Nicki Chapman's Smart Property Investment: A £700,000 Return On Her Escape To The Country Home

Table of Contents

<meta name="description" content="Discover how TV presenter Nicki Chapman achieved a remarkable £700,000 profit on her Escape to the Country property investment. Learn smart strategies for your own property portfolio.">

Nicki Chapman, the beloved presenter of Escape to the Country, isn't just an expert at helping others find their dream homes; she's also a shrewd property investor. Her recent sale demonstrates the incredible potential returns achievable through smart property investment. This article delves into the secrets behind her £700,000 profit and offers insights for aspiring investors looking to replicate her success. Learn about her strategic choices and how you can apply them to your own property journey.

<h2>Nicki Chapman's Initial Property Purchase</h2>

<h3>Location, Location, Location</h3>

The strategic importance of property location cannot be overstated, and Nicki Chapman's success highlights this perfectly. Her initial property purchase was in a highly desirable area, a key factor contributing to its future value appreciation.

- Desirable area: The specific location remains undisclosed for privacy reasons, but reports suggest it was a sought-after area known for its excellent schools, charming character, and strong community spirit.

- Proximity to amenities: Easy access to local shops, restaurants, and recreational facilities significantly boosted the property's appeal and, consequently, its value.

- Transport links: Convenient access to major transport routes, including road and rail networks, increased its desirability for potential buyers.

- Growth potential: The area showed a consistent history of property price growth, making it an attractive investment prospect.

This combination of factors is crucial for property investment success. While specific data on house price growth in the exact area isn't publicly available for privacy reasons, similar areas have shown average annual growth rates consistently exceeding the national average.

<h3>Property Type and Condition</h3>

The type of property and its condition at the time of purchase also played a significant role in Nicki's eventual profit. While the exact details are not publicly known, it's likely she recognized the potential for renovation and improvement.

- Potential for renovation: The property likely offered opportunities to increase its value through strategic renovations. This could have included updating outdated fixtures or expanding the living space.

- Suitability for the rental market: A property suitable for renting can provide additional income streams during the ownership period, mitigating costs and maximizing returns. This is a common strategy for savvy investors.

- Initial purchase price: Securing a property at a favorable purchase price is key to maximizing profits. This suggests careful research and negotiation skills were employed by Nicki.

Buying a property needing renovation can be risky, but if done correctly, it offers significant potential for profit. However, it's crucial to accurately assess renovation costs and ensure the final value justifies the investment.

<h2>Value-Adding Strategies Employed</h2>

<h3>Renovation and Improvement</h3>

Nicki Chapman's success was significantly boosted by strategic renovations. Although precise details aren't publicly available, it's clear she invested wisely in upgrades that maximized the property's value.

- Specific renovations: Likely improvements include a modern kitchen and bathroom remodel, landscaping enhancements, and potentially even extensions or structural improvements.

- Cost of renovations: The exact cost remains private, but the investment clearly generated a substantial return.

- Return on investment (ROI): Each renovation likely added significantly to the property's value, far exceeding the initial investment cost.

Before and after photos, if available, would dramatically showcase the impact of these improvements. However, the overall effect is demonstrably clear in the substantial £700,000 profit achieved.

<h3>Market Timing and Strategic Selling</h3>

Nicki's success wasn't just about buying well; it was also about selling strategically. Timing the sale perfectly is crucial in property investment.

- Market conditions: Selling at a time of high demand and relatively low supply maximizes profits. Nicki likely monitored market trends closely.

- Factors influencing the decision to sell: Several factors could have influenced the decision, including personal circumstances, but the timing itself suggests a strong understanding of market cycles.

The importance of patience and timing in property investment cannot be overemphasized. Holding onto a property for the right time, even if it means waiting longer, can significantly impact the eventual profit.

<h2>Lessons Learned from Nicki Chapman's Success</h2>

<h3>Key Takeaways for Aspiring Investors</h3>

Nicki Chapman's investment journey offers valuable lessons for aspiring property investors:

- Importance of research: Thorough research into the property market, location, and comparable properties is essential.

- Due diligence: Careful checks on property condition, legal aspects, and potential risks are crucial.

- Careful planning: A well-defined investment strategy, including budget and exit strategy, is crucial for success.

- Patience: Property investment is a long-term game; patience is required to maximize returns.

- Understanding market trends: Staying informed about market fluctuations and economic indicators is essential.

Seeking professional advice from property experts, including estate agents, solicitors, and financial advisors, is highly recommended.

<h3>Avoiding Common Property Investment Mistakes</h3>

Nicki's success highlights the pitfalls to avoid:

- Overspending: Buying beyond your means can lead to financial difficulties.

- Poor research: Insufficient research can result in purchasing an unsuitable property or paying an inflated price.

- Neglecting maintenance: Regular maintenance is essential to preserve property value and avoid costly repairs later.

- Unrealistic expectations: Property investment involves risks; avoid unrealistic profit expectations.

By learning from these mistakes, aspiring investors can significantly improve their chances of success and potentially replicate Nicki Chapman's impressive returns.

