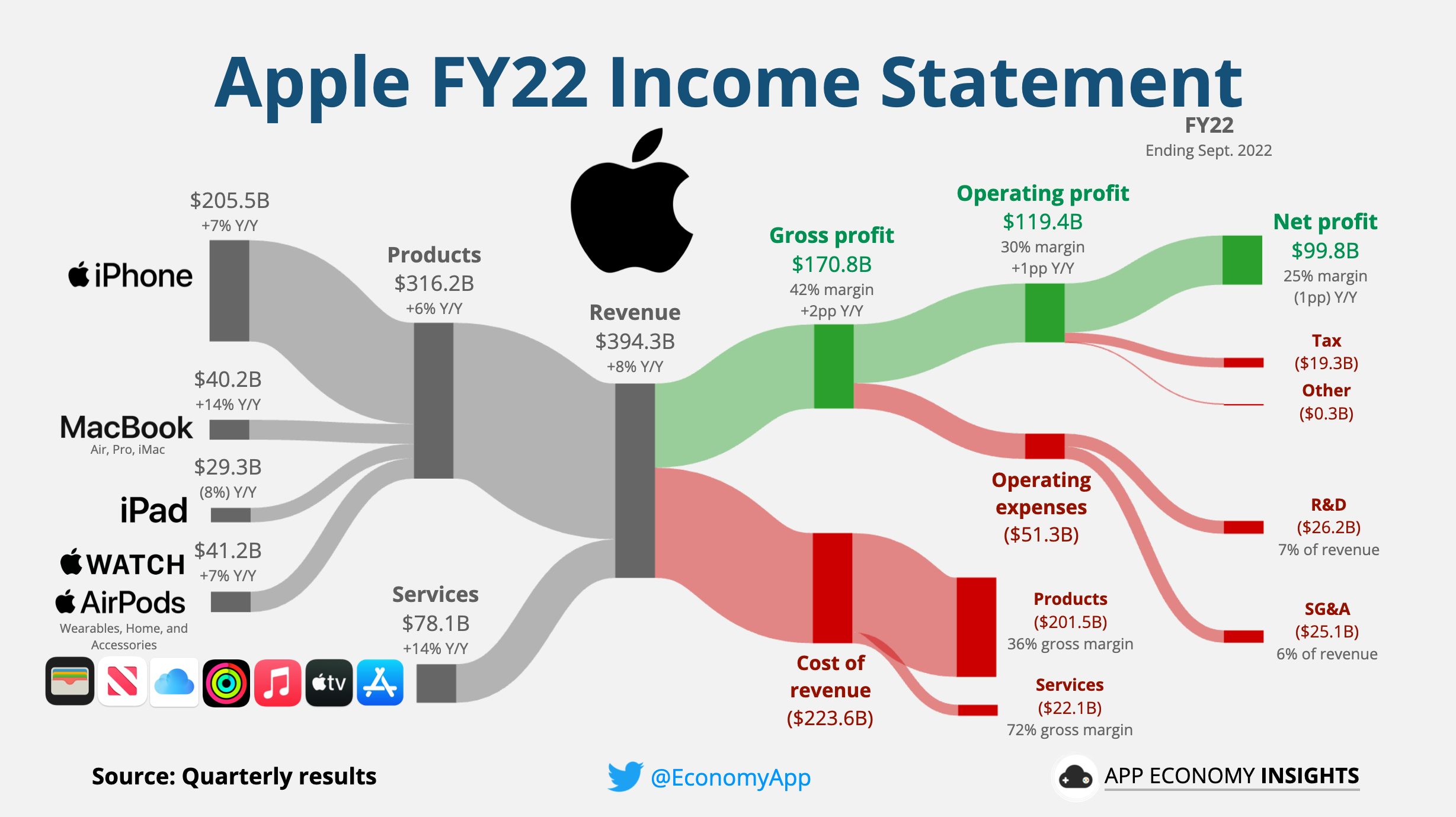

Apple's Q2 earnings report unveiled key financial metrics that provide a snapshot of the company's performance. Analyzing these figures against previous quarters and analyst expectations is crucial for gauging the overall health of the tech giant and its impact on Apple stock price. Let's delve into the specifics:

-

Revenue: Apple reported [Insert actual revenue figure here] in Q2, representing a [Insert percentage]% year-over-year growth/decline. This figure is [higher/lower] than analyst expectations of [Insert analyst expectation figure here]. The variance can be attributed to [mention reasons, e.g., strong iPhone sales, weaker Mac sales, etc.].

-

Earnings Per Share (EPS): Apple's EPS came in at [Insert actual EPS figure here], compared to [Insert previous quarter EPS figure here] in Q1 and analyst predictions of [Insert analyst prediction figure here]. This indicates [positive/negative] growth and reflects [mention factors like cost-cutting measures, increased sales, or other relevant factors].

-

Gross Margin: The gross margin stood at [Insert actual gross margin percentage here], signifying [positive/negative] movement compared to the previous quarter. This change can be attributed to [mention factors such as component costs, pricing strategies, or product mix]. A shrinking gross margin might signal increasing pressure on profitability, while a widening margin suggests improved efficiency.

-

Net Income: Apple reported a net income of [Insert actual net income figure here], a [positive/negative] change compared to the same period last year. This translates to [explain impact on investor returns and potential dividends].

