The Correlation Between US Policy And Elon Musk's Net Worth

Table of Contents

Tax Policies and Their Influence on Musk's Wealth

H3: Capital Gains Taxes and their impact on Tesla and SpaceX valuations.

Capital gains taxes directly impact Elon Musk's wealth. A substantial portion of his net worth is tied up in Tesla and SpaceX stock. Changes in capital gains tax rates significantly affect the valuation of these companies and, consequently, Musk's personal wealth.

- Tax increases: Higher capital gains taxes could incentivize Musk to sell fewer shares, potentially lowering the overall valuation of Tesla and SpaceX. This would, in turn, reduce his net worth.

- Tax decreases: Conversely, lower capital gains taxes might encourage Musk to hold onto his shares, potentially increasing the overall valuation of his holdings and boosting his net worth. However, this also depends on market factors independent of tax policy.

- Impact of long-term vs. short-term capital gains: The distinction between long-term and short-term capital gains also plays a crucial role. Musk's tax liability could vary considerably depending on the holding period of his shares.

H3: Corporate Tax Rates and their effect on Tesla's profitability.

Corporate tax rates also play a vital role in shaping Musk's wealth. Tesla's profitability, influenced by corporate tax policies, directly impacts its stock price and, therefore, Musk's net worth.

- Lower corporate tax rates: Reduced corporate tax burdens can lead to increased profitability for Tesla, potentially boosting its stock price and increasing Musk's wealth.

- Higher corporate tax rates: Conversely, higher corporate taxes can eat into Tesla's profits, potentially lowering its stock price and negatively impacting Musk's net worth. This effect would be amplified if the increased tax burden is not offset by other factors.

- International implications: Tesla operates globally. US corporate tax policy interacts with international tax laws and treaties, creating a complex environment impacting the overall profitability of the company.

Regulatory Environment and its Impact on Tesla and SpaceX

H3: Environmental regulations and their effect on Tesla's growth.

US environmental policies significantly influence Tesla's growth and, consequently, Musk's wealth. Incentives for electric vehicles and stricter emission standards directly benefit Tesla's market position.

- EV tax credits and subsidies: Government incentives for electric vehicle purchases directly stimulate demand for Tesla cars, boosting sales and profitability.

- Stringent emission standards: Stricter regulations on emissions can benefit Tesla, as its electric vehicles are inherently cleaner than gasoline-powered alternatives, giving them a competitive edge.

- Potential for future regulations: Changes to fuel efficiency standards or policies promoting alternative fuels could either benefit or hinder Tesla's market dominance, significantly impacting Musk's wealth.

H3: Space exploration regulations and their influence on SpaceX's funding and contracts.

SpaceX's success, and hence Musk's wealth, is intrinsically linked to US government regulations and contracts related to space exploration.

- NASA partnerships: Contracts with NASA and other government agencies provide crucial funding and validation for SpaceX's projects, driving growth and increasing Musk's stake in the company.

- Regulatory hurdles: Conversely, complex regulatory processes and licensing requirements can potentially hinder SpaceX's progress and affect its profitability.

- Future of space exploration funding: Changes in government funding for space exploration programs will directly influence SpaceX's potential for growth and its valuation, with a direct effect on Musk's wealth.

Economic Policies and their Broader Impact on Musk's Holdings

H3: Interest rate changes and their effects on Tesla's stock price.

Federal Reserve interest rate decisions influence investor sentiment and the overall stock market. These changes have a direct impact on Tesla's stock price and therefore Musk's net worth.

- Interest rate hikes: Increased interest rates can lead to decreased investor confidence and lower stock valuations, potentially reducing Musk's net worth.

- Interest rate cuts: Conversely, lower interest rates can boost investor confidence and increase stock valuations, benefiting Musk's net worth.

- Market volatility: Uncertainty surrounding interest rate changes contributes to market volatility, impacting the stability of Tesla's stock price and therefore Musk's wealth.

H3: Inflation and its impact on consumer spending and demand for Tesla vehicles.

Inflation affects consumer spending patterns, impacting demand for Tesla vehicles and ultimately affecting Musk's wealth.

- High inflation: High inflation can reduce consumer purchasing power, leading to decreased demand for Tesla vehicles, potentially affecting Tesla’s profitability and Musk’s net worth.

- Low inflation: A stable inflationary environment can positively affect consumer spending, leading to increased demand for Tesla vehicles and potentially boosting Musk's net worth.

