BofA's Reassuring View: Are High Stock Market Valuations Justified?

Table of Contents

BofA's Core Argument: Why High Valuations Might Be Sustainable

BofA's optimistic outlook on current high stock market valuations rests on several key pillars. Their central argument suggests that these valuations, while seemingly high, are justifiable given the current economic climate and projected future growth. The bank's analysis points to several factors supporting this view:

-

Strong Corporate Earnings Growth Projections: BofA projects robust earnings growth for many companies across various sectors, fueled by sustained consumer spending and business investment. This anticipated growth is a major factor in justifying current price levels. They anticipate continued strong profit margins despite inflationary pressures.

-

Low Interest Rates (or Expected Future Trajectory): While interest rates have begun to rise, BofA's analysis may suggest that the rate of increase will be gradual, allowing for sustained economic expansion and supporting higher stock valuations. Low borrowing costs enable companies to invest and expand, boosting earnings and justifying higher stock prices.

-

Positive Economic Outlook: BofA's positive economic outlook, supported by indicators such as strong employment figures and increasing consumer confidence, further reinforces their view that high stock market valuations are sustainable. They may point to specific GDP growth forecasts and other macroeconomic indicators.

-

Technological Advancements Driving Innovation and Growth: Rapid technological advancements are driving innovation and productivity across various sectors, creating new growth opportunities and potentially justifying higher valuations for companies at the forefront of these trends. The technology sector, in particular, often commands high valuations based on future growth potential.

Counterarguments and Potential Risks: A Balanced Perspective

While BofA presents a compelling case for the sustainability of high stock market valuations, it's crucial to acknowledge potential counterarguments and risks. A balanced perspective necessitates considering the downsides:

-

High Valuations Relative to Historical Averages: Current valuations, when compared to historical averages using metrics like the Shiller P/E ratio, appear significantly elevated, suggesting a potential overvaluation.

-

Potential for Interest Rate Hikes Impacting Market Sentiment: Further and more aggressive interest rate increases by central banks could dampen economic growth and negatively impact market sentiment, leading to a potential market correction.

-

Geopolitical Risks and Their Effect on the Market: Geopolitical instability and unforeseen global events can significantly impact market performance, introducing uncertainty and potentially leading to lower valuations.

-

Inflationary Pressures and Their Potential to Erode Corporate Profits: Persistent inflationary pressures can erode corporate profit margins, potentially impacting future earnings growth and thus challenging the justification for high stock market valuations.

-

Alternative Viewpoints: It's important to note that other financial analysts may hold differing opinions on the sustainability of current valuations, offering alternative perspectives and risk assessments.

Key Metrics and Data Supporting BofA's Analysis

BofA's analysis likely relies on a range of key metrics and data points to support its conclusions. Understanding these is crucial for assessing the validity of their arguments. These might include:

-

Price-to-Earnings Ratios (P/E): BofA likely analyzes P/E ratios across various sectors, comparing them to historical averages and projections to assess whether current valuations are justified.

-

Growth Forecasts: The analysis likely includes forecasts for GDP growth, corporate earnings growth, and other relevant economic indicators to support their projections.

-

Specific Data Points from BofA's Report: Referencing specific charts, graphs, and data tables from BofA's original report provides concrete evidence for their claims.

-

Relevant Financial Indicators: The analysis likely incorporates other relevant financial indicators like market capitalization, dividend yields, and other valuation multiples to provide a comprehensive assessment.

Implications for Investors: Strategies Based on BofA's Assessment

BofA's assessment carries significant implications for investors. Understanding their analysis allows for the development of informed investment strategies:

-

Investment Strategies: Investors might consider strategies suitable for a market with high valuations, such as value investing, focusing on undervalued companies, or diversification across different asset classes to mitigate risk.

-

Risk Management: Implementing robust risk management strategies, including diversification and careful position sizing, is crucial to mitigate potential downsides in a market with high valuations.

-

Individual Risk Tolerance: Investors must carefully consider their own individual risk tolerance before making any investment decisions. A high-risk tolerance may allow for a more aggressive investment approach, while a lower risk tolerance necessitates a more conservative strategy.

-

Long-Term vs. Short-Term Horizons: The time horizon for investments plays a vital role. Long-term investors may be more willing to withstand short-term market fluctuations, while short-term investors might adopt a more cautious approach.

Conclusion: Navigating High Stock Market Valuations Based on BofA's Insights

BofA's analysis provides a valuable perspective on the justification of high stock market valuations, emphasizing strong corporate earnings growth, a positive economic outlook, and technological advancements as supporting factors. However, it is essential to acknowledge counterarguments, including elevated valuations relative to historical averages, the potential impact of interest rate hikes, and various geopolitical risks. Understanding both the optimistic and pessimistic viewpoints is crucial before making investment decisions. Therefore, before making any investment choices related to high stock market valuations, conduct thorough research, consult with qualified financial advisors, and carefully assess your risk tolerance. Understanding high stock market valuations and assessing high stock valuations requires a balanced approach, enabling you to manage your portfolio effectively in this complex market environment.

