Apple Stock Price Action Ahead Of Fiscal Q2 Report

Table of Contents

Analyst Predictions and Expectations for Apple's Q2 Earnings

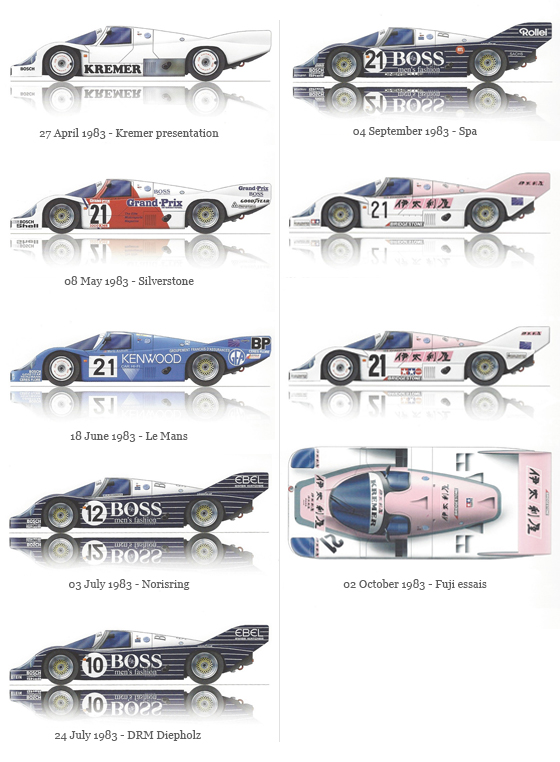

Wall Street analysts are keenly anticipating Apple's Q2 earnings report, with predictions varying across the board. Understanding these expectations is crucial for gauging potential market reactions to the actual results. The consensus forecast often serves as a benchmark against which the actual figures are compared.

-

Average EPS Forecast: Leading analysts offer a range of EPS (earnings per share) forecasts, with the average currently hovering around [insert current average EPS forecast from reputable sources]. This average, however, represents a blend of optimistic and pessimistic outlooks.

-

Revenue Projections: The range of revenue projections is equally diverse, largely reflecting varying expectations regarding iPhone sales, Services revenue growth, and the impact of macroeconomic headwinds. A wider range indicates greater uncertainty surrounding the company's performance.

-

Analyst Ratings and Price Targets: Tracking changes in analyst ratings (buy, hold, sell) and price targets is vital. Significant upgrades or downgrades, accompanied by detailed justifications, can significantly influence Apple stock price movements. Look for analysts who provide detailed reasoning for their predictions.

-

Apple Guidance: Apple's own guidance—the company's forward-looking financial estimates—carries substantial weight. Any surprises or significant revisions to guidance during the Q2 earnings call can trigger substantial volatility in the AAPL stock price.

Key Factors Influencing Apple Stock Price Volatility

Several interconnected factors could significantly impact the market's response to Apple's Q2 results. Understanding these variables is essential for predicting potential price fluctuations.

-

iPhone Sales: The performance of iPhone sales remains paramount. Any shortfall in sales compared to expectations could negatively impact the Apple stock price, while exceeding forecasts could generate significant upward momentum. Watch for specific sales figures for the various iPhone models.

-

Services Revenue: Apple's Services segment—including App Store revenue, Apple Music subscriptions, iCloud storage, and AppleCare—is a crucial driver of profitability and consistency. Continued strong growth in this sector can offset potential weakness in other areas.

-

Supply Chain Issues and Inflation: Persistent supply chain disruptions and inflationary pressures pose ongoing challenges. The impact of these factors on production costs, product availability, and consumer spending directly influences Apple's financial performance and stock price.

-

Macroeconomic Factors: Broader macroeconomic conditions, including interest rate hikes and overall consumer spending habits, cannot be ignored. A weakening global economy could dampen demand for Apple products, affecting the Apple stock price forecast.

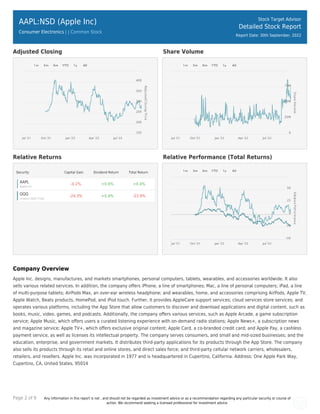

Analyzing Recent Apple Stock Price Trends

Analyzing recent Apple stock chart patterns and price movements can provide valuable insights into potential post-earnings reactions. Technical analysis can help identify potential support and resistance levels that might influence price action after the Q2 report.

