BigBear.ai (BBAI) Stock: Penny Stock Potential And Investment Risks

Table of Contents

BBAI Stock's Potential for Growth

The allure of BBAI lies primarily in its involvement in the rapidly expanding AI market. This sector shows immense growth potential, and BBAI aims to capitalize on this.

The Appeal of Artificial Intelligence

- Explosive Market Growth: The global AI market is predicted to experience exponential growth in the coming years, driven by increasing adoption across various sectors. This presents a significant opportunity for companies like BigBear.ai.

- BBAI's Focus Areas: BigBear.ai focuses on several key AI applications, including advanced analytics, cybersecurity solutions, and mission-critical decision support. These areas represent substantial market segments with growing demand.

- Potential Market Share Gains: BBAI's technological advancements and strategic partnerships could allow it to gain significant market share in its chosen niches. Future technological breakthroughs could further enhance this potential.

- Positive Analyst Predictions (if any): [Insert any relevant and verifiable positive analyst predictions or recent company achievements here, citing the source]. This information should be carefully considered alongside other factors.

Penny Stock Characteristics and Volatility

BBAI stock currently qualifies as a penny stock, meaning its price per share is typically low. This characteristic brings inherent volatility.

- High Risk, High Reward: Penny stocks are known for their potential for rapid price increases, but equally, for equally rapid and substantial losses. The relationship between risk and reward is amplified in this segment.

- BBAI as a Penny Stock: BigBear.ai's current share price and trading volume align with the definition of a penny stock. It's crucial to understand this characteristic before investing.

- Historical Volatility: [Insert data on the historical price volatility of BBAI stock. Visual representation with a chart could be helpful here. Cite the source of your data].

Significant Risks Associated with Investing in BBAI

Despite the potential upside, investing in BBAI carries substantial risks. A careful evaluation of these risks is essential.

Financial Instability and Debt

BBAI's financial health requires careful scrutiny. High debt levels, low revenue, and a lack of profitability represent significant concerns for potential investors.

- Debt Levels: [Insert data on BBAI's debt-to-equity ratio, total debt, and other relevant financial metrics. Cite the source]. High debt can significantly impact the company's ability to invest in growth and withstand economic downturns.

- Revenue Streams and Profitability: [Analyze BBAI's revenue streams, growth rate, and profitability. Include data points from financial reports and explain their implications]. Consistent revenue growth and eventual profitability are crucial for long-term sustainability.

- Cash Flow and Burn Rate: [Discuss BBAI's cash flow and its burn rate (the rate at which the company is spending cash). This will illustrate the company's financial sustainability].

Market Competition and Technological Disruption

The AI market is highly competitive, and technological disruption is a constant threat. BBAI faces challenges from established players and emerging competitors.

- Key Competitors: [Identify BBAI's main competitors and analyze their strengths and market positions]. The competitive landscape will impact BBAI's ability to gain and maintain market share.

- Technological Disruption: [Discuss potential technological advancements that could render BBAI's technology obsolete or less competitive. Consider mentioning advancements in AI algorithms, hardware, or other related technologies].

- Competitive Advantages: [Analyze BBAI's competitive advantages, if any. This could include proprietary technology, strong partnerships, or a unique market niche].

Regulatory and Legal Risks

The regulatory environment for AI companies is constantly evolving, presenting potential challenges and risks for BBAI.

- Potential Lawsuits or Investigations: [Mention any existing or potential lawsuits or regulatory investigations affecting BBAI]. Legal issues can significantly impact a company's stock price and operations.

- Regulatory Environment for AI: [Discuss the current and potential future regulations impacting the AI industry. These regulations could impact BBAI's operations and profitability].

- Impact of Regulatory Changes: [Analyze how changes in regulations could affect BBAI's business model, operations, and profitability].

Conclusion

BigBear.ai (BBAI) stock presents a classic high-risk, high-reward investment opportunity. The potential for growth within the rapidly expanding AI market is significant, but the financial instability, intense competition, and regulatory risks associated with BBAI cannot be ignored. While the potential for substantial gains exists, the potential for significant losses is equally real.

Call to Action: Before investing in BigBear.ai (BBAI) stock or any penny stock, conduct thorough due diligence. Independently verify all information and consult with a qualified financial advisor to assess your risk tolerance and investment goals. Understand the inherent volatility of BBAI stock and consider diversifying your portfolio to mitigate potential losses. Remember that past performance is not indicative of future results. Investing in BBAI requires careful consideration and a realistic understanding of the risks involved.

