Bank Of Canada's Monetary Policy: Rosenberg's Critique Of A Timid Approach

Table of Contents

Rosenberg's Core Argument: Insufficient Rate Hikes

Rosenberg's central thesis is that the Bank of Canada's interest rate increases have been too gradual and insufficient to effectively combat persistent inflation. He argues that the Bank has consistently underestimated the inflationary pressures and has been too slow to react.

- Evidence of persistent inflation: Despite several interest rate hikes, inflation in Canada remains significantly above the Bank of Canada's target of 2%. This persistent inflation, argues Rosenberg, demonstrates the inadequacy of the current monetary policy.

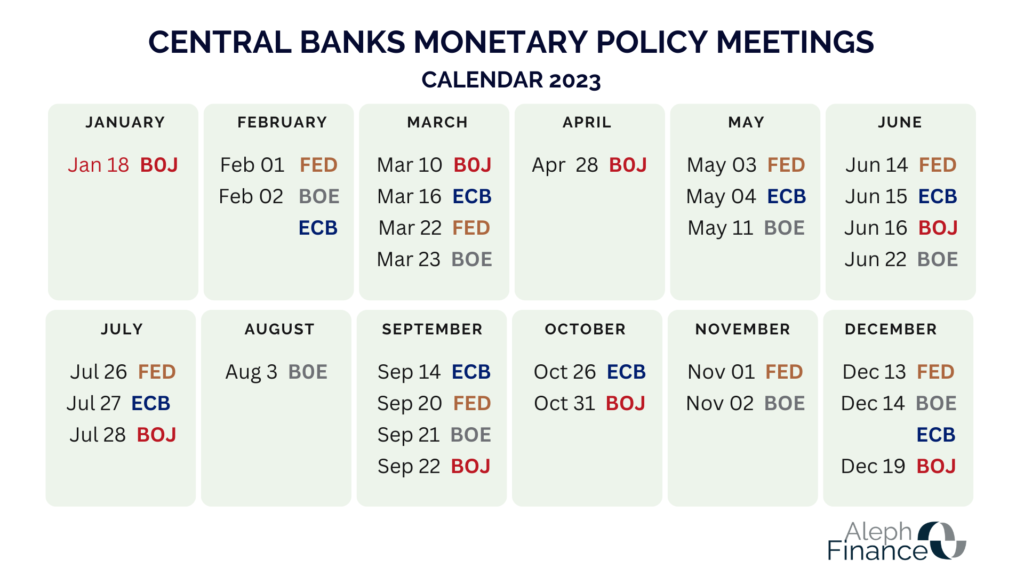

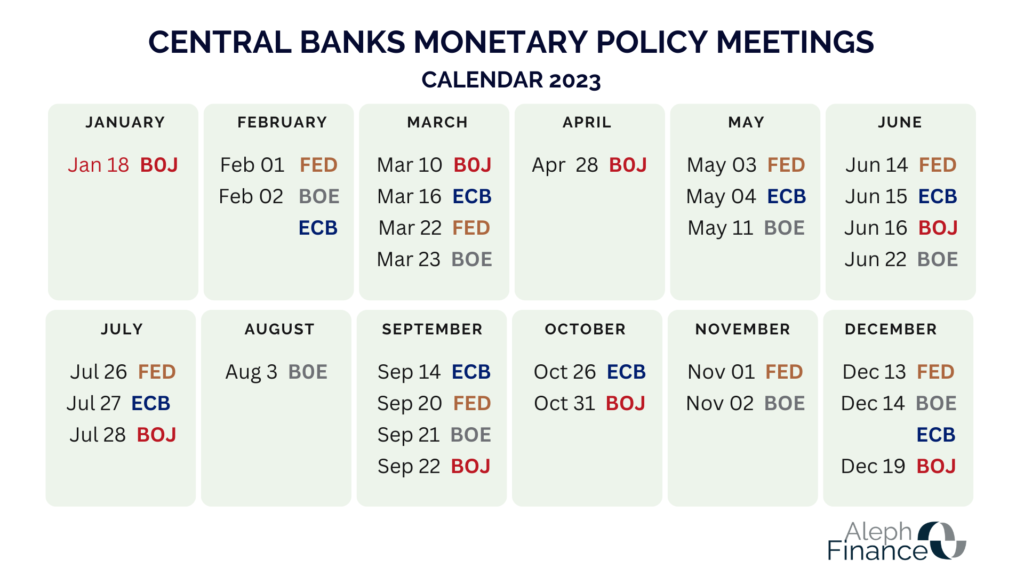

- Comparison with other central banks: Rosenberg points to the more aggressive interest rate hikes implemented by other central banks globally, suggesting that the Bank of Canada's approach has been comparatively less forceful. He cites examples of central banks in countries like the US and UK that raised interest rates more swiftly, indicating a potentially more effective approach to combating inflation.

- Lagged effects of monetary policy: While acknowledging the time lag between interest rate changes and their impact on the economy, Rosenberg maintains that the Bank of Canada has waited too long to implement substantial rate hikes, thereby allowing inflation to become entrenched. This delayed reaction, he argues, exacerbates the problem and increases the difficulty of controlling price increases.

- Specific interest rate decisions: Rosenberg frequently points to specific instances where the Bank of Canada raised interest rates by smaller increments than many market analysts expected. These decisions, he contends, reveal a cautious and ultimately ineffective approach to managing inflation.

The Risks of a Gradual Approach: Potential for Stagflation

Rosenberg emphasizes the inherent risks associated with a gradual approach to tightening monetary policy, primarily the potential for stagflation – a simultaneous period of high inflation and slow economic growth.

- Stagflation and its consequences: Stagflation erodes purchasing power, increases unemployment, and disrupts economic stability. Rosenberg warns that the Bank of Canada's cautious approach could allow inflation to become entrenched, leading to a prolonged period of stagflation.

- Entrenched inflation: Delayed action increases the likelihood of inflation becoming ingrained in the economy's structure, making it considerably harder to control in the long run. This could lead to a wage-price spiral, whereby rising prices lead to increased wage demands, further fueling inflation.

