BigBear.ai: A Deep Dive Into The Recent Securities Lawsuit

Table of Contents

The Core Allegations of the BigBear.ai Lawsuit

The lawsuit against BigBear.ai centers on serious allegations of misleading investors regarding the company's financial performance and prospects. The plaintiffs claim that BigBear.ai engaged in deceptive practices, painting a rosier picture than reality warranted. These allegations include:

-

Misrepresentation of financial performance: The lawsuit alleges that BigBear.ai misrepresented its key financial metrics, potentially inflating revenue figures and obscuring losses. This could involve aggressive accounting practices or the selective reporting of data. Further investigation is needed to uncover the full extent of these alleged misrepresentations.

-

Inflated revenue projections: Plaintiffs claim that BigBear.ai provided overly optimistic forecasts about future revenue, leading investors to believe in a growth trajectory that was ultimately unsustainable. These projections, the lawsuit argues, were not grounded in realistic assessments of market conditions or the company's operational capabilities.

-

Omission of material facts related to contracts or financial health: The lawsuit alleges that BigBear.ai failed to disclose crucial information regarding its contracts, financial health, or potential risks. This omission of material facts, it is argued, deprived investors of the ability to make fully informed investment decisions. Specific examples of omitted information are likely to emerge during the legal proceedings.

-

Violation of federal securities laws: The lawsuit likely cites violations of specific federal securities laws, such as the Securities Exchange Act of 1934, which prohibits fraudulent and manipulative activities in the securities markets. The specifics of these alleged violations will be central to the case's trajectory.

-

Key individuals named in the lawsuit: While specific names may not be publicly available immediately, the lawsuit likely names key executives and/or board members of BigBear.ai, implicating their roles in the alleged misconduct.

BigBear.ai's Response to the Lawsuit

BigBear.ai has responded to the lawsuit, typically issuing a statement denying the allegations and expressing its intention to vigorously defend itself. The company’s official response usually emphasizes its commitment to transparency and adherence to all applicable laws and regulations. Further analysis of their defense strategy will become clearer as the legal process unfolds.

-

Denial of allegations: The company will likely deny all or some of the specific allegations made in the complaint. This denial will form the basis of their legal defense.

-

Plans to fight the lawsuit: BigBear.ai will almost certainly announce its plan to fully contest the lawsuit, outlining its legal strategy. This might involve hiring top legal counsel and employing various defense tactics.

-

Potential legal strategies: The company's defense strategy might involve challenging the plaintiffs’ evidence, arguing that the alleged misrepresentations were not material, or contesting the plaintiffs' standing to bring the lawsuit.

-

Impact on company operations and stock price: The lawsuit is expected to have an immediate and potentially long-term impact on BigBear.ai's operations and its stock price, leading to uncertainty and volatility in the market.

Potential Impact on BigBear.ai Investors

The BigBear.ai lawsuit poses significant risks to investors. The potential consequences are far-reaching, affecting not only the company's stock price but also its overall reputation and future prospects.

-

Short-term and long-term stock price volatility: The lawsuit will almost certainly lead to increased volatility in BigBear.ai's stock price, impacting investor portfolios.

-

Potential for investor lawsuits: If the lawsuit is successful, it could trigger further litigation from other investors who suffered losses due to the alleged misrepresentations.

-

Impact on company credibility and future partnerships: A negative outcome in the lawsuit could severely damage BigBear.ai's credibility and make it harder to attract future investors and secure partnerships.

-

Financial implications for the company: Legal fees, potential settlements, and reputational damage could have significant financial implications for BigBear.ai.

Legal Experts' Opinions on the BigBear.ai Lawsuit

Legal experts specializing in securities law offer varied perspectives on the merits of the BigBear.ai lawsuit. While predicting the outcome remains speculative, their analysis provides valuable insights. (Note: This section would ideally include quotes or links to articles from reputable legal experts and news sources.)

-

Likelihood of success for both sides: Experts might assess the strengths and weaknesses of both the plaintiffs' and the defendants’ arguments, offering predictions about the likelihood of success for each side.

-

Potential settlement scenarios: Experts could analyze various potential settlement scenarios, including the range of potential financial settlements or other resolutions.

-

Implications for similar companies in the industry: The outcome of this lawsuit could set a precedent that impacts other companies in the same industry, potentially leading to increased regulatory scrutiny.

-

Legal precedents that could influence the case: Experts might point to relevant past legal cases that could influence the judge’s decisions and the overall outcome.

Future Outlook for BigBear.ai

The long-term implications of this lawsuit on BigBear.ai are uncertain but potentially significant. The outcome will significantly shape the company's trajectory.

-

Impact on future contracts and acquisitions: The lawsuit could make it more difficult for BigBear.ai to secure future contracts or complete acquisitions, potentially hindering its growth.

-

Effect on employee morale and talent retention: The negative publicity and uncertainty surrounding the lawsuit could impact employee morale and make it harder to attract and retain top talent.

-

Potential for regulatory scrutiny: The lawsuit could attract increased regulatory scrutiny from government agencies, leading to further investigations and potential penalties.

-

Long-term financial implications: The financial consequences of the lawsuit, including legal fees, settlements, and reputational damage, could have a lasting impact on BigBear.ai's financial stability.