Featured Posts

-

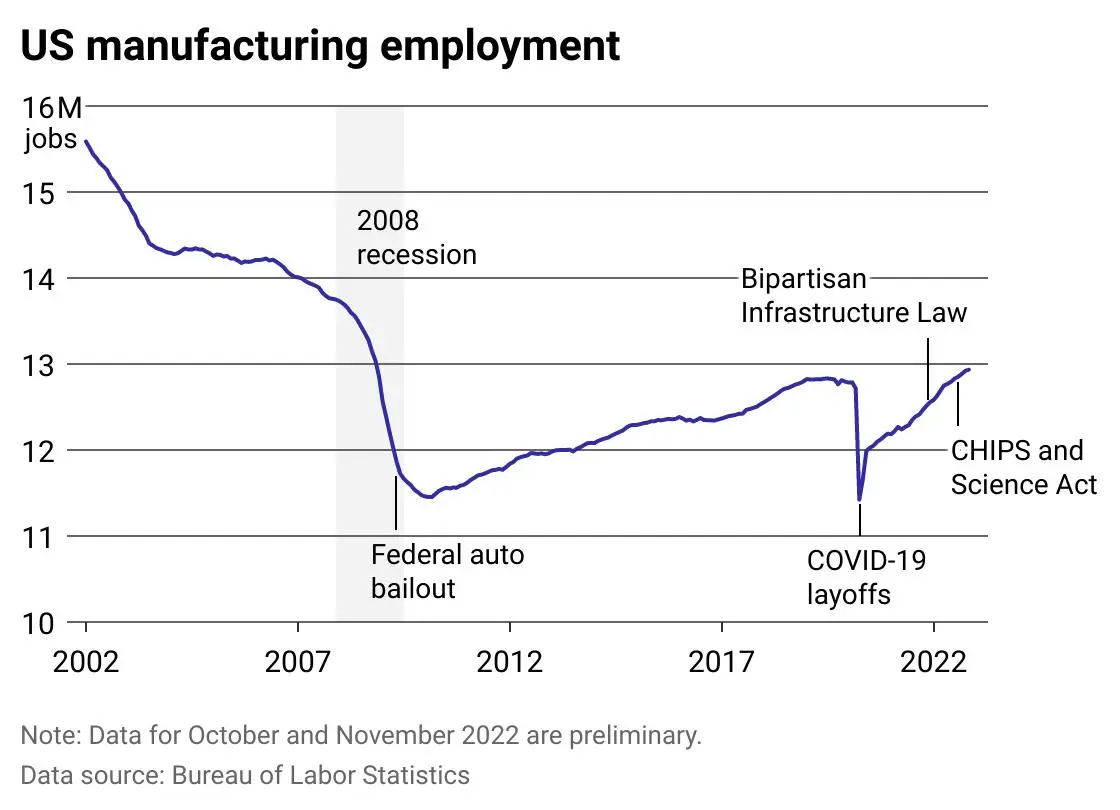

The Future Of American Manufacturing Will Factory Jobs Return Under Trumps Policies

May 20, 2025

The Future Of American Manufacturing Will Factory Jobs Return Under Trumps Policies

May 20, 2025 -

Damaging Winds How Fast Moving Storms Impact Your Area

May 20, 2025

Damaging Winds How Fast Moving Storms Impact Your Area

May 20, 2025 -

Blue Origin Postpones Launch Technical Glitch Halts Mission

May 20, 2025

Blue Origin Postpones Launch Technical Glitch Halts Mission

May 20, 2025 -

Agatha Christies Endless Night The Bbc Television Adaptation

May 20, 2025

Agatha Christies Endless Night The Bbc Television Adaptation

May 20, 2025 -

Find The Answers Nyt Mini Crossword March 13 Solutions

May 20, 2025

Find The Answers Nyt Mini Crossword March 13 Solutions

May 20, 2025

Latest Posts

-

Comparing And Contrasting Gangsta Granny With Other Works

May 20, 2025

Comparing And Contrasting Gangsta Granny With Other Works

May 20, 2025 -

Creative Writing Prompts Inspired By Gangsta Granny

May 20, 2025

Creative Writing Prompts Inspired By Gangsta Granny

May 20, 2025 -

David Walliams Comment Leaves Lorraine Kelly Uncomfortable A Tv Moment

May 20, 2025

David Walliams Comment Leaves Lorraine Kelly Uncomfortable A Tv Moment

May 20, 2025 -

The Impact Of Gangsta Granny On Childrens Literature

May 20, 2025

The Impact Of Gangsta Granny On Childrens Literature

May 20, 2025 -

Lorraine Kelly Reacts To David Walliams Controversial Cancelled Remarks

May 20, 2025

Lorraine Kelly Reacts To David Walliams Controversial Cancelled Remarks

May 20, 2025