High Stock Valuations: BofA's Rationale For Investor Calm

Table of Contents

BofA's Arguments for Maintaining a Long-Term Perspective

BofA's core message revolves around the importance of long-term investing strategies. In the face of short-term market fluctuations and concerns about high stock valuations, maintaining a long-term perspective is paramount. This isn't about ignoring potential risks; it's about understanding that market cycles are inherent and that focusing on the long-term growth potential can mitigate short-term anxieties.

- Focus on long-term growth: While short-term volatility is inevitable, focusing on the underlying growth potential of the market, driven by technological innovation, economic expansion, and evolving consumer behavior, is key. High stock valuations today might reflect this future growth.

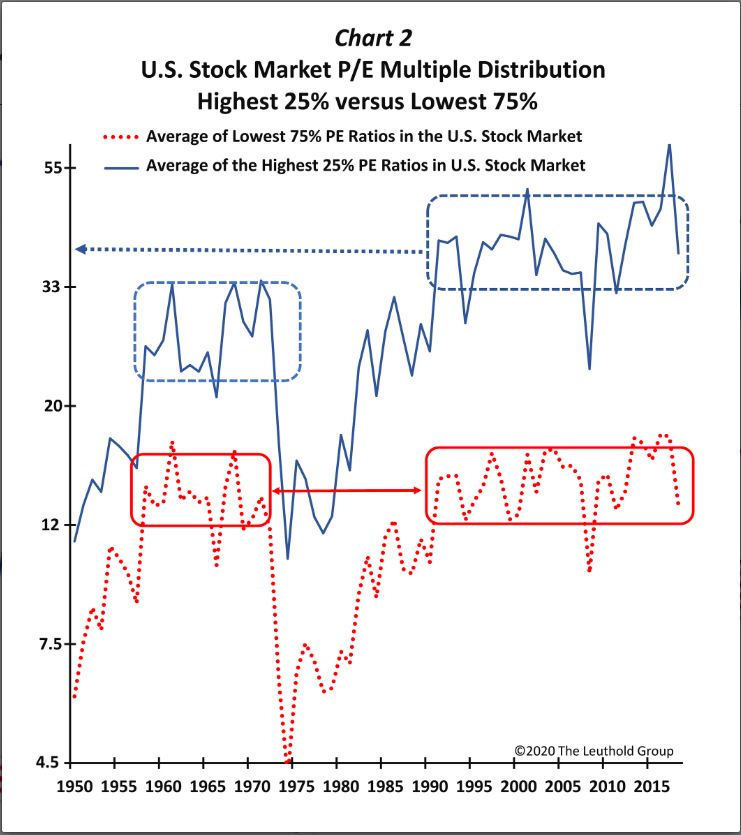

- Historical context: Examining historical market cycles reveals periods of high valuations followed by periods of correction. These fluctuations are normal parts of the market's natural rhythm. Understanding this historical context helps investors avoid knee-jerk reactions.

- Diversification is key: A well-diversified investment portfolio, spread across different asset classes and sectors, helps mitigate risk associated with high stock valuations in specific areas. This diversification cushions against potential losses in any single sector.

- Avoid panic selling: Panic selling during periods of high stock valuations often leads to losses. Holding onto investments, particularly those aligned with a long-term strategy, can help mitigate these losses and potentially capitalize on future growth. Disciplined investing, rather than emotional reactions, is crucial.

Analyzing the Factors Contributing to High Stock Valuations

Several economic factors are contributing to the current environment of high stock valuations. Understanding these factors provides a more nuanced perspective on the current market situation.

- Low interest rates: Historically low interest rates have encouraged investment in riskier assets like stocks, pushing valuations higher. This monetary policy has had a significant impact on stock prices.

- Robust corporate earnings: Strong corporate earnings and profit growth, particularly in certain sectors, are supporting higher stock prices. Companies demonstrating consistent and strong earnings are less susceptible to valuation concerns.

- Investor sentiment: Positive investor sentiment and confidence in the future economic outlook contribute significantly to high stock valuations. Market psychology plays a crucial role in determining price levels.

- Sector-specific strength: Certain sectors, such as technology and healthcare, are experiencing particularly high valuations, reflecting both their growth potential and investor enthusiasm. Understanding sector-specific trends is vital for informed investment decisions.

BofA's Predictions and Recommended Strategies for Investors

BofA's outlook generally remains cautiously optimistic, although specific predictions are always subject to change. They suggest investors take a measured and strategic approach.

- Market performance outlook: BofA's outlook acknowledges the potential for near-term corrections but maintains a longer-term positive view. It's crucial to remember that these are predictions, not guarantees.

- Sector-specific recommendations: While not endorsing specific stocks, BofA might suggest allocating more towards sectors they expect to perform well while possibly reducing exposure to overvalued sectors.

- Investment strategy adjustments: Regular portfolio rebalancing is often suggested to maintain the desired level of risk and diversification, particularly during periods of high stock valuations.

- Professional financial advice: BofA emphasizes the importance of consulting with a qualified financial advisor to develop a personalized investment strategy tailored to individual risk tolerance and financial goals.

Addressing the Risks Associated with High Stock Valuations

While BofA encourages a calm approach, it's essential to acknowledge the inherent risks associated with high stock valuations.

