Bank Of Canada Interest Rate Outlook: Job Losses And The Potential For Further Cuts

Table of Contents

The Current State of the Canadian Economy and Job Market

The Canadian economy is facing significant headwinds. Recent data reveals a concerning trend of rising unemployment, impacting various sectors and fueling concerns about a potential recession. Understanding the severity of this situation is crucial to predicting the Bank of Canada's next move regarding interest rates.

-

Recent job loss figures and their significance: The latest employment reports show a [insert actual recent data on job losses – e.g., "significant increase in unemployment claims," or specific numbers and percentage changes]. This surge represents a worrying shift in the labor market and suggests a slowdown in economic activity.

-

Analysis of key economic indicators (GDP, inflation, consumer confidence): GDP growth has [insert actual recent data on GDP growth – e.g., "slowed considerably," or specific percentage change], while inflation remains [insert actual recent data on inflation – e.g., "elevated," or specific percentage]. Consumer confidence is also [insert actual recent data on consumer confidence – e.g., "waning," or specific index numbers], indicating a pessimistic outlook among consumers. These indicators paint a complex picture requiring careful analysis by the Bank of Canada.

-

Discussion of the impact of global economic uncertainty on the Canadian job market: Global economic instability, including [mention specific global economic factors like geopolitical tensions, supply chain disruptions, etc.], further exacerbates the challenges faced by the Canadian job market. These external factors are beyond the direct control of the Bank of Canada but significantly influence its policy decisions.

-

Comparison to historical trends in job losses and economic downturns: Comparing the current situation to past economic downturns provides valuable context. [Insert comparisons to past recessions and the corresponding responses by the Bank of Canada]. This historical analysis helps policymakers anticipate potential future developments and tailor their responses.

-

Potential for further job losses in key sectors: Sectors like [mention specific vulnerable sectors, e.g., manufacturing, technology, real estate] are particularly vulnerable to further job losses. This sectoral analysis helps the Bank of Canada target specific areas in need of stimulus through its monetary policy.

The Bank of Canada's Response to Rising Unemployment

The Bank of Canada's primary mandate is to maintain price stability and promote sustainable economic growth. Balancing these competing goals, especially in the face of rising unemployment, is a significant challenge.

-

Examination of the Bank of Canada's mandate and its priorities: The Bank of Canada's mandate requires a delicate balancing act. While it aims to control inflation, it also seeks to support economic growth and employment. The current situation forces a reassessment of these priorities.

