BofA's Reassuring View: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

BofA's Rationale Behind a Positive Market Outlook Despite High Valuations

BofA's positive market outlook, even in the face of high stock market valuations, rests on several key pillars. Their analysis incorporates a range of valuation metrics and considers macroeconomic factors influencing market performance.

-

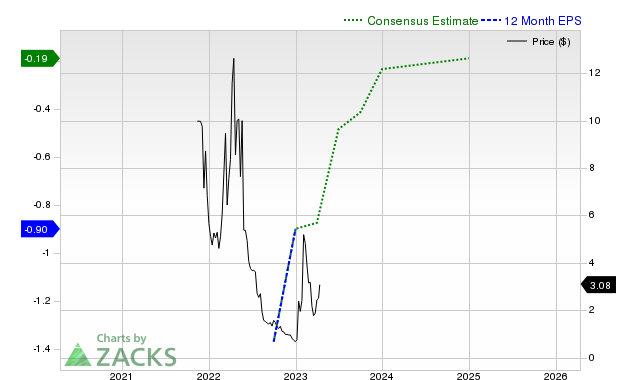

Strong Earnings Growth: BofA points to robust corporate earnings growth as a key justification for current valuations. They highlight the resilience of many companies, even in the face of economic headwinds, demonstrating their ability to maintain profitability and even increase earnings. This strong earnings growth, they argue, supports the current price levels.

-

Anticipated Inflation Decline: A significant factor in BofA's analysis is the anticipated moderation of inflation. As inflation cools, interest rates are expected to follow suit, potentially reducing the pressure on valuations. This expectation, backed by economic forecasts, is crucial to their positive market projection.

-

Robust Economic Fundamentals: BofA's assessment incorporates a broader view of economic fundamentals, considering factors beyond just inflation. They analyze indicators of economic growth, consumer spending, and unemployment figures to support their belief in a continued, albeit potentially slower, economic expansion.

-

Valuation Metrics: BofA likely uses a combination of valuation metrics such as the Price-to-Earnings (P/E) ratio and the Cyclically Adjusted Price-to-Earnings (CAPE or Shiller PE) ratio. While these metrics may appear high compared to historical averages, BofA likely contextualizes these figures within the framework of strong earnings growth and anticipated future performance. Specific data points from BofA's reports would be necessary for a complete analysis, however, their overall message points towards a positive outlook.

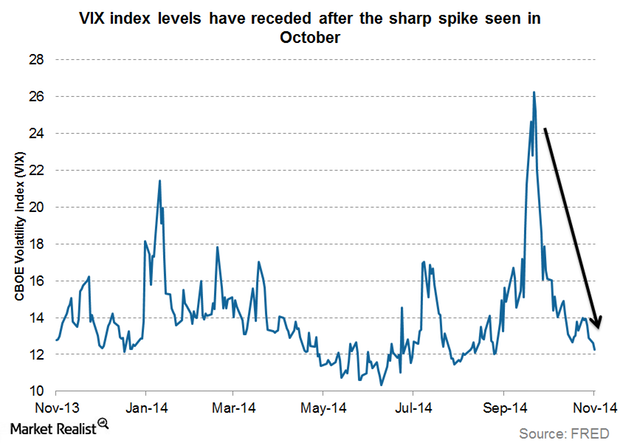

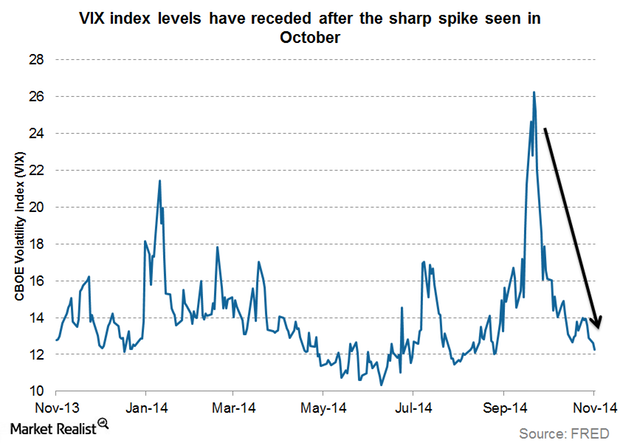

Addressing Investor Concerns About Market Volatility and Potential Corrections

While BofA presents a positive outlook, it's crucial to acknowledge legitimate investor concerns regarding market volatility and the possibility of corrections. Market fluctuations are inherent to investing, and understanding how to navigate these is paramount.

-

Historical Context: BofA's analysis likely incorporates historical market cycles, demonstrating the market's resilience in overcoming past challenges. Understanding that corrections are a normal part of market behavior is key to managing expectations.

-

Risk Management Strategies: BofA likely advocates for prudent risk management techniques. These could include:

- Portfolio Diversification: Spreading investments across different asset classes and sectors to reduce the impact of any single market downturn.

- Long-Term Investing: Focusing on a long-term investment horizon, minimizing the impact of short-term market fluctuations.

