BigBear.ai Holdings (BBAI) 2025 Stock Performance: Factors Contributing To The Fall

Table of Contents

Macroeconomic Factors Impacting BBAI Stock

Several macroeconomic factors have significantly impacted BBAI's stock performance and continue to pose challenges for the company's future growth.

Broad Market Downturn and Investor Sentiment

The broader market downturn, particularly affecting technology stocks, has significantly influenced BBAI's stock price. Negative investor sentiment, fueled by several macroeconomic factors, has led to a sell-off in many growth stocks, including BBAI.

- Increased interest rates: The Federal Reserve's policy of raising interest rates to combat inflation has increased borrowing costs for companies, reducing investment and impacting overall market growth. This has a direct correlation with decreased valuations of high-growth companies like BBAI.

- Inflation concerns: Persistent inflation erodes purchasing power and increases uncertainty, leading to risk aversion among investors, impacting demand for technology stocks.

- Recessionary fears: Concerns about a potential recession have further dampened investor confidence, leading to a decline in stock prices across various sectors, including the AI and data analytics industry where BBAI operates.

- Correlation with Economic Indicators: BBAI's stock price has shown a strong negative correlation with rising inflation rates and interest rate hikes, mirroring the broader market trend in technology stocks.

Competition within the AI and Data Analytics Sector

The AI and data analytics sector is highly competitive, with numerous established players vying for market share. This intense competition presents significant challenges for BBAI.

- Key Competitors: BigBear.ai faces competition from large technology companies like Microsoft, Google, and Amazon, as well as specialized AI and data analytics firms with significant resources and established market positions. These competitors often possess superior brand recognition and larger client bases.

- Competitive Advantages and Disadvantages: BBAI's competitive advantages lie in its specialized AI solutions for government and defense sectors. However, its smaller size and relatively lower brand recognition compared to its larger competitors represent a significant disadvantage.

- Mergers and Acquisitions: Consolidation through mergers and acquisitions is prevalent in the industry, leading to a more concentrated market. This can put pressure on smaller companies like BBAI to compete effectively or risk being acquired by a larger entity.

Company-Specific Challenges Affecting BBAI Performance

Beyond macroeconomic headwinds, several company-specific challenges have contributed to BBAI's stock performance decline.

Financial Performance and Revenue Growth

BBAI's financial performance has been a key factor affecting investor confidence. Concerns exist regarding revenue growth, profitability, and financial stability.

- Key Financial Metrics: Analyzing BBAI's financial reports reveals fluctuations in revenue growth, profitability margins, and an often-high debt-to-equity ratio. Consistent analysis of EPS (earnings per share) is also crucial in evaluating the company's financial health.

- Missed Earnings Expectations: Any instances where BBAI has failed to meet analysts' earnings expectations have negatively impacted investor sentiment and contributed to the stock price decline.

- Concerns Regarding Financial Sustainability: Investors are closely monitoring BBAI's financial performance to gauge its long-term sustainability and ability to generate consistent profits.

Strategic Execution and Operational Efficiency

Concerns regarding BBAI's strategic execution and operational efficiency also play a role.

- Product Development: The speed and effectiveness of BBAI's product development process is crucial for its competitiveness. Delays or shortcomings in this area could hinder growth.

- Sales and Marketing Strategies: The effectiveness of BBAI's sales and marketing efforts in reaching target customers and securing contracts is paramount to revenue generation.

- Cost Management: Efficient cost management is critical for profitability, particularly in a competitive market. Investors carefully scrutinize BBAI's operating expenses to assess its efficiency.

- Internal Restructuring and Management Changes: Any significant internal restructuring or management changes can impact investor confidence and create uncertainty, potentially affecting the stock price.

Regulatory and Legal Issues

Regulatory hurdles or legal challenges can significantly impact BBAI's operations and stock performance.

- Regulatory Compliance Issues: Compliance with government regulations, particularly in sectors where BBAI operates (such as defense and intelligence), is crucial and any non-compliance can have severe consequences.

- Lawsuits or Investigations: Any lawsuits or investigations facing BBAI can negatively impact investor confidence and lead to a decline in the stock price.

- Impact of Legal or Regulatory Changes: Changes in regulations can affect BBAI's business operations and potentially increase costs or restrict its activities, impacting its overall performance.

