BofA's Take: Are High Stock Market Valuations Cause For Concern?

Table of Contents

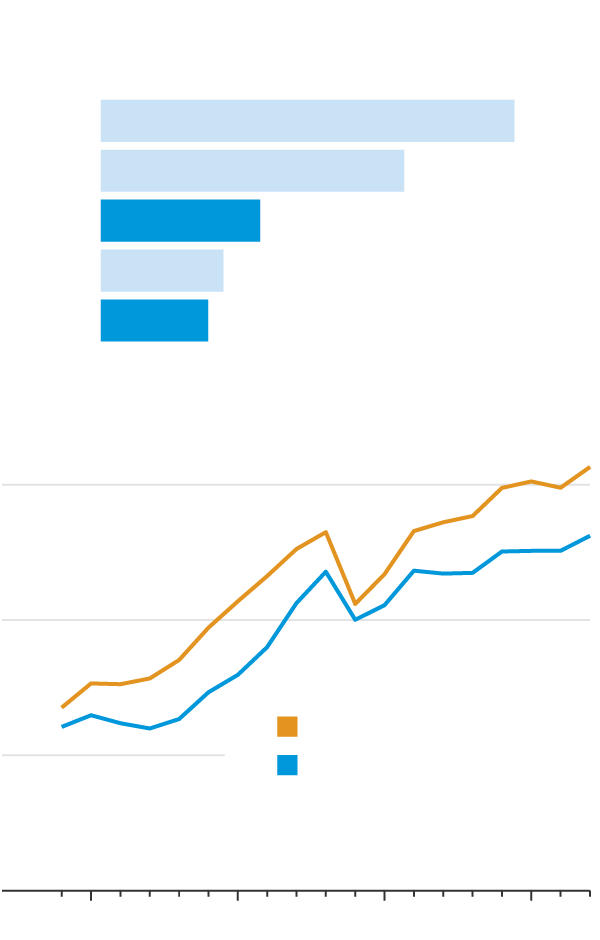

BofA's Current Assessment of Market Valuations

BofA's analysts closely monitor various market indicators to assess the overall health and potential risks associated with current market valuations. Their findings often influence investment strategies across the globe.

Identifying Overvalued Sectors

BofA's research frequently identifies specific sectors as potentially overvalued based on various metrics. This analysis helps investors understand where potential risks might lie.

- Specific Sectors: BofA may flag sectors like technology and consumer discretionary as potentially overvalued, depending on the current market conditions.

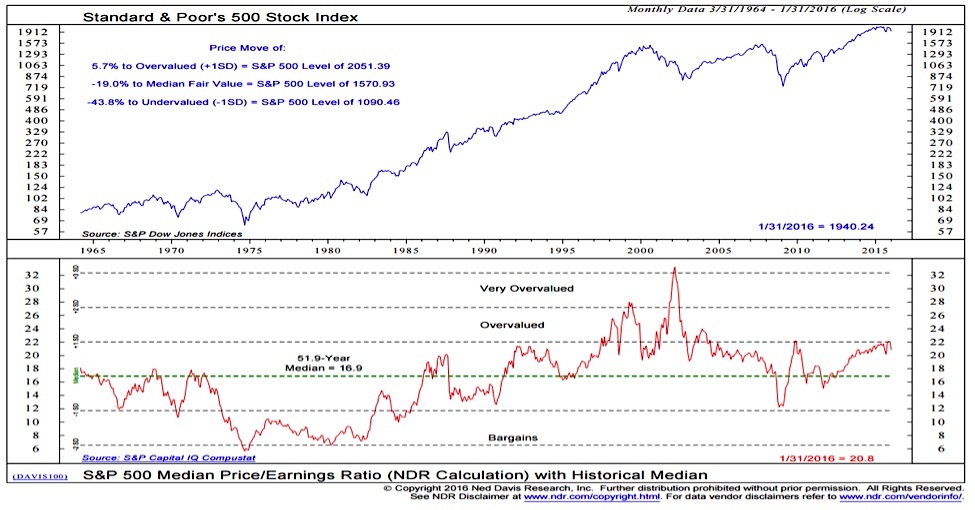

- Valuation Metrics: The Price-to-Earnings (P/E) ratio and Price-to-Sales (P/S) ratio are key metrics used by BofA to assess whether stock prices accurately reflect a company's fundamentals. High ratios compared to historical averages or industry peers often suggest overvaluation.

- Data Visualization: Unfortunately, direct access to BofA's internal reports and charts is restricted. However, their public statements and press releases often contain summaries of their findings.

Factors Contributing to High Valuations

Several interconnected factors have contributed to the elevated stock market valuations. Understanding these is crucial for interpreting BofA's assessment.

- Low Interest Rates & Quantitative Easing: Historically low interest rates and quantitative easing policies by central banks have injected significant liquidity into the market, driving up asset prices, including stocks.