- Pricing strategies: Tesla's pricing strategies will need to adapt to changes in inflation to maintain profitability and consumer demand.

H3: Trade policies and their impact on Tesla's global operations.

Trade policies, including tariffs and trade agreements, affect Tesla's global operations and impact its profitability, thus indirectly impacting Musk's wealth.

- Tariffs: Import tariffs on Tesla vehicles or components in specific markets can increase production costs and reduce profitability.

- Trade agreements: Trade agreements that facilitate global trade can reduce barriers to entry for Tesla in international markets, potentially boosting profits and Musk's wealth.

- Geopolitical factors: Geopolitical instability and changing international trade relations create considerable uncertainty, influencing Tesla's global operations and the value of Musk's holdings.

Conclusion: Understanding the Interplay Between US Policy and Elon Musk's Financial Success

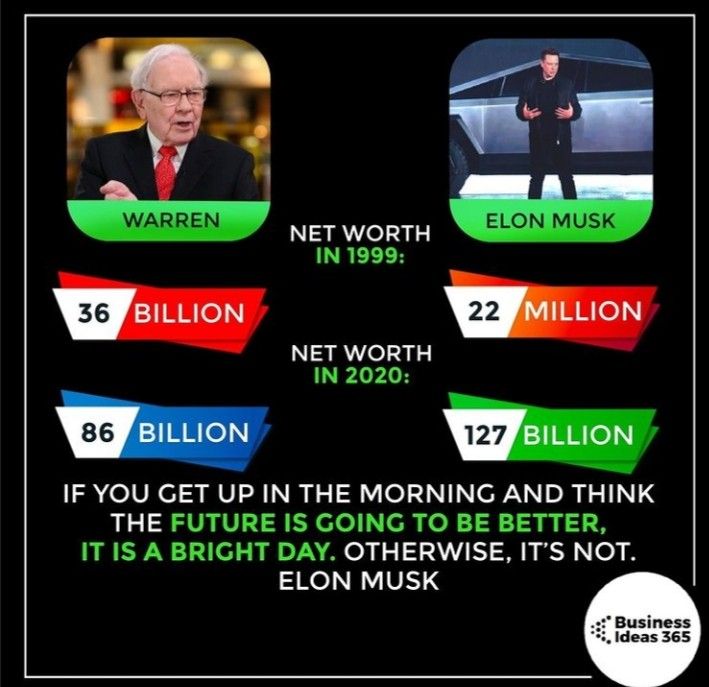

The correlation between US policy and Elon Musk's net worth is undeniable. Tax policies directly affect his capital gains and Tesla's profitability. Regulatory environments shape both Tesla's growth and SpaceX's access to government contracts. Broader economic policies, including interest rates, inflation, and trade agreements, significantly influence the overall market environment and the valuation of Musk's holdings.

Key Takeaways:

- Capital gains taxes directly impact the valuation of Musk's Tesla and SpaceX shares.

- Corporate tax rates influence Tesla's profitability and its stock price.

- Environmental and space exploration regulations significantly impact Tesla and SpaceX's growth.

- Economic policies, including interest rates and inflation, affect consumer demand and investor confidence.

Delve deeper into the complex relationship between US policy and Elon Musk's net worth by researching specific policy changes and their impact on Tesla and SpaceX. Continue exploring the impact of various governmental decisions on one of the world's most influential entrepreneurs.

Featured Posts

-

Hertls Injury Golden Knights Face Potential Absence Against Lightning

May 09, 2025

Hertls Injury Golden Knights Face Potential Absence Against Lightning

May 09, 2025 -

Vizit Soyuznikov V Kiev 9 Maya Polniy Spisok I Analiz Otsutstviya Nekotorykh Gostey

May 09, 2025

Vizit Soyuznikov V Kiev 9 Maya Polniy Spisok I Analiz Otsutstviya Nekotorykh Gostey

May 09, 2025 -

Taiwans Lais Ve Day Address A Warning Against Totalitarianism

May 09, 2025

Taiwans Lais Ve Day Address A Warning Against Totalitarianism

May 09, 2025 -

Formula Racing Colapinto A Potential Threat To Lawsons Red Bull Position

May 09, 2025

Formula Racing Colapinto A Potential Threat To Lawsons Red Bull Position

May 09, 2025 -

Palantir Stock A 30 Dip Buy Or Sell

May 09, 2025

Palantir Stock A 30 Dip Buy Or Sell

May 09, 2025