Apple Stock Under Pressure: Q2 Earnings Report Looms

Table of Contents

Factors Contributing to Apple Stock Pressure

Several significant factors are currently weighing on Apple stock. Understanding these challenges is crucial for investors seeking to navigate the current market conditions.

Slowing iPhone Sales

Weakening demand for iPhones is a major concern. Market saturation, coupled with a global economic downturn, has led to a noticeable slowdown in sales growth compared to previous years. This directly impacts Apple's revenue projections, a key metric for investors.

- Market research firm Counterpoint Research recently reported a year-on-year decline in global smartphone shipments, with Apple experiencing a steeper-than-average drop.

- Several analysts predict a single-digit percentage growth in iPhone sales for Q2, significantly lower than previous years' double-digit increases.

- Comparisons to previous quarters reveal a clear trend of iPhone sales decline, impacting Apple revenue forecast significantly. The weakening consumer demand is a contributing factor to the smartphone market saturation.

Supply Chain Issues and Inflation

Persistent global supply chain disruptions and rampant inflation are significantly impacting Apple's manufacturing and profitability. Increased costs for raw materials and components are squeezing profit margins.

- Shortages of crucial components, such as certain chips and display panels, continue to hamper production.

- Production costs have risen sharply, forcing Apple to consider strategies like price increases, which can further impact consumer demand.

- The impact of inflation on both production and consumer spending is a double whammy affecting Apple's bottom line. Apple's manufacturing processes are directly vulnerable to these global challenges.

Competition in the Tech Market

Apple faces increasingly fierce competition in the tech market. Rivals are aggressively challenging its dominance in smartphones and other key areas like services.

- Samsung continues to be a strong competitor in the smartphone market, particularly in certain regions.

- Google's Pixel line and other Android-based devices are gaining traction, chipping away at Apple's market share.

- The competitive landscape is intensifying in the services sector as well, with competitors offering similar features and subscriptions. Analyzing the Apple competitors and their strategies is critical to understanding the market share dynamics.

Analyzing the Upcoming Q2 Earnings Report

The upcoming Q2 earnings report will be crucial in determining the future trajectory of Apple stock. Investors will be closely scrutinizing several key performance indicators.

Key Metrics to Watch

Investors will be focusing on several key financial metrics to gauge Apple's health:

- Apple earnings per share (EPS): A key indicator of profitability, showing the portion of earnings allocated to each outstanding share.

- Revenue growth: A measure of Apple's overall sales performance, reflecting the demand for its products and services.

- Apple Q2 earnings will also include crucial information on the company's financial guidance, providing insight into future expectations. Any deviations from previous guidance could significantly impact the stock price.

Analyst Predictions and Expectations

Financial analysts offer a range of predictions for Apple's Q2 performance.

- While there's a consensus that growth will be slower than in previous years, forecasts vary widely regarding the extent of the slowdown.

- Several analysts have lowered their Apple stock forecast in recent weeks, reflecting the concerns surrounding slowing iPhone sales and macroeconomic headwinds.

- Market sentiment is currently cautious, with investors closely monitoring the economic outlook and its impact on consumer spending. Investor expectations are therefore tempered compared to previous quarters.

Potential Market Reactions

The market's reaction to the Q2 earnings report will likely depend on how Apple's actual results compare to expectations.

- A strong performance, exceeding analyst predictions, could lead to a significant Apple stock price increase, potentially reducing market volatility.

- Conversely, disappointing results could trigger a sell-off, increasing market volatility and potentially leading to a sharper decline in the Apple stock price. Understanding the potential stock market reaction is key to developing a robust investment strategy.

Navigating the Uncertainty Surrounding Apple Stock

In summary, several factors are currently putting Apple stock under pressure, including slowing iPhone sales, supply chain issues, and increasing competition. The upcoming Q2 earnings report will be crucial in determining the future direction of the stock price. Investors need to carefully consider these factors and monitor the report closely. Stay informed about the upcoming Apple stock report and make informed decisions about your Apple stock investment. Conduct thorough Apple share price analysis to better understand the Apple stock outlook and adjust your investment strategies accordingly.