- Strong Corporate Earnings: Strong earnings reports from many companies, particularly in the technology sector, have supported higher stock prices and contributed to these high market valuations.

- Investor Sentiment: Positive investor sentiment and a general feeling of optimism about the future can push stock prices beyond what might be justified by fundamentals.

BofA's Predicted Market Outlook

BofA's market outlook, while not publicly available in its entirety, is often reflected in their investment recommendations and strategic guidance. They consider various factors.

- Projected Growth Rates: BofA's projections likely incorporate expected earnings growth, interest rate changes, and overall economic conditions. These projections inform their assessment of whether current high stock market valuations are sustainable.

- Potential Downside Risks: BofA's analysis certainly accounts for potential downside risks, including market corrections or economic downturns. These risks are weighed against potential upside to form a complete picture.

Potential Risks Associated with High Stock Market Valuations

While high stock market valuations can signal economic strength, they also present significant risks.

Increased Market Volatility

High valuations often make the market more susceptible to sharp corrections.

- Potential for Sharp Price Declines: When valuations are stretched, even minor negative news can trigger significant sell-offs, leading to substantial price declines.

- Impact on Investor Portfolios: Increased market volatility directly impacts investor portfolios, potentially leading to significant losses if not properly managed.

Impact of Rising Interest Rates

Rising interest rates can significantly impact stock valuations.

- Reduced Investor Appetite: Higher interest rates make bonds more attractive, potentially diverting investment away from stocks. This can put downward pressure on stock prices.

- Impact on Different Sectors: Interest rate hikes disproportionately affect sectors sensitive to borrowing costs, such as real estate and consumer discretionary.

Geopolitical and Economic Uncertainty

External factors introduce additional uncertainty.

- Inflation, Geopolitical Instability, and Supply Chain Disruptions: These factors can negatively impact corporate earnings and investor confidence, leading to market corrections.

- Effect on Stock Market Valuations: The impact of these risks can be seen in lower stock prices and potentially decreased market valuations.

Opportunities Within a High-Valuation Market

Despite the risks, opportunities exist even in a high-valuation market.

Identifying Undervalued Assets

Smart investors can still find undervalued assets.

- Examples of Undervalued Sectors/Stocks: While BofA doesn't publicly list all undervalued assets, they likely use fundamental analysis to identify companies trading below their intrinsic value.

- Strategies for Identifying Undervalued Assets: Thorough fundamental analysis, focusing on factors like earnings growth, debt levels, and competitive advantage, is crucial.

Defensive Investment Strategies

Mitigating risks is key.

- Diversification, Value Investing, and Hedging Strategies: Diversifying across asset classes, focusing on undervalued companies with strong fundamentals (value investing), and employing hedging strategies can reduce portfolio risk.

- Protection Against Market Downturns: These strategies aim to cushion the impact of potential market downturns, protecting your investments during periods of high volatility.

Conclusion

BofA's assessment of high stock market valuations highlights both the potential for continued growth and the significant risks associated with these elevated levels. Understanding the factors contributing to these high stock market valuations, alongside the potential for increased market volatility and the impact of rising interest rates, is crucial for investors. While opportunities exist, a cautious approach with a focus on risk mitigation is advisable. By carefully evaluating your portfolio and considering the risks and opportunities outlined, you can navigate this market effectively. Understanding BofA's perspective on high stock market valuations is crucial for making informed investment decisions. Consider diversifying your portfolio and employing defensive investment strategies to better manage your exposure to elevated market valuations.