Conclusion

The BigBear.ai lawsuit represents a significant legal and financial challenge for the company and its investors. The allegations of misrepresentation, inflated projections, and omission of material facts raise serious concerns about corporate governance and transparency. The outcome of this lawsuit will have significant ramifications for BigBear.ai's future, shaping its market position, investor confidence, and overall operational capacity. The potential for financial losses, reputational damage, and increased regulatory scrutiny is substantial.

Call to Action: Stay updated on the evolving situation surrounding the BigBear.ai lawsuit and make informed decisions regarding your investments. Follow reputable financial news sources and legal updates for the latest developments.

Featured Posts

-

Debat Litteraire Les Grands Fusains De Boulemane De Abdelkebir Rabi Au Book Club Le Matin

May 21, 2025

Debat Litteraire Les Grands Fusains De Boulemane De Abdelkebir Rabi Au Book Club Le Matin

May 21, 2025 -

Beenie Mans New York Takeover Is This The Next Big It Stream

May 21, 2025

Beenie Mans New York Takeover Is This The Next Big It Stream

May 21, 2025 -

Ex Tory Councillors Wife Fights Racial Hatred Tweet Sentence

May 21, 2025

Ex Tory Councillors Wife Fights Racial Hatred Tweet Sentence

May 21, 2025 -

Occasionmarkt Bloeit Abn Amro Rapporteert Aanzienlijke Verkooptoename

May 21, 2025

Occasionmarkt Bloeit Abn Amro Rapporteert Aanzienlijke Verkooptoename

May 21, 2025 -

Why Did D Wave Quantum Qbts Stock Price Rise Today An In Depth Analysis

May 21, 2025

Why Did D Wave Quantum Qbts Stock Price Rise Today An In Depth Analysis

May 21, 2025

Latest Posts

-

Bp Ceo Pay Cut A 31 Decrease In Executive Compensation

May 22, 2025

Bp Ceo Pay Cut A 31 Decrease In Executive Compensation

May 22, 2025 -

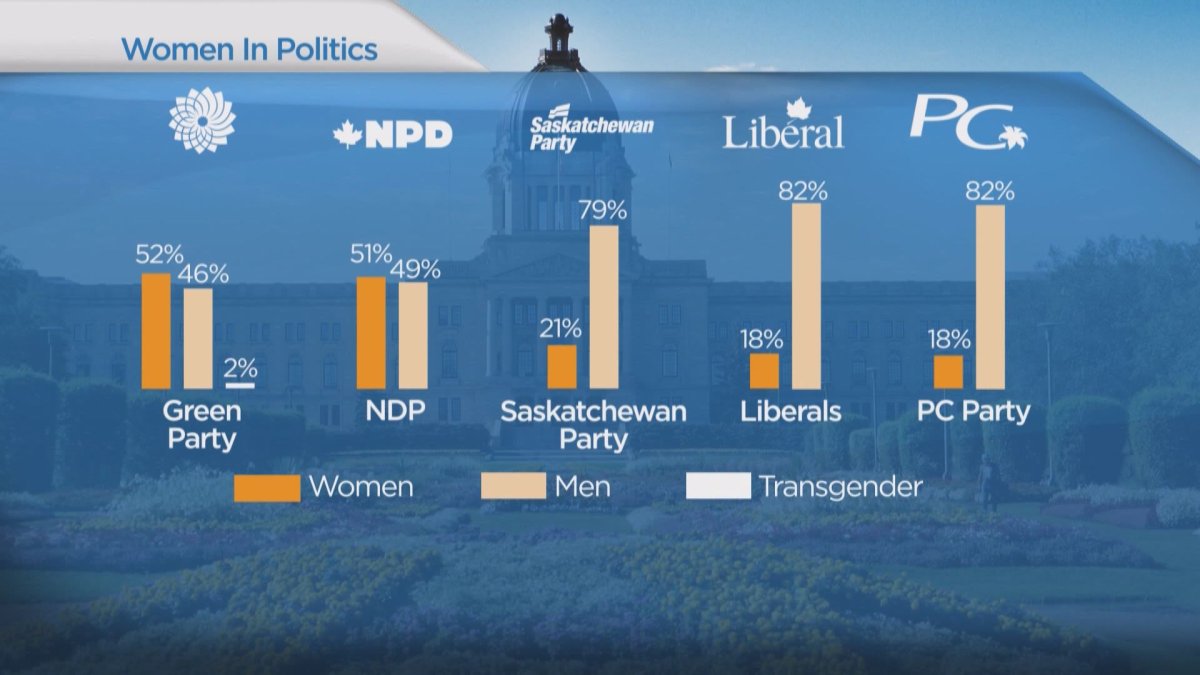

Costco And Saskatchewan Politics Examining A Recent Campaign

May 22, 2025

Costco And Saskatchewan Politics Examining A Recent Campaign

May 22, 2025 -

The Costco Campaign A Case Study In Saskatchewan Politics

May 22, 2025

The Costco Campaign A Case Study In Saskatchewan Politics

May 22, 2025 -

Saskatchewans Costco Campaign A Political Panel Perspective

May 22, 2025

Saskatchewans Costco Campaign A Political Panel Perspective

May 22, 2025 -

Saskatchewan Political Panel Analyzing The Costco Campaign

May 22, 2025

Saskatchewan Political Panel Analyzing The Costco Campaign

May 22, 2025