Bitcoin Miner Surge: Reasons Behind This Week's Increase

Table of Contents

Rising Bitcoin Price and its Impact on Miner Profitability

The most immediate and significant factor contributing to the Bitcoin miner surge is the recent rise in Bitcoin's price. A direct correlation exists between Bitcoin's price and the profitability of Bitcoin mining. Higher Bitcoin prices translate directly into increased revenue for miners. This increased profitability incentivizes existing miners to expand their operations and attracts new entrants to the market.

- Increased revenue per mined Bitcoin: A higher Bitcoin price means each successfully mined Bitcoin generates more revenue, significantly boosting profitability.

- Greater return on investment (ROI) for mining hardware: With higher Bitcoin prices, the initial investment in specialized mining equipment (ASICs) yields a faster return, making mining a more attractive proposition.

- Attraction of new miners entering the market: The improved profitability encourages individuals and companies to invest in mining hardware and join the Bitcoin mining network, leading to an overall increase in hashing power.

Bitcoin's price recently touched $30,000, a significant increase from its lows earlier this year. This price surge, coupled with relatively stable energy costs in some regions, has markedly improved miner profitability, directly contributing to the observed Bitcoin miner surge. It's also crucial to understand the concept of "mining difficulty." While a higher price boosts revenue, increased mining participation also increases the mining difficulty, making it harder to earn Bitcoins. However, the recent price increase has outweighed the impact of increased difficulty.

Technological Advancements and Mining Efficiency

Technological advancements in mining hardware and software have played a crucial role in the recent Bitcoin miner surge. The development of increasingly efficient Application-Specific Integrated Circuits (ASICs) has significantly lowered the cost of mining. These advancements allow miners to achieve higher hash rates while consuming less energy.

- Introduction of new ASIC models with higher hash rates: Manufacturers continually release new ASIC models boasting higher hash rates, enabling miners to solve cryptographic puzzles faster and generate more Bitcoin.

- Lower energy consumption per terahash: Improvements in chip design and manufacturing processes have led to substantial reductions in energy consumption per unit of hashing power, reducing operational costs.

- Impact of technological innovation on the overall mining landscape: These advancements make Bitcoin mining more accessible and profitable, encouraging broader participation and contributing to the increased hashing power.

Companies like Bitmain and MicroBT are constantly releasing new, more efficient ASICs, driving down the cost per Bitcoin mined and attracting more miners to the network. This technological arms race directly contributes to the overall increase in hashing power observed in the recent Bitcoin miner surge.

Regulatory Shifts and their Influence on Bitcoin Mining

Regulatory landscapes vary significantly across different jurisdictions, and these differences heavily influence the Bitcoin mining industry. Supportive regulations can attract investment and encourage the expansion of mining operations, whereas restrictive regulations can stifle growth.

- Specific examples of supportive or restrictive policies in different countries: Some countries have implemented favorable policies towards Bitcoin mining, offering tax incentives or streamlined licensing processes, while others maintain strict regulations or outright bans.

- Impact of regulatory uncertainty on miner behavior: Uncertainty surrounding future regulations can lead to hesitancy among miners, potentially impacting investment decisions and expansion plans.

- Potential future regulatory changes and their anticipated influence: Ongoing regulatory debates and potential future policy shifts will continue to shape the Bitcoin mining landscape, influencing the levels of investment and participation.

While specific regulatory changes weren't the primary driver of this particular Bitcoin miner surge, the general trend towards clearer (though not always favorable) regulatory frameworks in certain regions has provided a degree of certainty that encourages investment in the long term. A lack of significant negative regulatory changes in key mining regions has also indirectly contributed to the current increase.

The Role of Institutional Investment in Bitcoin Mining

The growing involvement of large-scale institutional investors in the Bitcoin mining sector has played a noteworthy role in boosting the overall hashing power. These institutions bring substantial capital and resources to the industry, facilitating large-scale mining operations.