<h2>Conclusion</h2>

Nicki Chapman’s £700,000 profit from her Escape to the Country home demonstrates the significant potential rewards of smart property investment. By carefully selecting a property, undertaking strategic renovations, and timing the sale effectively, she achieved remarkable returns. Her success underscores the importance of location, careful planning, and understanding market trends.

Inspired by Nicki Chapman's success? Learn more about smart property investment strategies and start building your own portfolio today! Research properties in desirable locations, consider renovations that add value, and seek professional advice to make informed decisions. Don't miss out on the potential for significant returns – your Escape to the Country investment could be closer than you think!

Featured Posts

-

Glastonbury 2025 Lineup Charli Xcx Neil Young And Must See Acts

May 25, 2025

Glastonbury 2025 Lineup Charli Xcx Neil Young And Must See Acts

May 25, 2025 -

Porsche 956 Nin Havada Asili Durmasinin Sirri

May 25, 2025

Porsche 956 Nin Havada Asili Durmasinin Sirri

May 25, 2025 -

Eurovision Village 2025 Conchita Wursts Performance With Jj

May 25, 2025

Eurovision Village 2025 Conchita Wursts Performance With Jj

May 25, 2025 -

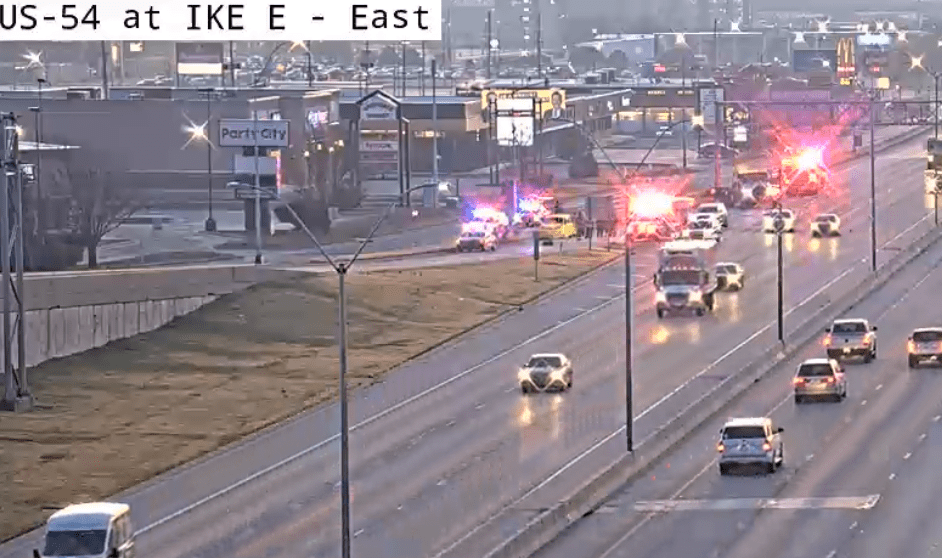

Live Emergency Response To Princess Road Accident Pedestrian Injured

May 25, 2025

Live Emergency Response To Princess Road Accident Pedestrian Injured

May 25, 2025 -

Following A Night Out With Kyle Walker Annie Kilners Poisoning Claims

May 25, 2025

Following A Night Out With Kyle Walker Annie Kilners Poisoning Claims

May 25, 2025

Latest Posts

-

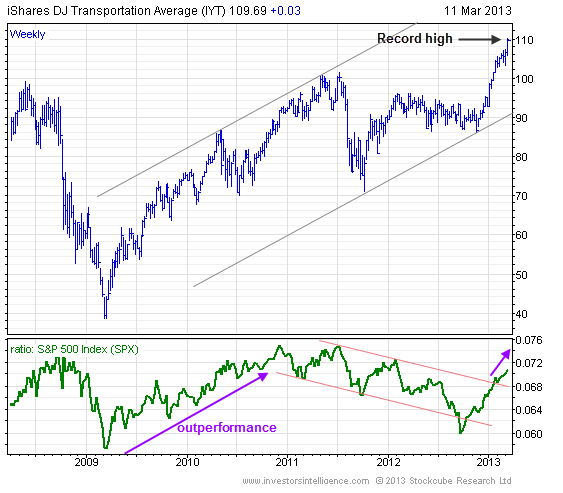

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Their Significance

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Daily Nav Updates And Their Significance

May 25, 2025 -

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025

Analyzing The Net Asset Value Of The Amundi Dow Jones Industrial Average Ucits Etf Distributing

May 25, 2025 -

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf A Comprehensive Guide

May 25, 2025

Net Asset Value Nav Of The Amundi Dow Jones Industrial Average Ucits Etf A Comprehensive Guide

May 25, 2025 -

She Waits By The Phone A Tale Of Anticipation

May 25, 2025

She Waits By The Phone A Tale Of Anticipation

May 25, 2025 -

Waiting For The Call A Personal Narrative

May 25, 2025

Waiting For The Call A Personal Narrative

May 25, 2025