- Dollar-Cost Averaging: Investing a fixed amount of money at regular intervals, regardless of market conditions.

-

Avoiding Panic Selling: BofA's message likely emphasizes the importance of resisting the urge to panic sell during market downturns. A well-diversified portfolio and long-term investment strategy can help weather these storms.

The Importance of a Long-Term Investment Strategy

Navigating market volatility effectively requires a well-defined, long-term investment strategy. Short-term market timing attempts often prove fruitless, while a long-term approach allows investors to ride out short-term fluctuations.

-

Buy and Hold Strategy: A buy-and-hold strategy, consistent with long-term investing, involves purchasing assets and holding them for an extended period, regardless of short-term price movements.

-

Patience in Investing: Long-term investing necessitates patience. Investors should avoid making impulsive decisions based on short-term market noise.

-

Aligning with Goals: A well-defined investment strategy aligns with long-term financial goals, allowing investors to focus on the bigger picture rather than daily market fluctuations.

Opportunities and Sectors BofA Highlights for Potential Growth

BofA's analysts likely identify specific sectors poised for growth, providing investors with targeted opportunities. While specific stock recommendations should be sourced directly from official BofA reports and should not be taken as financial advice, their analysis usually highlights promising areas. These sectors are typically chosen based on various market trends and economic factors. This could include industries benefiting from technological advancements, demographic shifts, or evolving consumer preferences. For precise details, referring to BofA's official research publications is essential.

Conclusion

BofA's positive market outlook, even with high stock market valuations, presents a counterpoint to prevalent market anxieties. Their analysis emphasizes the importance of considering strong earnings growth, anticipated inflation decline, and robust economic fundamentals. Addressing concerns about market volatility, BofA advocates for risk management strategies like portfolio diversification and long-term investing. By focusing on a well-defined, long-term investment plan aligned with personal financial goals, investors can minimize the impact of short-term market fluctuations. Don't let stretched stock market valuations deter you; understand BofA's reassuring view and build a solid investment strategy today.

Featured Posts

-

Restauration Du Patrimoine Breton Plouzane Et Clisson Dans Le Programme Mission Patrimoine 2025

May 21, 2025

Restauration Du Patrimoine Breton Plouzane Et Clisson Dans Le Programme Mission Patrimoine 2025

May 21, 2025 -

Big Bear Ai Holdings Inc Bbai Understanding The 17 87 Price Drop

May 21, 2025

Big Bear Ai Holdings Inc Bbai Understanding The 17 87 Price Drop

May 21, 2025 -

Reactia Publicului La Aparitia Fratilor Tate In Bucuresti Dupa Arestare

May 21, 2025

Reactia Publicului La Aparitia Fratilor Tate In Bucuresti Dupa Arestare

May 21, 2025 -

Wtt Contender Chennai 2025 Sharath Kamals Farewell Match Against Snehit Suravajjula

May 21, 2025

Wtt Contender Chennai 2025 Sharath Kamals Farewell Match Against Snehit Suravajjula

May 21, 2025 -

Nj Transit Averts Strike Engineers Union Reaches Tentative Agreement

May 21, 2025

Nj Transit Averts Strike Engineers Union Reaches Tentative Agreement

May 21, 2025

Latest Posts

-

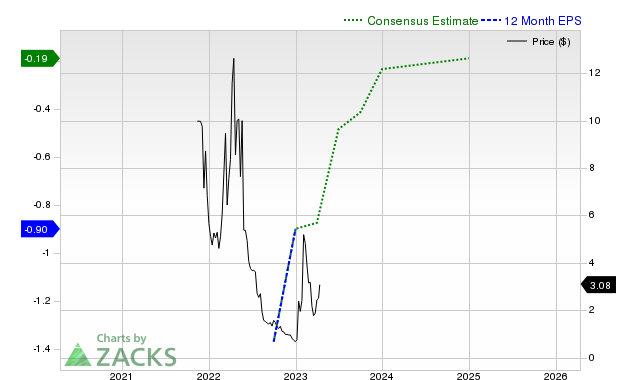

A Single Powerful Argument For Buying This Ai Quantum Computing Stock

May 21, 2025

A Single Powerful Argument For Buying This Ai Quantum Computing Stock

May 21, 2025 -

Big Bear Ai Holdings Inc Bbai Understanding The 17 87 Price Drop

May 21, 2025

Big Bear Ai Holdings Inc Bbai Understanding The 17 87 Price Drop

May 21, 2025 -

Big Bear Ai Bbai A Deep Dive Into The Recent Stock Market Decline

May 21, 2025

Big Bear Ai Bbai A Deep Dive Into The Recent Stock Market Decline

May 21, 2025 -

One Strong Reason To Consider This Ai Quantum Computing Stock

May 21, 2025

One Strong Reason To Consider This Ai Quantum Computing Stock

May 21, 2025 -

Analyst Upgrades Big Bear Ai Bbai To Buy Defense Spending Drives Growth

May 21, 2025

Analyst Upgrades Big Bear Ai Bbai To Buy Defense Spending Drives Growth

May 21, 2025