Conclusion

BigBear.ai Holdings (BBAI) stock's performance in 2025 will likely depend on several interconnected factors, ranging from macroeconomic conditions to the company’s internal execution. While macroeconomic headwinds and intense competition pose significant challenges, BBAI's strategic adaptations and financial stability will play a crucial role in its future trajectory. Investors should carefully consider the interplay of these factors before making investment decisions related to BBAI. Further research into BigBear.ai Holdings (BBAI) and the broader AI market is recommended for a comprehensive understanding of the potential risks and rewards associated with this stock. Conduct thorough due diligence before investing in BBAI or any other stock. Understanding the complexities affecting BBAI's stock performance is key to navigating the investment landscape surrounding this company.

Featured Posts

-

Ferrari Faces Dilemma Hamiltons Comfort Vs Leclercs Loyalty

May 20, 2025

Ferrari Faces Dilemma Hamiltons Comfort Vs Leclercs Loyalty

May 20, 2025 -

Jennifer Lawrence Egine Mitera Gia Deyteri Fora

May 20, 2025

Jennifer Lawrence Egine Mitera Gia Deyteri Fora

May 20, 2025 -

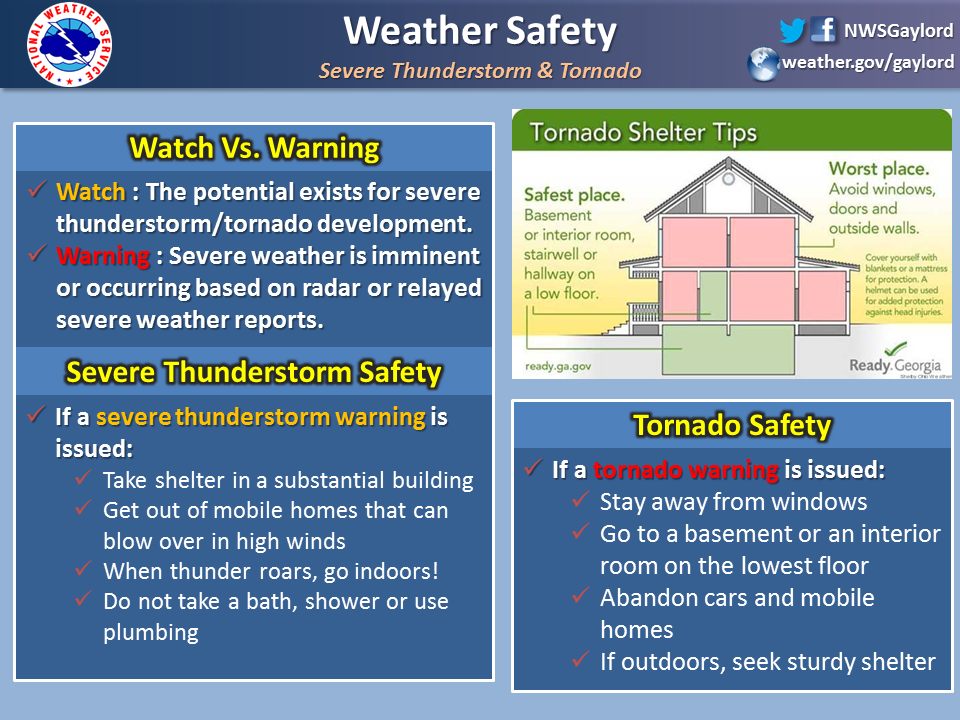

Storm Chance Overnight Severe Weather Potential Monday

May 20, 2025

Storm Chance Overnight Severe Weather Potential Monday

May 20, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Pois Puolasta

May 20, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Pois Puolasta

May 20, 2025 -

D Wave Quantum Qbts Understanding Its Significant Stock Decline In 2025

May 20, 2025

D Wave Quantum Qbts Understanding Its Significant Stock Decline In 2025

May 20, 2025

Latest Posts

-

Social Media Age Limits Texas House Takes Action

May 20, 2025

Social Media Age Limits Texas House Takes Action

May 20, 2025 -

Old North State Report May 9 2025 Key Events And Developments

May 20, 2025

Old North State Report May 9 2025 Key Events And Developments

May 20, 2025 -

Albrlman Aleraqy Ybhth Tqryry Dywan Almhasbt En Almkhalfat 2022 2023

May 20, 2025

Albrlman Aleraqy Ybhth Tqryry Dywan Almhasbt En Almkhalfat 2022 2023

May 20, 2025 -

Old North State Report May 9 2025 News And Updates

May 20, 2025

Old North State Report May 9 2025 News And Updates

May 20, 2025 -

Mkhalfat Malyt Jsymt Tqryr Dywan Almhasbt Yunaqshha Alnwab 2022 2023

May 20, 2025

Mkhalfat Malyt Jsymt Tqryr Dywan Almhasbt Yunaqshha Alnwab 2022 2023

May 20, 2025