Bitcoin's Future: Analyzing The 1,500% Growth Prediction

Table of Contents

Factors Supporting a 1500% Bitcoin Price Surge

Several factors could contribute to a significant increase in Bitcoin's price, potentially even reaching the predicted 1500% growth. Let's examine some key drivers:

Increasing Institutional Adoption

Large financial institutions are increasingly recognizing Bitcoin's potential. The growing interest from corporations and investment funds is a significant catalyst for price appreciation. This institutional adoption represents a shift from a largely retail-driven market to one with substantial institutional backing, adding stability and potentially driving demand higher.

- Grayscale Bitcoin Trust holdings: Grayscale's significant holdings demonstrate institutional confidence in Bitcoin as a long-term investment.

- MicroStrategy's Bitcoin strategy: MicroStrategy's substantial Bitcoin purchases showcase the strategic adoption of Bitcoin as a treasury asset by major corporations.

- PayPal's Bitcoin integration: PayPal's integration of Bitcoin allows millions of users to buy, hold, and sell Bitcoin, expanding accessibility and fueling demand.

Regulatory clarity, or the lack thereof, plays a crucial role. Clearer regulatory frameworks in major markets could further accelerate institutional investment and Bitcoin adoption. Conversely, overly restrictive regulations could hinder growth.

Scarcity and Deflationary Nature of Bitcoin

Bitcoin's inherent scarcity is a powerful driver of its potential for long-term price appreciation. With a fixed supply of only 21 million coins, Bitcoin operates under a deflationary model, unlike fiat currencies that are subject to inflation. This scarcity creates a unique value proposition, particularly in times of economic uncertainty.

- Halving events and their impact: The halving events, which reduce the rate of Bitcoin creation, contribute to the deflationary pressure and are often followed by periods of price growth.

- Bitcoin's fixed supply: The unchanging supply contrasts sharply with fiat currencies, which are subject to inflationary pressures from central bank policies.

- Demand exceeding supply: As demand for Bitcoin continues to grow, and the supply remains fixed, the price is naturally pushed upward. This basic economic principle is a core argument for the potential of a 1500% growth.

Growing Global Adoption and Use Cases

Bitcoin's expanding use cases as a store of value, a medium of exchange, and a hedge against inflation are driving global adoption. The increasing acceptance of Bitcoin in developing countries, where traditional financial systems are often underdeveloped or unreliable, is particularly noteworthy.

- Growth of Bitcoin ATMs: The increasing number of Bitcoin ATMs worldwide enhances accessibility and convenience for users.

- Lightning Network adoption: The Lightning Network is scaling Bitcoin's transaction capacity, addressing a previous limitation and improving its usability as a medium of exchange.

- Use of Bitcoin in remittances: Bitcoin's use in cross-border remittances provides a faster, cheaper, and more transparent alternative to traditional methods.

Challenges and Risks to a 1500% Bitcoin Price Prediction

While the factors above support the potential for significant price increases, several challenges and risks could hinder the achievement of a 1500% growth prediction.

Regulatory Uncertainty and Government Intervention

Varying regulatory approaches across different countries create significant uncertainty. Governments worldwide are still grappling with how to regulate cryptocurrencies, and the potential for bans or restrictions on cryptocurrency trading remains a real risk. This regulatory uncertainty can lead to market volatility and price fluctuations.

- Different regulatory stances in the US, China, and EU: The differing approaches taken by these major economies highlight the challenges of global regulation.

- Potential for increased taxation: Increased taxes on cryptocurrency transactions could dampen investment enthusiasm.

- Impact of regulatory changes on market volatility: Sudden regulatory changes can trigger significant price swings, potentially leading to dramatic price drops.

Market Volatility and Price Fluctuations

Bitcoin is known for its volatility, and significant price corrections are not uncommon. Factors such as social media sentiment, macroeconomic events, and even unexpected news can trigger sudden price drops. This inherent volatility is a major risk factor for investors.

- Past price crashes and their causes: Analyzing past price crashes can offer insights into potential future risks and volatility triggers.

- Influence of social media sentiment: Social media hype and fear-mongering can significantly influence market sentiment and price fluctuations.

- Impact of macroeconomic factors: Global economic events and financial crises can have a profound impact on Bitcoin's price.

Competition from Altcoins and Emerging Technologies

The emergence of other cryptocurrencies (altcoins) and competing technologies poses a challenge to Bitcoin's dominance. The rapid development of decentralized finance (DeFi) and non-fungible tokens (NFTs) presents further competition for investment capital and attention.

- Rise of Ethereum and other smart contract platforms: Ethereum and other platforms offer alternative blockchain functionalities, potentially diverting investment away from Bitcoin.

- Development of new blockchain technologies: The constant innovation in blockchain technology could lead to the emergence of superior alternatives to Bitcoin.

- Competition from central bank digital currencies (CBDCs): The potential rollout of CBDCs by central banks could reduce the demand for cryptocurrencies like Bitcoin.

Conclusion: The Future of Bitcoin and the 1500% Growth Prediction

The potential for a 1500% Bitcoin price surge is a complex issue with compelling arguments on both sides. While factors like increasing institutional adoption, scarcity, and growing global adoption suggest potential for significant price appreciation, regulatory uncertainty, market volatility, and competition from alternative technologies pose substantial risks. A 1500% price increase is certainly possible, but far from guaranteed.

While a 1500% surge in Bitcoin's price remains a possibility, thorough due diligence and a realistic assessment of the risks are crucial. Continue learning about Bitcoin and its potential – only then can you make informed decisions about this volatile yet potentially rewarding asset. Understanding the interplay of these factors is essential for navigating the exciting yet unpredictable future of Bitcoin.

Featured Posts

-

Ethereums Path To 2 700 A Deep Dive Into Wyckoff Accumulation

May 08, 2025

Ethereums Path To 2 700 A Deep Dive Into Wyckoff Accumulation

May 08, 2025 -

Door Dash Faces Antitrust Lawsuit From Uber Examining The Food Delivery Landscape

May 08, 2025

Door Dash Faces Antitrust Lawsuit From Uber Examining The Food Delivery Landscape

May 08, 2025 -

Carneys Assessment Trump A Transformational President

May 08, 2025

Carneys Assessment Trump A Transformational President

May 08, 2025 -

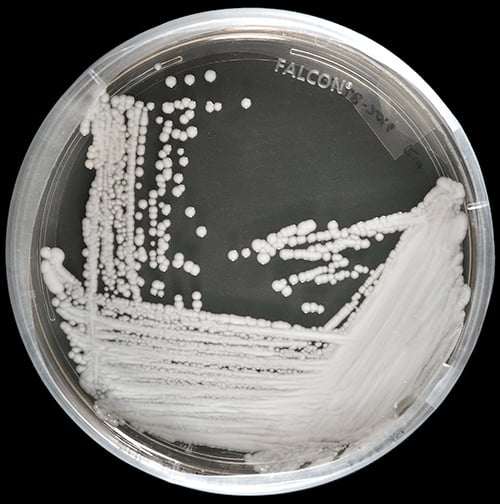

Deadly Fungi The Emerging Superbug Crisis

May 08, 2025

Deadly Fungi The Emerging Superbug Crisis

May 08, 2025 -

Pjesa E Pare Dominuese Si Psg Arriti Fitoren Minimaliste

May 08, 2025

Pjesa E Pare Dominuese Si Psg Arriti Fitoren Minimaliste

May 08, 2025