-

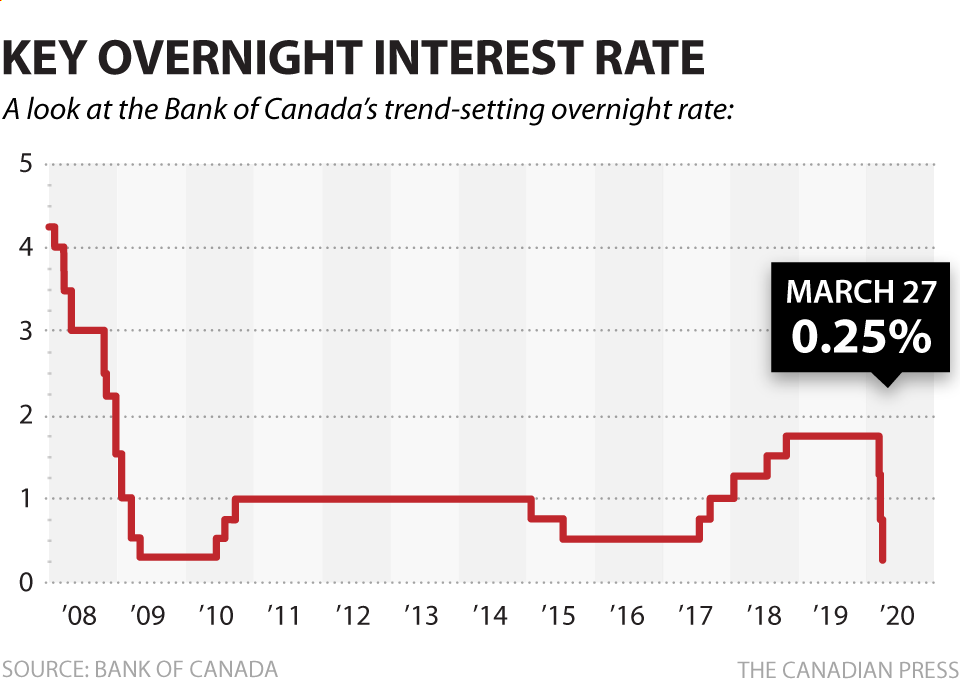

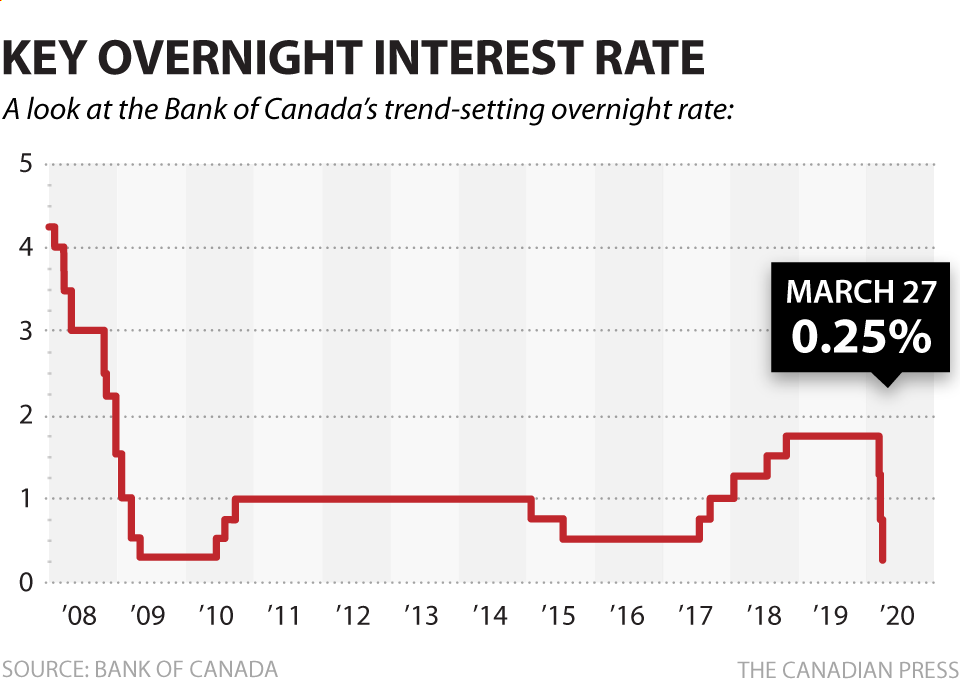

Analysis of past responses to economic downturns and job losses: Historically, the Bank of Canada has responded to economic downturns by [mention historical examples of monetary policy responses such as interest rate cuts, quantitative easing programs, etc.]. These precedents inform their current strategies, but each situation has its unique characteristics.

-

Discussion of the potential tools available to the Bank of Canada (interest rate cuts, quantitative easing): The Bank of Canada possesses several tools to stimulate the economy. Interest rate cuts reduce borrowing costs for businesses and consumers, encouraging investment and spending. Quantitative easing involves injecting liquidity into the financial system.

-

Consideration of the potential trade-offs between inflation control and economic stimulus: Lowering interest rates can fuel inflation, while inaction risks prolonging economic stagnation and high unemployment. The Bank must carefully weigh these risks and benefits when setting its monetary policy.

-

Assessment of the effectiveness of previous monetary policy interventions: Past interventions have had varying degrees of success. Analyzing the effectiveness of previous policies provides crucial insights for current decision-making.

Factors Influencing the Probability of Further Interest Rate Cuts

The decision to cut interest rates further hinges on several key economic factors. The Bank of Canada meticulously monitors these variables to inform its policy choices.

-

Current inflation rate and its trajectory: The current inflation rate of [insert current inflation data] is a crucial factor. If inflation remains stubbornly high, interest rate cuts might be less likely, even in the face of rising unemployment.

-

Analysis of inflation expectations and their impact on policy decisions: The Bank closely monitors inflation expectations – what businesses and consumers anticipate future inflation to be. If expectations are high, the Bank may be more reluctant to cut rates.

-

Examination of bond yields and their implications for future interest rate movements: Bond yields reflect investor sentiment and expectations about future interest rates. Rising bond yields might signal that further rate cuts are unlikely.