Featured Posts

-

Patrick Schwarzenegger Addresses White Lotus Role Amid Nepotism Claims

May 06, 2025

Patrick Schwarzenegger Addresses White Lotus Role Amid Nepotism Claims

May 06, 2025 -

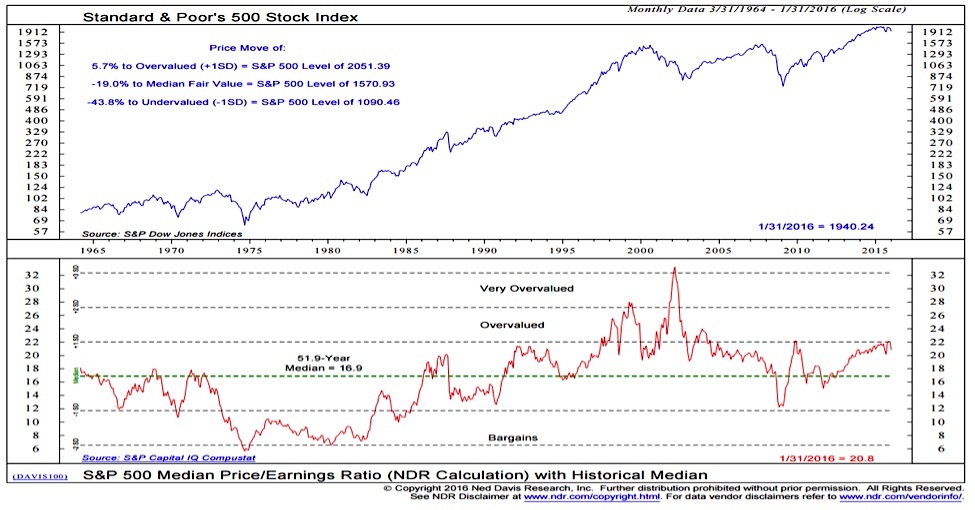

Papal Name Selection Tradition Symbolism And The Next Popes Name

May 06, 2025

Papal Name Selection Tradition Symbolism And The Next Popes Name

May 06, 2025 -

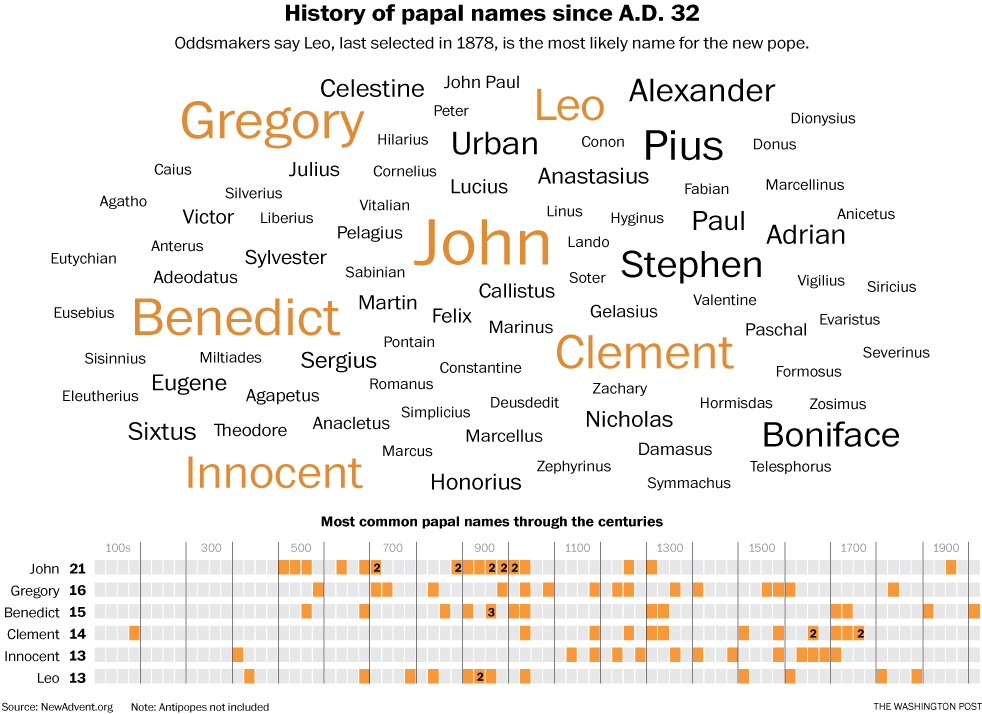

Office365 Executive Inboxes Targeted In Multi Million Dollar Cybercrime

May 06, 2025

Office365 Executive Inboxes Targeted In Multi Million Dollar Cybercrime

May 06, 2025 -

Understanding Papal Names History Significance And Predictions For The Future

May 06, 2025

Understanding Papal Names History Significance And Predictions For The Future

May 06, 2025 -

The Economic Fallout Of Trumps Trade Deal Strategy

May 06, 2025

The Economic Fallout Of Trumps Trade Deal Strategy

May 06, 2025

Latest Posts

-

Celtics Vs Suns Basketball Game Date Time Tv Channel And Streaming Details April 4th

May 06, 2025

Celtics Vs Suns Basketball Game Date Time Tv Channel And Streaming Details April 4th

May 06, 2025 -

Celtics Vs Knicks Prediction Game 1 Playoffs Betting Preview And Picks

May 06, 2025

Celtics Vs Knicks Prediction Game 1 Playoffs Betting Preview And Picks

May 06, 2025 -

Nba Playoffs 2024 Knicks Vs Celtics Game 1 Predictions And Picks

May 06, 2025

Nba Playoffs 2024 Knicks Vs Celtics Game 1 Predictions And Picks

May 06, 2025 -

Celtics Vs Suns April 4th Game Time Tv Schedule And Live Streaming Info

May 06, 2025

Celtics Vs Suns April 4th Game Time Tv Schedule And Live Streaming Info

May 06, 2025 -

Knicks Vs Celtics Game 1 Expert Predictions Best Bets And Analysis

May 06, 2025

Knicks Vs Celtics Game 1 Expert Predictions Best Bets And Analysis

May 06, 2025