Bitcoin Price: Crucial Levels To Monitor Now

Table of Contents

Current Bitcoin Price and Market Sentiment

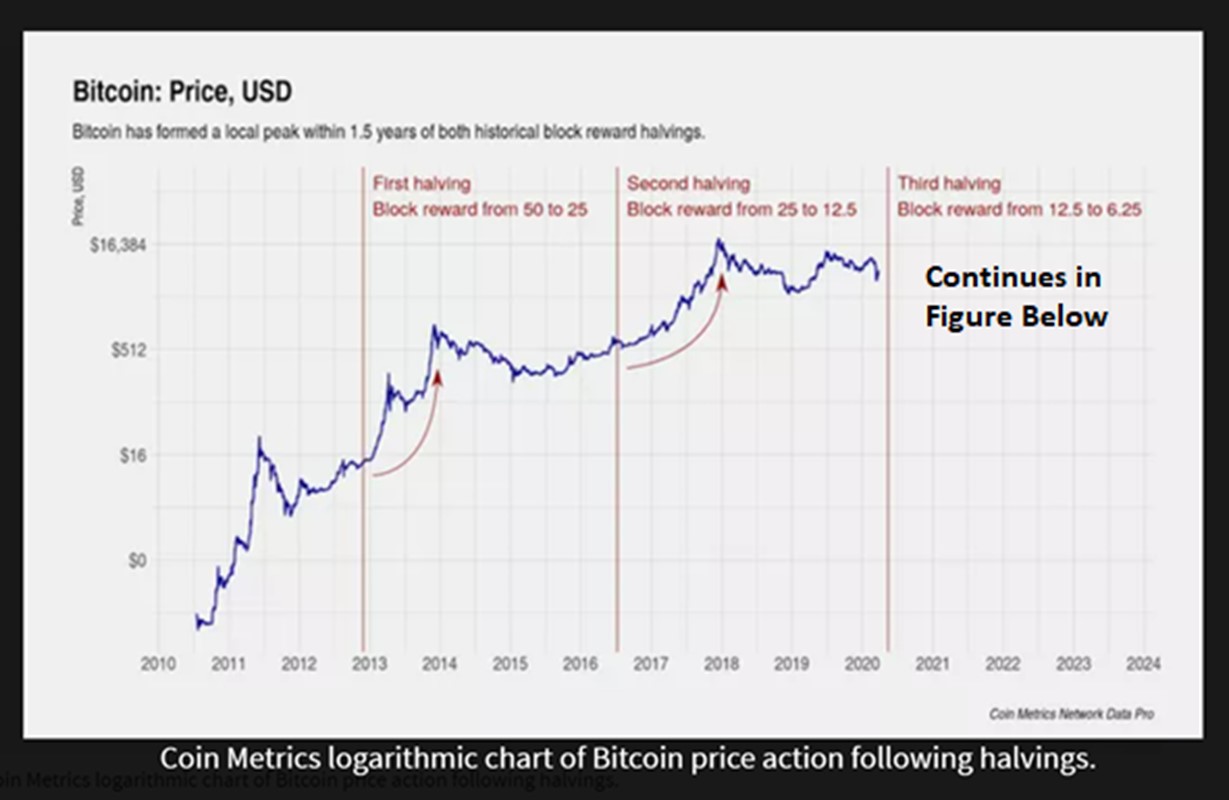

Analyzing the Recent Price Action: The Bitcoin price has experienced significant fluctuations recently. [Insert relevant chart showing recent price action, highlighting highs and lows]. Analyzing this price action reveals key insights into the current market sentiment.

- Short-term trends: [Describe short-term trends, e.g., a recent pullback after a period of growth].

- Long-term trends: [Describe long-term trends, e.g., a generally upward trend over the past year].

- Trading volume: High trading volume during price increases suggests strong bullish sentiment, while low volume may indicate a lack of conviction. Conversely, high volume during price decreases signals strong bearish pressure. [Insert chart showing trading volume correlated with price].

- Market sentiment: Currently, the market sentiment appears to be [bullish/bearish/neutral], primarily driven by [mention relevant news events, e.g., regulatory announcements, adoption by major companies, macroeconomic factors].

Key Support Levels to Watch

Identifying Strong Support: A strong support level in a Bitcoin price chart represents a price point where buying pressure is expected to outweigh selling pressure, preventing a further decline.

- Specific support levels: Based on recent price action and technical analysis, key support levels for the Bitcoin price are currently at [Price Level 1], [Price Level 2], and [Price Level 3].

- Rationale: These levels are significant because they represent [Explain the rationale for each level, e.g., previous lows, psychological barriers like round numbers, convergence of moving averages].

- Consequences of a breakdown: A breakdown below these support levels could signal a further price decline, potentially triggering stop-loss orders and exacerbating the bearish trend. This would negatively impact the Bitcoin price trends.

Key Resistance Levels to Watch

Understanding Resistance in Bitcoin Trading: Resistance levels are price points where selling pressure is expected to overcome buying pressure, hindering further price increases.

- Specific resistance levels: Potential resistance levels for the Bitcoin price are currently situated at [Price Level 1], [Price Level 2], and [Price Level 3].