- Examples of major institutional investors entering the mining space: Several large investment firms and publicly traded companies have invested heavily in Bitcoin mining infrastructure, further expanding capacity.

- Impact of institutional investment on mining infrastructure: Institutional investments have fueled the construction of large, highly efficient mining facilities, significantly increasing the overall hashing power.

- Increased capital availability for mining operations: The influx of institutional capital has broadened access to funding, enabling miners to scale their operations and acquire more advanced equipment.

This institutional investment provides a significant influx of capital into the Bitcoin mining industry, leading to increased capacity and contributing significantly to the observed Bitcoin miner surge.

Conclusion

The recent Bitcoin miner surge is a multifaceted phenomenon driven by a confluence of factors. The rise in Bitcoin's price has boosted miner profitability, attracting new entrants and encouraging expansion among existing operators. Technological advancements, particularly in ASIC technology, have improved mining efficiency, reducing operational costs. While not a primary driver of this specific surge, a relatively stable and in some cases supportive regulatory environment, combined with significant institutional investment, further fueled the growth. These factors, acting in concert, have resulted in the substantial increase in Bitcoin's mining hash rate.

Key Takeaways: Understanding the interplay between Bitcoin price, technological innovation, regulatory environment, and institutional investment is crucial for comprehending the dynamics of the Bitcoin mining industry. The current surge highlights the inherent volatility and rapid evolution of this sector.

Stay updated on future Bitcoin miner surges and their implications by subscribing to our newsletter, or explore our other resources on Bitcoin mining and its evolving landscape.

