Understanding Elevated Stock Market Valuations: A BofA Analysis

Table of Contents

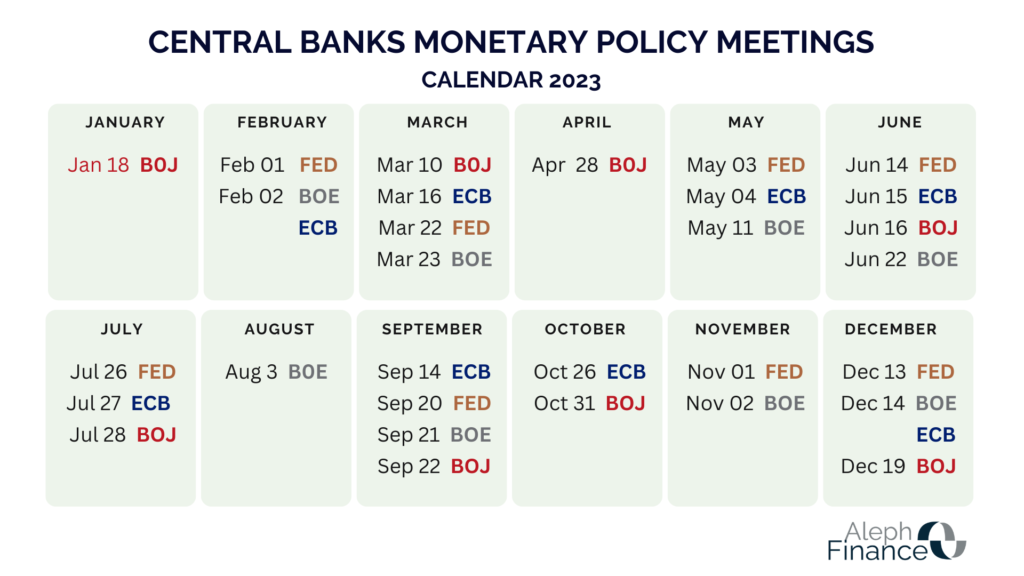

The Role of Monetary Policy in Elevated Stock Market Valuations

Monetary policy, primarily controlled by central banks like the Federal Reserve in the US, plays a significant role in shaping stock market valuations. Understanding how these policies influence investor behavior and asset prices is key to interpreting periods of high valuations.

Low Interest Rates and Their Impact

Low interest rates are a powerful tool used to stimulate economic growth. However, they can also have a significant impact on stock market valuations.

- Increased Investment in Riskier Assets: When interest rates are low, the returns on safer investments like bonds become less attractive. This incentivizes investors to seek higher returns in riskier assets, such as stocks, pushing up demand and valuations.

- Quantitative Easing (QE) and Money Supply: QE programs, where central banks inject liquidity into the market by purchasing assets, directly increase the money supply. This excess liquidity often flows into the stock market, further boosting prices and contributing to elevated valuations.

- Liquidity Trap: In some cases, low interest rates can lead to a "liquidity trap," where excess cash doesn't stimulate economic activity but instead inflates asset prices, potentially creating a bubble in the stock market. This is a scenario where understanding the underlying economic conditions becomes critical.

- Example: 2008 Financial Crisis: Following the 2008 financial crisis, the Federal Reserve implemented a series of near-zero interest rate policies and QE programs. This significantly influenced stock market valuations, leading to a period of sustained growth despite slower economic recovery in other sectors.

The Impact of Interest Rate Hikes

Conversely, interest rate hikes aim to curb inflation and cool down an overheated economy. This policy shift can significantly impact stock market valuations.

- Reduced Investment and Increased Borrowing Costs: Higher interest rates make borrowing more expensive for businesses and individuals, reducing investment and potentially slowing economic growth. This can lead to decreased corporate earnings and lower stock prices.

- Attractiveness of Bonds: Higher interest rates make bonds more attractive to investors seeking a safer, fixed-income investment, diverting capital away from the stock market.

- Historical Instances: Examining historical instances of interest rate increases reveals a mixed impact on stock market valuations. The magnitude and speed of the increases, alongside the overall economic context, play a significant role in determining the market's response. Analyzing these periods offers valuable insight into the interplay between monetary policy and stock market performance.

Economic Growth and its Correlation with Stock Market Valuations

Economic growth is fundamentally linked to stock market valuations. Strong economic fundamentals usually translate into higher corporate earnings and increased investor confidence.

Strong Earnings Growth as a Driver

High corporate profits are a primary driver of elevated stock market valuations.

- Profitability and Stock Prices: When companies report strong earnings, their stock prices typically rise, reflecting investor confidence in their future prospects. This positive feedback loop contributes to overall market valuation increases.

- Technological Innovation and Global Expansion: Technological advancements and global expansion often create opportunities for companies to increase their revenue and earnings, positively impacting stock valuations.

