BigBear.ai Holdings, Inc.: Securities Lawsuit Filed

Table of Contents

Details of the Securities Lawsuit Against BigBear.ai

A securities lawsuit has been filed against BigBear.ai, alleging several instances of misrepresentation and omission of material facts. While the exact nature of the lawsuit (class action or individual) may be evolving, the plaintiffs claim that BigBear.ai knowingly misled investors, leading to inflated stock prices and significant financial losses. The legal grounds cited are violations of federal securities laws, specifically focusing on the company's public statements and filings. Access to official court documents may vary depending on court rules and the case's progress.

-

Allegation 1: Misleading statements about revenue projections: The lawsuit alleges that BigBear.ai provided overly optimistic revenue projections, failing to adequately disclose the inherent uncertainties and risks involved. This potentially led investors to believe in a growth trajectory that was not realistic.

-

Allegation 2: Failure to disclose material risks: Plaintiffs claim that BigBear.ai neglected to disclose significant risks related to its business model, competitive landscape, and financial stability, leading to a distorted view of the company's true performance. This alleged omission of material risks constitutes a key violation of securities laws.

-

Allegation 3: Inflated stock price due to misleading information: The cumulative effect of the alleged misrepresentations is claimed to have artificially inflated the BigBear.ai stock price, causing investors to purchase shares at an inflated value. This is a central component of the BigBear.ai allegations.

[Link to official court documents, if available]. Keywords: BigBear.ai allegations, BigBear.ai class action, BigBear.ai legal action.

Potential Impact on BigBear.ai Stock and Investors

The BigBear.ai lawsuit carries substantial potential impact on both the company’s stock price and its investors. The short-term effect could involve significant stock price volatility, potentially leading to substantial losses for investors who held shares during the period of alleged misrepresentation.

In the long term, the outcome of the lawsuit will significantly affect BigBear.ai's financial stability and reputation. A negative judgment or substantial settlement could severely impact the company's financial health and erode investor confidence.

-

Stock price volatility: Expect significant fluctuations in BigBear.ai stock price as the lawsuit progresses and news emerges.

-

Potential for settlement or judgment against BigBear.ai: The lawsuit could result in a financial settlement or a court judgment against BigBear.ai, significantly impacting its resources and potentially affecting its future operations.

-

Impact on investor confidence: The negative publicity surrounding the lawsuit is likely to damage investor confidence in BigBear.ai, potentially leading to further stock price declines.

-

Reputational damage to BigBear.ai: Even if the lawsuit is resolved favorably for BigBear.ai, the damage to its reputation could have long-lasting effects on its business prospects. Keywords: BigBear.ai stock price, BigBear.ai investment risk, BigBear.ai investor impact.

How Investors Should Respond to the BigBear.ai Lawsuit

Investors affected by the BigBear.ai lawsuit need to take proactive steps to protect their interests. Closely monitoring the situation and seeking professional guidance are paramount. Investors should consider their options carefully.

-

Review your investment portfolio: Assess the extent of your investment in BigBear.ai and determine the potential impact of the lawsuit on your overall portfolio.

-

Monitor news and updates related to the lawsuit: Stay informed about the legal proceedings, any developments, and court decisions through reputable news sources.

-

Consult with a financial advisor: Seek advice from a financial advisor to understand the implications of the lawsuit for your investment strategy.

-

Consider legal options (if applicable): If you believe you have been directly harmed by the alleged misrepresentations, consult with a securities lawyer to explore potential legal options. Keywords: BigBear.ai investor advice, BigBear.ai legal options, BigBear.ai investment strategy.

Conclusion: Understanding the BigBear.ai Securities Lawsuit and Protecting Your Investment

The securities lawsuit against BigBear.ai highlights the importance of due diligence and understanding the risks involved in any investment. The potential consequences for investors are significant, ranging from short-term stock price volatility to long-term financial losses. Staying informed about the progress of the BigBear.ai lawsuit, consulting with financial and legal professionals, and carefully considering your investment strategy are crucial steps to mitigate potential risks. Keep monitoring for BigBear.ai updates and news; seeking professional BigBear.ai legal counsel is highly recommended.