-

Recent Stock Price Highs and Lows: Examining recent price highs and lows reveals the stock's short-term momentum and potential turning points. This can highlight trends that may continue.

-

Trading Volume: Increased trading volume often accompanies significant price changes. Monitoring volume can help gauge the strength of any price movements following the Q2 report. High volume confirms the movement; low volume may suggest a temporary fluctuation.

-

Support and Resistance Levels: Identifying key support and resistance levels on the Apple stock chart using technical indicators can help anticipate potential price reversals. These act as price boundaries.

-

Chart Patterns: Analyzing chart patterns (e.g., head and shoulders, triangles) can offer additional insights into potential future price movements. This adds another layer of analysis beyond simple price movements.

Strategies for Investors Ahead of the Q2 Report

The period surrounding Apple's Q2 report presents both opportunities and risks. Investors should adopt strategies aligned with their individual risk tolerance and investment goals.

-

Risk Management: Risk management is paramount. Diversifying your portfolio is crucial to mitigate potential losses. Don't put all your eggs in one basket.

-

Long-Term vs. Short-Term Strategies: Long-term investors may choose a "wait-and-see" approach, while short-term traders may attempt to profit from short-term price fluctuations. Both require careful assessment.

-

Buy, Sell, or Hold Decisions: The decision to buy, sell, or hold Apple stock should be based on a comprehensive analysis of the Q2 report, considering all factors discussed in this article. Remember to consider your own individual investment goals and risk profile.

-

Preemptive Actions: Preemptive buying or selling before the report carries significant risk. Careful evaluation and thorough research are advised rather than reacting solely to speculation.

Conclusion

The Apple stock price leading up to and following the fiscal Q2 report will be influenced by a confluence of factors, including analyst predictions, iPhone sales, Services revenue growth, macroeconomic conditions, and existing price trends. Investors need to carefully consider their own risk tolerance and investment strategy before making any decisions regarding Apple stock. Remember to diversify your portfolio.

Call to Action: Stay informed about the upcoming Apple fiscal Q2 report and its potential impact on your Apple stock holdings. Monitor news, expert analysis, and the actual earnings release closely to make informed investment decisions. Continue researching Apple stock and its potential for future growth. Understanding the intricacies of Apple stock price action will ultimately improve your investment strategies.

Featured Posts

-

Securing Your Country Retreat Properties Available Under 1 Million

May 25, 2025

Securing Your Country Retreat Properties Available Under 1 Million

May 25, 2025 -

Nicki Chapmans Smart Property Investment A 700 000 Return On Her Escape To The Country Home

May 25, 2025

Nicki Chapmans Smart Property Investment A 700 000 Return On Her Escape To The Country Home

May 25, 2025 -

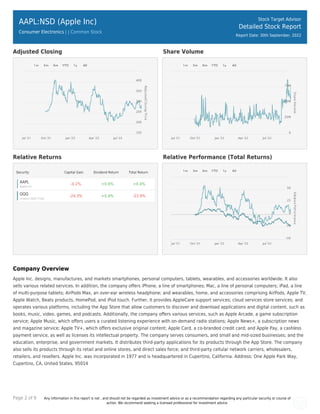

Neden Porsche 956 Araclari Tavanlardan Asili

May 25, 2025

Neden Porsche 956 Araclari Tavanlardan Asili

May 25, 2025 -

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025

Farrows Plea Hold Trump Accountable For Venezuelan Gang Member Deportations

May 25, 2025 -

Trogatelniy Vecher V Teatre Mossoveta Posvyaschenie Sergeyu Yurskomu

May 25, 2025

Trogatelniy Vecher V Teatre Mossoveta Posvyaschenie Sergeyu Yurskomu

May 25, 2025

Latest Posts

-

Cybercriminals Millions Fbi Investigates Massive Office365 Executive Data Breach

May 25, 2025

Cybercriminals Millions Fbi Investigates Massive Office365 Executive Data Breach

May 25, 2025 -

Millions Stolen Inside Job Exposes Office365 Executive Account Vulnerabilities

May 25, 2025

Millions Stolen Inside Job Exposes Office365 Executive Account Vulnerabilities

May 25, 2025 -

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 25, 2025

Federal Investigation Hacker Makes Millions From Executive Office365 Accounts

May 25, 2025 -

Build Voice Assistants Easily Open Ais New Tools At The 2024 Developer Conference

May 25, 2025

Build Voice Assistants Easily Open Ais New Tools At The 2024 Developer Conference

May 25, 2025 -

T Mobile Penalized 16 Million For Three Years Of Data Breaches

May 25, 2025

T Mobile Penalized 16 Million For Three Years Of Data Breaches

May 25, 2025