Featured Posts

-

Analyzing Toronto Raptors Nba Draft Lottery Odds With Cooper Flagg In Mind

May 13, 2025

Analyzing Toronto Raptors Nba Draft Lottery Odds With Cooper Flagg In Mind

May 13, 2025 -

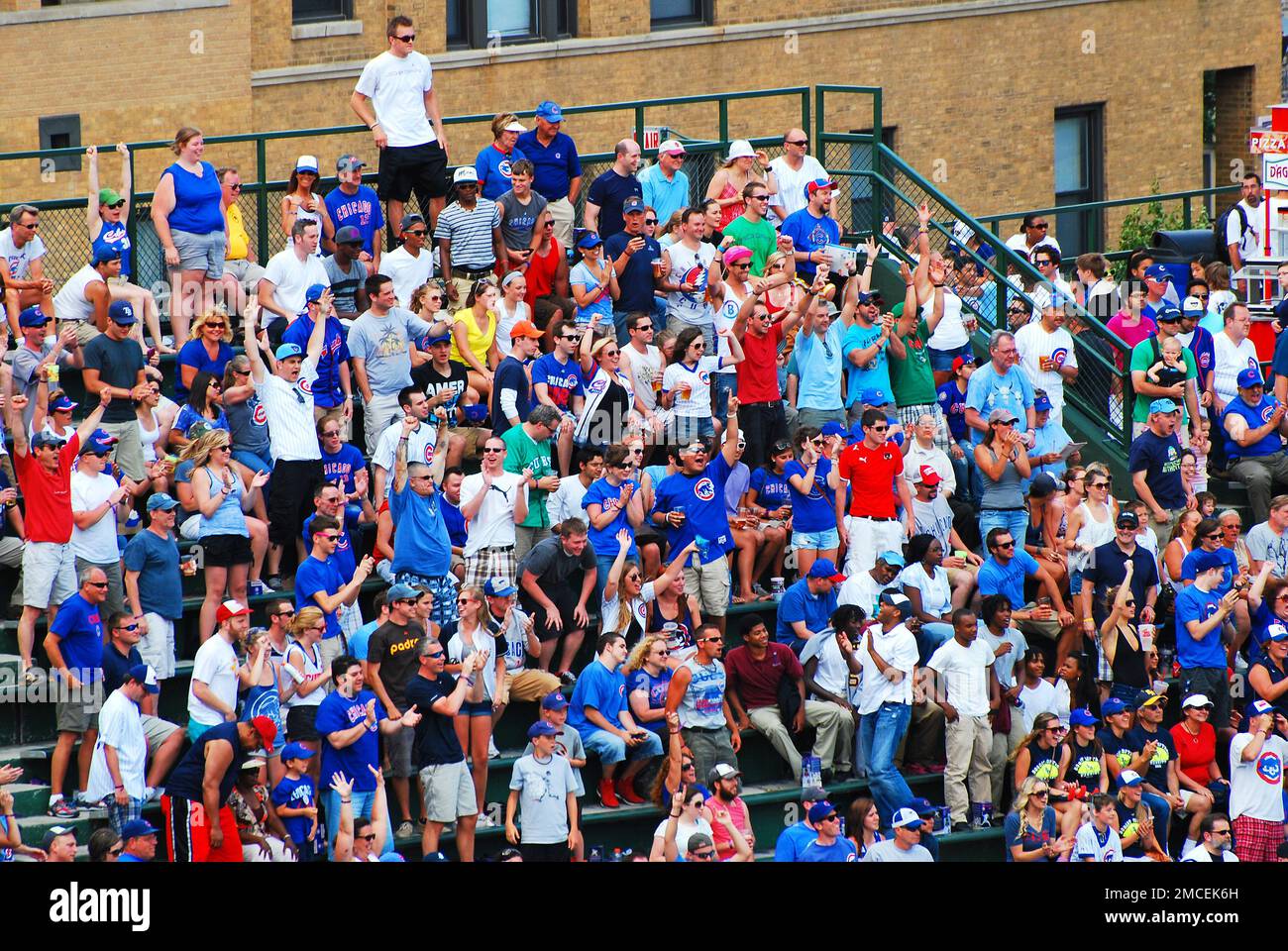

Tuckers Remarks On Cubs Fans A Closer Look

May 13, 2025

Tuckers Remarks On Cubs Fans A Closer Look

May 13, 2025 -

Ftcs Appeal Of Microsoft Activision Merger Implications For The Gaming Industry

May 13, 2025

Ftcs Appeal Of Microsoft Activision Merger Implications For The Gaming Industry

May 13, 2025 -

Angel Has Fallen Review Plot Summary And Cast Analysis

May 13, 2025

Angel Has Fallen Review Plot Summary And Cast Analysis

May 13, 2025 -

Platforms Poised To Become The Xr Battleground Ai Powered Devices Drive Market Growth

May 13, 2025

Platforms Poised To Become The Xr Battleground Ai Powered Devices Drive Market Growth

May 13, 2025

Latest Posts

-

Suits La Premiere Reactions To The Major Betrayal

May 14, 2025

Suits La Premiere Reactions To The Major Betrayal

May 14, 2025 -

Unraveling The Mystery The Deeper Meaning Of That 70s Shows Ghost In La

May 14, 2025

Unraveling The Mystery The Deeper Meaning Of That 70s Shows Ghost In La

May 14, 2025 -

The Haunted History Of Suits La A Paranormal Investigation

May 14, 2025

The Haunted History Of Suits La A Paranormal Investigation

May 14, 2025 -

The Suits La Premiere A Deep Dive Into The Plot Twist

May 14, 2025

The Suits La Premiere A Deep Dive Into The Plot Twist

May 14, 2025 -

Suits La Episode 5 Replacing Harvey And Mike

May 14, 2025

Suits La Episode 5 Replacing Harvey And Mike

May 14, 2025