-

Guidance: Management provided guidance for the next quarter, projecting [Insert management guidance here]. This forecast offers valuable insights into Apple's anticipated performance and helps investors gauge future expectations for Apple stock price.

Product Performance and Segment Analysis

A granular analysis of Apple's product segments provides a more nuanced understanding of its overall performance. The success or underperformance of specific products significantly influences the overall Apple stock price and investor sentiment.

-

iPhone Sales: iPhone sales totaled [Insert actual sales figures here], showing [percentage]% year-over-year growth/decline. This reflects [mention market trends, competitive pressures, or success of new models].

-

Mac Sales: Mac sales reached [Insert actual sales figures here], with [percentage]% year-over-year growth/decline. Factors such as [mention factors like new product launches, market competition, or economic conditions] influenced this result.

-

iPad Sales: The iPad segment generated [Insert actual sales figures here] in revenue, representing [percentage]% year-over-year growth/decline. This performance can be explained by [mention relevant factors like market saturation, new model releases, or changing consumer preferences].

-

Wearables, Home, and Accessories: This category showed [Insert actual sales figures here], indicating [percentage]% year-over-year growth/decline. Growth within this segment often reflects broader consumer adoption of Apple's ecosystem.

-

Services Revenue: Apple's Services segment continues to be a growth engine, generating [Insert actual revenue figures here] and showing [percentage]% year-over-year growth. This persistent growth showcases the strength and stickiness of the Apple ecosystem.

Supply Chain and Economic Factors

External factors played a significant role in shaping Apple's Q2 performance. Understanding these macroeconomic influences is essential for a comprehensive analysis of Apple stock.

-

Supply Chain Disruptions: Ongoing supply chain disruptions, particularly related to [mention specific challenges], impacted production and potentially limited sales growth.

-

Inflation: Rising inflation rates impacted consumer spending, potentially affecting demand for Apple products, particularly in price-sensitive segments.

-

Global Economy: The overall global economic climate, characterized by [mention current economic conditions], also influenced Apple's Q2 results. Uncertainty in the global market can affect consumer confidence and spending.

-

Consumer Spending: Changes in consumer spending patterns, driven by [mention influencing factors], also impacted Apple's performance.

Stock Market Reaction and Future Outlook

The market's reaction to Apple's Q2 earnings report provides valuable insights into investor sentiment and future price movements for Apple stock.

-

Immediate Stock Price Reaction: Following the earnings release, Apple's stock price [increased/decreased] by [percentage]%. This initial reaction reflects the market's immediate assessment of the reported results.

-

Analyst Ratings and Price Targets: Analysts revised their ratings and price targets for Apple stock based on the Q2 performance, with [mention specific changes and their rationale].

-

Long-Term Outlook: Considering the Q2 performance and future projections, the long-term outlook for Apple stock appears [positive/cautious/negative]. This assessment considers factors such as [mention key factors contributing to the outlook].

-

Potential Risks and Opportunities: Investors should consider both potential risks (e.g., intensifying competition, economic downturn) and opportunities (e.g., growth in emerging markets, new product innovations) when evaluating Apple stock.

Conclusion

Apple's Q2 earnings report presented a mixed bag, with strong performance in some segments offset by challenges in others. Understanding the key financial metrics, product performance, external factors, and market reaction is crucial for informed investment decisions. While the immediate stock price reaction provides a snapshot, a longer-term perspective is needed to evaluate the true impact on Apple Stock. Stay updated on Apple Stock and analyze future Apple earnings reports to make informed decisions about your Apple Stock investments. Continuous monitoring of Apple’s financial performance and market trends is key to optimizing your investment strategy.

Featured Posts

-

Apple Stock Analysis Of Q2 Results And Future Outlook

May 25, 2025

Apple Stock Analysis Of Q2 Results And Future Outlook

May 25, 2025 -

Porsche F1 Motorral Legendas Hajtomu Koezuti Autokban

May 25, 2025

Porsche F1 Motorral Legendas Hajtomu Koezuti Autokban

May 25, 2025 -

England Airpark And Alexandria International Airports Ae Xplore Campaign Connecting Communities Expanding Horizons

May 25, 2025

England Airpark And Alexandria International Airports Ae Xplore Campaign Connecting Communities Expanding Horizons

May 25, 2025 -

Major Road Closed After Serious Accident Person Hospitalized

May 25, 2025

Major Road Closed After Serious Accident Person Hospitalized

May 25, 2025 -

Unbuilt Roads Investigating The Proposed M62 Bury Relief Route

May 25, 2025

Unbuilt Roads Investigating The Proposed M62 Bury Relief Route

May 25, 2025

Latest Posts

-

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025

From Scatological Documents To Engaging Podcasts An Ai Solution

May 25, 2025 -

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025

Ai Powered Podcast Creation Analyzing And Transforming Scatological Data

May 25, 2025 -

Turning Poop Into Podcast Gold Ai Digest For Repetitive Documents

May 25, 2025

Turning Poop Into Podcast Gold Ai Digest For Repetitive Documents

May 25, 2025 -

Dogecoin Price Prediction Considering Elon Musks Role

May 25, 2025

Dogecoin Price Prediction Considering Elon Musks Role

May 25, 2025 -

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025

The Impact Of Elon Musks Actions On The Dogecoin Price

May 25, 2025