-

Consideration of the impact of the Canadian dollar exchange rate on the economy: A weaker Canadian dollar can boost exports, but also increase the cost of imports, affecting inflation. The exchange rate is thus a critical consideration in the Bank's decision-making.

-

Discussion of other relevant economic factors such as consumer spending and business investment: Consumer spending and business investment are crucial indicators of economic health. Weak spending and investment suggest a need for stimulus measures.

Potential Economic Consequences of Further Rate Cuts

Further interest rate cuts, while potentially stimulating the economy, also carry risks.

-

Impact on borrowing costs for businesses and consumers: Lower interest rates reduce borrowing costs, making it cheaper for businesses to invest and consumers to borrow money.

-

Effects on investment and economic growth: Lower borrowing costs can spur investment, potentially boosting economic growth.

-

Potential impact on consumer spending and debt levels: Lower rates can encourage consumer spending, but also potentially lead to increased debt levels.

-

Risks associated with excessively low interest rates: Extremely low interest rates can lead to asset bubbles and distort market signals.

Conclusion

The Bank of Canada's interest rate outlook is heavily influenced by the current economic climate, particularly the rising job losses and potential for a recession. While further interest rate cuts are possible to stimulate the economy, the Bank must carefully weigh the potential risks and benefits, considering factors such as inflation and exchange rates. The decision will hinge on a complex interplay of economic indicators and forecasts.

Call to Action: Stay informed about the Bank of Canada’s interest rate decisions and their impact on the Canadian economy. Regularly monitor updates on the Bank of Canada interest rates to make informed financial decisions. Understanding the Bank of Canada interest rate outlook is crucial for navigating these uncertain economic times.

Featured Posts

-

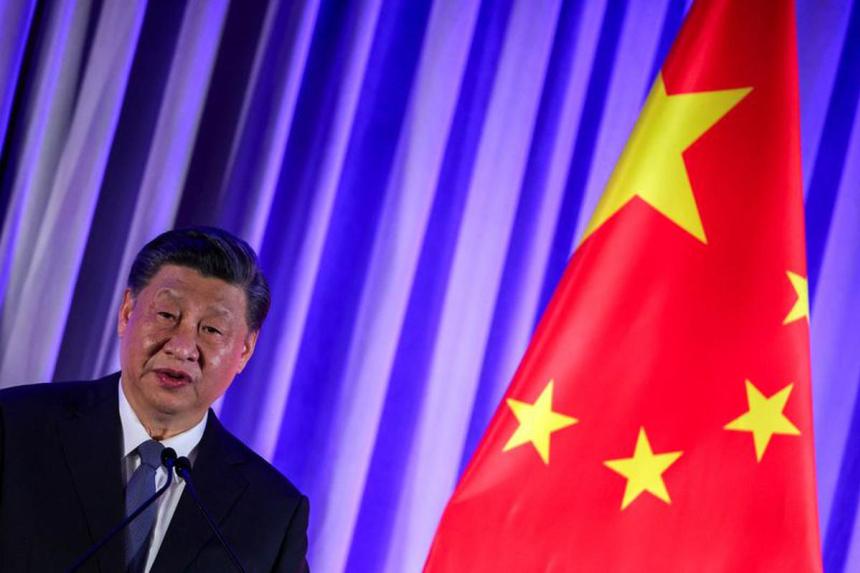

Tres Toros Presidenciables Viajan De Uruguay A China Para Xi Jinping

May 11, 2025

Tres Toros Presidenciables Viajan De Uruguay A China Para Xi Jinping

May 11, 2025 -

Diamond League 2024 Duplantis And The Evolving Landscape Of Track And Field

May 11, 2025

Diamond League 2024 Duplantis And The Evolving Landscape Of Track And Field

May 11, 2025 -

Alberto Osunas Injunction Denied Ineligible For Tennessee Baseball In 2025

May 11, 2025

Alberto Osunas Injunction Denied Ineligible For Tennessee Baseball In 2025

May 11, 2025 -

Trumps China Trade Push Focusing On Tariff Cuts And Rare Earth Supply

May 11, 2025

Trumps China Trade Push Focusing On Tariff Cuts And Rare Earth Supply

May 11, 2025 -

Conclave 2023 Quienes Podrian Suceder Al Papa Francisco

May 11, 2025

Conclave 2023 Quienes Podrian Suceder Al Papa Francisco

May 11, 2025