- Rationale: These levels are considered resistance because they represent [Explain the rationale, e.g., previous highs, psychological barriers, divergence of moving averages].

- Implications of a breakout: A successful breakout above these resistance levels could signify a strong bullish momentum, potentially leading to a significant price rally and altering Bitcoin price trends.

Technical Indicators for Bitcoin Price Analysis

Utilizing Technical Analysis Tools: Technical indicators provide valuable insights into market momentum and potential price movements.

- RSI (Relative Strength Index): The RSI helps identify overbought and oversold conditions, providing potential signals for reversals in the Bitcoin price.

- MACD (Moving Average Convergence Divergence): The MACD indicates momentum changes and potential trend shifts.

- Moving Averages: Moving averages, such as the 50-day and 200-day moving averages, can help identify trends and potential support/resistance levels. Using these in conjunction with price action analysis improves accuracy.

- Caution: Remember that no single indicator is foolproof. It's crucial to use multiple indicators and combine technical analysis with fundamental analysis for a comprehensive Bitcoin market analysis.

Conclusion

In summary, monitoring the Bitcoin price effectively requires careful observation of key support and resistance levels, alongside the use of technical indicators. We've identified crucial Bitcoin price levels – both support and resistance – that traders and investors should actively watch. Understanding these key points, coupled with a robust understanding of market sentiment and technical analysis tools, provides a stronger foundation for informed decision-making. Stay vigilant and continue to monitor these crucial Bitcoin price levels for optimal trading strategies. Understanding these key support and resistance points is essential for navigating the volatile Bitcoin market and capitalizing on Bitcoin price trends. Staying informed about the Bitcoin market analysis is crucial for successful trading.

Featured Posts

-

Predicting The Arsenal Vs Psg Semi Final A More Difficult Test Than Real Madrid

May 08, 2025

Predicting The Arsenal Vs Psg Semi Final A More Difficult Test Than Real Madrid

May 08, 2025 -

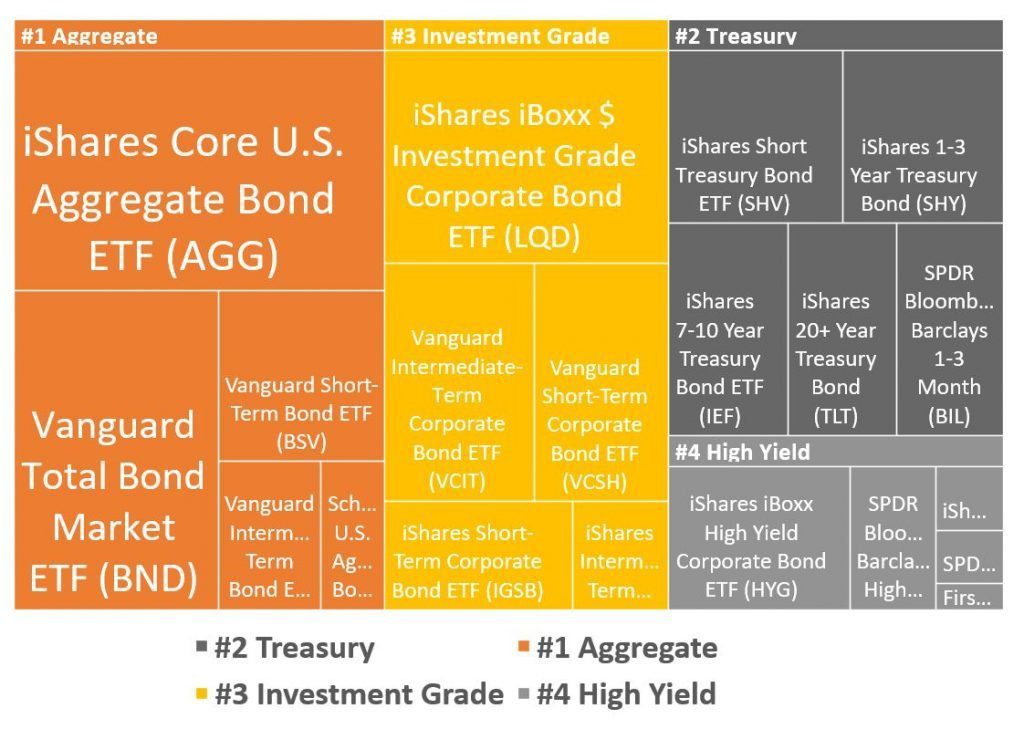

Us Bond Etf Sell Off Taiwanese Investors Leading The Retreat

May 08, 2025

Us Bond Etf Sell Off Taiwanese Investors Leading The Retreat

May 08, 2025 -

2025 Los Angeles Angels Games Your Guide To Cord Free Viewing

May 08, 2025

2025 Los Angeles Angels Games Your Guide To Cord Free Viewing

May 08, 2025 -

Princess Leias Return 3 Hints She Ll Appear In The New Star Wars Show

May 08, 2025

Princess Leias Return 3 Hints She Ll Appear In The New Star Wars Show

May 08, 2025 -

Behind The Scenes Of Andor Cast Insights Into The Rogue One Prequels Final Season

May 08, 2025

Behind The Scenes Of Andor Cast Insights Into The Rogue One Prequels Final Season

May 08, 2025