Featured Posts

-

Makron O Vstreche Zelenskogo I Trampa V Vatikane Podrobnosti I Analiz

May 09, 2025

Makron O Vstreche Zelenskogo I Trampa V Vatikane Podrobnosti I Analiz

May 09, 2025 -

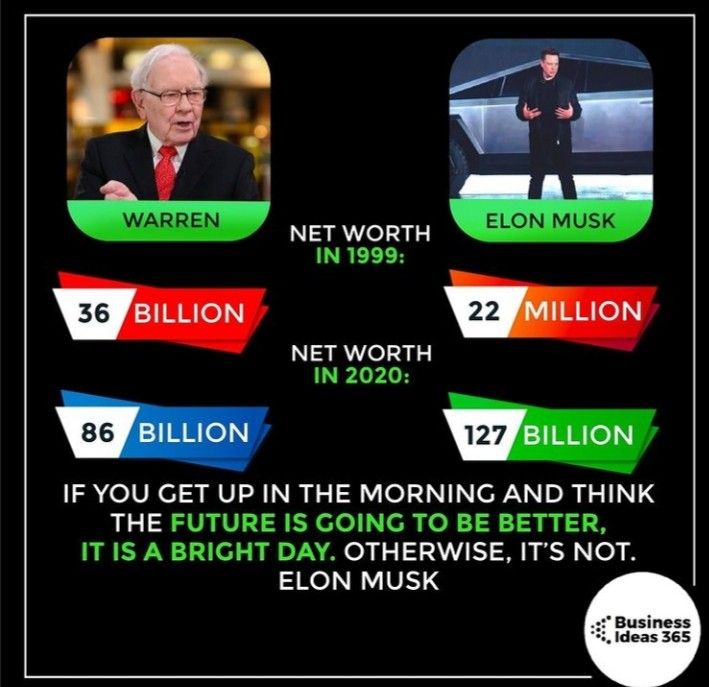

The Correlation Between Us Policy And Elon Musks Net Worth

May 09, 2025

The Correlation Between Us Policy And Elon Musks Net Worth

May 09, 2025 -

Bitcoin Madenciligi Eskisi Gibi Karli Degil Mi Neden

May 09, 2025

Bitcoin Madenciligi Eskisi Gibi Karli Degil Mi Neden

May 09, 2025 -

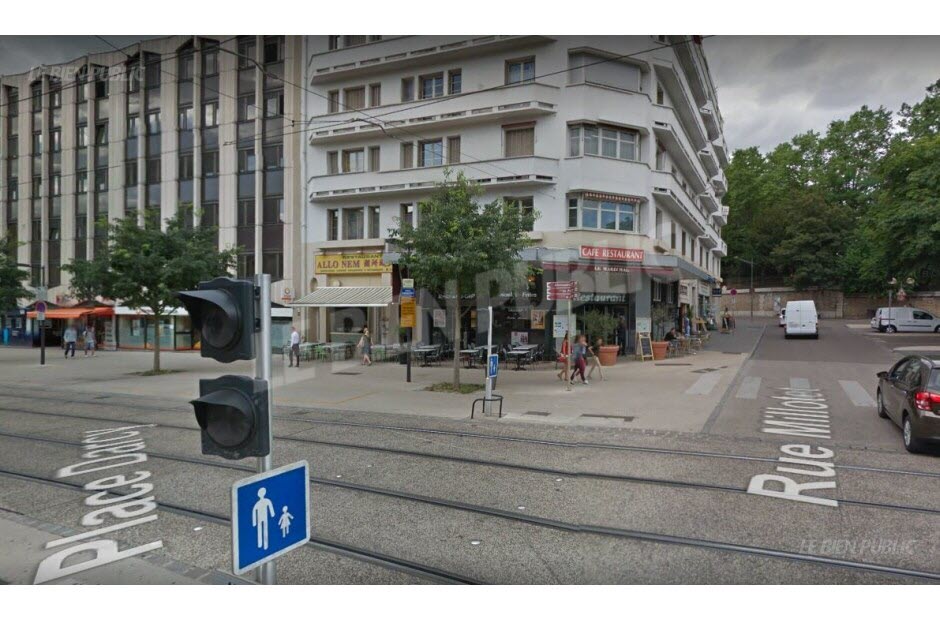

Agression Sauvage A Dijon Trois Hommes Attaques Au Lac Kir

May 09, 2025

Agression Sauvage A Dijon Trois Hommes Attaques Au Lac Kir

May 09, 2025 -

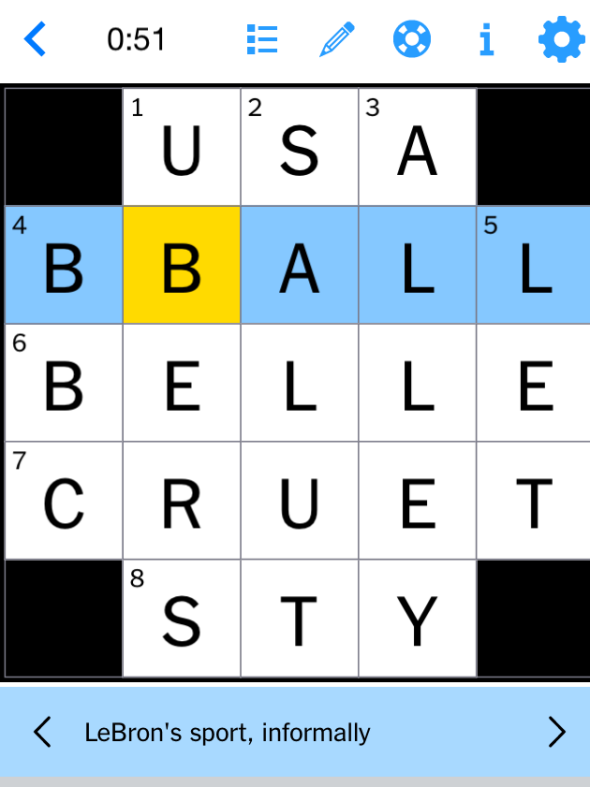

Nyt Strands Today April 6 2025 Crossword Clues And Solutions

May 09, 2025

Nyt Strands Today April 6 2025 Crossword Clues And Solutions

May 09, 2025