- Impact on economic growth and employment: While higher interest rates curb inflation, they also tend to slow down economic growth and potentially increase unemployment. Rosenberg argues that the Bank of Canada's gradual approach hasn't effectively balanced these competing concerns, potentially leading to a suboptimal economic outcome.

- Negative consequences for the Canadian dollar: A weaker Canadian dollar due to sustained inflation could increase import costs and further fuel price increases, creating a vicious cycle. Rosenberg highlights this as another potential downside of a hesitant monetary policy response.

Alternative Strategies: A More Aggressive Monetary Policy?

Rosenberg and other economists suggest alternative strategies, advocating for a more aggressive monetary policy approach.

- More aggressive rate hikes: Proponents argue that faster and more significant interest rate hikes could have more quickly cooled inflationary pressures, reducing the risk of prolonged inflation. This approach, however, carries its own inherent risks.

- Impact on different sectors: More aggressive rate hikes would disproportionately affect sectors sensitive to interest rates, such as housing and consumer spending. A careful analysis of the potential impact on various economic segments is crucial.

- Risks of recession or financial market instability: Rapid interest rate increases could trigger a recession or destabilize financial markets, posing significant challenges for the economy. This risk needs careful consideration when deciding on policy.

- Role of fiscal policy: Some argue that fiscal policy, through government spending and taxation, should play a larger role in complementing monetary policy to combat inflation. Coordinated efforts between monetary and fiscal authorities could potentially yield better results.

Analyzing the Bank of Canada's Rationale: Data and Considerations

The Bank of Canada justifies its more gradual approach based on its analysis of various economic indicators.

- Data used for decision-making: The Bank relies on a range of data, including inflation data (CPI), employment figures, and consumer confidence indices, to inform its monetary policy decisions. They emphasize the importance of considering a variety of factors beyond just headline inflation.

- Concerns about sharp economic downturn: The Bank acknowledges the risks of triggering a sharp economic downturn through overly aggressive rate hikes. They aim to strike a balance between controlling inflation and ensuring sustainable economic growth.

