Bitcoin's 10x Multiplier: Could It Storm Wall Street? Chart Of The Week

Table of Contents

Factors Suggesting a Potential Bitcoin 10x Multiplier

Several factors suggest that a 10x Bitcoin price increase, while ambitious, isn't entirely out of the realm of possibility.

Increasing Institutional Adoption

- MicroStrategy: This business intelligence company has made significant investments in Bitcoin, holding a substantial portion of its treasury reserves in BTC.

- Tesla: Elon Musk's electric vehicle company initially invested heavily in Bitcoin, showcasing the growing acceptance among large corporations.

- BlackRock: The world's largest asset manager has filed for a Bitcoin ETF, indicating a potential shift in the institutional investment landscape.

The increasing institutional adoption of Bitcoin signifies a crucial turning point. Institutional investors bring substantial capital and a more conservative approach to the market, reducing volatility concerns and boosting confidence. This influx of institutional money can fuel significant price growth, contributing to Bitcoin's potential 10x multiplier. Keywords: Institutional Bitcoin adoption, Bitcoin investment, institutional investors, BTC price prediction.

Growing Global Adoption and Demand

- Increasing usage in developing countries: Bitcoin offers a solution for individuals in countries with unstable currencies or limited access to traditional banking systems.

- Retail investor growth: The number of individuals investing in Bitcoin continues to increase globally, driven by its perceived potential for high returns.

- Scarcity: Bitcoin's fixed supply of 21 million coins creates inherent scarcity, driving up demand as more people seek to own a piece of this limited asset.

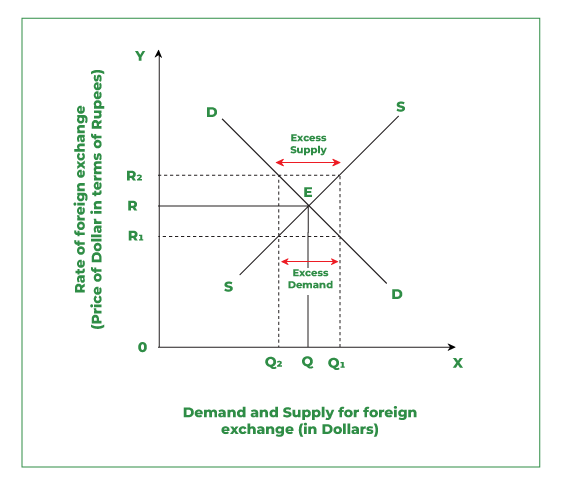

The combination of increasing global adoption and limited supply is a powerful driver of price appreciation. As demand surpasses supply, the price inevitably increases. This growing global Bitcoin usage, coupled with the inherent scarcity, significantly contributes to the possibility of Bitcoin's 10x multiplier. Keywords: Bitcoin adoption rate, global Bitcoin usage, Bitcoin demand, Bitcoin supply.

Macroeconomic Uncertainty and Safe-Haven Demand

- Inflationary pressures: Global inflation is driving investors to seek alternative assets that could hedge against currency devaluation.

- Geopolitical instability: Uncertainties in the global political landscape make Bitcoin an attractive option for those seeking to diversify their investments.

- Decentralized nature: Bitcoin's independence from central banks and governments makes it a potentially attractive safe haven asset during times of economic or political crisis.

In times of economic instability, Bitcoin’s decentralized nature and limited supply can increase its appeal as a safe haven asset. Investors seeking refuge from market volatility may flock to Bitcoin, driving up its price. This increased demand during times of macroeconomic uncertainty plays a significant role in Bitcoin's potential 10x multiplier. Keywords: Bitcoin as a safe haven, macroeconomic factors, inflation hedge, Bitcoin price volatility.

Challenges and Risks to a Bitcoin 10x Multiplier

While the potential for a 10x multiplier exists, several significant challenges and risks could hinder its realization.

Regulatory Uncertainty

- Varying regulations across countries: Different countries have adopted different regulatory frameworks for cryptocurrencies, creating uncertainty for investors.

- Potential for government intervention: Governments could implement stricter regulations, impacting Bitcoin's price and adoption.

- Lack of clear legal frameworks: The absence of universally accepted legal frameworks for cryptocurrencies creates risks and can stifle growth.

Regulatory uncertainty remains a major hurdle. Inconsistent or overly restrictive regulations could dampen investor enthusiasm and hinder Bitcoin's price appreciation. Keywords: Bitcoin regulation, regulatory uncertainty, crypto regulation, government intervention.

