Belgium's Energy Market: A Guide To Financing A 270MWh Battery Energy Storage System

Table of Contents

Understanding Belgium's Energy Market and its Need for Battery Storage

The Rise of Renewables and Intermittency Challenges

Belgium, like many European nations, has ambitious renewable energy targets. The country is aggressively pursuing a transition to sustainable energy sources, with significant investments in wind and solar power. However, the intermittent nature of these renewable sources presents a challenge to grid stability. The fluctuating output of solar and wind power necessitates effective energy storage solutions to ensure a reliable and consistent electricity supply.

- Belgian Renewable Energy Policies: The Belgian government actively promotes renewable energy through various feed-in tariffs, tax incentives, and renewable portfolio standards (RPS). These policies aim to significantly increase the share of renewables in the energy mix.

- Growth of Wind and Solar: Wind and solar power capacity in Belgium has been experiencing rapid growth, contributing significantly to the country's overall renewable energy production. This growth, while positive for the environment, highlights the need for effective grid management and energy balancing.

- Grid Stability Challenges: The intermittent nature of wind and solar power creates challenges for grid operators. Sudden fluctuations in supply can lead to instability and potentially blackouts. This underscores the crucial role of battery energy storage in ensuring grid reliability.

BESS solutions offer an effective way to address this intermittency. By storing excess renewable energy during periods of high generation and releasing it during periods of low generation, BESS systems help stabilize the grid, improve power quality, and facilitate the integration of variable renewable energy sources. This enhanced grid stability leads to improved energy security for Belgian citizens and businesses.

Regulatory Framework for Energy Storage in Belgium

The regulatory landscape for battery storage systems in Belgium is continuously evolving to accommodate the growing need for energy storage solutions. Understanding the applicable regulations is crucial for project developers.

- Key Regulations and Permitting Bodies: The Federal Public Service Economy, SMEs, Self-Employed and Energy (FPS Economy) plays a significant role in regulating the energy sector. Specific regulations concerning grid connection, safety standards, and environmental impact assessments need to be considered.

- Relevant Governmental Websites: The FPS Economy website ([insert relevant link here]), along with regional regulatory bodies, provides detailed information on permits, licensing requirements, and grid connection procedures for energy storage projects.

- Incentives and Support Mechanisms: The Belgian government offers various incentives and support mechanisms, including subsidies and tax benefits, to encourage investment in renewable energy projects, including battery storage systems. These incentives can significantly reduce the overall project cost.

Financing Options for a 270MWh BESS in Belgium

Securing financing for a large-scale BESS project requires a multi-faceted approach, combining various funding sources.

Equity Financing

Attracting private equity or venture capital can provide significant upfront capital for the project. However, this often comes with a dilution of ownership.

- Advantages: Access to substantial capital, industry expertise, and potential for future investment rounds.

- Disadvantages: Dilution of ownership, potential loss of control, and alignment of investor interests with project goals.

- Examples of Investors: Several private equity firms and venture capital funds are actively investing in the Belgian renewable energy sector, showing a strong interest in energy storage projects.

Debt Financing

Bank loans, green bonds, and project finance are essential tools for securing the necessary capital.

- Bank Loans: Traditional bank loans provide a relatively straightforward financing option, but interest rates and loan terms can vary significantly based on the lender's risk assessment.

- Green Bonds: Green bonds are debt securities specifically issued to finance environmentally friendly projects, often attracting investors interested in ESG (environmental, social, and governance) factors. They might offer advantageous interest rates compared to conventional bonds.

- Project Finance: This approach involves structuring the financing around the specific cash flows of the project, reducing the risk for lenders. It often involves a syndicate of banks and other financial institutions.

- Credit Ratings: A strong credit rating is crucial for securing favorable loan terms and attracting investors.

Public Funding and Grants

Belgian governmental agencies and the European Union offer various grant programs and subsidies aimed at promoting renewable energy and energy storage projects.

- Relevant Government Agencies and Programs: Research programs offered by the Flemish and Walloon regions, as well as federal programs, can provide significant financial support.

- Application Process: Detailed application processes, eligibility criteria, and funding amounts vary depending on the specific program.

Power Purchase Agreements (PPAs)

PPAs are crucial for securing long-term revenue streams, significantly reducing the investment risk.

- Mitigating Investment Risk: A well-structured PPA guarantees a consistent stream of revenue, making the project more attractive to lenders and investors.

- Market Dynamics: The Belgian PPA market is competitive, and understanding the market dynamics is crucial for negotiating favorable contract terms.

Key Considerations for Project Success

Careful planning and risk mitigation are essential for the successful implementation of a 270MWh BESS project.

Site Selection and Grid Connection

Optimal site selection is crucial for minimizing transmission losses and ensuring seamless grid integration. Factors such as proximity to the grid, land availability, and environmental impact need to be carefully considered.