- GDP Growth and Stock Market Performance: Historically, there's a strong correlation between GDP growth and stock market performance. Periods of robust economic expansion are typically associated with rising stock prices and elevated valuations, while recessions often lead to market corrections. Analyzing this historical data provides a valuable framework for understanding future market trends.

The Influence of Economic Uncertainty

Economic uncertainty can have a complex impact on stock market valuations.

- "Flight to Safety": During periods of uncertainty, investors may seek the perceived safety of established companies with strong fundamentals, driving up their valuations. This "flight to safety" phenomenon can lead to elevated valuations in specific sectors, even amidst overall economic weakness.

- Sharp Declines During Downturns: Conversely, significant economic downturns, such as recessions, typically lead to sharp declines in stock market valuations as investor confidence erodes.

- Investor Behavior: Understanding how economic uncertainty affects investor behavior and risk appetite is critical for analyzing stock market valuations. Market sentiment analysis and behavioral finance can provide valuable insights.

Investor Sentiment and Market Psychology in Elevated Valuations

Investor sentiment and market psychology play a significant role in driving stock market valuations, often surpassing fundamental analysis.

The "Fear of Missing Out" (FOMO) Effect

The "fear of missing out" (FOMO) can lead to irrational exuberance and speculative bubbles.

- Speculative Bubbles: FOMO can drive prices beyond what fundamentals would justify, creating speculative bubbles that ultimately burst, leading to significant market corrections.

- Social Media and News Cycles: Social media and news cycles can amplify FOMO, accelerating price increases and contributing to market volatility. The rapid spread of information, often lacking context or rigorous analysis, can quickly influence market sentiment.

Behavioral Finance and Market Bubbles

Behavioral finance explores how psychological biases can influence investment decisions and contribute to market bubbles.

- Behavioral Biases: Overconfidence, herd behavior, and anchoring biases can distort rational decision-making and amplify market trends, leading to unsustainable price increases.

- Market Sentiment Indicators: Market sentiment indicators, like the VIX (volatility index), can be used to gauge investor fear and potentially identify periods of excessive speculation.

- Historical Market Bubbles: Examining historical market bubbles, like the dot-com bubble of the late 1990s, provides valuable lessons about the role of investor psychology and the potential for significant market corrections.

Conclusion

Understanding elevated stock market valuations requires a nuanced understanding of the interplay between monetary policy, economic growth, and investor sentiment. BofA's analysis highlights the complexities of these interwoven factors, emphasizing the need for a long-term perspective and careful consideration of various market indicators. While periods of high valuations can offer opportunities, it's crucial to avoid being swept up in market exuberance and to maintain a diversified investment strategy. By carefully analyzing these factors and incorporating them into your investment approach, you can navigate the challenges of elevated stock market valuations more effectively and make well-informed decisions regarding your investment portfolio. Continue to research and monitor elevated stock market valuations and their underlying drivers for a more comprehensive understanding of the current market environment.