Featured Posts

-

Top Gbr News Affordable Groceries A 2000 Quarter And The Doge Poll

May 21, 2025

Top Gbr News Affordable Groceries A 2000 Quarter And The Doge Poll

May 21, 2025 -

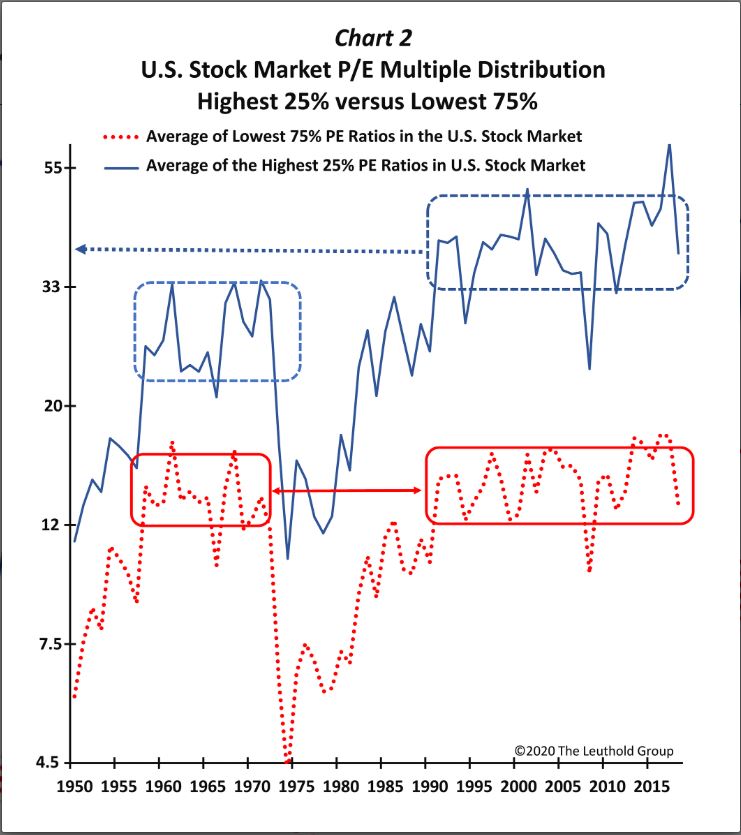

High Stock Valuations Bof As Rationale For Investor Calm

May 21, 2025

High Stock Valuations Bof As Rationale For Investor Calm

May 21, 2025 -

Germanys 5 4 Aggregate Victory Sends Them To Uefa Nations League Final Four

May 21, 2025

Germanys 5 4 Aggregate Victory Sends Them To Uefa Nations League Final Four

May 21, 2025 -

Benjamin Kaellman Maalitykki Huuhkajien Riveihin

May 21, 2025

Benjamin Kaellman Maalitykki Huuhkajien Riveihin

May 21, 2025 -

Understanding High Winds Accompanying Fast Moving Storms

May 21, 2025

Understanding High Winds Accompanying Fast Moving Storms

May 21, 2025

Latest Posts

-

Dancehall Stars Trinidad Visit Restricted Vybz Kartel Sends Love

May 22, 2025

Dancehall Stars Trinidad Visit Restricted Vybz Kartel Sends Love

May 22, 2025 -

The Kartel Rum Culture Connection Insights From Stabroek News

May 22, 2025

The Kartel Rum Culture Connection Insights From Stabroek News

May 22, 2025 -

Understanding Kartel Through The Lens Of Rum Culture Stabroek News

May 22, 2025

Understanding Kartel Through The Lens Of Rum Culture Stabroek News

May 22, 2025 -

Kartels Impact On Rum Culture In Stabroek News

May 22, 2025

Kartels Impact On Rum Culture In Stabroek News

May 22, 2025 -

From Fan To Tourmate Nuffys Journey With Vybz Kartel

May 22, 2025

From Fan To Tourmate Nuffys Journey With Vybz Kartel

May 22, 2025