Apple Stock Suffers Setback Amidst $900 Million Tariff Projection

Table of Contents

The $900 Million Tariff Projection: A Deep Dive

The $900 million tariff projection stems from increased tariffs imposed on various components imported from China, a crucial manufacturing hub for Apple. These tariffs, primarily enacted as part of the ongoing trade tensions between the US and China, significantly impact Apple's production costs and profitability.

- Specific Products Affected: The tariffs affect a wide range of Apple products, including iPhones, iPads, MacBooks, Apple Watches, and AirPods. These are core products driving Apple's revenue and profitability.

- Percentage Increase in Cost: Estimates suggest a percentage increase in cost ranging from 5% to 15% depending on the specific component and the product. This variation adds complexity to Apple’s response and affects profitability differently across its product lines.

- Impact on Profit Margins: The increased costs due to Apple import tariffs directly impact Apple's profit margins. The company's ability to absorb these costs without significantly raising prices or reducing profit will be crucial for maintaining investor confidence. The impact of China tariffs on Apple is a major concern for analysts. The effect of Apple tariff impact on future financial reports will be closely watched.

Apple's Response to Rising Tariffs

Apple hasn't publicly announced a comprehensive, singular response, preferring a multi-pronged approach. This includes lobbying efforts in Washington D.C. to influence trade policy and explore strategies to mitigate the effects of the Apple tariff strategy.

- Potential Mitigation Strategies: Apple might explore several options, including price increases, shifting production to countries outside of China (such as Vietnam or India), and negotiating more favorable terms with suppliers. They might also look to reduce reliance on certain components affected by the highest tariffs.

- Effectiveness of Strategies: The effectiveness of these strategies remains to be seen. Shifting production is a complex and costly undertaking, and price increases could negatively affect consumer demand. Negotiating with suppliers might offer limited success.

- Public Reaction: The public response has been mixed, with some consumers expressing understanding given the trade environment and others expressing concern about potential price hikes. This affects Apple's response to tariffs and impacts their brand image.

Impact on Apple Stock and Investor Sentiment

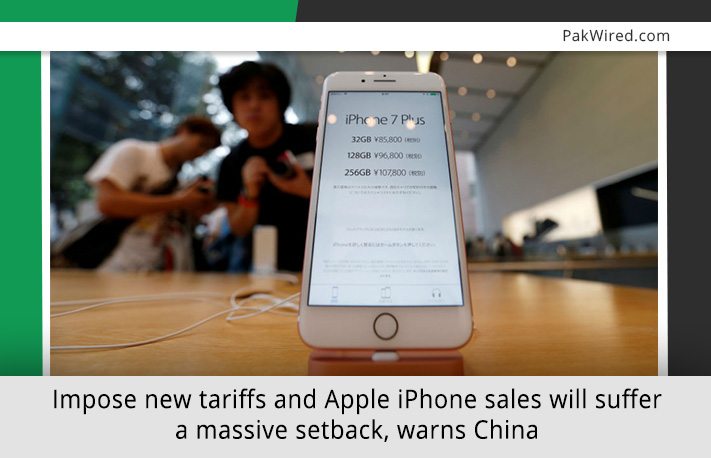

The projected tariffs have already caused a noticeable dip in Apple's stock price. The impact of Apple tariff impact on the overall stock market is also being observed.

- Stock Price Fluctuation: Since the tariff projection, Apple's stock price has experienced significant volatility, reflecting investor uncertainty about the long-term implications.

- Investor Reactions and Sentiment: Investors are showing mixed reactions, with some opting for sell-offs, while others are adopting a wait-and-see approach, hoping Apple will successfully navigate these challenges. Negative investor sentiment Apple may further impact the stock price.

- Analyst Predictions: Analyst predictions vary widely, reflecting the uncertainty surrounding the future impact of the tariffs and Apple's ability to mitigate their effects. Several ratings downgrades from various financial agencies have added to the negative sentiment. The Apple stock price remains volatile in light of these factors. Analyzing the Apple stock forecast is key to understanding the current situation. The Apple stock performance reflects the ongoing uncertainty surrounding the tariffs and the company’s response.

Alternative Investment Strategies in Light of Tariffs

Given the uncertainty surrounding the impact of the tariffs on Apple's stock, investors might consider alternative strategies to diversify their portfolios.

- Diversification Strategies: Diversifying into other sectors or even other tech stocks less susceptible to these specific tariffs is a prudent strategy.

- Alternative Tech Stocks: Consider investing in tech companies with less manufacturing reliance on China or those with a more diversified supply chain.

- Risk Tolerance: Investors with higher risk tolerance may hold onto Apple stock, betting on its resilience. Conversely, more risk-averse investors may seek safer investments to mitigate potential losses. This helps in diversifying Apple investments. Examining alternative tech stocks is a key factor to consider, as is risk management Apple stock.

Conclusion

The projected $900 million tariff increase represents a significant challenge for Apple, leading to a setback in its stock performance. The company's response and the long-term effects remain to be seen, highlighting the importance of staying informed about Apple tariff developments and considering diversification strategies. Investors should carefully analyze the situation and adjust their portfolios accordingly, considering the implications of Apple stock's performance amidst these rising tariffs. Keep monitoring the Apple stock and its response to these tariff projections for informed investment decisions.

Featured Posts

-

Apple Stock Price Action Ahead Of Fiscal Q2 Report

May 25, 2025

Apple Stock Price Action Ahead Of Fiscal Q2 Report

May 25, 2025 -

Significant Fall In Amsterdam Stock Exchange Aex Index At One Year Low

May 25, 2025

Significant Fall In Amsterdam Stock Exchange Aex Index At One Year Low

May 25, 2025 -

European Shares Rise On Trump Tariff Relief Hints Lvmh Falls

May 25, 2025

European Shares Rise On Trump Tariff Relief Hints Lvmh Falls

May 25, 2025 -

French Pms Dissent Key Decisions Questioned Under Macron Presidency

May 25, 2025

French Pms Dissent Key Decisions Questioned Under Macron Presidency

May 25, 2025 -

Anchor Brewing Company Shuttering Its Doors After 127 Years Of Brewing History

May 25, 2025

Anchor Brewing Company Shuttering Its Doors After 127 Years Of Brewing History

May 25, 2025

Latest Posts

-

Miami Valley Under Flood Advisory Impacts And Safety Precautions

May 25, 2025

Miami Valley Under Flood Advisory Impacts And Safety Precautions

May 25, 2025 -

Urgent Coastal Flood Advisory For Southeast Pennsylvania Wednesday

May 25, 2025

Urgent Coastal Flood Advisory For Southeast Pennsylvania Wednesday

May 25, 2025 -

Flash Flood Warning Bradford And Wyoming Counties Until Tuesday

May 25, 2025

Flash Flood Warning Bradford And Wyoming Counties Until Tuesday

May 25, 2025 -

Flood Warnings And Advisories For Miami Valley What You Need To Know

May 25, 2025

Flood Warnings And Advisories For Miami Valley What You Need To Know

May 25, 2025 -

Wednesday Coastal Flood Warning Southeast Pa Update

May 25, 2025

Wednesday Coastal Flood Warning Southeast Pa Update

May 25, 2025