Easing Monetary Policy: China Lowers Rates To Counter Tariff Effects

Table of Contents

Why China Lowered Interest Rates

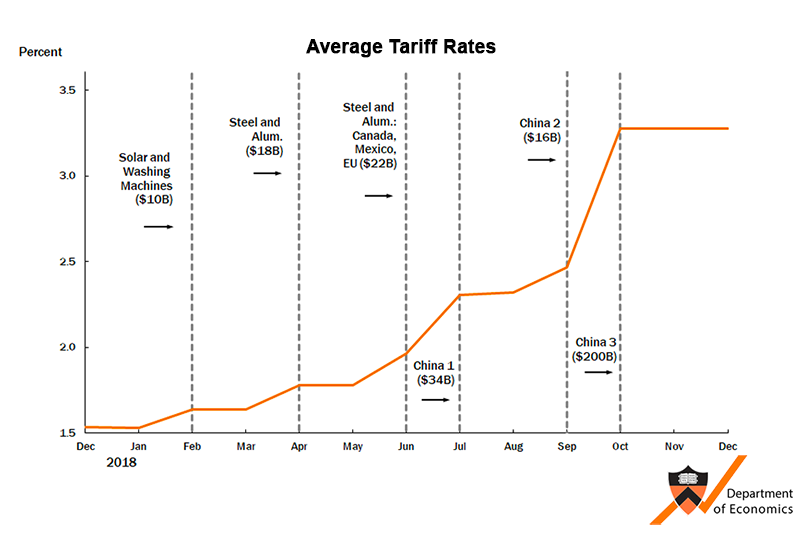

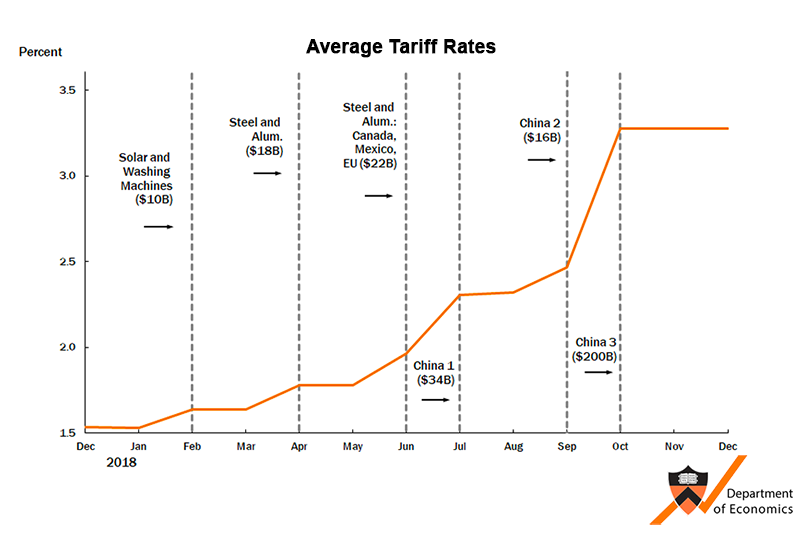

The US-China trade war has dealt a considerable blow to the Chinese economy. Tariffs imposed on Chinese exports have severely hampered economic growth, leading to a decline in exports and impacting various sectors. This trade uncertainty has also resulted in decreased investment and consumer spending, creating a ripple effect throughout the economy. To counter this slowdown and stimulate domestic demand, the Chinese government opted for monetary easing through interest rate cuts.

The detrimental impacts of the tariffs are multifaceted:

- Reduced export orders: Leading to factory closures, job losses, and a decline in manufacturing output. This directly impacts economic growth and employment figures.

- Weakening of the Yuan: The ongoing trade war has put pressure on the Chinese Yuan, impacting import costs and further squeezing profit margins for businesses. This weakens purchasing power and overall economic stability.

- Decreased foreign investment: Uncertainty surrounding the trade war has discouraged foreign direct investment, hindering economic development and technological advancements.

- Need to boost infrastructure spending and consumption: Lowering interest rates is designed to incentivize both government-led infrastructure projects and consumer spending, thereby boosting aggregate demand.