Technology Selection and Lifecycle Costs

The choice of battery technology significantly impacts the project's overall cost-effectiveness and longevity. Lifecycle costs, including maintenance and potential upgrades, need to be carefully evaluated.

Risk Mitigation Strategies

Addressing technological, regulatory, and financial risks is paramount for project success. This involves thorough due diligence, robust risk assessments, and the implementation of appropriate risk mitigation strategies, potentially including insurance products.

Conclusion

This guide has outlined the key steps in financing a 270MWh Battery Energy Storage System in Belgium. Navigating Belgium's energy market requires understanding its regulatory framework, exploring diverse financing options, and carefully managing project risks. By leveraging a combination of equity, debt, and potentially public funding, alongside securing suitable PPAs, developers can successfully finance and deploy large-scale BESS projects. Remember to thoroughly research and adapt these strategies to the specifics of your project. Start planning your BESS project in Belgium today! Contact us to discuss your Battery Energy Storage System financing needs further.

Featured Posts

-

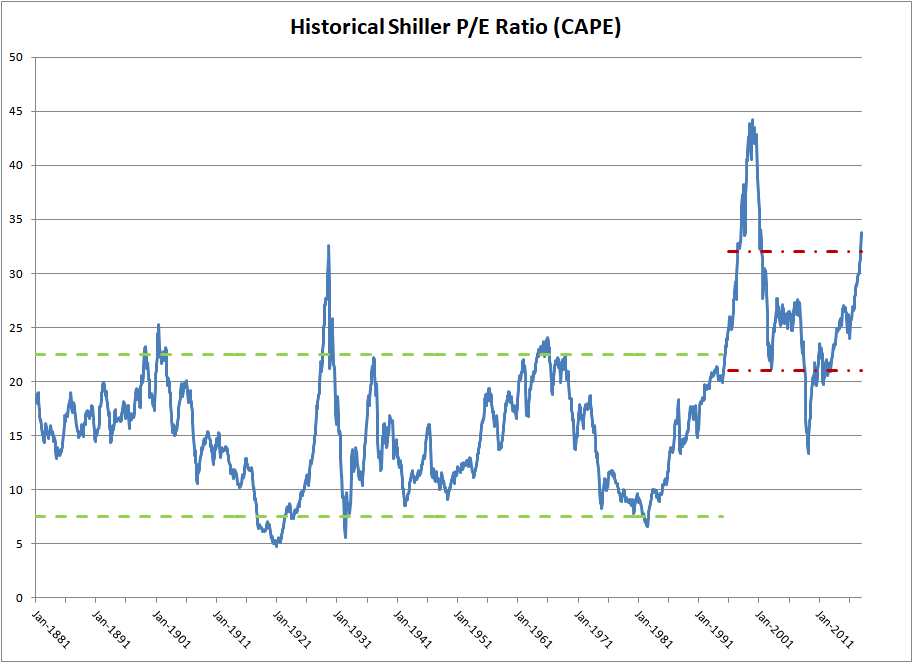

Addressing Investor Concerns Bof As View On High Stock Market Valuations

May 04, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

May 04, 2025 -

2025 Gold Market Consecutive Weekly Losses Predicted

May 04, 2025

2025 Gold Market Consecutive Weekly Losses Predicted

May 04, 2025 -

Shopifys New Lifetime Revenue Share Impact On Developer Earnings

May 04, 2025

Shopifys New Lifetime Revenue Share Impact On Developer Earnings

May 04, 2025 -

The Age Of Anna Kendrick A Milestone And Fan Reactions

May 04, 2025

The Age Of Anna Kendrick A Milestone And Fan Reactions

May 04, 2025 -

From Scatological Documents To Podcast Success The Power Of Ai

May 04, 2025

From Scatological Documents To Podcast Success The Power Of Ai

May 04, 2025

Latest Posts

-

Kuper Predal Di Kaprio Razgadka Tayny Ikh Slozhnykh Otnosheniy

May 04, 2025

Kuper Predal Di Kaprio Razgadka Tayny Ikh Slozhnykh Otnosheniy

May 04, 2025 -

Druzhba Kupera I Di Kaprio Istoriya Predatelstva I Rasstavaniya

May 04, 2025

Druzhba Kupera I Di Kaprio Istoriya Predatelstva I Rasstavaniya

May 04, 2025 -

Razlad Kupera I Di Kaprio Rol Zhenschiny V Razrushenii Druzhby

May 04, 2025

Razlad Kupera I Di Kaprio Rol Zhenschiny V Razrushenii Druzhby

May 04, 2025 -

Bredli Kuper I Leonardo Di Kaprio Pochemu Druzhba Zakonchilas

May 04, 2025

Bredli Kuper I Leonardo Di Kaprio Pochemu Druzhba Zakonchilas

May 04, 2025 -

Oni Byli Kak Bratya Pravda O Razlade Kupera I Di Kaprio

May 04, 2025

Oni Byli Kak Bratya Pravda O Razlade Kupera I Di Kaprio

May 04, 2025