- Market corrections: The potential for market corrections or even a significant downturn remains a realistic concern, particularly given the current valuations.

- Capital loss risk: High valuations increase the potential for substantial capital losses if the market corrects. Understanding and accepting this risk is crucial for informed investment.

- Risk management and diversification: Effective risk management strategies, including diversification and careful asset allocation, are vital tools for mitigating potential losses.

- Alternative investments: Considering alternative investments, such as bonds or real estate, can help diversify portfolios and potentially reduce overall risk.

Conclusion: Navigating High Stock Valuations with Confidence

BofA's message centers on the importance of maintaining a long-term perspective and understanding the factors driving high stock valuations. While acknowledging the inherent risks, they highlight the historical context of market cycles and the potential for long-term growth. Understanding high stock valuations requires careful analysis, a diversified portfolio, and a measured approach. Remember to consider BofA's analysis alongside your own research, and consult a financial advisor to develop a well-informed investment strategy for managing your portfolio effectively during periods of high stock valuations. Successfully navigating high valuations requires careful planning and a long-term view.

Featured Posts

-

D Wave Quantum Qbts Stock Explaining The Friday Price Movement

May 21, 2025

D Wave Quantum Qbts Stock Explaining The Friday Price Movement

May 21, 2025 -

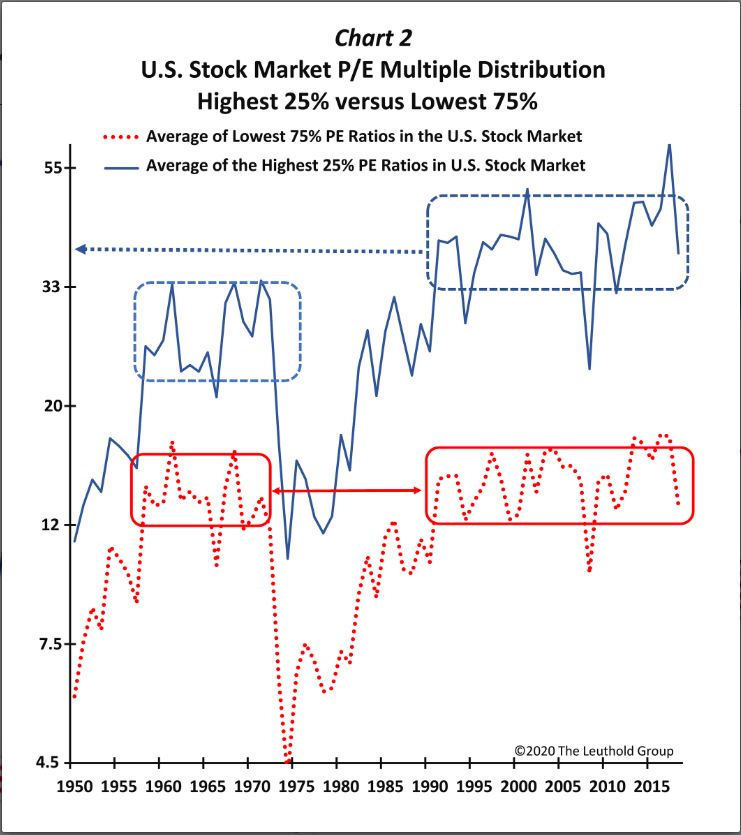

Nyt Mini Crossword Solutions For March 18 2025

May 21, 2025

Nyt Mini Crossword Solutions For March 18 2025

May 21, 2025 -

Understanding Michael Strahans Interview Success Amidst Intense Competition

May 21, 2025

Understanding Michael Strahans Interview Success Amidst Intense Competition

May 21, 2025 -

Dancehall Musicians Trinidad Trip Curtailed Show Of Support From Kartel

May 21, 2025

Dancehall Musicians Trinidad Trip Curtailed Show Of Support From Kartel

May 21, 2025 -

El Superalimento Que Combate Enfermedades Cronicas Y Promueve La Longevidad

May 21, 2025

El Superalimento Que Combate Enfermedades Cronicas Y Promueve La Longevidad

May 21, 2025

Latest Posts

-

Big Bear Ai Bbai A Deep Dive Into The Recent Stock Market Decline

May 21, 2025

Big Bear Ai Bbai A Deep Dive Into The Recent Stock Market Decline

May 21, 2025 -

One Strong Reason To Consider This Ai Quantum Computing Stock

May 21, 2025

One Strong Reason To Consider This Ai Quantum Computing Stock

May 21, 2025 -

Analyst Upgrades Big Bear Ai Bbai To Buy Defense Spending Drives Growth

May 21, 2025

Analyst Upgrades Big Bear Ai Bbai To Buy Defense Spending Drives Growth

May 21, 2025 -

Should You Buy This Ai Quantum Computing Stock On The Decline

May 21, 2025

Should You Buy This Ai Quantum Computing Stock On The Decline

May 21, 2025 -

Big Bear Ai Holdings Inc Bbai Penny Stock Potential In The Ai Sector

May 21, 2025

Big Bear Ai Holdings Inc Bbai Penny Stock Potential In The Ai Sector

May 21, 2025