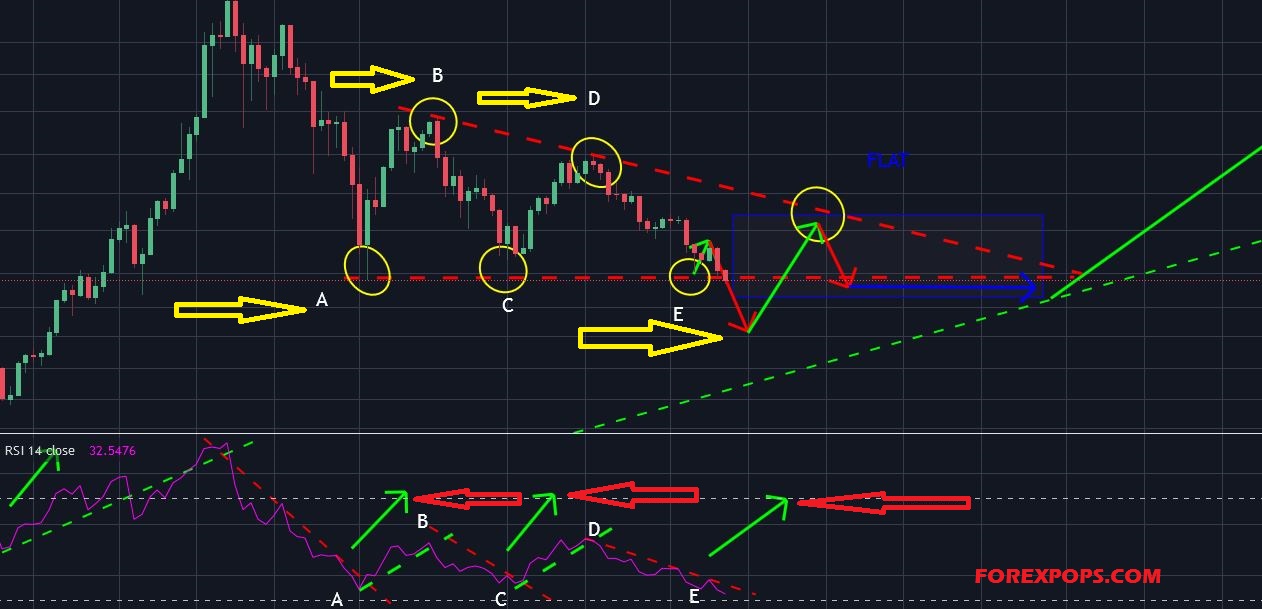

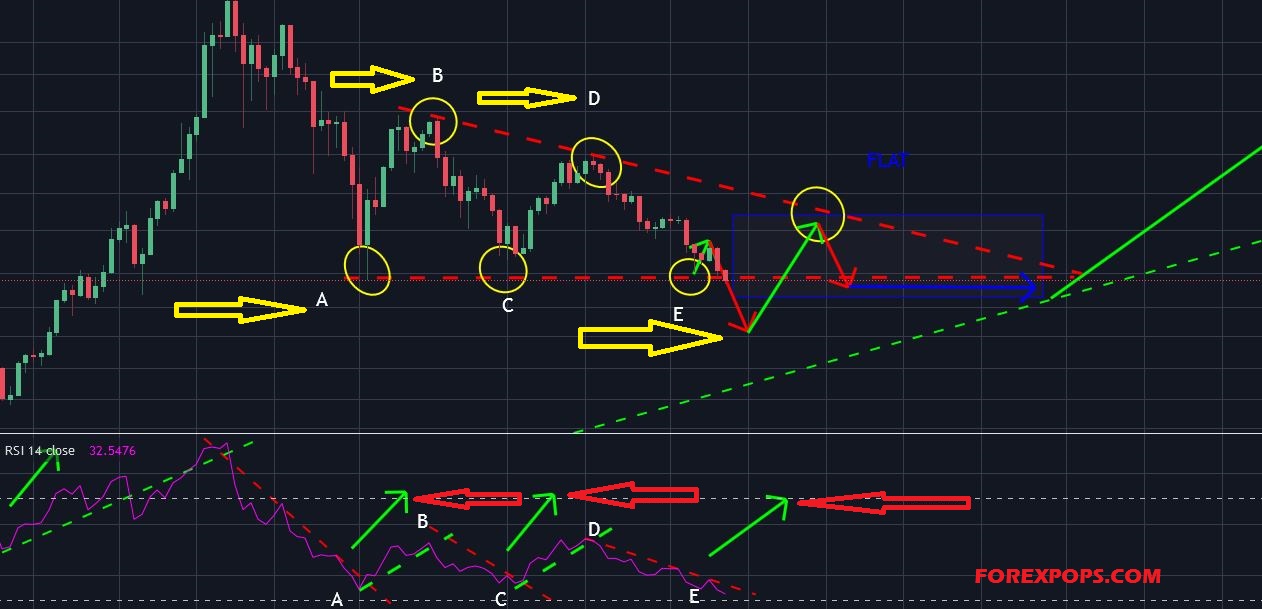

Market Volatility and Price Corrections

- History of significant price drops: Bitcoin's price has experienced dramatic drops in the past, highlighting the inherent volatility of the cryptocurrency market.

