Bitcoin Golden Cross: A Rare Signal, What Does It Mean For Investors?

Table of Contents

Understanding the Bitcoin Golden Cross

What is a Golden Cross?

In technical analysis, a Golden Cross occurs when a shorter-term moving average crosses above a longer-term moving average. In the context of Bitcoin, this typically refers to the 50-day moving average crossing above the 200-day moving average. These moving averages smooth out price fluctuations, providing a clearer picture of the underlying trend. The 50-day moving average reflects shorter-term price momentum, while the 200-day moving average represents the longer-term trend. A Golden Cross suggests a potential shift from a bearish to a bullish market sentiment.

Why is the Bitcoin Golden Cross Rare and Significant?

The Bitcoin Golden Cross is a relatively infrequent event. Its rarity stems from the volatility inherent in the cryptocurrency market. Historically, when this event has occurred in Bitcoin's past, it has often (but not always!) been followed by periods of increased price. This correlation doesn't guarantee future performance, but it does lend some weight to the Golden Cross as a potential bullish signal for long-term investment. However, it's crucial to remember that past performance is not indicative of future results. The significance lies in the potential for a sustained upward price momentum.

- Historical Performance: Examining historical Bitcoin charts reveals that past Golden Cross events have, in many cases, preceded periods of significant price appreciation. However, the magnitude and duration of these increases varied considerably.

- Limitations of the Golden Cross: The Golden Cross should not be considered a standalone indicator. Relying solely on this signal can lead to inaccurate predictions and potentially significant losses.

- Other Technical Indicators: Investors should use the Golden Cross in conjunction with other technical indicators, such as the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands, for a more comprehensive market analysis.

Interpreting the Signal: What to Expect After a Bitcoin Golden Cross

Potential Price Increases

A Bitcoin Golden Cross often fuels speculation of potential price increases. This is because the indicator suggests a shift in market sentiment from bearish to bullish, indicating that more buyers are entering the market. However, it's crucial to manage expectations. The price increase isn't guaranteed, and the magnitude of any increase is highly uncertain. Market analysis shows that volatility remains a significant factor even after a Golden Cross.

Risk Management and Diversification

Even after a seemingly bullish signal like the Golden Cross, risk management remains paramount. Cryptocurrency markets are inherently volatile, and significant price corrections can occur even during an uptrend. Diversification is key to mitigating risk. Don't put all your eggs in one basket.

- Potential Scenarios: Following a Golden Cross, several scenarios are possible: a sustained uptrend leading to significant price appreciation, a temporary surge followed by a correction, or even a continuation of the bearish trend despite the Golden Cross signal.

- Investment Strategies: Your investment strategy should align with your risk tolerance. Long-term holders might view the Golden Cross as a confirmation of their bullish outlook, while short-term traders might look for opportune entry and exit points based on shorter-term price movements.

- Thorough Research: Remember that technical indicators are tools, not crystal balls. Thorough research and understanding of the underlying fundamentals of Bitcoin are crucial before making any investment decisions.

Bitcoin Golden Cross vs. Other Market Indicators

Comparing the Golden Cross to Other Technical Indicators

The Bitcoin Golden Cross shouldn't be analyzed in isolation. Other technical indicators provide valuable insights into market sentiment and potential price movements. For example, the RSI can indicate whether Bitcoin is overbought or oversold, while the MACD highlights momentum shifts. Bollinger Bands help visualize price volatility. Using these indicators in conjunction with the Golden Cross allows for a more nuanced and comprehensive market analysis. This strengthens your trading signals and allows for a more well-rounded approach to technical analysis.

Fundamental Analysis and Bitcoin's Golden Cross

While technical analysis, including the Golden Cross, is valuable, it's crucial to consider fundamental analysis as well. Factors such as Bitcoin adoption rates, regulatory developments, technological advancements (like the Lightning Network), and macroeconomic conditions significantly influence Bitcoin's price. Ignoring these fundamentals can lead to flawed conclusions.

- Indicator Confirmation/Contradiction: For example, a Golden Cross might be weakened if the RSI is showing Bitcoin to be overbought, suggesting a potential correction is imminent.

- Technical and Fundamental Synergy: Integrating technical and fundamental analysis allows for a holistic approach to investment decision-making, reducing reliance on any single signal.

Conclusion

The Bitcoin Golden Cross is a potentially bullish signal, but it's not a guarantee of price increases. Its rarity and historical correlation with price rises make it noteworthy, but it shouldn't be the sole basis for investment decisions. Remember that the cryptocurrency market remains highly volatile. Thorough research, considering other technical indicators, and incorporating fundamental analysis are essential for informed decision-making. To succeed in cryptocurrency investment, learning more about Bitcoin Golden Cross and exploring various Bitcoin investment strategies, alongside a comprehensive cryptocurrency market analysis, is vital. Conduct thorough research, seek professional financial advice if needed, and always prioritize responsible investing in the dynamic world of cryptocurrencies. Don't let the allure of a Bitcoin Golden Cross overshadow the importance of calculated risk management and diversified portfolio building.

Featured Posts

-

Easing Monetary Policy China Lowers Rates To Counter Tariff Effects

May 08, 2025

Easing Monetary Policy China Lowers Rates To Counter Tariff Effects

May 08, 2025 -

Tnt Announcers Hilarious Commentary Jayson Tatum In Lakers Celtics Promo

May 08, 2025

Tnt Announcers Hilarious Commentary Jayson Tatum In Lakers Celtics Promo

May 08, 2025 -

La Geometrie Des Corneilles Une Performance Cognitive Superieure A Celle Des Babouins

May 08, 2025

La Geometrie Des Corneilles Une Performance Cognitive Superieure A Celle Des Babouins

May 08, 2025 -

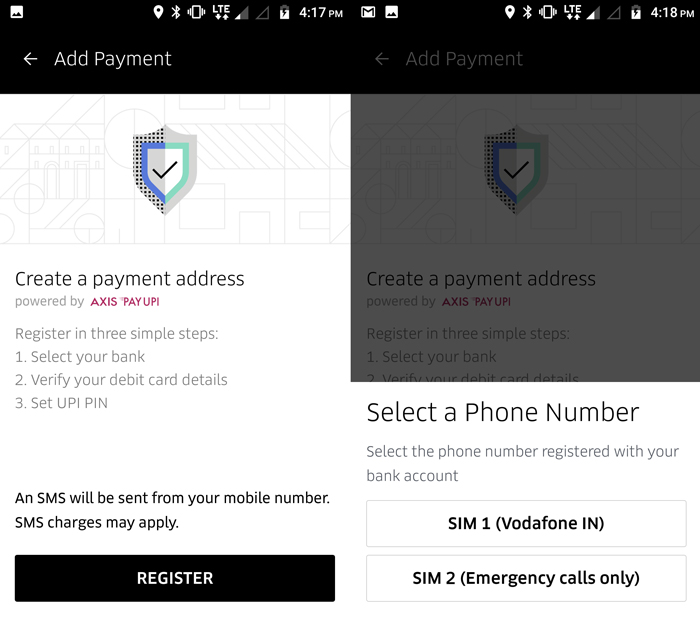

Can I Still Use Upi To Pay For Uber Auto Rides A Complete Guide

May 08, 2025

Can I Still Use Upi To Pay For Uber Auto Rides A Complete Guide

May 08, 2025 -

3 Star Wars Andor Episodes Streaming Free On You Tube

May 08, 2025

3 Star Wars Andor Episodes Streaming Free On You Tube

May 08, 2025