Binance Bitcoin Trading: Buyers Dominate After Six-Month Slump

Table of Contents

Analyzing the Six-Month Slump on Binance Bitcoin Trading

The period leading up to this recent surge saw a considerable downturn in Bitcoin trading on Binance. This six-month slump, characterized by declining trading volume and a persistent price decrease, was influenced by several intertwined factors. The bearish market sentiment was palpable.

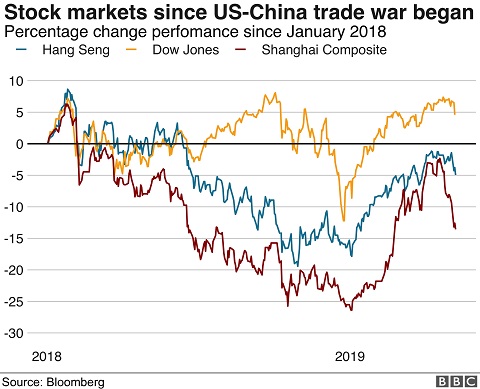

- Macroeconomic Headwinds: Global economic uncertainty, rising inflation, and increasing interest rates significantly impacted investor confidence, leading to a risk-off sentiment across various asset classes, including cryptocurrencies.

- Regulatory Uncertainty: Increased regulatory scrutiny of the cryptocurrency industry in various jurisdictions created a climate of uncertainty and hesitancy among investors. Concerns about potential bans or restrictions weighed heavily on the market.

- Negative News Cycle: Several negative news events surrounding prominent crypto projects and exchanges fueled the bearish sentiment and contributed to the slump in Bitcoin trading volume on Binance.

Data illustrating the slump:

- Price Decline: Bitcoin's price on Binance plummeted from approximately $48,000 on [Insert Date] to a low of around $25,000 on [Insert Date], representing a decrease of approximately 48%.

- Trading Volume Reduction: The daily trading volume of Bitcoin on Binance decreased by an estimated [Insert Percentage]% during this six-month period. This signifies a significant reduction in overall market activity.

- Market Sentiment Indicators: Various market sentiment indicators, such as the Crypto Fear & Greed Index, consistently reflected extreme fear throughout the slump period.

The Recent Surge in Binance Bitcoin Buying Activity

The recent weeks have witnessed a dramatic reversal of fortune. Binance Bitcoin trading has experienced a significant upswing, marked by a considerable increase in both price and trading volume. This bullish sentiment is undeniable.

Data illustrating the surge:

- Price Increase: Bitcoin's price on Binance has rebounded significantly, rising from approximately $25,000 on [Insert Date] to [Insert Current Price] on [Insert Current Date], indicating an increase of approximately [Insert Percentage]%.

- Trading Volume Surge: The daily trading volume of Bitcoin on Binance has seen a remarkable increase of [Insert Percentage]%, signaling renewed investor interest and activity.

- Market Sentiment Indicators: Positive news regarding institutional adoption, technological advancements within the Bitcoin ecosystem, and a shift in macroeconomic sentiment have contributed to a more optimistic outlook, boosting investor confidence.

Potential Reasons Behind the Shift in Binance Bitcoin Market Sentiment

The shift from a bearish to a bullish market sentiment on Binance is likely a result of several interwoven factors:

- Easing Macroeconomic Concerns: Some signs suggest that inflation might be peaking, and central banks may be less aggressive with interest rate hikes, potentially leading to increased risk appetite among investors.

- Positive Regulatory Developments: While regulatory uncertainty persists, some positive developments in certain jurisdictions have eased concerns and fostered a more favorable environment for cryptocurrency investment.

- Bitcoin Network Upgrades: Recent upgrades to the Bitcoin network have enhanced its scalability and efficiency, making it more attractive to both individual and institutional investors.

- Increased Institutional Interest: Reports of increased institutional investment in Bitcoin have helped to boost confidence and drive up demand.

- Social Media and Market Sentiment: Positive news and discussions on social media platforms played a role in shifting market sentiment, particularly among retail investors.

Future Outlook for Binance Bitcoin Trading

Predicting the future of Bitcoin trading on Binance is inherently challenging, given the volatile nature of the cryptocurrency market. However, considering the current market conditions, a cautiously optimistic outlook is warranted.

- Potential Price Targets: Short-term price targets could range from [Insert Price] to [Insert Price], while long-term projections remain highly speculative, depending significantly on macroeconomic factors and regulatory developments.

- Influencing Factors: Ongoing macroeconomic conditions, regulatory changes, technological advancements, and overall market sentiment will significantly influence future price movements.

- Risks and Opportunities: While the potential for significant returns exists, investors should be aware of the inherent risks involved in cryptocurrency trading and exercise caution before making any investment decisions.

Conclusion: Navigating the Binance Bitcoin Trading Landscape

The recent surge in Binance Bitcoin trading marks a significant shift from the six-month slump, with buyers clearly dominating the market. This change is attributed to a combination of factors including easing macroeconomic concerns, positive regulatory developments, and increased institutional interest. However, the cryptocurrency market remains volatile, and careful analysis is crucial before making any investment decisions. Stay ahead of the curve in Binance Bitcoin trading by staying informed about market trends and conducting thorough research. Learn more about navigating the dynamic world of Binance Bitcoin trading and make informed decisions.

Featured Posts

-

Kripto Duenyasinda Doenuem Noktasi Spk Nin Duyurusu Ve Etkileri

May 08, 2025

Kripto Duenyasinda Doenuem Noktasi Spk Nin Duyurusu Ve Etkileri

May 08, 2025 -

Liberation Day Tariffs And Their Long Term Effects On Stock Market Performance

May 08, 2025

Liberation Day Tariffs And Their Long Term Effects On Stock Market Performance

May 08, 2025 -

New Tariffs Contribute To Reduced Canadian Trade Deficit Of 506 Million

May 08, 2025

New Tariffs Contribute To Reduced Canadian Trade Deficit Of 506 Million

May 08, 2025 -

7 Hidden Gems Streaming Now On Paramount

May 08, 2025

7 Hidden Gems Streaming Now On Paramount

May 08, 2025 -

Londontsy Protiv Parizhan Istoriya Matchey Arsenal Ps Zh V Evrokubkakh

May 08, 2025

Londontsy Protiv Parizhan Istoriya Matchey Arsenal Ps Zh V Evrokubkakh

May 08, 2025