- Market corrections are normal: Significant price corrections are a natural part of any growing market, and Bitcoin is no exception.

- Risk management is crucial: Investors need to carefully manage their risk when investing in Bitcoin.

The cryptocurrency market is notoriously volatile. Significant price corrections are to be expected. Investors must be prepared for potential price drops and manage their risk accordingly. Keywords: Bitcoin price volatility, cryptocurrency risk, market correction, Bitcoin price prediction.

Competition from Other Cryptocurrencies

- Emergence of altcoins: Numerous alternative cryptocurrencies (altcoins) compete with Bitcoin for market share.

- Technological advancements: Innovations in blockchain technology and the emergence of new cryptocurrencies could challenge Bitcoin's dominance.

- Shifting investor preferences: Investor preferences can shift, potentially diverting investment away from Bitcoin to other cryptocurrencies.

The rise of altcoins and technological advancements pose a constant challenge to Bitcoin's dominance. Competition for investor attention and capital could limit Bitcoin's price appreciation potential. Keywords: Altcoins, cryptocurrency competition, Bitcoin market share, Ethereum.

Bitcoin's Impact on Wall Street: A Paradigm Shift?

Bitcoin's potential 10x multiplier could have a profound impact on Wall Street, potentially disrupting the traditional financial system.

Disruption of Traditional Finance

- Decentralization: Bitcoin's decentralized nature challenges the centralized control of traditional financial institutions.

- Transparency: Bitcoin transactions are transparent and recorded on a public ledger, increasing accountability.

- Reduced reliance on intermediaries: Bitcoin eliminates the need for intermediaries like banks, potentially lowering transaction costs.

Bitcoin's decentralized nature challenges the established financial order. Its potential to disrupt traditional finance is a key factor in its long-term appeal. Keywords: Decentralized finance (DeFi), disruption of Wall Street, Bitcoin impact on finance.

Integration with Traditional Markets

- Bitcoin futures and ETFs: The introduction of Bitcoin futures and ETFs allows institutional investors to access the Bitcoin market more easily.

- Growing acceptance by financial institutions: Major financial institutions are increasingly integrating Bitcoin into their offerings.

- Increased liquidity: Greater integration with traditional markets increases Bitcoin's liquidity, making it easier to buy and sell.

The increasing integration of Bitcoin into traditional financial markets signals a significant shift. This integration benefits both Bitcoin and Wall Street, creating new opportunities for investment and trading. Keywords: Bitcoin futures, Bitcoin ETFs, Bitcoin institutional adoption.

Conclusion: Bitcoin's 10x Multiplier: A Realistic Possibility?

The possibility of a Bitcoin 10x multiplier is a complex issue. While factors like increasing institutional adoption, growing global demand, and macroeconomic uncertainty suggest a potential for significant price appreciation, challenges like regulatory uncertainty, market volatility, and competition from other cryptocurrencies remain significant hurdles. Whether Bitcoin reaches a 10x multiplier remains uncertain, but its potential impact on Wall Street is undeniable. Learn more about Bitcoin's potential 10x multiplier and its impact on Wall Street, and consider the implications of Bitcoin's potential surge. Stay updated on the latest developments in Bitcoin’s journey to potentially disrupt Wall Street.

Featured Posts

-

Hkd Usd Exchange Rate Intervention Triggers Record Interest Rate Drop

May 08, 2025

Hkd Usd Exchange Rate Intervention Triggers Record Interest Rate Drop

May 08, 2025 -

Tnts Hilarious Take On Jayson Tatum For Lakers Vs Celtics Abc Game

May 08, 2025

Tnts Hilarious Take On Jayson Tatum For Lakers Vs Celtics Abc Game

May 08, 2025 -

Triunfo Para Filipe Luis Un Nuevo Titulo

May 08, 2025

Triunfo Para Filipe Luis Un Nuevo Titulo

May 08, 2025 -

New Xrp Etfs From Pro Shares What Investors Need To Know

May 08, 2025

New Xrp Etfs From Pro Shares What Investors Need To Know

May 08, 2025 -

Navigating Ubers New Cash Only Auto Service Option

May 08, 2025

Navigating Ubers New Cash Only Auto Service Option

May 08, 2025