The Mechanics of China's Monetary Easing

The People's Bank of China (PBOC) implemented several measures to ease monetary policy. These included lowering the reserve requirement ratio (RRR) – the percentage of deposits banks must hold in reserve – and reducing the Loan Prime Rate (LPR), a benchmark lending rate. These actions aim to inject liquidity into the financial system and stimulate borrowing and investment.

- RRR Cut: A significant reduction in the RRR frees up capital for banks, allowing them to increase lending to businesses and consumers. This directly impacts the amount of credit available in the economy.

- LPR Reduction: Lowering the LPR reduces borrowing costs for businesses and consumers, encouraging investment in new projects and increased consumer spending. This is a crucial driver of economic activity.

- Potential for further tools: The PBOC might consider additional monetary policy tools, such as quantitative easing (QE), to further stimulate the economy if necessary. QE involves the central bank purchasing government bonds or other assets to increase the money supply.

Potential Economic Impacts of the Policy

China's monetary easing strategy carries both potential benefits and risks. On the positive side, reduced interest rates should stimulate investment, leading to higher levels of capital expenditure and job creation. Increased consumer spending, driven by lower borrowing costs, can also boost economic activity. Ultimately, this could lead to improved GDP growth.

However, there are potential downsides:

- Increased inflation: Easing monetary policy can lead to increased money supply, potentially fueling inflation if not managed carefully. This could erode purchasing power and destabilize the economy.

- Asset bubbles: Lower interest rates can inflate asset prices, creating the risk of asset bubbles in the real estate or stock markets. These bubbles can burst, causing significant economic damage.

- Risks to financial stability: Excessive borrowing fueled by readily available credit can lead to increased debt levels, potentially threatening financial stability. This requires careful monitoring and regulation.

- Government spending's role: The effectiveness of monetary easing is often enhanced when coupled with targeted government spending on infrastructure projects and social programs.

Global Implications of China's Monetary Policy

China's monetary policy decisions have far-reaching global implications. The actions taken by the PBOC can influence currency exchange rates and commodity prices, impacting economies worldwide. Countries heavily reliant on trade with China will feel the ripple effects most acutely.

- Currency exchange rates: Changes in Chinese interest rates can impact the value of the US dollar and other major currencies, creating volatility in the global foreign exchange markets.

- Commodity prices: Increased Chinese economic activity, spurred by monetary easing, can lead to higher demand for raw materials and energy, impacting commodity prices globally.

- Global competition: The resulting boost to Chinese exports could intensify global competition, impacting businesses in other countries.

Conclusion

China's decision to ease its monetary policy through interest rate cuts is a direct response to the negative economic impacts of the ongoing trade war. The PBOC's actions, including RRR cuts and LPR reductions, aim to stimulate domestic demand and counter the slowdown. While this strategy holds the potential for increased economic growth and investment, it also carries risks such as inflation and asset bubbles. Understanding the complexities of easing monetary policy in the context of global trade wars is crucial. Stay informed about future developments in China's monetary policy and its impact on global markets by following updates on "China's monetary policy updates," "easing monetary policy news," and "interest rate cuts analysis." Continue exploring our website for in-depth analyses and insights into these crucial economic trends.

Featured Posts

-

Test Your Knowledge Nba Playoffs Triple Doubles Leader Quiz

May 08, 2025

Test Your Knowledge Nba Playoffs Triple Doubles Leader Quiz

May 08, 2025 -

Shop Official Boston Celtics Apparel And Merchandise At Fanatics

May 08, 2025

Shop Official Boston Celtics Apparel And Merchandise At Fanatics

May 08, 2025 -

Uber Stock A Comprehensive Investment Analysis

May 08, 2025

Uber Stock A Comprehensive Investment Analysis

May 08, 2025 -

Market Braces For Volatility As Billions In Crypto Options Expire

May 08, 2025

Market Braces For Volatility As Billions In Crypto Options Expire

May 08, 2025 -

Four Inter Milan Players Out Of Contract In 2026 Analysis And Potential Outcomes

May 08, 2025

Four Inter Milan Players Out Of Contract In 2026 Analysis And Potential Outcomes

May 08, 2025