Featured Posts

-

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025

Unveiling The Ccp United Fronts Activities In Minnesota

Apr 29, 2025 -

Blue Origins Rocket Launch Cancelled Due To Technical Difficulties

Apr 29, 2025

Blue Origins Rocket Launch Cancelled Due To Technical Difficulties

Apr 29, 2025 -

Secret Service Ends Probe Of Cocaine Found At White House

Apr 29, 2025

Secret Service Ends Probe Of Cocaine Found At White House

Apr 29, 2025 -

Millions Stolen Through Office365 How A Hacker Targeted Executives

Apr 29, 2025

Millions Stolen Through Office365 How A Hacker Targeted Executives

Apr 29, 2025 -

Bank Of Canadas Monetary Policy Rosenbergs Critique Of A Timid Approach

Apr 29, 2025

Bank Of Canadas Monetary Policy Rosenbergs Critique Of A Timid Approach

Apr 29, 2025

Latest Posts

-

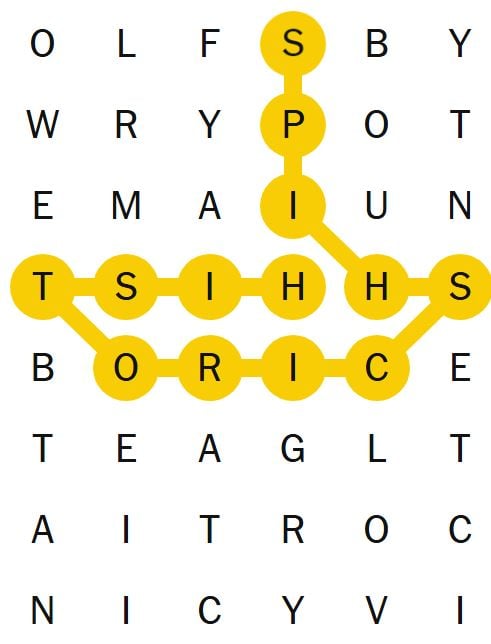

Nyt Spelling Bee March 13 2025 Solutions And Spangram

Apr 29, 2025

Nyt Spelling Bee March 13 2025 Solutions And Spangram

Apr 29, 2025 -

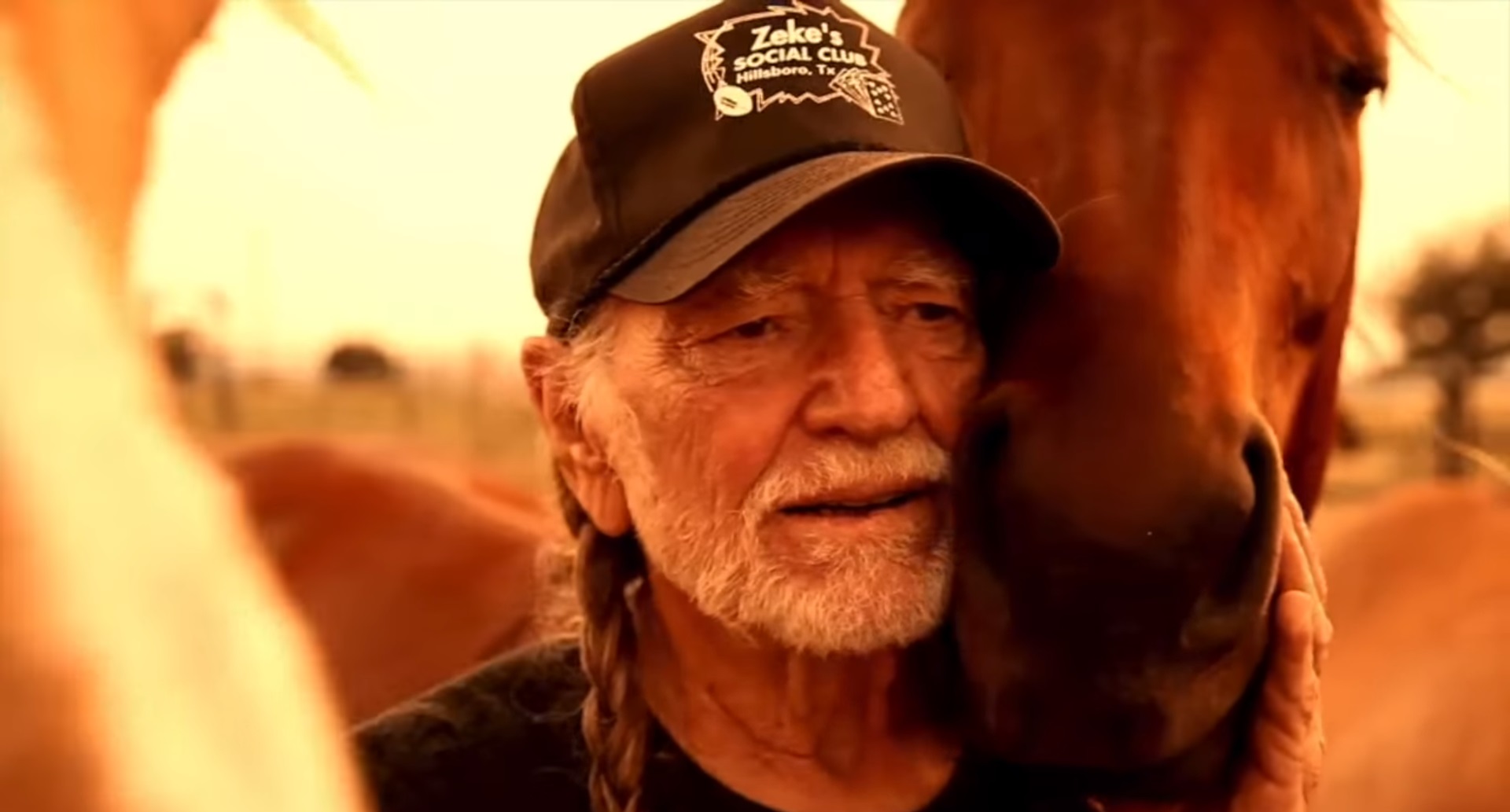

New Willie Nelson Album Celebrating 92 Years With 77 Albums

Apr 29, 2025

New Willie Nelson Album Celebrating 92 Years With 77 Albums

Apr 29, 2025 -

Willie Nelson Pays Tribute To Longtime Roadie In Touching Documentary

Apr 29, 2025

Willie Nelson Pays Tribute To Longtime Roadie In Touching Documentary

Apr 29, 2025 -

Country Legend Willie Nelson Releases 77th Solo Album

Apr 29, 2025

Country Legend Willie Nelson Releases 77th Solo Album

Apr 29, 2025 -

New Music Willie Nelsons 77th Solo Album Out Now

Apr 29, 2025

New Music Willie Nelsons 77th Solo Album Out Now

Apr 29, 2025