Bitcoin Price Prediction 2024: Trump's Impact On BTC's Value

Table of Contents

Trump's Economic Policies and Their Potential Effect on Bitcoin

A Trump administration could significantly shape the cryptocurrency landscape, influencing Bitcoin's price through various avenues.

Regulatory Uncertainty

Regulatory clarity (or lack thereof) is crucial for cryptocurrency adoption. A second Trump term could bring either increased regulatory scrutiny or a more laissez-faire approach, drastically altering the Bitcoin market.

- Pro-crypto policies: A potential easing of regulations could boost institutional investment and increase mainstream adoption, driving up BTC's price.

- Anti-crypto policies: Conversely, stricter regulations, perhaps mirroring stricter SEC actions, could stifle innovation and reduce market confidence, potentially leading to price drops. The impact on institutional investment would be particularly noteworthy. Increased scrutiny might also negatively affect the accessibility of Bitcoin for smaller investors.

The SEC's actions under a Trump administration would be pivotal. A more lenient stance could spur growth, while a stricter one could dampen enthusiasm and investment.

Fiscal Policy and Inflation

Trump's fiscal policies, often characterized by expansionary measures, could impact inflation. Bitcoin is sometimes viewed as a hedge against inflation; therefore, a rise in inflation might boost Bitcoin's appeal as a store of value.

- Inflationary policies: Increased government spending could lead to higher inflation, potentially increasing demand for Bitcoin as a safeguard against currency devaluation.

- Deflationary policies: Conversely, more fiscally conservative policies might curb inflation, reducing the appeal of Bitcoin as an inflation hedge.

The US dollar's strength relative to other currencies will also play a crucial role. A weakened dollar could indirectly boost Bitcoin's price, while a strengthening dollar might have the opposite effect.

Global Market Reaction

A Trump presidency could trigger diverse reactions in global markets, indirectly affecting Bitcoin.

- Positive reactions: Some might view a Trump presidency as fostering economic growth, potentially driving up the value of risk assets like Bitcoin.

- Negative reactions: Others might perceive it as increasing geopolitical uncertainty, leading to capital flight into safe haven assets and away from riskier investments like Bitcoin. This could trigger a decline in the BTC price.

Bitcoin's Intrinsic Value and Market Dynamics in 2024

Beyond Trump's influence, inherent Bitcoin characteristics and broader market factors will play a crucial role in shaping its 2024 price.

Halving Event

The Bitcoin halving, scheduled for 2024, will significantly reduce the rate of new Bitcoin creation, impacting supply and demand dynamics.

- Halving mechanism: This event cuts the reward for Bitcoin miners in half, reducing the influx of new Bitcoins into circulation.

- Historical impact: Past halving events have generally been followed by periods of price appreciation, although this is not guaranteed.

The reduced supply, coupled with potentially sustained demand, could lead to a price increase.

Technological Advancements

Advancements in the crypto space will influence Bitcoin's competitiveness and price.

- Layer-2 scaling solutions: Improved scalability could reduce transaction fees and processing times, boosting Bitcoin's usability and appeal.

- Improved privacy features: Enhanced privacy features could attract a wider range of users, increasing demand for Bitcoin.

- Institutional adoption: Growing institutional investment in Bitcoin could further drive up the price.

Macroeconomic Factors

Beyond Trump and Bitcoin-specific factors, broader economic conditions will matter.

- Global economic growth: Strong global economic growth could boost risk appetite and benefit Bitcoin's price.

- Interest rates: Rising interest rates could divert investment away from Bitcoin towards higher-yielding assets.

- Other factors: Geopolitical events, technological disruptions, and shifts in investor sentiment will all play a role.

Potential Bitcoin Price Scenarios in 2024 Considering Trump's Influence

Based on the factors discussed above, several price scenarios are possible. Note that these are speculative and based on current trends and expert opinions.

Bullish Scenarios

A combination of positive factors—reduced regulation, strong adoption fueled by the halving, positive market sentiment, and a surprisingly stable global economy—could lead to significant price appreciation.

- Price target: $100,000 or more is not unrealistic under such a scenario.

Bearish Scenarios

Conversely, increased regulation, negative market sentiment due to geopolitical uncertainty or economic downturn, and unforeseen technological challenges could depress Bitcoin's price.

- Price target: A drop below $20,000 is possible under unfavorable conditions.

Neutral Scenarios

A more stable macroeconomic environment, balanced regulatory actions, and moderate adoption rates could result in relatively stable Bitcoin pricing.

- Price target: A price range between $30,000 and $60,000 is plausible in this scenario.

Bitcoin Price Prediction 2024: Final Thoughts and Call to Action

Predicting Bitcoin's price is inherently challenging, as it depends on a complex interplay of factors extending beyond a single political figure's influence. While a Trump presidency could significantly impact Bitcoin's trajectory through regulatory decisions and market sentiment, other factors—the halving, technological advancements, and macroeconomic conditions—are equally important. Therefore, it is crucial to conduct thorough research and consider multiple perspectives.

Stay informed about the latest developments in the crypto market and continue researching Bitcoin price prediction 2024 to make your own informed decisions. [Link to further resources]

Featured Posts

-

Nevilles Prediction Psg Vs Arsenal A Close Call

May 08, 2025

Nevilles Prediction Psg Vs Arsenal A Close Call

May 08, 2025 -

Kyle Kuzma Weighs In On Jayson Tatums Trending Instagram Post

May 08, 2025

Kyle Kuzma Weighs In On Jayson Tatums Trending Instagram Post

May 08, 2025 -

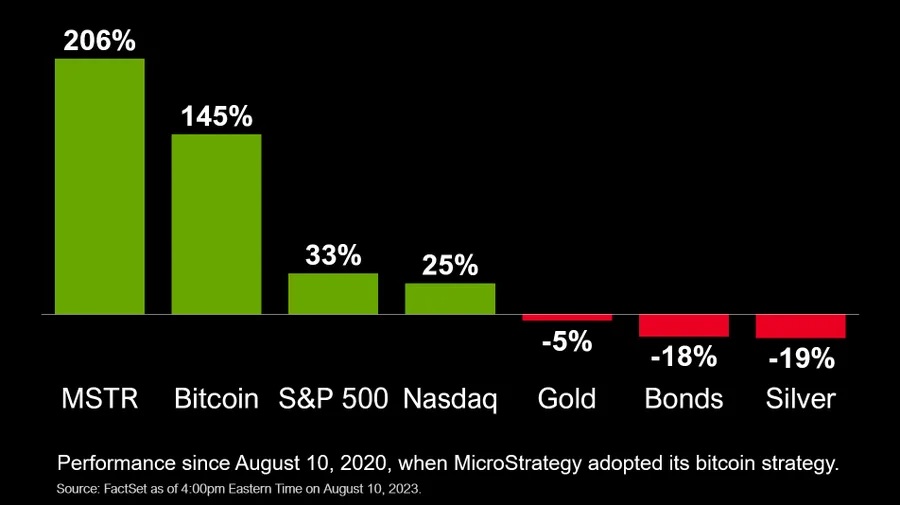

Bitcoin Or Micro Strategy Stock A Smart Investment Strategy For 2025

May 08, 2025

Bitcoin Or Micro Strategy Stock A Smart Investment Strategy For 2025

May 08, 2025 -

Thunder Vs Pacers Full Injury Report For March 29th Game

May 08, 2025

Thunder Vs Pacers Full Injury Report For March 29th Game

May 08, 2025 -

Analyzing The Potential Counting Crows 2025 Setlist

May 08, 2025

Analyzing The Potential Counting Crows 2025 Setlist

May 08, 2025