Featured Posts

-

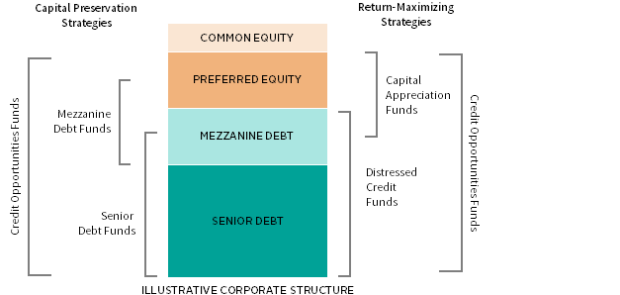

5 Essential Dos And Don Ts To Succeed In The Private Credit Industry

May 24, 2025

5 Essential Dos And Don Ts To Succeed In The Private Credit Industry

May 24, 2025 -

Riviera Blue Porsche 911 S T Exceptional Condition Private Sale

May 24, 2025

Riviera Blue Porsche 911 S T Exceptional Condition Private Sale

May 24, 2025 -

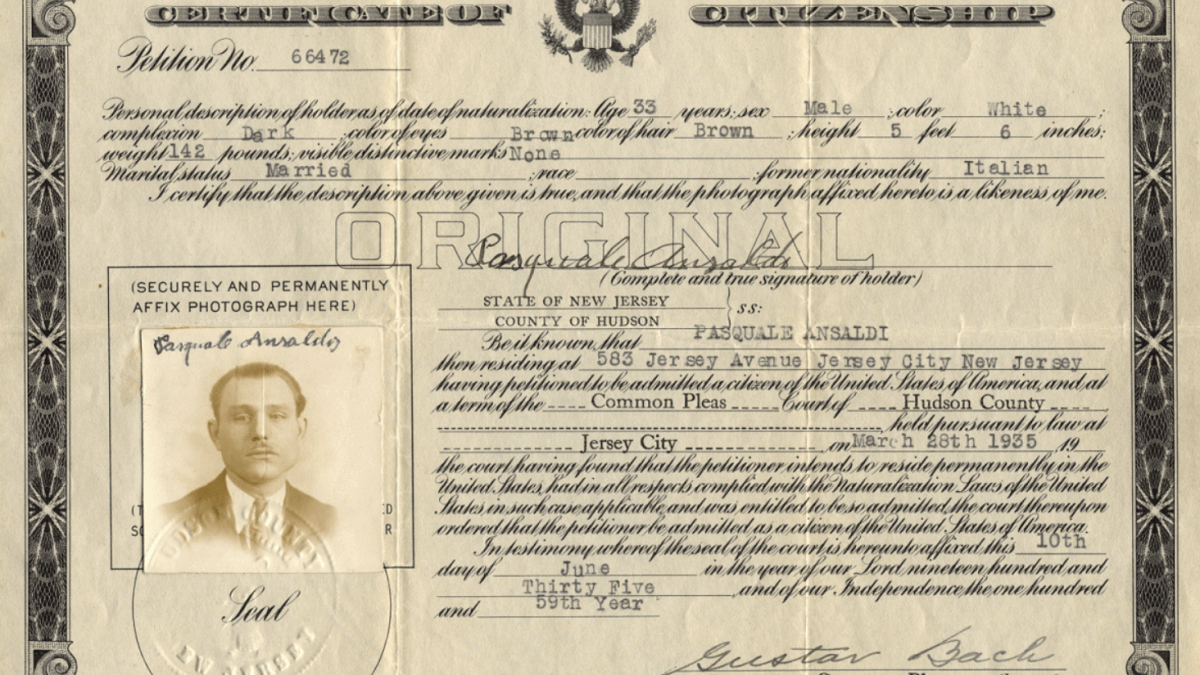

Updated Italian Citizenship Law Great Grandparents Ancestry Accepted

May 24, 2025

Updated Italian Citizenship Law Great Grandparents Ancestry Accepted

May 24, 2025 -

Trade War Fallout Another Day Of Losses For Dutch Stocks

May 24, 2025

Trade War Fallout Another Day Of Losses For Dutch Stocks

May 24, 2025 -

Glastonbury Festival 2025 Full Lineup Announcement Featuring Olivia Rodrigo And The 1975

May 24, 2025

Glastonbury Festival 2025 Full Lineup Announcement Featuring Olivia Rodrigo And The 1975

May 24, 2025

Latest Posts

-

Repetitive Documents An Ai Solution For Creating A Poop Podcast

May 24, 2025

Repetitive Documents An Ai Solution For Creating A Poop Podcast

May 24, 2025 -

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025

Ai Digest Transforming Repetitive Documents Into Informative Poop Podcasts

May 24, 2025 -

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025

Lab Owners Guilty Plea Faking Covid 19 Test Results During Pandemic

May 24, 2025 -

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025

Utilizing Orbital Space Crystals For Superior Drug Production

May 24, 2025 -

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025

Space Crystals And Pharmaceutical Advancement Exploring New Frontiers In Drug Research

May 24, 2025