- Bank of Canada forecasts: The Bank publishes regular forecasts outlining its predictions for inflation and economic growth. These projections guide its monetary policy decisions and provide transparency to the public.

- Political pressures: While ideally independent, central banks can be susceptible to political pressures. It's important to consider whether political considerations might influence the Bank of Canada's decision-making.

The Long-Term Implications of the Bank of Canada's Approach

The Bank of Canada's current monetary policy strategy will have profound long-term consequences for the Canadian economy.

- Impact on future inflation expectations: The effectiveness of monetary policy hinges on influencing inflation expectations. If inflation remains high for an extended period, it could become ingrained in expectations, making it harder to bring down in the future.

- Effect on long-term interest rates and borrowing costs: The current monetary policy will significantly impact long-term interest rates and borrowing costs for consumers and businesses, potentially affecting investment and consumer spending.

- Implications for Canadian household debt: Higher interest rates increase the burden of household debt, impacting affordability and financial stability for many Canadians.

- Impact on foreign investment: Canada's monetary policy influences its attractiveness to foreign investors, impacting the flow of capital and economic growth.

Conclusion: Evaluating the Bank of Canada's Monetary Policy and Rosenberg's Critique

Rosenberg's critique centers on the Bank of Canada's perceived "timid" approach to raising interest rates to combat inflation. He argues this gradual strategy risks allowing inflation to become entrenched, leading to stagflation and significant long-term economic consequences. However, the Bank of Canada justifies its approach by citing the need to avoid triggering a sharp economic downturn and highlighting the complexities of navigating the current economic environment. The debate highlights the difficult balancing act central banks face between controlling inflation and fostering sustainable economic growth. To form your own informed opinion, further research into the Bank of Canada's monetary policy, including its rationale and data analysis, is crucial. Explore additional resources on inflation, interest rates, and Canadian economics to gain a comprehensive understanding of this critical issue. Understanding the intricacies of the Bank of Canada's monetary policy is vital for navigating the complexities of the Canadian economy.

Featured Posts

-

The Grim Truth About Retail Sales And The Bank Of Canadas Next Move

Apr 29, 2025

The Grim Truth About Retail Sales And The Bank Of Canadas Next Move

Apr 29, 2025 -

Is The One Plus 13 R Worth It Comparing It To The Google Pixel 9a

Apr 29, 2025

Is The One Plus 13 R Worth It Comparing It To The Google Pixel 9a

Apr 29, 2025 -

Understanding Elevated Stock Market Valuations A Bof A Analysis

Apr 29, 2025

Understanding Elevated Stock Market Valuations A Bof A Analysis

Apr 29, 2025 -

Nyt Strands Hints And Answers Monday March 31 Game 393

Apr 29, 2025

Nyt Strands Hints And Answers Monday March 31 Game 393

Apr 29, 2025 -

Louisville Downtown Buildings Evacuated Due To Gas Leak Investigation

Apr 29, 2025

Louisville Downtown Buildings Evacuated Due To Gas Leak Investigation

Apr 29, 2025

Latest Posts

-

Missing British Paralympian Las Vegas Authorities Appeal For Information

Apr 29, 2025

Missing British Paralympian Las Vegas Authorities Appeal For Information

Apr 29, 2025 -

Search Intensifies For Missing British Paralympian In Las Vegas

Apr 29, 2025

Search Intensifies For Missing British Paralympian In Las Vegas

Apr 29, 2025 -

British Paralympian Sam Ruddock Missing Las Vegas Police Appeal For Witnesses

Apr 29, 2025

British Paralympian Sam Ruddock Missing Las Vegas Police Appeal For Witnesses

Apr 29, 2025 -

Update British Paralympian Still Missing In Las Vegas

Apr 29, 2025

Update British Paralympian Still Missing In Las Vegas

Apr 29, 2025 -

Family Appeals For Information On Missing Paralympian Sam Ruddock In Las Vegas

Apr 29, 2025

Family Appeals For Information On Missing Paralympian Sam Ruddock In Las Vegas

Apr 29, 2025